Introduction: The Throttle, the Screen, and the Cloud

The motorcycle, a machine once celebrated for its mechanical purity and analog defiance, has entered a new era. The roar of the engine now intertwines with the hum of processors and the constant exchange of data. Today’s motorcycles are no longer just collections of steel and rubber; they are smart, connected devices, mobile hubs for information, entertainment, and safety. This report delves into the heart of this transformation by examining two pivotal players at a critical crossroads: Honda, with its new RoadSync Duo software for electric vehicles, and CFMoto, whose RideSync app has sparked a global conversation about the future of vehicle ownership.

This analysis explores a fundamental question facing the industry: is integrated connectivity a compelling value-add, an expected standard, or a contentious new frontier for subscription-based revenue? The answer reveals the delicate balance between technological innovation and consumer trust. We will navigate this emerging landscape, dissecting the strategies, the market forces, and the very real-world feedback from the riders who are living the digital experience on two wheels.

Chapter 1: Honda’s Calculated Circuit: Engineering a Practical EV Experience

The Blueprint for the Future

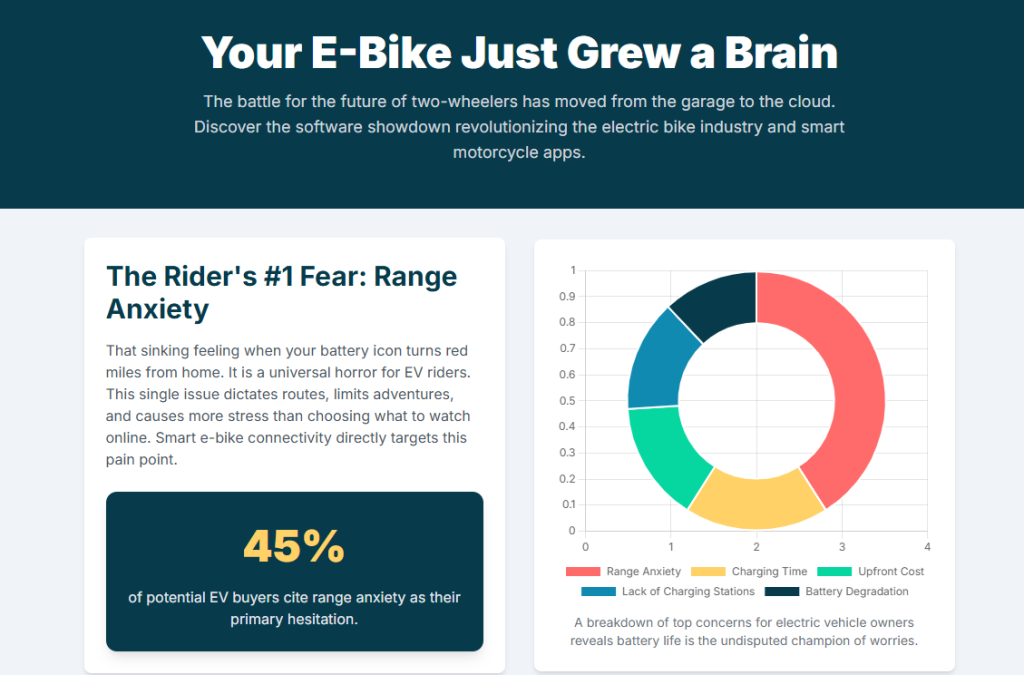

Honda’s entry into the electric motorcycle space with its new RoadSync Duo app is a masterclass in strategic product design. The company has focused on a practical, purpose-built solution that addresses one of the most significant anxieties for electric vehicle owners: range. The RoadSync Duo app goes well beyond simple turn-by-turn navigation; it functions as a comprehensive mobile power manager.1 This EV Routing feature calculates routes based on the remaining battery life, predicts the charge level upon arrival, and, if a rider is running low on juice, automatically guides them to a nearby battery swapping station.3 For riders of compatible models, this feature is a game-changer, providing a real-time solution to the most pressing concern of electric two-wheeler travel. The system is so forward-thinking that it will even display an “Out of Range” warning before a rider departs if their intended destination is beyond the bike’s current capabilities, a proactive safety measure that prevents a journey from becoming an ordeal.3

