Bajaj Auto’s Electric Two-Wheeler Performance in August 2025: Geopolitical Vulnerability and Competitive Realignment

I. Executive Summary: The August Anomaly and Strategic Implications

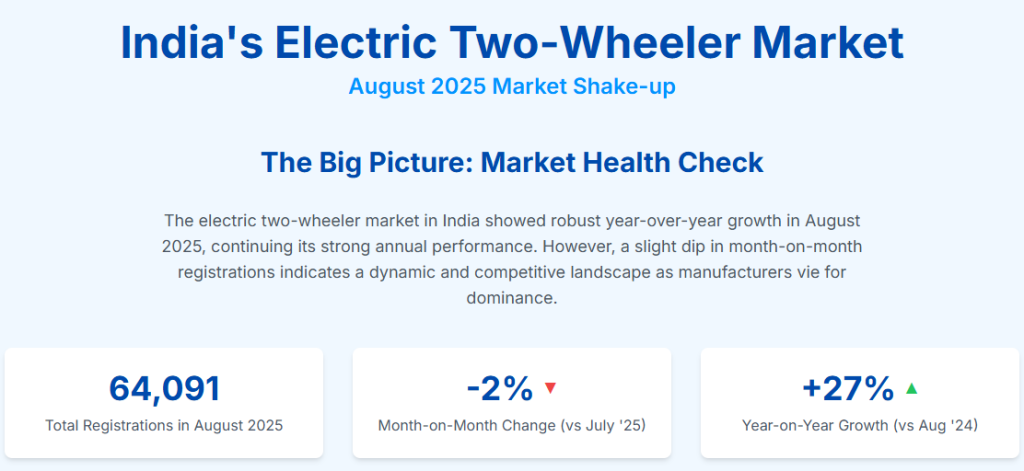

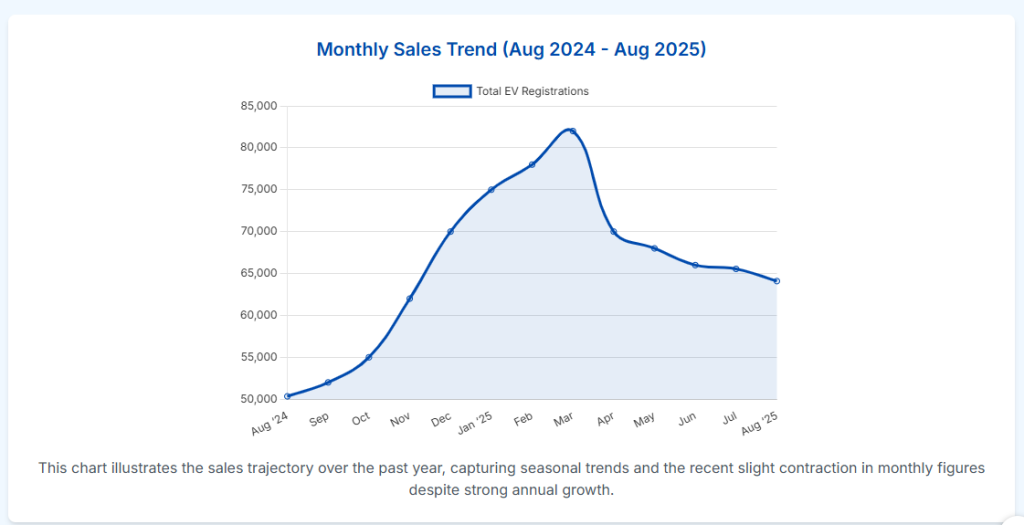

The operational performance of Bajaj Auto in the Indian electric two-wheeler (E2W) market during August 2025 warrants a deep analysis, as the company experienced an unprecedented drop to the fifth position in retail sales/registrations. This decline followed months of consistent performance as the nation’s second-largest E2W manufacturer.1

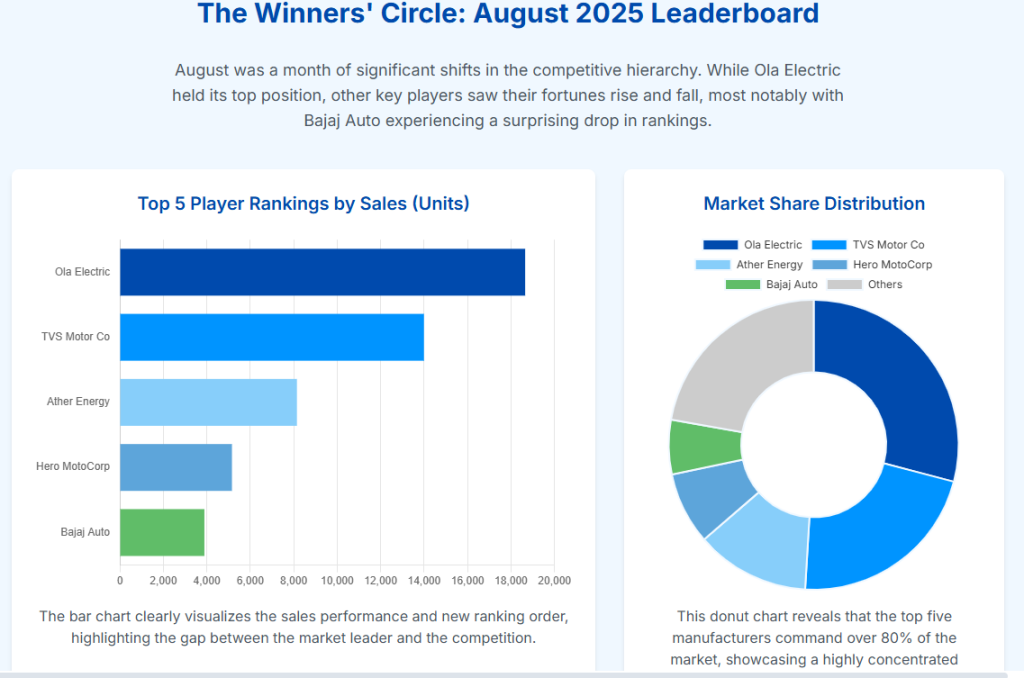

The quantitative shock was severe: Bajaj Auto registered only 11,730 units of its Chetak electric scooter.1 This figure reflects a dramatic month-on-month (MoM) contraction of 40.6% compared to the 19,754 units sold in July 2025.3 This setback allowed rivals to capitalize instantly, with TVS Motor Company retaining the lead, while Ola Electric, Ather Energy, and Hero MotoCorp (Vida) surged ahead to claim the second, third, and fourth spots, respectively.2

The root cause of this performance contraction was identified as an acute supply chain vulnerability. The crisis stemmed from an unexpected shortage of heavy rare-earth magnets, a critical component necessary for high-performance EV motors, following new export restrictions imposed by China.3 Management had previously issued a warning that this scarcity could severely impact production, even threatening a ‘zero month’ scenario.5

Despite the pronounced failure in the domestic E2W segment, the corporate impact was successfully contained. Bajaj Auto’s overall financial stability was maintained by a robust performance in international markets, where exports surged 29% year-on-year (YoY), and continued leadership in the high-EV-penetration three-wheeler (3W) segment.6 The market’s rapid response to the vacuum confirms that supply continuity is now a critical competitive metric, with rivals like Hero Vida successfully deploying aggressive mass-market strategies, including Battery-as-a-Service (BaaS), to seize share.8

II. Quantification of Bajaj Auto’s E2W Performance in August 2025

The performance in August 2025 represents an acute, operational interruption rather than a fundamental flaw in demand for the Chetak brand. The analysis of VAHAN registration data clearly outlines the magnitude of the competitive shift in that specific month.

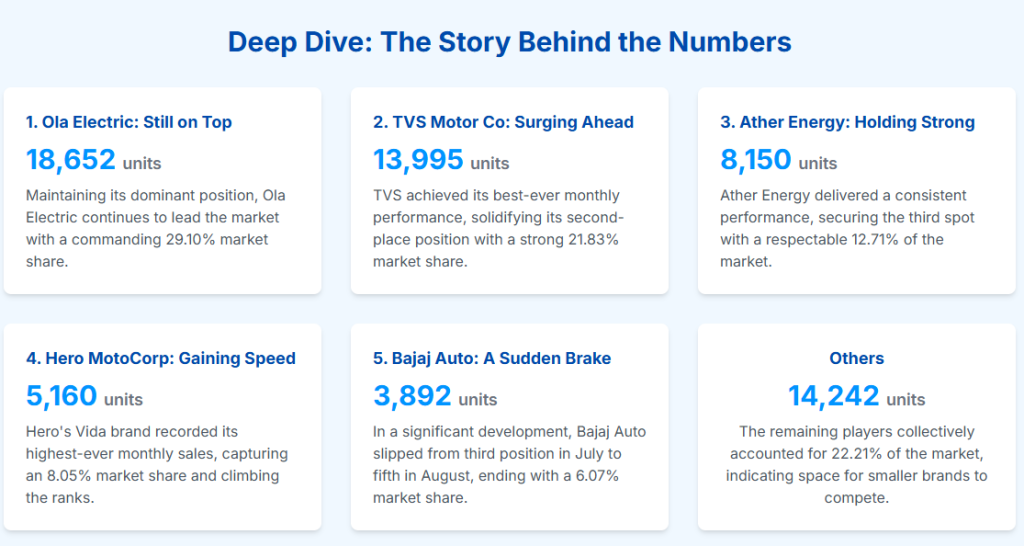

2.1 The Slip to Fifth Place: Detailed VAHAN Data Analysis

Bajaj Auto’s E2W market share fell precipitously from approximately 19% in July to an estimated 11.3% in August.3 This market share erosion resulted in the company falling behind key competitors, marking the first time the legacy manufacturer has ranked outside the top three in recent fiscal quarters.

The table below details the competitive hierarchy based on August 2025 retail registrations (excluding Telangana data, consistent with some VAHAN reports, though the overall market size was approximately 1.04 lakh units).10

Indian Electric Two-Wheeler Retail Registrations (August 2025)

| Rank | OEM (Brand) | Units Registered (Vahan) | Market Share (%) | Source | ||

| 1 | TVS Motor Company (iQube) | 24,087 | ~23.1% | 2 | ||

| 2 | Ola Electric | 18,972 | ~18.2% | 2 | ||

| 3 | Ather Energy | 17,856 | ~17.1% | 2 | ||

| 4 | Hero MotoCorp (Vida) | 13,313 | ~12.8% | 2 | ||

| 5 | Bajaj Auto (Chetak) | 11,730 | ~11.3% | 1 |

The 30% YoY decline in Bajaj’s e-scooter sales stood in stark contrast to the overall E2W market, which grew 17% YoY, achieving its second-best monthly performance of 2025.1 This highlights that the challenge faced by Bajaj was localized and company-specific, driven by supply constraints, while underlying sector demand remained robust.

2.2 Nuances in Competitive Data Interpretation

A comprehensive view of the competitive landscape requires consideration of regional data, which is sometimes omitted from initial VAHAN releases. The aggregated data, including Telangana registrations, alters the immediate competitive ranking. With the inclusion of this state data, Ather Energy (20,800 units) actually surpassed Ola Electric (19,999 units) in August, primarily because Telangana contributed nearly 14% of Ather’s national sales, compared to just 5% for Ola.13 This statistical deviation underscores that successful regional penetration strategies, particularly in rapidly growing markets, are now significant enough to influence national competitive dynamics, requiring continuous, holistic data monitoring for accurate market assessment.

Furthermore, the operational setback in the E2W segment, characterized by a 40.6% MoM drop, did not cascade into a corporate catastrophe. Bajaj Auto reported a 5% YoY increase in its total sales for August.6 This clear separation of the E2W segment’s operational volatility from the company’s overall sales stability confirms that E2W, despite being a crucial growth driver, is presently a strategically important but financially minor component within Bajaj’s extensive global product and revenue portfolio.

III. The Crux of the Crisis: Rare Earth Magnet Shortage

The single most determinative factor in Bajaj Auto’s August decline was the acute supply-side shock originating from geopolitical trade policy.

3.1 Geopolitical Impact on the EV Supply Chain

The operational constraint was driven by China’s export restrictions on specific heavy rare-earth magnets, components essential for permanent magnet motors utilized in electric vehicles.3 Given China’s dominant position in the global supply of these critical minerals, this policy shift created an immediate, powerful bottleneck for manufacturers reliant on existing supply chains.

Bajaj Auto management had previously highlighted the seriousness of this situation, noting that the volume requirements for their Chetak production necessitated a substantial and reliable supply chain. Warnings were issued in early August that the constraints might force the company to reduce EV production by 50% and even face a “zero month”.5 The resulting 40% sales plunge in August validated these concerns, illustrating the fragility of the EV manufacturing sector when relying heavily on concentrated critical mineral sources. The management also cautioned that identifying alternative suppliers or undertaking component redesigns would be “costly and time-consuming,” particularly ahead of the high-demand festive season.3 This indicates that the consequence of the supply shock extends beyond immediate revenue loss to potential near-term margin pressure caused by higher expedited procurement costs or necessary re-engineering efforts.

3.2 Supply Chain Resilience Differential

The variance in performance among major original equipment manufacturers (OEMs) during August underscores a significant difference in supply chain resilience strategies.

TVS Motor Company demonstrated superior preparedness, successfully retaining its market leadership with high volumes.2 This capability is generally attributed to robust, well-established OEM supply networks and strong dealer inventory management, allowing TVS to ride out the immediate magnet scarcity with minimal disruption compared to rivals.

In contrast, Bajaj’s severe operational vulnerability suggests a greater reliance on a specific magnet component, making its motor design structure particularly susceptible to the China curbs. This high dependency created a structural geopolitical risk that became an operational reality in August.

Ather Energy, while also impacted by disruptions (leading to a delay in claiming demand incentives worth ₹26.25 crore for affected vehicles 15), showcased a proactive mitigation strategy. Ather successfully developed and secured type approval for a Heavy Rare Earth Free (HREF) motor.15 The development of HREF technology is a strategic move, eliminating reliance on the volatile heavy rare-earth supply and ensuring long-term compliance with domestic sourcing requirements (Phased Manufacturing Program, or PMP). This commitment to mineral-independent technology represents a choice to prioritize supply chain security over the higher performance specifications typically associated with REE-dependent permanent magnet motors.

IV. Redefining the E2W Competitive Hierarchy: August 2025

Bajaj Auto’s temporary retreat provided a clear, albeit brief, opportunity for competitors to redefine the market structure and cement critical strategic positions.

TVS Motor Company leveraged its robust supply infrastructure to maintain a commanding position, confirming its strategy of focusing on product reliability (iQube) and structural stability.11 The company’s ability to manage dealer inventory effectively proved paramount during a period of component scarcity.

Among the new-age players, Ola Electric reclaimed the number two ranking with 18,972 units.2 However, the growth narrative for Ola remains complex, as this registration volume represented a 31% YoY decline, suggesting that while the company benefited from Bajaj’s shortfall, broader market softness or specific underlying challenges persist.10 Ather Energy’s leap to third place (17,856 units) was attributed to aggressive and successful geographic expansion, particularly its penetration into new, high-growth markets like Maharashtra and Gujarat with models such as the Rizta.2

4.1 Hero Vida’s Strategic Leap: The Mass-Market Disruptor

Perhaps the most significant development in August was Hero MotoCorp’s Vida brand surpassing Bajaj for the first time, registering 13,313 units.2 This moment confirms the shift from a three-way (TVS, Ola, Bajaj/Ather) contest to a fierce four-way battle, centered on affordability and access.

Hero’s success was fundamentally driven by the launch of the affordable Vida VX2, priced strategically around ₹82,000.8 Crucially, Hero introduced the Battery-as-a-Service (BaaS) model, which decoupled the battery cost from the vehicle purchase. This innovation lowered the initial acquisition price for consumers to as little as

₹44,990.8 This strategy directly addresses the primary inhibition for mass EV adoption in India—the high upfront cost of the battery.16 The rapid market share gained by Hero using this model signals that the structural imperative for deep E2W penetration into the mass-market ICE segment now requires pricing disruption far below the

₹1.0 Lakh threshold, a strategy that moves beyond reliance on government FAME subsidies alone.17

The competitive vacuum created by Bajaj’s supply issues resulted in an instantaneous and complete redistribution of its lost 7 percentage points of market share.8 This event establishes that short-term success in the dynamic E2W market hinges almost entirely on immediate supply continuity and operational agility, especially when anticipating demand surges during the festive preparation period (the Ganpati festival began on August 27).8 To reclaim lost positioning, Bajaj must not only restore production but also aggressively win back customers who switched to rivals due to immediate availability.

V. Financial Context and Investor Response

Bajaj Auto’s decades-long strategy of portfolio diversification proved effective in mitigating the financial impact of the E2W segment’s temporary failure.

5.1 Exports as the Corporate Financial Shield

While domestic two-wheeler sales, including ICE and EV components, declined 12% YoY 6, the total sales for Bajaj Auto still grew 5% YoY to 417,616 units.6 This resilience was overwhelmingly driven by strong international performance. Exports surged 29% YoY to 1,85,218 units, successfully counteracting the domestic slowdown.6 Two-wheeler exports alone grew 25% YoY.6 This ability of a 29% surge in international business to nullify the negative perception of a 40% domestic E2W crash highlights that Bajaj’s global market footprint (exporting to over 75 countries 20) functions as the ultimate defense mechanism against segment-specific supply chain failures and domestic market volatility.

Further buttressing the company’s stability was the performance of its commercial vehicle (CV) segment, a segment where EV penetration is already significantly high. CV sales rose 21% overall, driven by a remarkable 58% surge in exports.6

5.2 Investor Sentiment and Stock Performance

Despite the highly publicized E2W volume crash, investors reacted positively to the overall August sales report. Bajaj Auto shares rallied 3–4% after the sales data release, closing near ₹8,978 on the NSE.7 The market’s reaction confirms that institutional investors viewed the magnet shortage as a temporary, non-structural operational shock, placing greater faith in Bajaj’s diversified international business and sustained leadership in the 3W sector.7

Prior to the August disruption, EVs contributed over 20% to Bajaj’s domestic sales in Q1 FY26.14 This substantial and rapidly growing domestic revenue contribution emphasizes that while the immediate crisis was handled, a prolonged or recurring supply chain disruption would quickly escalate from a segment-specific issue to a material threat against the company’s domestic revenue stream, making the rapid resolution of the component scarcity imperative.

VI. Bajaj’s Path to Recovery and Future Strategy

Bajaj Auto has demonstrated operational agility in overcoming the crisis, centered on supply stabilization and a renewed focus on its mass-market product pipeline.

6.1 Mitigation Success and September Rebound

Following the crisis, Bajaj successfully navigated the supply chain challenge, securing magnet supplies ahead of schedule.23 This mitigation effort allowed for the immediate resumption of Chetak production and normalization of deliveries just in time to address the demand acceleration preceding the festive season.24 The effectiveness of this recovery was visible in mid-September sales data (through Sept 15), where Bajaj sold 7,546 units, successfully reclaiming the number two market rank and pushing rivals like Ola and Hero down the chart, demonstrating strong operational recovery momentum.25

6.2 Product and Pricing Strategy

Bajaj is aggressively targeting the mass-market commuter segment with the newly positioned Chetak 3001. This model is strategically engineered for practicality, featuring an ARAI-rated range of 127 km, a large 35-liter under-seat storage compartment, faster charging times, and the Chetak’s signature durable steel metal body.26 Bajaj leverages its wide distribution network, which includes over 3,800 service centers, positioning the Chetak 3001 as a reliable choice backed by ease of service and longevity.26

The Chetak 3001’s ex-showroom price (around ₹1.07 Lakh 9) positions it at the lower end of Bajaj’s electric offering. However, it still falls into the Premium Mass Market bracket, maintaining a higher price point than the most aggressive rivals.

Competitive Pricing Analysis: Mass-Market E2W (2025)

| Model | Manufacturer | Ex-Showroom Price (INR) | Key Strategic Feature/Pricing Model | |

| Vida VX2 (Go BaaS) | Hero MotoCorp | ₹44,990 (with BaaS) | Lowest upfront cost; BaaS model eliminates battery barrier 8 | |

| Ola S1 Air | Ola Electric | ₹89,999 | Aggressive volume pricing, feature-rich 9 | |

| TVS iQube (Base) | TVS Motor Company | ₹99,326 – 1.37 Lakh | High reliability, stable supply, deep market penetration 27 | |

| Bajaj Chetak 3001 | Bajaj Auto | ₹1,07,400 | Metal body, established service network, improved practicality 26 | |

| Ather Rizta (Base) | Ather Energy | ₹1.12 Lakh | Technology focus, strong regional expansion 28 |

6.3 Sustained Leadership in Commercial Electric Three-Wheelers (E3W)

Bajaj’s fundamental strength in electrification remains firmly rooted in the commercial vehicle segment. In August 2025, Bajaj led the 3W passenger L5 market (of which 18.8% were EVs) and the 3W cargo L5 market (where 10.6% were EVs).29 The overall EV penetration in the E3W segment (35.9% passenger, 23.7% cargo) far surpasses the 7.6% penetration seen in E2W.29

This E3W dominance is driven by a compelling Total Cost of Ownership (TCO) argument. The rapid commercial adoption confirms that Bajaj possesses a sound core EV manufacturing and distribution strategy. The success achieved in this segment provides a commercial blueprint—focusing on reliability and minimizing running costs—which must now be aggressively applied to the Chetak E2W line to achieve similar market penetration. Bajaj’s entry into the e-rickshaw market with the new ‘Riki’ brand in August further capitalizes on its commercial leadership and portfolio diversification.22

VII. Conclusions and Strategic Outlook

Bajaj Auto’s steep drop to fifth position in August 2025 was a tactical failure, resulting from a high dependency on a fragile geopolitical supply chain for rare-earth magnets. The event confirmed that supply stability is now as critical as product quality in the competitive Indian E2W market. The crisis was temporary, evidenced by the September recovery, and was financially buffered by the company’s strategic diversification across exports and the commercial vehicle segment.

7.1 Imperatives for Geopolitical Risk Mitigation

To prevent future disruptions, Bajaj must swiftly adopt strategies to de-risk its supply chain. The company should accelerate the integration of alternative motor technologies, such as Heavy Rare Earth Free (HREF) solutions, echoing the proactive measures taken by competitors like Ather Energy.15 Such a shift is necessary to stabilize long-term compliance with domestic sourcing requirements and eliminate single-point geopolitical vulnerability. Furthermore, collaboration with national initiatives, such as Khanij Bidesh India Limited (KABIL), aimed at securing critical mineral supply chains overseas, is crucial for bolstering the resilience of the entire Indian EV manufacturing ecosystem.4

7.2 Competitive and Pricing Strategy

The success of Hero Vida’s BaaS model establishes a new structural imperative: mass adoption requires eliminating the high upfront battery cost barrier.8 Bajaj must deploy a BaaS or similar low-initial-cost financing option for the Chetak 3001 to aggressively challenge the sub-₹1.0 Lakh price point and effectively compete with ICE two-wheelers.

Long-term cost reduction must be driven by domestic manufacturing, leveraging the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cells (ACC) to localize battery production.31 This localization, potentially utilizing chemistries like Lithium Iron Phosphate (LFP) for mass-market models, is essential for reducing the highest cost component of the EV and achieving sustainable price parity with conventional vehicles.32

7.3 Market Maturity and Service Dominance

The underlying E2W market remains structurally robust, projected to experience substantial growth, driven by a favorable macroeconomic outlook (FY26 GDP growth projected at 6.5% 33) and legislative support that boosts middle-income disposable spending.33

The crisis emphasizes that future regulatory policy should shift focus from only incentivizing demand (subsidies) to actively ensuring supply-side security for critical components. For Bajaj, its expansive network of over 3,800 service centers 26 provides a decisive competitive advantage in the burgeoning mass market. As the E2W segment pushes into Tier 2 and Tier 3 cities, the reliability and convenience offered by a massive established service footprint will become a significant differentiator against new-age rivals, demanding that Bajaj integrate this network strategically not just for service, but as a crucial pillar of its charging and infrastructure assurance strategy.

Sources

- Bajaj slips behind Ola, Ather, Hero in August electric two-wheeler sales – Fortune India, accessed on September 30, 2025, https://www.fortuneindia.com/auto/bajaj-slips-behind-ola-ather-hero-in-august-ev-sales/126086

- August 2025 EV Sales: TVS #1, Ola Surges, Ather at #3, Vida Breaks Records | EVINDIA, accessed on September 30, 2025, https://evindia.online/news/august-ev-sales-shocker-tvs-holds-1-ola-back-at-2-ather-beats-bajaj

- Bajaj EV volumes fall sharply in August , hit by shortage of rare earth magnets, accessed on September 30, 2025, https://www.financialexpress.com/business/industry-bajaj-ev-volumes-fall-sharply-in-august-hit-by-shortage-of-rare-earth-magnets-3954273/

- China’s export curbs on rare earth magnets impacting EV manufacturers, accessed on September 30, 2025, https://m.economictimes.com/industry/renewables/chinas-export-curbs-on-rare-earth-magnets-impacting-ev-manufacturers/articleshow/123383815.cms

- ‘Been hit quite hard…’: Bajaj Auto reels from China’s rare earth magnet curbs; Rajiv Bajaj says ‘looking at a zero month’ – Times of India, accessed on September 30, 2025, https://timesofindia.indiatimes.com/business/india-business/been-hit-quite-hard-bajaj-auto-reels-from-chinas-rare-earth-magnet-curbs-rajiv-bajaj-says-looking-at-a-zero-month/articleshow/122898433.cms

- Bajaj Auto sales down 8% Y-o-Y in August, accessed on September 30, 2025, https://auto.economictimes.indiatimes.com/news/industry/bajaj-auto-reports-mixed-sales-results-two-wheeler-sales-down-12-while-exports-surge-29/123625941

- Bajaj Auto August 2025 Sales Analysis: Exports & CVs Drive 5% Growth – Finology Ticker, accessed on September 30, 2025, https://ticker.finology.in/discover/market-update/bajaj-auto-sales-august-2025-analysis-exports-cvs

- EV 2-Wheeler Sales August 2025: Ather Takes Second Spot as Bajaj Drops – Angel One, accessed on September 30, 2025, https://www.angelone.in/news/market-updates/ev-2-wheeler-sales-august-2025-ather-takes-second-spot-as-bajaj-drops

- Bajaj Chetak vs Ola Electric S1 Air – Know Which is Better – BikeDekho, accessed on September 30, 2025, https://www.bikedekho.com/compare/chetak-vs-s1-air

- EV Two-Wheeler Sales August 2025: TVS Leads, Ola Electric Overtakes Bajaj, Ather, accessed on September 30, 2025, https://www.angelone.in/news/market-updates/ev-two-wheeler-sales-august-2025-tvs-leads-ola-electric-overtakes-bajaj-ather

- TVS iQube India’s bestselling electric scooter for fifth month in a row, accessed on September 30, 2025, https://www.autocarindia.com/industry/tvs-iqube-indias-bestselling-electric-scooter-for-fifth-month-in-a-row-436963

- E2W Registrations: China’s Curbs Hit Bajaj In Aug, Ola Electric Reclaims Second Spot, accessed on September 30, 2025, https://inc42.com/buzz/e2w-registrations-chinas-curbs-hit-bajaj-in-aug-ola-electric-reclaims-second-spot/

- August 2025 EV Sales: Telangana Data Flips Rankings as Ather Overtakes Ola for First Time | EVINDIA, accessed on September 30, 2025, https://evindia.online/news/august-2025-ev-sales-telangana-data-flips-rankings-as-ather-overtakes-ola-for-first-time

- Bajaj Auto Reports 5% Growth in August Sales, Driven by Strong Export Performance, accessed on September 30, 2025, https://scanx.trade/stock-market-news/earnings/bajaj-auto-reports-5-growth-in-august-sales-driven-by-strong-export-performance/18243424

- Ather Energy shares in focus as rare earth magnet crunch delays Rs 26 crore incentive claim, accessed on September 30, 2025, https://m.economictimes.com/markets/stocks/news/ather-energy-shares-in-focus-as-rare-earth-magnet-crunch-delays-rs-26-crore-incentive-claim/articleshow/124144057.cms

- India Electric Bike Market Trends, Opportunities, and Growth Forecast 2035, accessed on September 30, 2025, https://www.openpr.com/news/4202803/india-electric-bike-market-trends-opportunities-and-growth

- A wave of launches revs up e2W market; OEMs keep prices competitive – Business Standard, accessed on September 30, 2025, https://www.business-standard.com/industry/auto/new-electric-two-wheeler-launches-drive-market-growth-despite-subsidy-cuts-125031600183_1.html

- Indian Electric Scooter & Motorcycles Market 2025 | MotorCyclesData, accessed on September 30, 2025, https://www.motorcyclesdata.com/2025/07/07/indian-electric-scooter-and-motorcycles-market/

- August Auto Sales: Bajaj, TVS, Eicher Drive Exports Higher; Mahindra, Ashok Leyland Show Mixed Trends – Stocktwits, accessed on September 30, 2025, https://stocktwits.com/news-articles/markets/equity/august-auto-sales-bajaj-tvs-eicher-drive-exports-higher-mahindra-ashok-leyland-show-mixed-trends/chvUi64RdVh

- Trend of Moto Bajaj 2025: EV Growth vs Traditional Sales Decline – Accio, accessed on September 30, 2025, https://www.accio.com/business/trend-of-moto-bajaj-2025

- Bajaj Auto shares jump almost 4% after release of August sales data | Stock Market News, accessed on September 30, 2025, https://www.livemint.com/market/stock-market-news/bajaj-auto-shares-jump-almost-4-after-release-of-august-sales-data-11756712191462.html

- Bajaj Auto’s domestic 2-wheeler sales fall 12% in August; exports jump 25% – Storyboard18, accessed on September 30, 2025, https://www.storyboard18.com/brand-marketing/bajaj-autos-domestic-2-wheeler-sales-fall-12-in-august-exports-jump-25-79979.htm

- Supply Situation Of Rare-Earth Magnet Has Improved; Will Sell Over 15K Chetak EV In Aug: Rajiv Bajaj – YouTube, accessed on September 30, 2025, https://www.youtube.com/watch?v=hHT3xNXXxQ4

- Bajaj Chetak production resumes after rare-earth magnet shortage – Autocar India, accessed on September 30, 2025, https://www.autocarindia.com/industry/bajaj-chetak-production-resumes-after-rareearth-magnet-shortage-436794

- Bajaj Beats Ola in September 2025 EV Sales | TVS Leads, Ather Steady, Hero Gains, accessed on September 30, 2025, https://evindia.online/news/bajaj-overtakes-ola-september-2025-ev-sales-shake-up-tvs-leads-ola-falls-to-5th

- Bajaj Chetak 3001: 5 practical highlights of the new everyday electric scooter | HT Auto, accessed on September 30, 2025, https://auto.hindustantimes.com/auto/two-wheelers/bajaj-chetak-3001-5-practical-highlights-of-the-new-everyday-electric-scooter-41750234055922.html

- Bajaj Chetak 3001 On road Price, Specifications, Weight, Range – BikeDekho, accessed on September 30, 2025, https://www.bikedekho.com/bajaj/chetak-3001.html

- Bajaj Chetak vs Ola S1 Pro vs Ather Rizta : A Detailed Comparison – 91Wheels, accessed on September 30, 2025, https://www.91wheels.com/expert-review/bajaj-chetak-vs-ola-s1-pro-vs-ather-rizta-a-detailed-comparison

- India ICE vs EV sales | For top 2W, 3W, 4W OEMs in August 2025 – EVreporter •, accessed on September 30, 2025, https://evreporter.com/india-ice-vs-ev-sales-for-top-2w-3w-4w-oems-in-august-2025/

- India’s Electric Vehicle sales trend | August 2025 – EVreporter •, accessed on September 30, 2025, https://evreporter.com/indias-electric-vehicle-sales-trend-august-2025/

- Forecasting Penetration of Electric Two-Wheelers – NITI Aayog, accessed on September 30, 2025, https://www.niti.gov.in/sites/default/files/2022-06/ForecastingPenetration-ofElectric2W_28-06.pdf

- Designing the future: Inside the minds of the engineers powering India’s EV journey, accessed on September 30, 2025, https://manufacturing.economictimes.indiatimes.com/news/automotive/designing-the-future-inside-the-minds-of-the-engineers-powering-indias-ev-journey/124111826

- Management Discussion & Analysis – Annual Report 2024-25, accessed on September 30, 2025, https://investors.bajajauto.com/ar25/management-discussion-analysis/

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity