Yes, that’s right. US Transportation Secretary Pete Buttigieg has said that the US must take steps to cut into China’s advantage in batteries used to power electric vehicles. He said that building the refining capacity for key materials is “addressable.”

90%

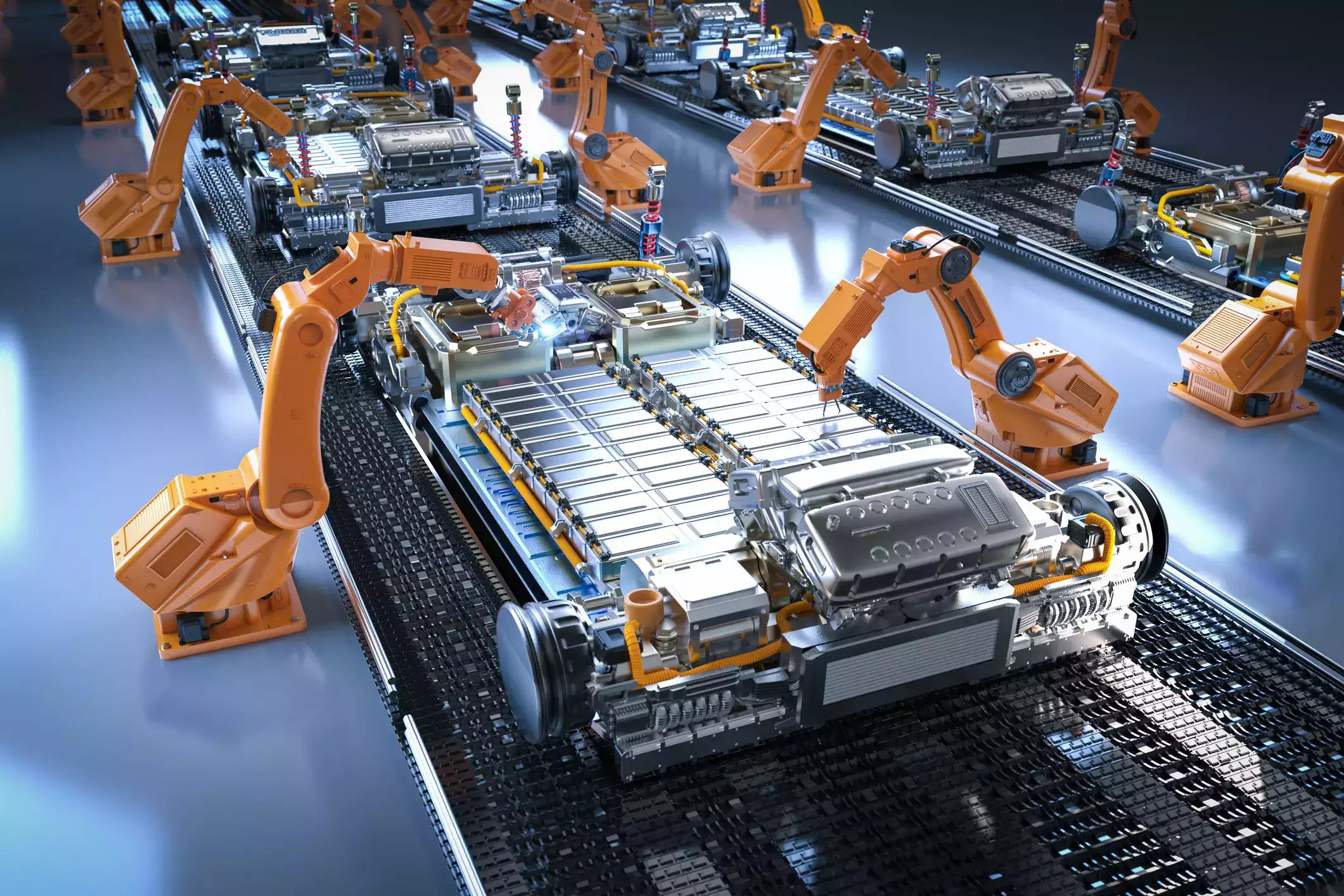

China currently dominates the market for EV batteries, producing up to 90% of the demand for certain battery materials due to economies of scale. This gives China a significant advantage in the EV market, allowing them to produce batteries at a lower cost than other countries.

Buttigieg said that the US needs to build its refining capacity and develop relationships with other countries to secure access to raw materials. He also said that the US needs to invest in research and development to develop new battery technologies.

Proactive steps

The US government has already taken some steps to address this issue. In 2021, the Biden administration announced a $3 billion investment in EV battery manufacturing. The administration is also developing a national battery strategy that will outline how the US can become a leader in the EV battery market.

It will be challenging for the US to break China’s EV battery stronghold, but it is possible. With the right investment and focus, the US can become a significant player in the EV battery market.

In addition to Tesla, Li Auto is the second most significant battery EV player in the US. Li Auto is a Chinese company that manufactures and sells electric SUVs. CATL, the world’s largest battery manufacturer, makes the company’s battery cells.

Li Auto

Li Auto is currently the only Chinese EV company with a significant US market presence. The company’s sales in the US have been growing rapidly, and it is expected to continue to grow in the coming years.

The growth of Li Auto and other Chinese EV companies in the US is a sign that China is becoming a significant player in the global EV market.

However, the US government is determined to break China’s dominance in the EV battery market. With suitable investment and focus, the US can become a significant player in the EV battery market and reduce its reliance on China.

When it comes to breaking China’s EV battery stronghold, several potential pros and cons exist. Here are some of them:

Pros:

- Increased domestic production: The United States could strengthen its domestic battery manufacturing capabilities by reducing dependence on foreign nations, particularly China. This could lead to job creation, economic growth, and improved energy security.

- Strategic advantage: Developing a robust domestic battery industry could give the United States a strategic advantage in the global electric vehicle market. It could enhance the competitiveness of American automakers, reduce supply chain vulnerabilities, and potentially lead to technological advancements.

- Environmental benefits: The expansion of the electric vehicle market relies on the availability of efficient and sustainable battery technology. By supporting domestic battery manufacturing, the US could promote the development of cleaner and more environmentally friendly energy storage solutions.

Cons:

- Short-term challenges: Breaking China’s EV battery stronghold is likely complex and challenging. China has a well-established and highly competitive battery industry, which might make it difficult for the US to catch up quickly.

- Increased costs: Developing a domestic battery industry could require significant investments in infrastructure, research and development, and workforce training. These expenses could potentially increase costs for consumers and industry players in the short term.

- International trade tensions: Focusing on reducing dependence on Chinese battery manufacturers might intensify trade tensions between the US and China. This could lead to retaliatory measures or disruptions in the global supply chain, impacting industries beyond the electric vehicle sector.

- Potential for slower innovation: Relying solely on domestic production may limit access to international markets and collaborations. It could potentially restrict the flow of ideas, knowledge, and technological advancements, often driven by global cooperation and competition.

Conclusion

Breaking China’s EV battery stronghold presents both potential advantages and disadvantages. On the positive side, increased domestic production could lead to job creation, economic growth, and enhanced energy security. It may give the United States a strategic advantage in the global electric vehicle market, improve environmental sustainability, and reduce supply chain vulnerabilities.

China’s Stronghold

However, there are also potential challenges and drawbacks. Breaking China’s stronghold would likely involve complex and costly endeavours, with short-term difficulties catching up to China’s established battery industry. It could intensify trade tensions between the US and China, potentially leading to retaliatory measures or disruptions in the global supply chain. Additionally, focusing solely on domestic production may limit access to international markets and collaborations and hinder the pace of innovation.

China’s EV Battery

Ultimately, the decision to break China’s EV battery stronghold would require careful consideration of these factors and a comprehensive strategy that balances short-term challenges with long-term benefits. It must also align with broader national objectives and policies in the electric vehicle and clean energy sectors.