Beyond its core routing functions, the app offers a suite of hands-free features.1 Riders can operate phone calls, control music from their favorite streaming apps, and even receive and send messages, all without touching their smartphone screen.5 These functions are controlled through a simple multi-switch on the left handlebar, allowing riders to keep their attention on the road and their hands on the bars.3 The system also provides a valuable layer of security and maintenance, offering remote alerts for unauthorized movement or fall detection, as well as timely reminders for periodic vehicle inspections and notifications for remote issues.1

Positioning and Marketing

The marketing strategy for Honda’s RoadSync Duo aligns with the brand’s broader digital-first, sustainability-focused approach.6 Honda positions the app as a tool to “enrich your electric motorcycle lifestyle,” seamlessly blending technology with the brand’s core values.1 The company’s digital marketing is a data-driven narrative, using platforms like Instagram and YouTube to showcase product walkthroughs and influencer testimonials.6 The app itself is presented as a free, value-added feature, a “convenient and user-friendly” tool that enhances the overall rider experience without adding any financial burden.8 This positioning is a powerful competitive differentiator, especially when contrasted with the subscription-based models explored by other manufacturers.

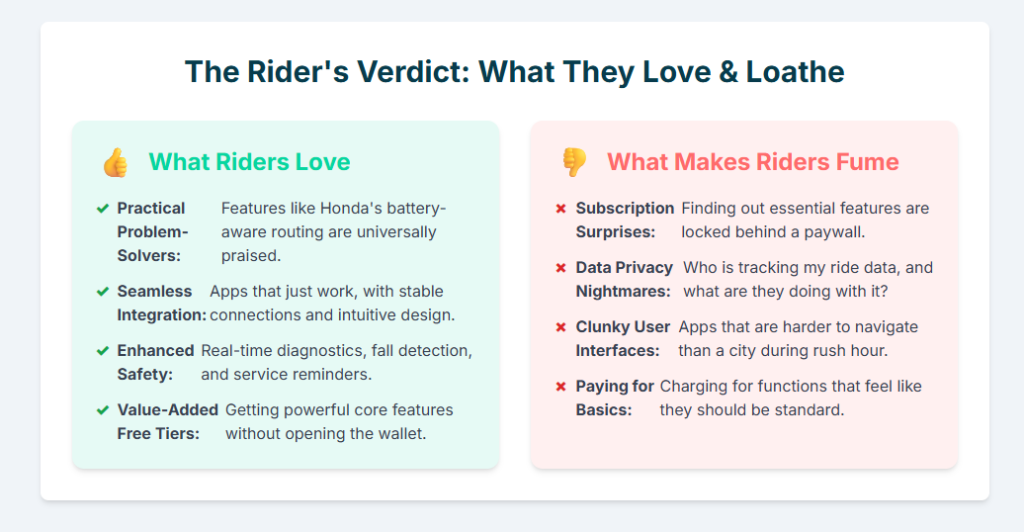

The Rider’s Verdict: A Reality Check from the Digital Road

While the concept and feature set of Honda’s app are compelling, user reviews reveal a significant gap between the intended functionality and the actual lived experience.5 The promise of a hands-free, intuitive interface is a major selling point, but riders have reported a multitude of software bugs and connection issues that diminish the experience. For instance, some users note unstable Bluetooth connections and an inconsistent auto-start feature, requiring a phone reboot to fix.5 Others have expressed frustration with limited media controls on the dashboard, an inability to skip backward in a playlist, and a system that requires the rider to turn off the engine and reload the app if they switch media programs.5 The navigation is also a source of discontent, with reports of a lack of useful information and voice guidance that mysteriously stops working.5 One particularly vexing problem for users on Android 15 is the need to go through the entire setup process every time the engine is started.5

This disparity between a legendary brand’s hardware and its buggy software is a critical point. A company like Honda has built its reputation on engineering excellence and bulletproof reliability. That reputation, however, can be undermined when the new digital component of its product is seen as clunky and unreliable. The frustration a rider feels from a software glitch becomes an annoyance with their new Honda. This creates a brand dissonance where the digital experience directly impacts the perception of the physical hardware. For a legacy manufacturer, the digital interface is no longer a peripheral accessory; it has become an integral part of the product and a critical component of brand trust.

Chapter 2: The CFMoto Conundrum: The Bait, the Switch, and the Backlash

The Tale of Two Apps

The central drama of CFMoto’s foray into connectivity is a tale of two distinct apps that caused a global commotion. The confusion began when a U.S. YouTuber mistakenly reported that CFMoto was planning to start charging American customers for the RideSync app.9 The report, which was based on misinformation from Portugal, sparked a swift and widespread backlash across social media.10 CFMoto USA had to issue a press release to clarify the situation, unequivocally stating that their RideSync app “is free to CFMOTO USA owners and CFMOTO USA does not—and has never had—any plans to charge for a subscription, now or in the future”.10

The Real “Stir”

The true source of the anger was the subscription model for the separate Global Ride App, used in Europe and other international markets.9 This app’s business model transitioned on August 15, 2025, from a free service to a paid subscription.9 Users who had purchased a bike or an optional T-Box dongle with the expectation of free features suddenly found themselves on a trial period, facing subscription fees for services that were previously included, such as real-time tracking, geofencing, and over-the-air updates.9 The company noted that the subscriptions would vary by region, with options that could reach as high as $49.90 USD per year.9

The core frustration for global riders was not necessarily the price, which some users pointed out was minimal compared to other daily expenditures, but a perceived breach of trust.14 The issue was the principle of paying for a feature that was sold as a standard, no-cost benefit.14 One user described it as a “bait and switch” because customers adopted the features when they were free, only to have a paywall introduced after the fact.14 This is a crucial distinction: the public takes issue with paying for a feature that is already physically present on the bike, which they believe they paid for at the point of purchase.15

Marketing on the Defensive

In the U.S., CFMoto’s marketing now leverages this controversy by positioning the free app as a key competitive differentiator for dealers.11 The company’s messaging frames RideSync as a “no-cost value-added benefit” that helps riders “Experience More” with CFMoto.11 This is a strategic move to turn a potential public relations disaster into a market advantage, reinforcing the brand’s consumer-friendly positioning in a major market.

User Sentiment: The Price of Trust

For U.S. riders, the app’s free status and its ability to provide in-depth ride analytics and vehicle telemetry are a major draw.16 Features like remote diagnostics and location tracking are popular.16 The global community, however, is much more wary. The backlash against the paywall highlights a deep-seated fear that a “pay-to-play” model will become the industry norm.18

The CFMoto case study serves as a cautionary tale for all manufacturers looking to enter the data monetization space. The backlash demonstrates that a retroactive paywall for vehicle features can be perceived as a profound betrayal of customer trust. To successfully monetize data and services, a company must establish a clear value proposition from the outset and tie subscriptions to a continuous, evolving service rather than a static, pre-existing feature. A transparent business model from the first moment of contact with a customer is far more effective than a “bait and switch” that can damage a brand’s reputation for years to come.

Chapter 3: The Connected Competition: Navigating a Crowded Digital Highway

Giants on the Road

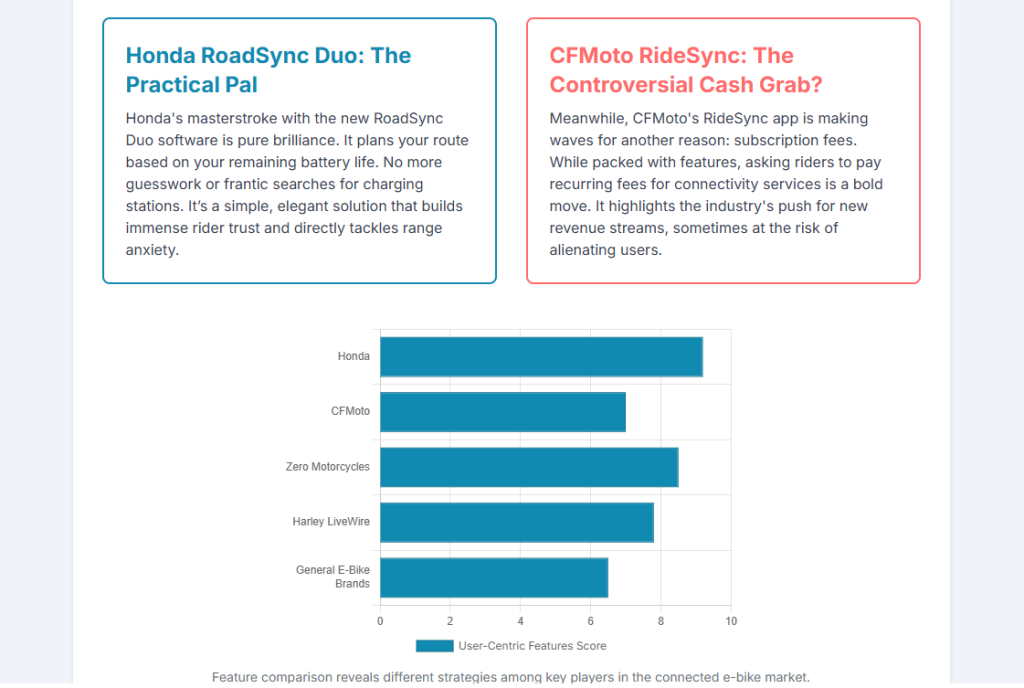

The motorcycle industry is bustling with manufacturers developing their own connectivity ecosystems, each with a unique approach to features and revenue. Harley-Davidson’s LiveWire model, for instance, offers the H-D™ Connect app.19 This service provides remote battery status checks, a charge station locator, and a robust security system that sends tamper alerts to a rider’s phone if their bike is bumped or moved.19 It is a clear and up-front business model: a one-year free trial is included with the purchase of a new LiveWire motorcycle, after which a subscription is required.19

Similarly, Zero Motorcycles provides an app that appeals to the “data nerd” rider.20 The Zero NextGen app connects via Bluetooth and allows riders to not only track their ride statistics but also to adjust performance settings such as top speed, torque, and regenerative braking.20 A particularly valuable feature is the ability to send diagnostic information directly to Zero’s headquarters for analysis, which could potentially save a trip to a dealership.20 However, as with Honda, user reviews report significant functional issues, including inconsistent connectivity and missing features.21

The Digital Freelancers: The Power of Open Ecosystems

Beyond the manufacturer-specific apps, a vibrant ecosystem of third-party apps exists, offering specialized functionality that is not tied to a single brand.22 For route planning and social tracking, apps like Strava and Komoot are hugely popular, allowing riders to track their rides and compete with friends.22 For electric vehicle owners, an app like PlugShare is invaluable, showing nearby charging stations to prevent range anxiety.23 Other apps like Bike Doctor provide maintenance tutorials, giving riders a new level of autonomy in caring for their bikes.22 These open-source tools highlight a different value proposition: they are not an extension of the vehicle, but rather a tool for the rider, providing a single, high-value function that serves a broad user base.

The following table provides a comparison of these different approaches:

| App Name | Manufacturer | Business Model | Key Features |

| Honda RoadSync Duo | Honda | Free | EV routing, theft alerts, maintenance reminders, hands-free calls/music |

| CFMoto RideSync | CFMoto USA | Free | Ride analytics, vehicle tracking, remote diagnostics, geofencing |

| CFMoto Ride App | CFMoto Global | Subscription | Real-time tracking, OTA updates, digital key, geofencing |

| H-D™ Connect | Harley-Davidson | Subscription (after 1-year trial) | Battery status, theft alerts, charge station locator, remote tracking |

| Zero NextGen | Zero Motorcycles | Free/Subscription (model dependent) | Ride mode customization, real-time data (lean angle), remote diagnostics |

| Strava | Independent | Free/Premium | Fitness tracking, social sharing, popular route maps |

| PlugShare | Independent | Free | EV charging station locator |

Chapter 4: The Business of Bytes: Where the Rubber Meets the Data

Market Projections: A Tsunami of Telematics

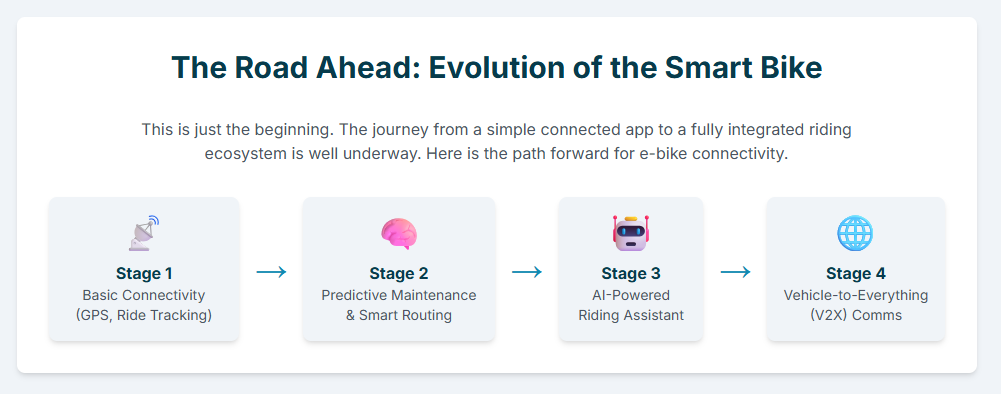

The connected motorcycle market is not just a passing trend; it is a financial juggernaut. It is projected to grow from a value of over $3 billion in 2024 to an estimated $15 billion by 2035, a substantial growth trajectory.24 This impressive expansion is a component of the broader automotive data monetization market, which was valued at

$7.8 billion in 2024 and is expected to reach $25.8 billion by 2034.25 The primary drivers of this growth are clear: advancements in connectivity technologies like IoT and 5G, increasing urbanization, and a rising demand for safety and navigation features.24

The following table provides a concise summary of the market’s trajectory and key growth drivers:

| Metric | Details |

| Market Size (2024) | USD 3.08 Billion 24 |

| Projected Market Size (2035) | USD 15.0 Billion 24 |

| Compound Annual Growth Rate (CAGR) | 15.48% (2025-2035) 24 |

| Key Growth Drivers | Increasing Urbanization & Traffic, Technological Advancements (IoT, 5G), Rising Demand for Safety & Navigation, Trend Towards Sustainability 24 |

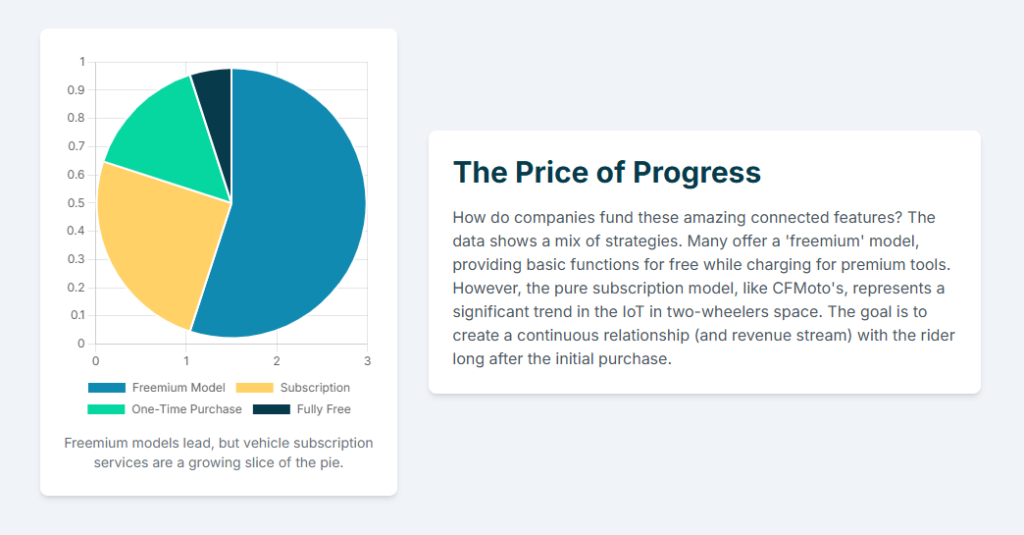

Monetization Masterclass

The CFMoto controversy serves as a live case study of the primary revenue strategies being explored by the industry.25 One of the most prominent is the

subscription-based model, which provides a scalable, recurring revenue stream for high-value features like infotainment and performance upgrades.25 The CFMoto Global app and Harley-Davidson’s LiveWire are examples of this strategy.

Another approach is predictive maintenance, which uses real-time sensor data from the vehicle to foresee and solve mechanical issues before they become critical.25 This adds immense value for riders and fleet operators alike by enhancing operational efficiency and minimizing downtime.

Finally, there is the Data-as-a-Service (DaaS) model.25 As the “data gatekeepers,” OEMs can sell or license anonymized vehicle data to third parties, such as insurance companies or urban planners. This allows them to generate recurring revenue streams by offering packaged vehicle data for sale, extracting profits without constant customer interaction.25

The Trust Equation

Despite the immense financial opportunity, a major obstacle remains: consumer skepticism. Only about one-third of consumers express a willingness to share personalized data from their vehicles.27 This hesitance can be overcome, however. Transparency is paramount; when the benefits and specific use cases are clearly explained, a rider’s willingness to share data increases by 28%.27 Furthermore, tangible incentives, such as discounts or rewards, are powerful motivators. When the possibility of discounts is mentioned, the proportion of participants willing to share personalized data rises to approximately 50%.27

Chapter 5: The Road Ahead: Strategic Insights and Recommendations

Key Takeaways

The journey into the connected motorcycle landscape reveals several critical lessons. The digital experience is no longer an optional bolt-on; it has become a core feature that can either enhance or diminish a brand’s hard-won reputation. As the Honda case study illustrates, a legendary name in engineering can face a credibility challenge if its software is buggy and inconsistent. At the same time, the CFMoto experience underscores the reality that a trust deficit is a real and present danger. Consumers are wary of data collection and actively resistant to retroactive monetization that feels like a “bait and switch.” The industry is learning that an up-front, transparent business model is far more effective than one that appears to hide costs after the point of sale.

Strategic Recommendations

To succeed in this evolving market, manufacturers must consider the following strategic imperatives:

- For Development Teams: Software quality and user experience must be prioritized with the same rigor and investment as hardware engineering. The digital interface is a new point of contact for the customer, and its performance must be flawless to match the reliability of the physical vehicle.

- For Marketing and Sales: Messaging should be transparent and honest. Connectivity should be positioned as a value-added service, not a hidden cost. Brands can build consumer trust by using data to offer tangible benefits, such as lower insurance premiums based on driving behavior or discounts on predictive maintenance services.

- For Business Strategists: The future of revenue lies in hybrid monetization models. The most effective approach appears to be offering a compelling, free core experience with optional, high-value subscription features. The cost and value of these subscriptions should be made explicit from the moment a customer considers a purchase, creating a clear and ethical exchange.

Conclusion: The Future of Riding is Here, and It’s a Wild Ride

The era of the connected motorcycle has arrived, bringing with it a mix of exhilarating convenience and thorny business challenges. As Honda builds a practical, if imperfect, digital future and CFMoto learns a hard lesson about the price of trust, the industry is entering a new chapter where brand loyalty is earned not just with horsepower and torque, but with every byte of data.

The road ahead for connected motorcycles is full of potential. The brands that will succeed are those that can prove their loyalty to the rider, one seamless, secure, and transparent connection at a time. The ultimate winners in this digital revolution will be the ones who understand that the most important feature a bike can have is the rider’s trust.

Sources

- https://apps.apple.com/id/app/honda-roadsync-duo/id6714453683?uo=2

- https://global.honda/en/roadsync-duo/

- https://www.jalopnik.com/1970068/motorcycles-arent-immune-subscription-services/

- https://www.rideapart.com/news/772181/cfmoto-app-subscription-fee-usa/

- https://play.google.com/store/apps/details?id=jp.co.honda.roadsync.duo

- https://www.reddit.com/r/motorcycles/comments/1n88c1s/cfmoto_subscription_clarification/

- https://www.cyclenews.com/2025/09/article/cfmoto-usa-statement-regarding-ridesync-app-subscription/

- https://pedegoelectricbikes.ca/best-electric-bike-apps/

- https://qiolor.com/blogs/news/8-ebike-apps

- https://h-dmediakit.com/dh/news-articles/harley-davidson-livewire-equipped-with-ride-enhancing-technology.html

- https://www.livewire.com/livewire-one-electric-motorcycle

- https://www.asphaltandrubber.com/news/zero-motorcycle-mobile-application/

- https://play.google.com/store/apps/details?id=com.zeromotorcycles.nextgen

- https://www.marketresearchfuture.com/reports/connected-motorcycle-market-12450

- https://www.alliedmarketresearch.com/motorcycle-bluetooth-connectivity-market-A12261

- https://www.gminsights.com/industry-analysis/automotive-data-monetization-market

- https://www.capgemini.com/wp-content/uploads/2021/09/CapgeminiInvent_VehicleDataMonetization_POV_Sep2020.pdf

- https://hondanews.ca/en-CA/releases/release-1d5625b1429c0ef7644379d25b0d030c-honda-canada-launches-roadsync-app-for-select-motorcycle-models

- https://play.google.com/store/apps/details?id=com.honda.ms.dm.sab

- https://powersportsbusiness.com/news/cfmoto/2025/09/09/cfmoto-clarifies-ridesync-app-confusion-is-free-for-u-s-customers/

- https://www.cfmoto.com/global/cfmoto-ride/faq.html

- https://theevreport.com/honda-wn7-electric-motorcycle-debuts-in-europe

- https://www.reddit.com/r/cfmoto/comments/1n23280/new_app_charges/

- https://www.reddit.com/r/motorcycles/comments/1msfcyb/before_you_buy_cfmoto/

- https://apps.apple.com/us/app/cfmoto-ridesync/id6476288693

- https://www.reddit.com/r/motorcycles/comments/1n88c1s/cfmoto_subscription_clarification/

- https://www.gminsights.com/industry-analysis/automotive-data-monetization-market

- https://apps.apple.com/id/app/honda-roadsync-duo/id6714453683

- https://play.google.com/store/apps/details?id=com.honda.ms.dm.sab

Sources

- Honda RoadSync Duo on the App Store, accessed on September 20, 2025, https://apps.apple.com/id/app/honda-roadsync-duo/id6714453683?uo=2

- Honda RoadSync Duo – Apps on Google Play, accessed on September 20, 2025, https://play.google.com/store/apps/details?id=jp.co.honda.roadsync.duo

- Honda RoadSync Duo | Honda Global, accessed on September 20, 2025, https://global.honda/en/roadsync-duo/

- Honda RoadSync Duo on the App Store, accessed on September 20, 2025, https://apps.apple.com/id/app/honda-roadsync-duo/id6714453683

- Honda RoadSync – Apps on Google Play, accessed on September 20, 2025, https://play.google.com/store/apps/details?id=com.honda.ms.dm.sab

- An In-Depth Case Study On Marketing Strategy Of Honda – IIDE, accessed on September 20, 2025, https://iide.co/case-studies/honda-marketing-strategy/

- Honda WN7 Electric Motorcycle Debuts in Europe – The EV Report, accessed on September 20, 2025, https://theevreport.com/honda-wn7-electric-motorcycle-debuts-in-europe

- Honda Canada Launches RoadSync App for Select Motorcycle Models, accessed on September 20, 2025, https://hondanews.ca/en-CA/releases/release-1d5625b1429c0ef7644379d25b0d030c-honda-canada-launches-roadsync-app-for-select-motorcycle-models

- Even Motorcycles Aren’t Immune To Subscription Services – Jalopnik, accessed on September 20, 2025, https://www.jalopnik.com/1970068/motorcycles-arent-immune-subscription-services/

- CFMOTO USA Statement Regarding RideSync App Subscription – Cycle News, accessed on September 20, 2025, https://www.cyclenews.com/2025/09/article/cfmoto-usa-statement-regarding-ridesync-app-subscription/

- CFMOTO clarifies RideSync App confusion — is free for U.S. – Powersports Business, accessed on September 20, 2025, https://powersportsbusiness.com/news/cfmoto/2025/09/09/cfmoto-clarifies-ridesync-app-confusion-is-free-for-u-s-customers/

- CFMoto Won’t Charge US Customer Subscription Fees, That’s a Different Story Elsewhere, accessed on September 20, 2025, https://www.rideapart.com/news/772181/cfmoto-app-subscription-fee-usa/

- FAQs – CFMOTO Global, accessed on September 20, 2025, https://www.cfmoto.com/global/cfmoto-ride/faq.html

- New App charges! : r/cfmoto – Reddit, accessed on September 20, 2025, https://www.reddit.com/r/cfmoto/comments/1n23280/new_app_charges/

- Before you buy cfmoto : r/motorcycles – Reddit, accessed on September 20, 2025, https://www.reddit.com/r/motorcycles/comments/1msfcyb/before_you_buy_cfmoto/

- CFMOTO RIDESYNC – Apps on Google Play, accessed on September 20, 2025, https://play.google.com/store/apps/details?id=cfmoto.ridesync

- CFMOTO RIDESYNC on the App Store, accessed on September 20, 2025, https://apps.apple.com/us/app/cfmoto-ridesync/id6476288693

- CFmoto subscription clarification : r/motorcycles – Reddit, accessed on September 20, 2025, https://www.reddit.com/r/motorcycles/comments/1n88c1s/cfmoto_subscription_clarification/

- HARLEY-DAVIDSON LIVEWIRE EQUIPPED WITH RIDE …, accessed on September 20, 2025, https://h-dmediakit.com/dh/news-articles/harley-davidson-livewire-equipped-with-ride-enhancing-technology.html

- Zero Motorcycle? There’s an App for That – Asphalt & Rubber, accessed on September 20, 2025, https://www.asphaltandrubber.com/news/zero-motorcycle-mobile-application/

- Zero Motorcycles NextGen – Apps on Google Play, accessed on September 20, 2025, https://play.google.com/store/apps/details?id=com.zeromotorcycles.nextgen

- 7 Of The Best Electric Bike Apps – Pedego Canada, accessed on September 20, 2025, https://pedegoelectricbikes.ca/best-electric-bike-apps/

- 8 Must-Have eBike Apps to Make Your Ride Better in the U.S. – qiolor, accessed on September 20, 2025, https://qiolor.com/blogs/news/8-ebike-apps

- Connected Motorcycle Market Size, Share, Trends Report 2035, accessed on September 20, 2025, https://www.marketresearchfuture.com/reports/connected-motorcycle-market-12450

- Automotive Data Monetization Market Size, Growth Analysis 2034, accessed on September 20, 2025, https://www.gminsights.com/industry-analysis/automotive-data-monetization-market

- Motorcycle Bluetooth Connectivity Market Size, Share, Trends – 2030, accessed on September 20, 2025, https://www.alliedmarketresearch.com/motorcycle-bluetooth-connectivity-market-A12261

- Monetizing Vehicle Data – Capgemini, accessed on September 20, 2025, https://www.capgemini.com/wp-content/uploads/2021/09/CapgeminiInvent_VehicleDataMonetization_POV_Sep2020.pdf

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity