I. Strategic Context: The Erosion of the Traditional Supersport Segment

A. The Industry Macro-Environment (2015–2025)

The United States motorcycle market has experienced significant volatility and contraction over the last decade, transitioning from a period of relative stability to sharp decline. For much of the decade leading up to the early 2020s, annual sales volume generally held steady, hovering near the half-million unit mark.1 However, recent economic data points to a concerning retraction.

The start of 2025 proved “awful” for domestic sales, showing a fast decline in consumer demand, culminating in year-to-date (YTD) June figures reaching only 271,205 units, representing a 9.2% decrease year-over-year (YoY).2 This instability is correlated with broader economic pressures, including forecasts of government spending cuts, anticipated layoffs, and the inflationary effects of tariffs.2

Amidst this market contraction, some brands have demonstrated strategic resilience. Kawasaki, for instance, achieved an exceptional performance trajectory, improving sales by a significant 17.7% YoY and capturing market leadership, overtaking historical front-runner Honda.2 This unusual market outcome—where a manufacturer achieves substantial growth despite a sector-wide slump—suggests that specific product strategies centered on value, accessibility, and high perceived relevance are powerful enough to defy negative macroeconomic trends.

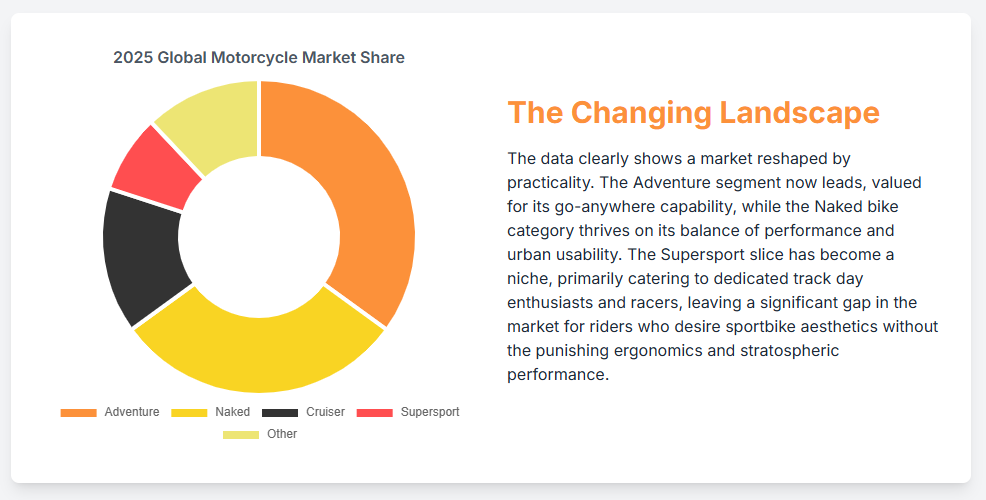

Within the declining overall market, the performance segment has undergone a critical metamorphosis. Traditional 1000cc superbikes are increasingly considered niche products.3 The shift is clearly gravitating toward middleweight sport models (such as the Yamaha YZF-R7 and Kawasaki Ninja 400), which successfully balance performance credentials with crucial consumer demands for affordability and usability.3

B. The Demise of the 600cc Inline-Four Paradigm

The traditional supersport class, historically dominated by high-revving 600cc inline-four (I4) machines, collapsed due to a confluence of regulatory and financial pressures. The primary technical catalyst was the introduction of stringent emissions requirements, particularly the Euro 5 standard, which made the complex, high-output, small-displacement I4 platform technically and economically difficult to maintain for mass production.4 Manufacturers found greater cost efficiency and better road manners by engineering less complex twin- or triple-cylinder engines.5

However, the deepest structural impediment to the traditional supersport segment remains the prohibitive Total Cost of Ownership (TCO), centered around insurance rates. Sportbikes have consistently attracted a demographic statistically associated with higher accident rates, driving up the risk profile of the entire class. Consequently, insurance companies charge exorbitant premiums—in some jurisdictions, up to 400% more than for other types of motorcycles—making the acquisition of a supersport extremely unattractive to most prospective riders.4 This insurmountable financial friction prevents market expansion and confirms that TCO, more than performance, dictated the fate of the segment.

Furthermore, the design philosophy of the traditional 600cc class was uncompromisingly track-focused, resulting in cramped, aggressive ergonomics unsuitable for daily road use.5 These “race-bike-with-lights” machines demanded high commitment, leading to a diminished appeal for the majority of street riders who value comfort and versatility.

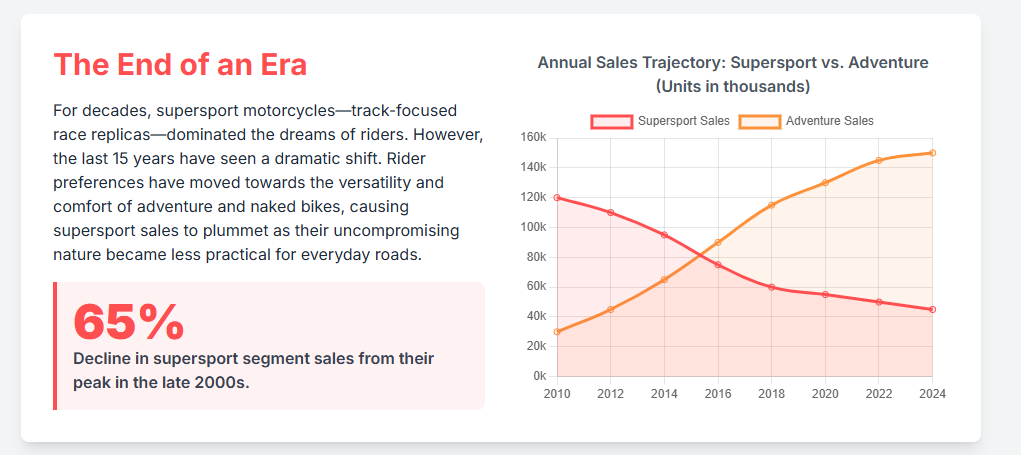

C. The Competitive Threat: Adventure Touring Ascendancy

The decline of the traditional sportbike segment created a vacuum that the Adventure Touring (ADV) segment has successfully filled. The ADV market is not merely stable but is exhibiting robust, sustainable growth, fundamentally challenging the sport segment’s share of high-end disposable income.

As detailed in market forecasts, the Adventure Touring Motorcycle Market was valued at approximately $0.37 Billion in 2023 and is projected to reach $0.74 Billion by 2031, showing a strong Compound Annual Growth Rate (CAGR) ranging between 5.06% and 8.45% over the forecast period.8

The core drivers of this growth underscore a fundamental shift in consumer values. Modern buyers, especially Millennials and Gen Z, prioritize versatility, seeking motorcycles capable of diverse terrain capabilities and suitable for the rapidly growing interest in adventure tourism.8 ADV bikes are successfully marketed on a promise of “adventure and freedom for the soul” 11, a multi-role capability that single-purpose superbikes cannot deliver. This analysis establishes the strategic objective: the Accessible Supersport (ASS) must pivot its value proposition to directly compete with the comfort and multi-role versatility that defines the burgeoning ADV segment.

The data below summarizes the current market dynamics:

Table 1: Competitive Landscape and Market Trajectories (2023-2031)

| Segment | Market Valuation (2023/2024) | Projected Market Valuation (2031) | Forecasted CAGR (2024-2031) | Primary Driver |

| Adventure Touring | ~$0.37 Billion 8 | $0.74 Billion 8 | 5.06% – 8.45% 8 | Versatility, Tourism, Disposable Income |

| U.S. Overall Motorcycle Market | N/A (Volume stable, but declining H1 2025) 1 | Low/Stagnant (Based on current decline) 2 | Near Zero/Negative (Forecasted) | Economic Pressures, Consumer Demand Decline 2 |

| Accessible Supersport (ASS) | N/A (Emerging Segment) | Significant Growth (Forecasted) | High (Forecasted) | Usability, Electronics, Reduced Friction 7 |

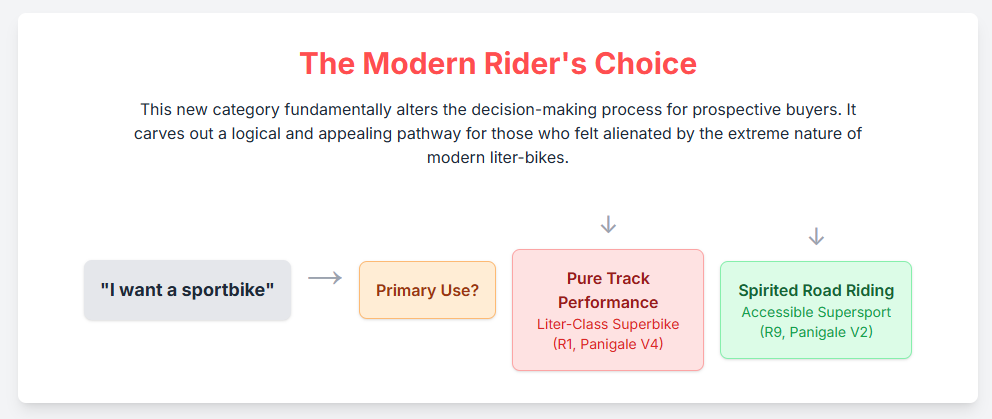

II. The Design Philosophy of Accessible Performance

The emergence of the Accessible Supersport (ASS) category represents a strategic repositioning, shifting the design goal from producing a “race-bike-with-lights” to developing a “road-bike-with-race-styling.” This new design mandate directly addresses the functional shortcomings of the traditional supersport class.

A. Shifting Engine Dynamics: Torque over Peak Horsepower

The ASS philosophy mandates a move away from the peaky power delivery of high-revving inline-fours toward engines that produce usable, engaging power in the mid-range. This has led manufacturers to favor twin-cylinder (Ducati Panigale V2, Aprilia RS 660) and triple-cylinder (Yamaha R9) configurations. These engines are strategically engineered to deliver strong torque at lower RPMs, making them exhilarating but manageable on public roads, where peak horsepower from a liter-bike is often unusable.7

The Ducati Panigale V2 exemplifies this mandate, delivering 70% of its torque from just 3,000 rpm, creating a “vast” powerband that is ideal for dynamic road riding.13 Similarly, the anticipated Yamaha R9’s 890cc CP3 engine is explicitly refined to offer a perfect balance of mid-range torque and top-end performance, ensuring “easy handling in everyday traffic situations”.14 This prioritization of accessible torque is not merely a performance choice; it is a financial one. Engines with fewer cylinders are inherently simpler and cheaper to manufacture, allowing companies to maintain robust profit margins even when offering competitive pricing.5

Furthermore, the design choice to reduce outright power is interpreted by some industry observers as a positive feature. The prevailing sentiment is that many modern superbikes are “too fast” for the average rider, leading to the conclusion that the second-most powerful machine is often the superior choice for most consumers.15 Ducati’s decision to base the newest Panigale V2 on a slightly smaller engine (890cc down from 955cc) with fewer horsepower 15 is therefore viewed not as a compromise, but as a deliberate engineering refinement designed to enhance usability. This strategic reduction in intensity validates the core thesis of the ASS segment: the market values usable performance and reduced complexity over uncompromising, extreme speed.

B. Ergonomics and Rider Comfort (The Usability Mandate)

A primary differentiator for the ASS segment is the complete overhaul of the rider triangle to facilitate comfortable street use. The Panigale V2, for instance, offers an “exceptionally comfortable” riding position for a sports bike, even accommodating riders over 6 feet tall.13 The weight distribution is shifted away from the wrists and onto the rider’s feet and bottom.13 This design makes the V2 feel like a “road bike that can work on track,” in stark contrast to its predecessor, which felt like a “race bike that’s being designed to work on the road”.17

This explicit design focus on comfort and versatility directly challenges the lifestyle appeal of the ADV and Sport Touring categories, aiming to capture riders who demand multi-role capability. Real-world rider reviews confirm that models like the Aprilia RS 660 are surprisingly comfortable for daily commuting, successfully navigating congested city streets and soaking up rough roads.18

Addressing another chronic failure point of traditional sportbikes, the new ASS models incorporate improved thermal management. The Aprilia RS 660, for example, features a distinctive double-layer fairing designed specifically to divert airflow away from the rider’s legs, mitigating the excessive heat typically experienced in traffic with a fully-faired machine.20

C. The Democratization of Electronics

The Accessible Supersport class benefits from the rapid trickle-down of advanced electronic rider aids, transforming these features from premium track necessities into standard safety and confidence tools for the road. The Aprilia RS 660 is densely packed with technology, featuring the full APRC (Aprilia Performance Ride Control) package, a six-axis Inertial Measurement Unit (IMU), Cornering ABS, and quickshifters.21

These sophisticated systems are marketed not as restraints on performance but as tools that actively enhance the riding experience.20 The technology provides a safety net that allows riders to explore the bike’s potential without relying on years of refined feel, making high performance more immediately accessible.23 By incorporating advanced safety features such as Cornering ABS and automatic low beam activation 22, the ASS segment achieves a technological density comparable to premium ADVs, which modern consumers expect.

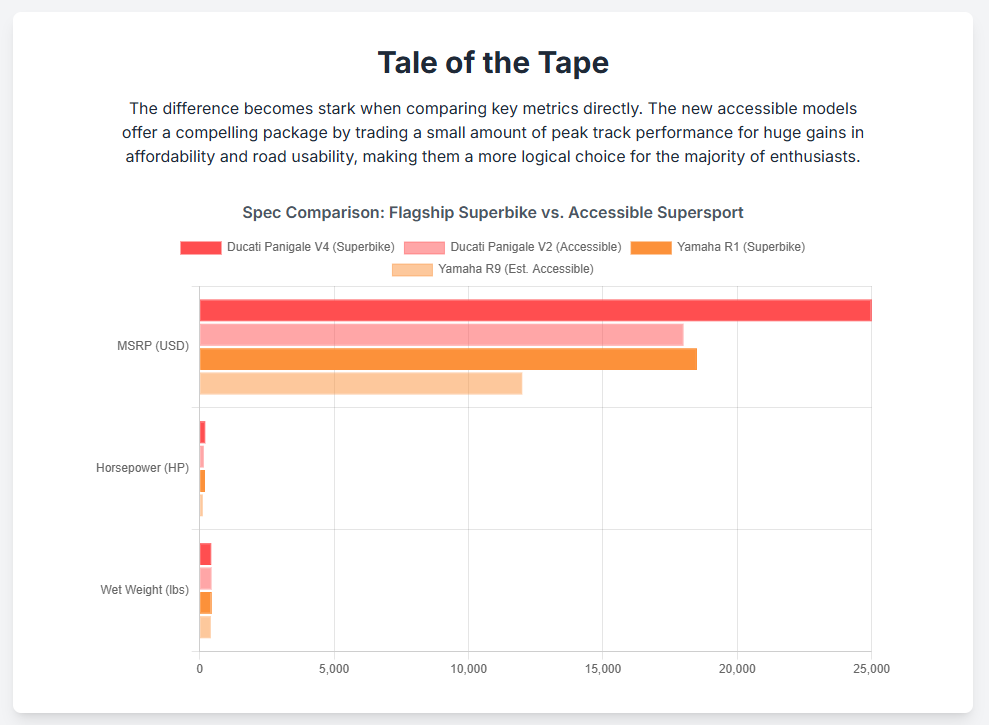

III. Case Study 1: The Premium Tier—Ducati Panigale V2

A. Design Genesis and Positioning

The Ducati Panigale V2 represents a pivotal moment in the history of Borgo Panigale sports bikes. It marks a historic transition because it was designed “from scratch” rather than being directly derived from the larger Superbike platform competing in Superbike racing.25 This allowed engineers to prioritize road usability from the outset, resulting in a significantly more “comfortable and versatile” riding position than previous models.16

The V2 maintains the core emotional appeal of the brand, featuring a clean, elegant design and the aggressive Panigale look, incorporating large air intakes and an iconic tail design.25 Crucially, Ducati established the V2 at the top of the ASS segment with a high starting Manufacturer’s Suggested Retail Price (MSRP) between $16,495 and $19,595.25 This premium pricing, however, still offers a substantial financial saving compared to the Panigale V4S (in the range of $13,000/$16,500 USD), positioning the V2 as an internal bargain for the affluent Ducati enthusiast.13

B. Road Performance and Rider Experience

The Panigale V2’s 890cc L-twin engine, generating approximately 126 claimed horsepower 15, is celebrated for its usable power delivery, especially on the road. The bike’s performance fulfills all criteria for an exceptional road experience, being “joyfully easy to ride” and highly refined.13 Journalists often conclude that for the dedicated road rider, the V2S (the high-spec variant) is unequivocally the better option compared to the more intense V4S.13 The geometry and suspension tuning of the V2 are optimized for stability and comfort on public roads, effectively managing typical road imperfections.13

This focus on refinement and accessibility indicates that Ducati is primarily targeting its existing, affluent customer base. The V2 serves as a highly desirable option for owners who seek the full Panigale aesthetic and experience without the physical demands, maintenance frequency, or top-end intensity of the V4. For this discerning demographic, the V2 functions as a comfort upgrade wrapped in race livery.17

C. Economic Barrier and Platform Standardization

Despite its road-friendly nature, the V2 remains constrained by the persistent TCO friction associated with premium sportbike aesthetics. Full coverage insurance quotes for the V2 start around $2,000 per year.27 This cost structure confirms that the high-end ASS segment is inherently limited to established riders with significant disposable income who can absorb the high TCO.

From a manufacturing standpoint, Ducati’s pivot to the smaller 890cc V-twin is significant for platform consolidation. This engine (or a close variant) is shared with the Multistrada V2 and Streetfighter V2 models.15 By standardizing the L-twin architecture around a compliant, high-output displacement, Ducati maximizes manufacturing efficiency and profitability through modular design across its Naked, Sport, and Adventure segments. The V2’s successful sales performance, alongside the V4 and Multistrada V2, proves that this platform standardization strategy is successfully driving demand in key regions.28

IV. Case Study 2: The Mid-Tier Disruptors—Aprilia RS 660 and Yamaha R9 (Anticipated)

The mid-tier ASS segment, defined by models like the Aprilia RS 660 and the anticipated Yamaha R9, holds the greatest potential for overall segment volume growth due to their relatively lower acquisition costs and emphasis on lightweight agility.

A. Aprilia RS 660: Lightweight Agility and Technological Density

The Aprilia RS 660 is built around a potent 660cc forward-facing parallel twin, generating 105 hp and 70 Nm of torque.22 The design achieves an exceptionally low curb weight of 403 lbs 21, delivering a superb power-to-weight ratio. Aprilia’s strategy has been to democratize technology, packing flagship-level electronics (full APRC, six-axis IMU) into this mid-tier model.20 This technological density sets a new standard for the segment, making advanced safety and performance aids accessible to newer riders.30

The RS 660 has proved to be a critical driver of regional sales growth for Aprilia. While global figures have been complex due to regulatory registrations in Europe, North American sales demonstrated a substantial increase of 28.5% in the first half of 2025.31 This robust performance validates the market acceptance of high-tech, torque-focused Italian middleweights, showing that consumers are willing to pay a premium for technological sophistication and light weight in this segment.32

B. Yamaha YZF-R9: Strategic Repositioning and the CP3 Engine

The anticipated arrival of the Yamaha YZF-R9 represents the most significant endorsement of the ASS philosophy by a major Japanese manufacturer. Positioned to replace the highly specialized R6 and to serve as the R Series flagship in markets where the R1 is no longer street legal 33, the R9 is a crucial strategic release.

The R9 is built upon the widely praised 890cc CP3 (Crossplane Concept, 3-cylinder) engine platform from the MT-09, expected to deliver 117–119 hp.14 This engine is prized for its charismatic sound and deep well of mid-range torque, which enhances rideability on the street.14 While sharing the engine, the R9 is not merely a faired MT-09; it incorporates a purpose-made chassis, full rider-assist technology via a six-axis IMU, and, in the high-spec SP variant, premium components like Öhlins suspension and Brembo Stylema calipers.33

The launch of the R9 completes Yamaha’s strategy of leveraging the CP3 engine across its Naked, Sport Touring, and Supersport lines, maximizing platform modularity and cost efficiency—a financial strategy mirrored by Aprilia’s use of the 660cc twin.19

A comparative analysis of the core ASS contenders shows how manufacturers are balancing performance, weight, and price:

Table 2: Accessible Supersport (ASS) Competitive Benchmarking

| Model | Engine Configuration | Displacement (cc) | Claimed Horsepower | Wet Weight (lbs) | Starting MSRP (Approx.) | Ergonomic/Road Feature |

| Ducati Panigale V2 | 90° V-Twin | 890 cc 15 | 126 hp 15 | ~395 lbs 15 | $16,495 – $19,595 25 | Superior Road Comfort, Low Wrist Stress 13 |

| Yamaha YZF-R9 (Anticipated) | CP3 Inline-Triple | 890 cc 14 | 117-119 hp 14 | 430 lbs 14 | ~$15,500 (Estimated Conversion) 33 | Mid-Range Torque Focus, Easy Traffic Handling 14 |

| Aprilia RS 660 Factory | Parallel Twin | 660 cc 29 | 105 hp 29 | 403 lbs 21 | $13,999 (Factory) 37 | Full APRC Electronics Suite, Commuter-Friendly 18 |

| Traditional 600cc I4 (e.g., ZX-6R) | Inline-Four | 636 cc (Typical) | 127 hp (Typical) | ~430 lbs (Typical) | $11,999 (Typical) | Track-focused, High TCO/Insurance 4 |

The R9, however, faces a strategic challenge regarding its acquisition cost. If priced similarly to its estimated UK price (£12,254, or approximately $15,500 USD), the R9 is more expensive and slightly less powerful in terms of peak output than the few remaining traditional 600cc I4 competitors, such as the Kawasaki ZX-6R.33 For the R9 to achieve mass success, its pricing must be justified either by offering drastically lower TCO (especially insurance) or by appealing exclusively to the consumer preference for usable torque and the specific charisma of the CP3 engine, overcoming the I4’s traditional peak horsepower advantage.

V. Total Cost of Ownership (TCO) and Consumer Decision Drivers

TCO remains the most critical structural barrier limiting the supersport resurgence to a niche market of affluent, established buyers. The inability of the ASS segment to fully escape the punitive TCO structure of its predecessor severely restricts its potential for volume growth, regardless of the technological advancements in usability.

A. Insurance Cost Disparity and Segment Risk Profile

The Panigale V2 demonstrates that even a road-focused design, when paired with premium race styling, struggles to shed the “supersport” risk label imposed by the insurance industry. Full coverage policies for the V2 start at $2,000 per year.27 This cost prevents the segment from attracting the volume of new, budget-conscious riders necessary for a true market resurgence.

The segment’s volume potential relies entirely on attracting a statistically more mature and financially stable demographic. Older riders (e.g., 30+ males) who receive much lower rates on sportbikes, even traditional I4s 4, are better positioned to absorb these costs. For ASS models to grow into a mass-market category, manufacturers must aggressively demonstrate to insurers that the standard inclusion of sophisticated rider aids (IMU, Cornering ABS) and the torque-centric engine profile inherently reduce accident severity and risk profile, thereby justifying lower rates.

B. Maintenance and Reliability Perception

Historically, European motorcycles (Ducati, Aprilia) have carried a perception of higher maintenance complexity, specialized service requirements, and greater parts costs compared to their Japanese counterparts.38 Routine maintenance items such as valve adjustments can cost between $300 and $1,200, depending on the complexity of the engine and the service interval.40

This perception of long-term financial burden affects used market value. In certain regions, late-model used Aprilia RS 660s (a superior performance and technology package with a higher MSRP) are observed trading at prices below the Yamaha R7.32 This discrepancy is not based on performance metrics but on powerful consumer trust in Japanese reliability and a fear of high long-term costs associated with European specialty service and parts availability.32

The industry must acknowledge that consumer confidence regarding long-term ownership costs is often a decisive factor overriding initial technical superiority. For European ASS models to maximize their market penetration, they must aggressively address this perception, potentially through standardizing maintenance schedules and offering comprehensive, affordable extended warranties to match the reliability confidence inherent in Japanese brands.

Table 3: TCO Friction Analysis (Supersport vs. Accessible Supersport)

| Cost Variable | Traditional 600cc I4 (Pre-2020) | Premium ASS (Panigale V2) | Mid-Tier ASS (RS 660/R9) | Strategic Implication |

| Initial Insurance (Annual Full Coverage) | Extremely High (400% higher than average) 4 | High (~$2,000/yr minimum) 27 | Moderate (Lower perception of risk than I4s) 4 | TCO remains the primary barrier for V2; R9/RS 660 must break the I4 risk perception. |

| Engine Platform Cost/Complexity | High-revving, narrow tolerances, complex valve trains 12 | V-Twin refinement, higher European labor/parts cost 38 | Parallel Twin/Triple (lower cylinder count, higher modularity) 5 | ASS platforms offer better internal profit margins and lower long-term complexity. |

| Maintenance Perception | Complex and frequent high-rev maintenance 38 | Specialized dealer service required (Italian premium) 41 | Perceived higher complexity/cost than Japanese bikes, impacting resale value 32 | Long-term reliability and service cost must be validated for ASS growth. |

VI. Competitive Landscape and Strategic Conclusions

A. European Leadership: Defining the New Segment

European manufacturers, particularly Ducati and Aprilia, have successfully defined and cornered the high-tech, accessible segment. Ducati established the template for the premium tier with the Panigale V2, proving that high road usability and advanced electronics are desired features in the $16,000+ price bracket. Aprilia, with the RS 660, demonstrated the capacity for a significant technological leap in the mid-range. By aggressively packaging sophisticated electronic control packages (APRC, IMU) into a lightweight chassis, Aprilia has redefined consumer expectations for the category and achieved substantial growth in critical markets like North America.31

B. The Japanese Strategic Response

The Japanese “Big Four” have adopted a bifurcated response to the European challenge. Yamaha’s R9 represents the full adoption of the ASS philosophy, prioritizing the unique, charismatic torque of the CP3 triple as the spiritual and functional successor to the R-series I4.34 This move confirms the industry-wide acceptance that platform consolidation around versatile, lower-cylinder-count engines is necessary for future profitability and compliance.

Conversely, Kawasaki is hedging its bets. While continuing to offer the traditional I4 experience with models like the ZX-6R, it simultaneously introduced the low-displacement, high-revving ZX-4R.42 This strategy serves both the diminishing I4 loyalist segment and the new enthusiasts seeking the nostalgia of a screaming engine, but at a more accessible cost and displacement. Honda has adopted the slowest approach to this segment renewal, focusing instead on its dominant Adventure (Africa Twin) and Superbike (Fireblade) platforms, with less radical middleweight offerings.43

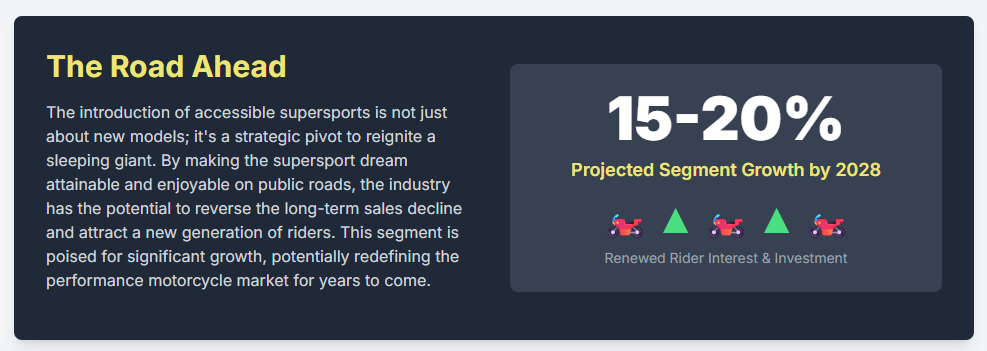

C. The Resurgence Outlook

The term “supersport resurgence” must be redefined: it is not a return to the golden age of the 600cc I4 but rather the strategic invention of the Accessible Supersport (ASS) category. This pivot is a strategic necessity driven by Euro 5 regulations and the market’s pivot toward versatility, rather than a market-driven opportunity for exponential volume growth.

The ASS models—V2, R9, RS 660—have successfully eliminated the three core functional failure points of previous superbikes: poor ergonomics, unusable high-end power delivery, and lack of modern safety technology. Consequently, the ASS segment is forecasted to achieve high growth, primarily driven by the success of versatile twin and triple architectures, though its absolute volume is likely to remain smaller than the Adventure and Touring segments. The highest volume potential rests with mid-tier models that successfully mitigate the TCO burdens associated with the “supersport” designation.

D. Strategic Recommendations for Industry Stakeholders

- Prioritize Modular Platform Engineering: R&D resources must continue to focus on advanced middleweight engine architectures (twins and triples) that facilitate modularity across three core motorcycle segments: Naked, Sport, and Adventure. This platform consolidation is essential for offsetting high compliance costs and maximizing product relevance.

- Aggressively Decouple TCO from Styling: Manufacturers must urgently invest in demonstrating the safety and lower risk profile of ASS models to insurance providers. The incorporation of standard six-axis IMU technology and torque-centric power delivery should be emphasized as factors that significantly reduce the statistical accident rates, allowing these models to secure insurance rates closer to those of naked or sport-touring machines.

- Refine the Marketing Narrative: Marketing strategies must pivot decisively away from track heroism and peak speed metrics. The core narrative should emphasize comfort, daily usability, technological refinement, and the joy of accessible performance (“smiles per mile” 20), directly challenging the lifestyle appeal and versatility that currently drive the Adventure segment’s dominance.

Sources

- The Imminent Collapse of the Motorcycle Market? | Two Wheeled Texans, accessed on October 5, 2025, https://www.twtex.com/forums/threads/the-imminent-collapse-of-the-motorcycle-market.138466/

- United States Motorcycles Market – Data & Insight 2025 | MotorcyclesData, accessed on October 5, 2025, https://www.motorcyclesdata.com/2025/07/24/united-states-motorcycles-market/

- Trend of Sportbikes 2025: Shift to Middleweight Models – Accio, accessed on October 5, 2025, https://www.accio.com/t-v2/business/trend-of-sportbikes

- Why are supersport motorcycles disappearing? Turns out the type of rider who buys them are what killed the segment – Reddit, accessed on October 5, 2025, https://www.reddit.com/r/motorcycles/comments/tpqto2/why_are_supersport_motorcycles_disappearing_turns/

- The Decline of 600cc Supersports: Misguided Regulations Are Killing Motorcycling’s Soul, accessed on October 5, 2025, https://www.reddit.com/r/motorcycle/comments/1fjqgf8/the_decline_of_600cc_supersports_misguided/

- Ducati V2 vs R1 vs S1000RR – Large Rider – Which is more comfortable – Reddit, accessed on October 5, 2025, https://www.reddit.com/r/Ducati/comments/10opz47/ducati_v2_vs_r1_vs_s1000rr_large_rider_which_is/

- What’s Up With SUPERSPORT Motorcycles these days? – YouTube, accessed on October 5, 2025, https://www.youtube.com/watch?v=n-P2lDOyLss

- Aventure Touring Motorcycle Market Size, Trends And Forecast – Verified Market Research, accessed on October 5, 2025, https://www.verifiedmarketresearch.com/product/adventure-touring-motorcycle-market/

- Adventure Motorcycle Market to Reach $64.4 Billion, Globally, by 2032 at 7.5% CAGR: Allied Market Research – PR Newswire, accessed on October 5, 2025, https://www.prnewswire.com/news-releases/adventure-motorcycle-market-to-reach-64-4-billion-globally-by-2032-at-7-5-cagr-allied-market-research-301988078.html

- Adventure Motorcycle Market Size to Reach USD 24.96 Bn by 2034 – Precedence Research, accessed on October 5, 2025, https://www.precedenceresearch.com/adventure-motorcycle-market

- Our Strategy – Harley-Davidson – Investor Relations, accessed on October 5, 2025, https://investor.harley-davidson.com/our-strategy/default.aspx

- What’s The Best Motorcycle Engine: Twin, Triple or Four?, accessed on October 5, 2025, https://www.motorcycle.com/ask-mo-anything/whats-the-best-motorcycle-engine-twin-triple-or-four.html

- REVIEW | Ducati Panigale V2 S – Sports Bike Perfection – Driven.Site, accessed on October 5, 2025, https://driven.site/words/ducati-panigale-v2s-review

- 2025 Yamaha YZF-R9 Unveiled: Meet the New Midweight Sportbike – Twisted Road, accessed on October 5, 2025, https://www.twistedroad.com/blog/posts/2025-yamaha-yzf-r9-bridging-street-practicality-with-track-performance

- 2025 Ducati Panigale V2 S first ride review – RevZilla, accessed on October 5, 2025, https://www.revzilla.com/common-tread/2025-ducati-panigale-v2-first-ride-review

- Technology and Design – Ducati Panigale V2, accessed on October 5, 2025, https://www.ducati.com/ww/en/bikes/panigale/panigale-v2/insights

- NEW DUCATI PANIGALE V2S vs OLD PANIGALE V2 955 | ROAD HEAD TO HEAD, accessed on October 5, 2025, https://www.youtube.com/watch?v=LuUFvQsfCHI

- Daily RS 660? : r/Aprilia – Reddit, accessed on October 5, 2025, https://www.reddit.com/r/Aprilia/comments/15a2f05/daily_rs_660/

- Why We Lust for the Aprilia RS 660: Review and Buyers Guide – Motofomo, accessed on October 5, 2025, https://motofomo.com/aprilia-rs-660-overview/

- 6 REASONS YOU CAN’T HELP BUT WANT IT – Aprilia, accessed on October 5, 2025, https://www.aprilia.com/us_EN/aprilia-rs-660/6-reasons-you-cant-help-but-want-it/

- RS 660 – Aprilia, accessed on October 5, 2025, https://www.aprilia.com/us_EN/models/rs-660/

- Aprilia RS 660: price, colors, consumption, accessed on October 5, 2025, https://www.aprilia.com/us_EN/models/rs-660/rs-660-660-parallel-twin-4-stroke-2025/

- V2 panigale or V4 panigale for track? : r/Ducati – Reddit, accessed on October 5, 2025, https://www.reddit.com/r/Ducati/comments/1m47gkp/v2_panigale_or_v4_panigale_for_track/

- UNMISTAKABLE DESIGN – Aprilia, accessed on October 5, 2025, https://www.aprilia.com/us_EN/aprilia-rs-660/unmistakable-design/

- Ducati USA: Panigale V2 | High-Performance Sport Bike, accessed on October 5, 2025, https://www.ducati.com/us/en/bikes/panigale/panigale-v2

- Ducati Panigale V2 – Price, Desing and Performance, accessed on October 5, 2025, https://www.ducati.com/in/en/bikes/panigale/panigale-v2

- Insurance Quotes for Panigale V2 Are Insane—Anyone Just Doing Liability? : r/Ducati, accessed on October 5, 2025, https://www.reddit.com/r/Ducati/comments/1j0eozj/insurance_quotes_for_panigale_v2_are_insaneanyone/

- Ducati Best Selling Bike: Top Models & Sales Trends Revealed, accessed on October 5, 2025, https://www.accio.com/business/ducati-best-selling-bike

- Aprilia RS 660 Factory: price, colors, consumption, accessed on October 5, 2025, https://www.aprilia.com/us_EN/models/rs-660/rs-660-factory-660-parallel-twin-4-stroke-2025/

- aprilia concept rs 660: a new concept of sportiness – Wide Magazine, accessed on October 5, 2025, https://wide.piaggiogroup.com/en/articles/innovation/aprilia-concept-rs-660-a-new-concept-of-sportiness/index.html

- Aprilia 2025. Global Sales Have Lost in Double-digit During The First Half, accessed on October 5, 2025, https://www.motorcyclesdata.com/2025/09/06/aprilia-motorcycles/

- Why people don’t appreciate Aprilia? – Reddit, accessed on October 5, 2025, https://www.reddit.com/r/Aprilia/comments/17n8t30/why_people_dont_appreciate_aprilia/

- Yamaha R9 (2025) – Review | Long awaited sportsbike – Bennetts Insurance, accessed on October 5, 2025, https://www.bennetts.co.uk/bikesocial/reviews/bikes/yamaha/r9-2025-review

- R9 | Supersport Motorcycle | 900cc | 2025 – Yamaha Motor Europe, accessed on October 5, 2025, https://www.yamaha-motor.eu/gb/en/motorcycles/supersport/pdp/r9-2025/

- Yamaha R9: Everything Confirmed So Far – Top Speed, accessed on October 5, 2025, https://www.topspeed.com/yamaha-r9-everything-confirmed-so-far/

- First Ride: 2025 Yamaha R9 – Road Dirt, accessed on October 5, 2025, https://roaddirt.tv/first-ride-2025-yamaha-r9/

- Aprilia RS 660 Factory vs. Panigale V2S: Which Bike Rules the Road? – YouTube, accessed on October 5, 2025, https://www.youtube.com/watch?v=v-5vmXnCCog

- Is it true that sport bikes require more maintenance than other types of motorcycles? If so … – Quora, accessed on October 5, 2025, https://www.quora.com/Is-it-true-that-sport-bikes-require-more-maintenance-than-other-types-of-motorcycles-If-so-what-makes-them-different-in-terms-of-maintenance-needs

- Aprilia rs660 vs Honda cbr600rr as a commuter? : r/SuggestAMotorcycle – Reddit, accessed on October 5, 2025, https://www.reddit.com/r/SuggestAMotorcycle/comments/wrdjxy/aprilia_rs660_vs_honda_cbr600rr_as_a_commuter/

- The Hidden Costs Of Motorcycle Ownership No One Talks About – Top Speed, accessed on October 5, 2025, https://www.topspeed.com/hidden-costs-of-motorcycle-ownership-no-one-talks-about/

- For those who wondering. First service rs 660 =$389 : r/Aprilia – Reddit, accessed on October 5, 2025, https://www.reddit.com/r/Aprilia/comments/xncepu/for_those_who_wondering_first_service_rs_660_389/

- Top 10 middleweight sports bikes of 2025 | Visordown, accessed on October 5, 2025, https://www.visordown.com/features/top-10s/top-10-middleweight-sports-bikes

- The 5 Best Honda Motorcycles for 2025 | Escondido Cycle Center California, accessed on October 5, 2025, https://www.teamecc.com/blog/the-5-best-honda-motorcycles-for-2025–93193

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity