Chinese Market Dominance in Electric Two-Wheelers: A Strategic Assessment of Global Supremacy and Supply Chain Control

Section 1: Establishing Global E2W Dominance: Market Scale and Trajectory

1.1. The Unmatched Scale of Chinese E2W Manufacturing and Sales

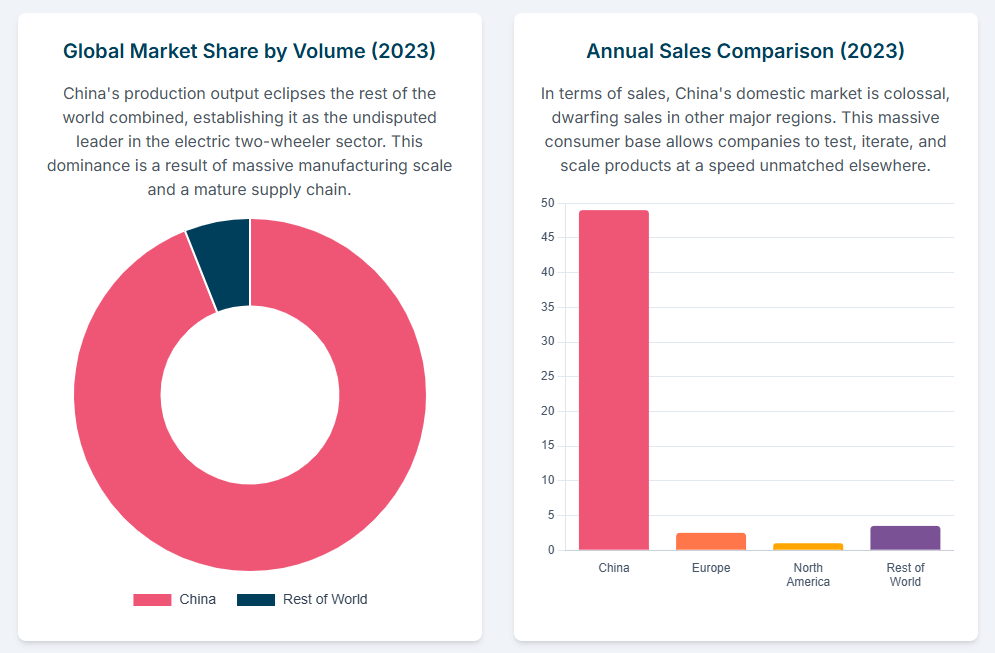

China maintains an overwhelming lead in the global electric two-wheeler (E2W) market, a position validated by massive production scale and strategic domestic policies. Globally, China accounts for an estimated 73% of total E2W sales volume, a figure often cited by analysts as approaching 90% when considering overall E2W sales worldwide.1 This market gravity establishes China as the undisputed pivotal player.

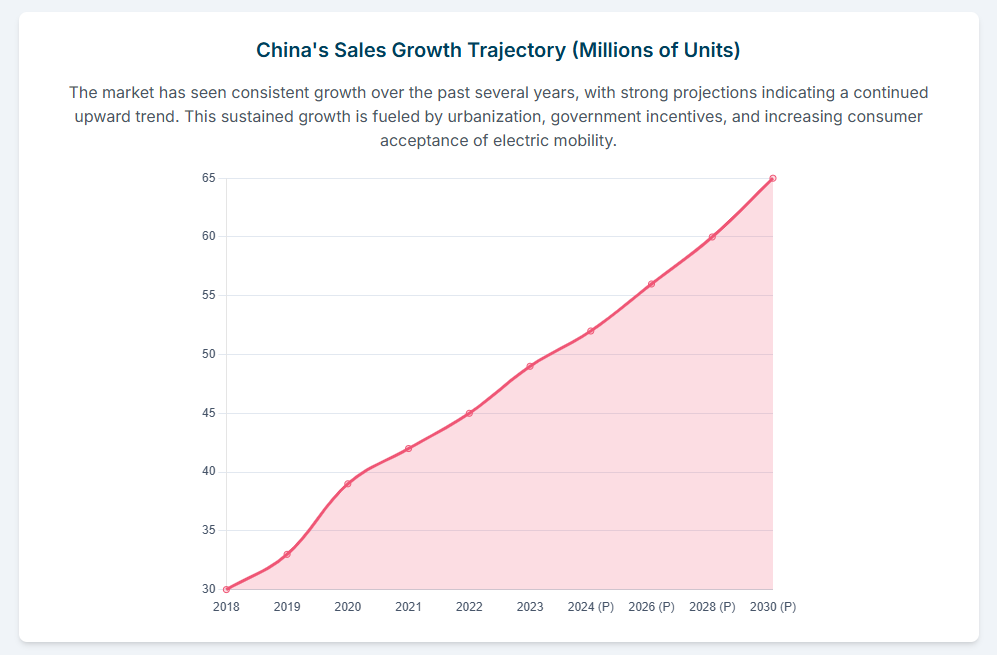

In terms of quantifiable metrics, the sheer magnitude of the Chinese E2W market demonstrates its global importance. The domestic market size was recorded at approximately 4,743,145 units in 2024.3 While the Asia-Pacific region is the dominant regional contributor, led by China and India, the expected growth trajectories reflect different stages of market maturity. China’s E2W sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 7% from 2024 to 2029.3 This robust but moderate growth contrasts sharply with emerging, high-potential markets like India, which is projected to achieve a 27% CAGR over the same period, signaling India’s rapid adoption phase.3

1.2. The Value/Volume Paradox: Domestic Market Evolution

The Chinese E2W industry is currently navigating a significant internal market shift, characterized by a paradox between volume contraction and value growth. Domestic registration figures for the broader two-wheeler market (including motorcycles and registered mopeds) experienced a sharp decline in volume, reporting less than 12.3 million sales in 2024—a substantial 16.1% drop from the previous year.4 This contraction is attributable to socioeconomic factors, primarily the rising pro capita income leading consumers to prefer four-wheeled vehicles, alongside increasing urban restrictions that ban two-wheelers from metropolitan centers to manage congestion and pollution.4

However, this volume decline is coupled with a structural transformation toward premiumization. The market is evolving rapidly toward technologically advanced solutions, high-specification models, and higher power outputs, driven by the new middle class viewing two-wheelers as leisure products.4 This pivot toward the premium segment, particularly those exceeding 250cc, signals an increase in the overall market

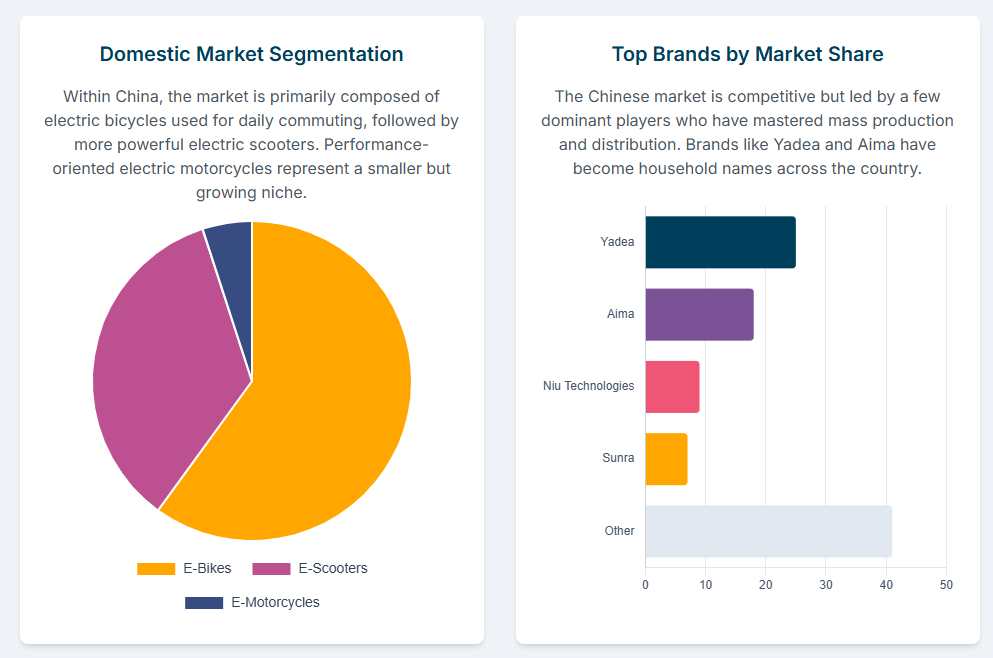

value, offsetting the stagnation or decline in entry-level volume. Furthermore, the competitive landscape is consolidating, with leading domestic Original Equipment Manufacturers (OEMs) such as Yadea, Aima, Tailg, Luyuan, and Xinri collectively dominating over 50% of the domestic market share.5 Premium entrants, such as Niu, have successfully leveraged brand image and lithium-ion technology to secure strong consumer interest and justify higher average selling prices, despite a smaller sales volume relative to established competitors.6

The decline in domestic volume and the tightening regulatory environment, including the mandated China Compulsory Certificate (3C) requirements, exert immense pressure on manufacturers.5 This strategic market constriction effectively filters out weaker players and necessitates that surviving OEMs leverage their scale and new high-spec products to seek growth internationally. Consequently, market saturation and increasing regulatory rigor domestically serve as the primary causal mechanism shifting Chinese OEM strategy toward aggressive international expansion, making global exports a necessity for sustained growth.

Table 1: Global E2W Market Dynamics: Volume, Share, and Growth Trajectories

| Metric | China | India | Global Market |

| 2024 Market Size (Units) | 4,743,145 (Electric) 3 | Second largest E2W market 1 | 4.4 million (H1 2025, +7.2%) 1 |

| Global E2W Sales Share | ~73% (Volume Dominance) 1 | Emerging | 100% |

| Projected CAGR (2024-2029) | 7% (Maturity Stage) 3 | 27% (Rapid Growth Stage) 3 | Robust growth expected globally |

| Domestic Registration Trend (2024) | -16.1% (2W/E2W combined) 4 | Strong growth 8 | Slowing growth post-COVID 1 |

1.3. State Policy as the Engine of Dominance

China’s global E2W dominance is fundamentally rooted in decades of strategic industrial policy. New Energy Vehicle (NEV) policies, tracing back to 2009 and institutionalized under the Made in China 2025 (MIC2025) initiative, provided crucial foundational support.9 This support included reduced taxes, direct subsidies for manufacturers and consumers, and substantial investments in the underlying infrastructure.10

Crucially, Chinese policy has strategically evolved from direct, costly financial subsidies to imposing stringent, forward-looking mandates. While subsidies helped achieve initial economies of scale and accelerate technology development 10, policymakers recognized the high cost associated with continued direct payouts.11 The current mechanism relies heavily on a complex credit system, which mandates that manufacturers achieve specific percentages of EV sales by earning points based on factors like range and energy efficiency.11 The goal, particularly in the related electric car sector, is to achieve 40% EV sales by 2030.11 This regulatory rigor, combined with the strict enforcement of China Compulsory Certificate (3C) standards for E2Ws 5, creates a highly competitive environment. By phasing out subsidies, the government forces manufacturers to achieve technological self-sufficiency and deep cost reduction. Only the most efficient and technologically advanced Chinese firms can survive and meet these mandates, thus forging powerful national champions (such as Yadea and Aima) that are inherently prepared for global market competition.

Section 2: Nexus of Innovation: Insights from the Chinese Bike Expo

2.1. The China Cycle 2025: A Strategic Launchpad

Major industry events, such as the CHINA CYCLE 2025 (Shanghai Bike Show), serve as key indicators of China’s technological trajectory and export ambitions. The 2025 event showcased the industry’s unprecedented scale, featuring 1,582 exhibitors across an expansive exhibition area of 160,000 square meters.12 The exhibition is widely regarded as a “weathervane for the development of global bicycles,” highlighting the shift toward electric mobility solutions, including e-bikes, e-motorcycles, and advanced components.12 The display of pioneering products, such as carbon fiber electric bikes and complex electronic shifting systems, underscores the focus on high-end innovation.13

2.2. Product and Design Leadership in E2Ws

Chinese E2W manufacturers are aggressively pursuing technological superiority, moving past the perception of being solely low-cost producers.

A defining characteristic of contemporary Chinese E2Ws is the integration of high-level connectivity and smart features. Premium models now commonly feature intelligent systems, including app connectivity and Over-the-Air (OTA) updates, enhancing the user experience and ensuring future-proofing.14

Furthermore, Chinese component manufacturers are directly challenging established global suppliers. Innovations such as Star Union’s Magnetic Mid-Drive Motor (MGM), which delivers 80 Nm of torque at just 2.8 kg, demonstrate a power-to-weight efficiency that rivals established Western competitors like Bosch.14 Similarly, Ananda’s Automatic Hub Motors, integrating three-speed shifting, improve efficiency for urban commuting.14 This homegrown component superiority reduces external dependency and ensures cost control across the value chain.

The shift is particularly noticeable in export market strategies. Manufacturers are moving beyond generic models toward precise regional customization. TAILG, for instance, showcased models like the EV51 specifically adapted for North American and European markets (with off-road capabilities and adjustable saddles), while the EO91 targets South Korea with features such as GPS tracking.14 High-end brands like Niu cement this premium strategy, maintaining high unit prices by leveraging sophisticated design (e.g., magnesium alloy frames and touchscreen displays) and advanced, fully smartphone-integrated technology.7 By concentrating R&D efforts on these high-spec components and smart features, Chinese manufacturers are capitalizing on their manufacturing scale to simultaneously capture high-margin, premium market segments globally, thereby bypassing the traditional low-cost image and challenging traditional European/Japanese competitors directly.

2.3. The New Battery Frontier: Sodium-ion Commercialization

The most strategic innovation showcased by the Chinese industry is the rapid commercialization of Sodium-ion (Na-ion) battery technology, following its successful domination of the Lithium Iron Phosphate (LFP) chemistry.

China’s foresight in prioritizing LFP has created the current cost floor for the E2W segment. LFP cell prices in China have plummeted by 51% over the past year, reaching an average of $53 per kilowatt-hour.15 This provides an overwhelming cost advantage that global competitors struggle to match.

The emergence of Na-ion represents a strategic leapfrog aimed at solidifying future dominance. In January 2025, major player Yadea announced and unveiled E2W models incorporating Na-ion batteries.16 This chemistry, previously limited to static energy storage systems or low-performance two-wheelers, is now being mobilized for the high-volume mobility sector.17 Although Na-ion cells currently have a higher initial average cell cost of approximately $87/kWh compared to the lowest-cost LFP 15, the long-term cost potential is transformative. Sodium is about 400 times more abundant than lithium, offering unparalleled supply security and eliminating vulnerability to lithium price volatility.17 Furthermore, Chinese battery giants like CATL are rapidly improving performance; while the first-generation Na-ion density was 160 watt-hours per kilogram (Wh/kg), the next generation is targeted to exceed 200 Wh/kg, making it viable for certain light electric vehicles.17

This rapid move to establish a lead in Na-ion technology serves as a critical strategic cost moat. By establishing early IP and scale in this next-generation chemistry, China ensures that the future evolution of affordable, mass-market electric mobility remains architecturally controlled by Chinese technology. This maintains perpetual cost leadership and insulates the industry from future global commodity shocks and geopolitical maneuvers targeting critical lithium supplies.

Table 2: Strategic Cost Leverage: Key Battery Chemistry Metrics

| Battery Chemistry | Primary Chinese Advantage | Average Cell Cost (Approx. $/kWh) | Energy Density Target (Wh/kg) | Strategic Implications for E2W |

| Lithium Iron Phosphate (LFP) | Supply Chain Integration & IP | $53 (Rapid decline ongoing) 15 | Moderate (Improving) 18 | Current cost floor; enables mass-market price parity. |

| Sodium-ion (Na-ion) | Raw Material Security (Abundance) 17 | $87 (Initial cost) 15 | 160-200+ (CATL Gen 1 & 2) 17 | Future cost floor; mitigates lithium geopolitical risk; ideal for battery swapping.19 |

Section 3: Strategic Depth: China’s Control over the EV Supply Chain

3.1. Raw Material Refining and Processing Supremacy

China’s dominance in E2Ws extends far beyond vehicle assembly; it is rooted in structural control over the entire battery supply chain, creating a robust competitive barrier. This control begins with securing raw materials globally and dominating the refining process domestically.

In terms of mineral sourcing, Chinese companies control approximately 25% of the world’s lithium mining capacity and have significant investments in the “lithium triangle” of South America.20 Furthermore, Chinese companies own 80% of cobalt production in Congo-Kinshasa.20 Domestically, China produced 79% of the world’s natural graphite in 2024, a critical anode precursor material.20

The key structural advantage is found not in mining, but in the downstream refining and processing stages. China accounts for nearly 90% of global cathode active material capacity and over 97% for anodes.21 China’s dominance extends to other key battery components, accounting for 78% of separator and 82% of electrolyte processing.21 This level of processing concentration represents a critical bottleneck. The International Energy Agency (IEA) projects that China’s dominance will intensify, forecasting that over 90% of battery-grade graphite and 77% of refined rare earths will originate from China by 2030.21

3.2. LFP Dominance and Global Dependency

For the cost-sensitive E2W and light EV markets, China’s vertical integration in Lithium Iron Phosphate (LFP) chemistry is an insurmountable moat. China dominates the entire lithium-ion battery value chain, controlling international and domestic production capacities.22 Specifically for LFP active materials, which are cost-effective and ideal for E2Ws, China’s manufacturing share exceeds 98%.22

This structural control creates profound geographic vulnerability for competitor regions. For example, Europe remains almost 100 percent dependent on imports for the mineral raw materials required for electromobility.22 This structural dependency on Chinese refinement and processing capabilities for core components, particularly LFP, jeopardizes the future of European electromobility, making Europe vulnerable to geopolitical tensions or export restrictions.22 Non-Chinese OEMs, including emerging E2W makers in India and Europe, face a fundamental competitive disadvantage: they must either rely on Chinese components or commit enormous capital to establish non-Chinese refining capacity, a process that requires substantial time and faces steep scaling challenges.23

Table 4: China’s Dominance Across the EV Supply Chain (Select Key Materials and Components)

| Component/Material Stage | China’s Global Market Share (%) | Critical Role | Source |

| Natural Graphite Production | 79% | Anode material precursor | 20 |

| Cobalt Production Control (DRC) | 80% | Cathode mineral sourcing | 20 |

| Cathode Active Material Capacity | ~90% | The chemical engine of the battery | 21 |

| LFP Active Material Production | >98% | Cost-effective mass-market chemistry | 22 |

3.3. Geopolitical Implications of Supply Chain Dependency

China’s structural control over the battery supply chain translates directly into significant geopolitical leverage, influencing trade patterns and technological licensing.24 The deep reliance on China for essential components and battery technology, particularly LFP and emerging Na-ion, mirrors the dependency seen across the entire EV sector, from E2Ws up to passenger vehicles.

This reliance is viewed by Western actors as a national security risk, as the battery is the core power source underpinning future industrial and military innovation, including AI and robotics.25 Any disruption, such as export restrictions on refined materials originating from China, would immediately impact global electric mobility, starting with the price-sensitive E2W market and quickly cascading to passenger vehicles.22 The difficulty in decoupling, specifically the time and investment required to replicate Chinese-controlled refining and processing capacity, means that the West remains reliant on Chinese refined cobalt and lithium (“the fuel”) to operate its own battery manufacturing plants.23

Section 4: Global Expansion and Competitive Friction

4.1. The Export-Driven Growth Imperative

Driven by domestic market maturity and regulatory tightening, Chinese OEMs are focusing on maximizing exports. This strategy is highly effective due to China’s immense manufacturing base. In 2023 alone, China exported 15.046 million units of E2Ws.2

Leading Chinese OEMs are moving away from supplying generic products for foreign assembly, choosing instead to market quality, branded offerings internationally.5 Niu, a leader in this export strategy, successfully displaced established European OEMs (Govecs, Askoll) in European ride-sharing moped markets before becoming a successful retail brand.16 Manufacturers like Yadea recognized this success and fine-tuned their strategies to build products with export markets explicitly in mind.16

4.2. Navigating Tariff Barriers (US and EU)

Chinese exports face intense geopolitical friction, particularly in key Western markets. Both the United States and the European Union have implemented substantial tariff regimes designed to protect domestic manufacturers.

In the US, the current total duty on Chinese E-bikes is approximately 55%, combining pre-existing, Section 301, and reciprocal tariffs.26 Furthermore, additional tariffs on Chinese-made battery packs used by E-bikes are expected to take effect soon.27 Such steep increases in import costs will inevitably be passed onto consumers, resulting in higher E-bike prices in the US market.28

The EU maintains its own protectionist stance, having introduced anti-dumping and countervailing duties on Chinese E-bikes in 2019. These duties, ranging from 18.8% to a crippling 79.3% depending on the specific manufacturer, are intended to mitigate the injurious effect of unfairly subsidized and dumped imports and have helped promote the development of new European companies.29

Chinese manufacturers are mitigating these tariff barriers through aggressive manufacturing regionalization, turning trade friction into an investment driver for Southeast Asia (SEA). Chinese battery and vehicle OEMs (e.g., CATL, EVE Energy, Gotion High-Tech) are rapidly expanding production capacity into SEA countries, including Indonesia, Thailand, and Vietnam.30 This strategic relocation is designed to reduce logistics costs, support local vehicle assembly operations, and, most critically, bypass Western tariff barriers by changing the country of origin.30 Instead of stopping Chinese dominance, high tariffs are primarily forcing Chinese capital investment into SEA, strengthening China’s technological and industrial influence across that region and creating diversified global supply hubs that remain structurally controlled by Chinese entities.

4.3. Regional Competition Analysis: India and SEA

While China dominates overall, emerging Asian markets present the most dynamic competitive landscape.

India is rapidly positioning itself as a major E2W market, projected to overtake China in total two-wheeler sales volume in CY24.8 The Indian E2W market exhibits a phenomenal 27% CAGR from 2024 to 2029 3, driven by economic growth and increasing demand for sustainable mobility.8 New Indian greenfield EV companies, such as Ola Electric and Ather Energy, are challenging incumbents and demonstrating strong early growth.8

Despite this explosive growth, Indian OEMs face a severe structural competitive challenge posed by Chinese cost superiority. The Indian market relies on affordability; however, receding government subsidies necessitate that Indian OEMs reduce their average Bill of Materials (BOM) by 40% to 50% (from approximately $1,500–$1,600 down to below $1,000) just to achieve Total Cost of Ownership (TCO) parity with existing Internal Combustion Engine (ICE) rivals.31 This is the major bottleneck preventing Indian firms from achieving sustainable mass-market price competitiveness. China’s control over low-cost LFP and emerging Na-ion batteries acts as an effective cost ceiling that local manufacturers struggle to breach. Consequently, even as Indian assembly grows, Chinese component technology is guaranteed to dominate the cost-sensitive segments of the Indian market.

The Southeast Asian market is already seeing rapid capture by Chinese brands due to competitive pricing and aggressive expansion.32 Chinese E2W brands now account for at least one of the top five brands in all major SEA countries.31 This strategic investment (e.g., CATL’s $6 billion battery plant in Indonesia 30) is establishing SEA as a vital link in the Chinese-led global EV supply chain.

4.4. European Market Footholds

The European E2W market provides a different entry vector for Chinese dominance, focusing on premium niches rather than utility mass-market volume. Chinese companies, particularly Niu and Yadea, have successfully penetrated European urban micromobility and e-scooter segments, challenging established local players.16

E2Ws in Europe are typically used for recreational purposes, contrasting with the utility-driven demand in Asia.31 This reduces consumer price sensitivity, allowing Chinese OEMs to successfully market their premium, connected, and technologically advanced models (e.g., Niu’s high-end offerings).7 This strategy allows Chinese manufacturers to use their immense scale to produce high-quality, feature-rich products that undercut traditional European/Japanese premium competitors, securing valuable footholds in high-margin segments.

Section 5: Strategic Outlook and Risk Assessment

5.1. The Trajectory of Cost Convergence and TCO Parity

The most critical factor accelerating global E2W adoption is the convergence of costs, leading to Total Cost of Ownership (TCO) parity with ICE vehicles. The rapid reduction in LFP cell costs, now averaging $53/kWh 15, combined with the emergence of ultra-low-cost Na-ion technology 16, significantly accelerates this convergence.34

Chinese manufacturing scale and proprietary technology ensure that they will lead this cost parity curve. This continued cost leadership makes it exponentially difficult for non-Chinese OEMs to compete in any utility or high-volume segment, as achieving the necessary 40–50% cost reductions requires access to the refined materials and battery IP controlled predominantly by China.31 This process is effectively a global mechanism for establishing Chinese industry standards by necessity of cost.

5.2. Geopolitical and Macroeconomic Risk Factors 2025 and Beyond

China’s structural dominance faces macro risks, primarily stemming from geopolitical tensions.

The escalating US-China trade tensions present the most significant near-term risk. The possibility of further US tariff hikes, coupled with the potential for financial decoupling, threatens to disrupt global sourcing and supply chain stability.24 However, the analysis shows that high tariffs, coupled with China’s vertical supply chain integration, create a self-defeating loop. Tariffs are absorbed or passed to Western consumers, increasing prices, while China’s structural superiority in material refinement and technology remains intact.21

Furthermore, the deep entanglement of Western economies with Chinese components and technology creates systemic national security vulnerabilities.25 Chinese manufacturers are already executing a critical strategic pivot by commercializing Na-ion technology.16 This move is a measure to future-proof the entire E2W industry from potential supply volatility or resource nationalism associated with lithium. Since sodium is abundant 17, establishing an industrial lead here ensures that Chinese manufacturers secure low-cost, domestically secure energy storage, solidifying their cost advantage for decades and replicating the LFP scenario with the next chemistry generation.

5.3. Strategic Recommendations for Non-Chinese Stakeholders

Given China’s entrenched, multi-layered dominance across technology, manufacturing, and supply chain control, non-Chinese stakeholders must adopt defensive and strategically focused measures.

- Investment in Alternative Supply Chain Resilience: Immediate and aggressive investment is required to accelerate refining and active material production capacity (specifically for lithium and graphite processing) outside of China. Mitigating the current 90%+ dependence on Chinese refinement capacity is a prerequisite for any meaningful supply chain decoupling.21

- Focus on Premium and Niche Segments: European and Japanese OEMs should strategically cede ground in high-volume utility E2Ws, where Chinese cost parity is insurmountable. Instead, they must focus on high-performance electric motorcycles, premium recreational scooters, and niche segments where consumer price sensitivity is lower, and where brand heritage and performance can command a premium.31

- Accelerated Na-ion R&D and Commercialization: Non-Chinese entities must urgently invest in developing and commercializing alternative, non-Chinese Na-ion supply chains. Failing to secure intellectual property and scaling capabilities in this emerging chemistry risks allowing Chinese manufacturers to completely dominate the next generation of battery technology, thereby perpetually controlling the structural cost advantages of the global E2W sector.

Sources

- Electric Motorcycles Market 2025 – Data & Facts | MotorCyclesData, accessed on October 6, 2025, https://www.motorcyclesdata.com/2025/08/05/electric-motorcycles-market/

- Can Indian electric two-wheelers challenge China’s dominance? – The Economic Times, accessed on October 6, 2025, https://m.economictimes.com/industry/renewables/can-indian-electric-two-wheelers-challenge-chinas-dominance/articleshow/113635285.cms

- Electric Two-Wheeler Market Size & Share Analysis – Industry Research Report – Growth Trends – Mordor Intelligence, accessed on October 6, 2025, https://www.mordorintelligence.com/industry-reports/global-electric-two-wheeler-market

- China Motorcycles Market 2025 – Data, Insight | MotorCyclesData, accessed on October 6, 2025, https://www.motorcyclesdata.com/2025/09/17/chinese-motorcycles-market/

- China Electric Two-wheeler Markets Report 2021 Featuring Aima, Luyuan, Ninebot, Niu, Tailg, Xinri, Yadea – Leading OEMs Dominate More Than 50% Share – ResearchAndMarkets.com – Business Wire, accessed on October 6, 2025, https://www.businesswire.com/news/home/20210901005720/en/China-Electric-Two-wheeler-Markets-Report-2021-Featuring-Aima-Luyuan-Ninebot-Niu-Tailg-Xinri-Yadea—Leading-OEMs-Dominate-More-Than-50-Share—ResearchAndMarkets.com

- NIU and the electric two-wheeler market in China – Daxue Consulting, accessed on October 6, 2025, https://daxueconsulting.com/electric-two-wheeler-market-in-china/

- NIU is China’s ‘Tesla on two wheels,’ but is that what the market wants?, accessed on October 6, 2025, https://thechinaproject.com/2022/08/18/niu-is-chinas-tesla-on-two-wheels-but-is-that-what-the-market-wants/

- Recent report claims India will surpass China to become world’s largest two-wheeler market, accessed on October 6, 2025, https://timeskuwait.com/recent-report-claims-india-will-surpass-china-to-become-worlds-largest-two-wheeler-market/

- Chinese Government Support for New Energy Vehicles as a Trade Battleground | The National Bureau of Asian Research (NBR), accessed on October 6, 2025, https://www.nbr.org/publication/chinese-government-support-for-new-energy-vehicles-as-a-trade-battleground/

- Government Subsidies in China’s EV Market – The Curious Economist, accessed on October 6, 2025, https://thecuriouseconomist.com/government-subsidies-in-chinas-ev-market/

- China’s transition to electric vehicles | MIT News | Massachusetts Institute of Technology, accessed on October 6, 2025, https://news.mit.edu/2021/chinas-transition-electric-vehicles-0429

- China Cycle releases 2025 International Bicycle Exhibition Analysis Report – thepack.news, accessed on October 6, 2025, https://thepack.news/china-cycle-releases-2025-international-bicycle-exhibition-analysis-report/

- CHINA CYCLE 2025: Connecting the World Through Cycling Innovation, accessed on October 6, 2025, https://electricbikereport.com/china-cycle-2025-connecting-the-world-through-cycling-innovation/

- Latest E-Bike Trends from Guangzhou China 2025 – Accio, accessed on October 6, 2025, https://www.accio.com/business/latest-e-bike-trends-from-guangzhou-china

- Can chinese mass produced LFP batteries compete with western mass produced sodium ion batteries in terms of cost per kwh? – Reddit, accessed on October 6, 2025, https://www.reddit.com/r/electricvehicles/comments/1e1ek67/can_chinese_mass_produced_lfp_batteries_compete/

- Yadea and the New Chinese – InsightEV, accessed on October 6, 2025, https://insightev.com/yadea-and-the-new-chinese/

- BriefCASE: Sodium-ion batteries to unseat lithium? Na, but they’ll be worth their salt, accessed on October 6, 2025, https://www.spglobal.com/mobility/en/research-analysis/briefcase-sodium-ion-batteries-to-unseat-lithium.html

- China Decade of Dominance in EV Batteries – EE Times, accessed on October 6, 2025, https://www.eetimes.com/china-decade-of-dominance-ev-batteries/

- The Rise of Electric Two-Wheelers: Trends, Market Analysis, And Future Prospects, accessed on October 6, 2025, https://insights.made-in-china.com/The-Rise-of-Electric-Two-Wheelers-Trends-Market-Analysis-And-Future-Prospects_atYTGCsxBElA.html

- China dominates global trade of battery minerals – U.S. Energy Information Administration (EIA), accessed on October 6, 2025, https://www.eia.gov/todayinenergy/detail.php?id=65305

- How Innovative Is China in the Electric Vehicle and Battery Industries? | ITIF, accessed on October 6, 2025, https://itif.org/publications/2024/07/29/how-innovative-is-china-in-the-electric-vehicle-and-battery-industries/

- Study on the battery supply chain shows China’s global dominance – Fraunhofer FFB, accessed on October 6, 2025, https://www.ffb.fraunhofer.de/en/press/news/Chinas_Dominanz_in_der_Batterielieferkette.html

- Cobalt refining power gives China an advantage in the race for EV battery dominance, accessed on October 6, 2025, https://resourcetrade.earth/publications/critical-metals-ev-batteries

- Top Geopolitical Risks of 2025 – S&P Global, accessed on October 6, 2025, https://www.spglobal.com/en/research-insights/market-insights/geopolitical-risk

- China’s EV Supremacy Raises National Security Concerns for the US – Newsweek, accessed on October 6, 2025, https://www.newsweek.com/chinas-ev-supremacy-raises-national-security-concerns-for-the-us-10799968

- August 1 Updated U.S. Reciprocal Tariffs on Bicycles and E-bikes Explained., accessed on October 6, 2025, https://oerus.com/oerus-blog/2025/8/1/august-1-updated-us-reciprocal-tariffs-on-bicycles-and-e-bikes-explained

- Navigating E-Bike Tariffs in 2025: What You Need to Know – Really Good Ebikes, accessed on October 6, 2025, https://reallygoodebikes.com/blogs/electric-bike-blog/ebike-tariffs-are-real-25-price-increases-start-soon

- How New Trump Tariffs Will Impact E-Bike Prices in the US | Upway, accessed on October 6, 2025, https://upway.co/blogs/news/how-new-trump-tariffs-will-impact-e-bike-prices-in-the-us

- EU extends duties on electric bicycles from China – European Commission, accessed on October 6, 2025, https://policy.trade.ec.europa.eu/news/eu-extends-duties-electric-bicycles-china-2025-01-24_en

- Chinese Electric Vehicle Battery Giants Accelerate Southeast Asia Expansion, accessed on October 6, 2025, https://www.euromonitor.com/article/chinese-electric-vehicle-battery-giants-accelerate-southeast-asia-expansion

- A road map for revving up the Asian electric two-wheeler market – McKinsey, accessed on October 6, 2025, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/a-road-map-for-revving-up-the-asian-electric-two-wheeler-market

- Overview of the ASEAN-6 Automotive Market – PwC, accessed on October 6, 2025, https://www.pwc.com/vn/en/publications/2025/asean-automative-market.pdf

- Electric Scooter Market Size, Share & Growth | Forecast [2032] – Fortune Business Insights, accessed on October 6, 2025, https://www.fortunebusinessinsights.com/electric-scooter-market-102056

- The real global EV buzz comes on two wheels – McKinsey, accessed on October 6, 2025, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-real-global-ev-buzz-comes-on-two-wheels

- MERICS Top China Risks 2025, accessed on October 6, 2025, https://merics.org/en/tracker/merics-top-china-risks-2025

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity