1. Executive Summary

The global motorcycle market is undergoing a significant transformation, marked by a pronounced shift among riders from larger, often more expensive motorcycles to more accessible and practical middleweight models, typically ranging from 126cc to 500cc. This evolving preference is driven by a complex interplay of economic realities, changing rider demographics, advancements in motorcycle technology, and a growing emphasis on utility and balanced performance.

The overall motorcycle market demonstrates robust growth, projected to expand from USD 71.92 billion in 2024 to USD 119.09 billion by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of 6.7% from 2025–2032.1 Asia-Pacific remains the dominant force, accounting for over 61% of the market share in 2024, fueled by a burgeoning middle class and increasing urbanization.1 Within this expanding market, the 200cc-400cc segment has emerged as the fastest-growing category, appealing to riders seeking a harmonious blend of performance and affordability for both daily commuting and recreational pursuits.1

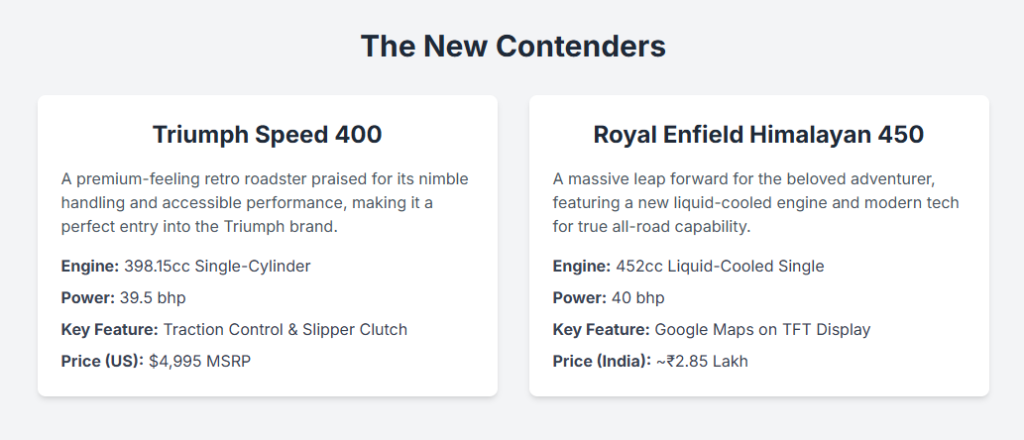

Leading manufacturers, including Triumph and Royal Enfield, have strategically responded to this trend with new models like the Triumph Speed 400, Scrambler 400X, and Royal Enfield Himalayan 450. These motorcycles are proving highly popular, demonstrating the industry’s successful adaptation to consumer demand for versatile, feature-rich, and economically sensible options. This report delves into the underlying drivers of this middleweight motorcycle boom, examines the competitive strategies of key players, and concludes with an assessment of the implications for the broader motorcycle market.

2. Introduction: The Evolving Landscape of Motorcycle Preferences

The motorcycle market is experiencing a notable trend: riders are increasingly moving away from larger, more expensive bikes towards more affordable and practical middleweight motorcycles. This shift is not merely a fleeting preference but a significant market realignment influenced by a confluence of economic, demographic, and technological factors. This reorientation in consumer choice is particularly evident in the burgeoning popularity of new models such as Triumph’s Speed 400 and Scrambler 400X, and Royal Enfield’s Himalayan 450, all of which offer a compelling balance of performance, features, and accessibility.

For the purpose of this analysis, the middleweight segment is primarily defined as motorcycles with engine displacements between 126cc and 500cc, aligning with the user query. It is important to acknowledge that industry definitions can vary, with some market research extending the “middleweight” or “medium and large displacement” categories to include motorcycles up to 800cc or even 1000cc.3 While this report focuses on the 126cc-500cc range, data from broader “middleweight” categories will be incorporated where relevant to provide a comprehensive market perspective on this dynamic segment.

3. Global Motorcycle Market Dynamics

The global motorcycle market demonstrates a robust growth trajectory, underscoring its significant role in personal mobility and recreation worldwide. The market was valued at USD 71.92 billion in 2024 and is projected to reach USD 119.09 billion by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of 6.7% from 2025–2032.1 Other assessments forecast the market growing from US

140.7billionin2025toUS186.4 billion by 2032 at a CAGR of 4.1% 2, or valued at USD 106.8 billion in 2023 with an anticipated CAGR of 8.5% between 2024 and 2032.6 These variations in projections reflect differing methodologies among research firms but consistently point towards substantial market expansion.

Overall Market Size, Growth Projections, and Regional Dominance

Asia-Pacific continues to exert its dominance over the global motorcycle industry, holding a substantial market share of 61.61% in 2024 1 and accounting for approximately 40% of the global market share.2 This regional leadership is largely propelled by a rapidly expanding middle class, accelerated urbanization, increasing disposable incomes, and supportive government policies, particularly those encouraging electric mobility.1 Key markets within Asia-Pacific include India, China, Indonesia, and Vietnam.2 India, in particular, leads the global motorcycle market due to a high demand for affordable two-wheelers and the critical role motorcycles play in rural mobility.2 The global market achieved an all-time high in units sold in 2024 2, with Q1 2025 sales reaching 15 million units, representing a 3.0% increase.8

The following table provides a clear overview of the global motorcycle market’s projected growth:

Table 1: Global Motorcycle Market Size and Growth Forecast (2024-2032)

| Year | Market Value (USD Billion) | CAGR (2025-2032) |

| 2024 | 71.92 | – |

| 2025 | 75.82 | 6.7% |

| 2032 | 119.09 | 6.7% |

Note: Data primarily sourced from Fortune Business Insights.1 Other sources provide slightly different figures (e.g., Persistence Market Research projects US

140.7Bnin2025toUS186.4 Bn by 2032 with a 4.1% CAGR 2, while GM Insights estimates USD 106.8 Billion in 2023 with an 8.5% CAGR between 2024 and 2032 6), highlighting variations in market analysis methodologies.

Segmentation by Engine Capacity, Highlighting the Growth of Middleweight Categories

Analysis of market segmentation by engine capacity reveals distinct trends. The 200cc to 400cc motorcycle segment is identified as the fastest-growing globally, significantly bolstering the overall market.1 These mid-sized bikes are valued for their versatility and capability, striking a balance between performance and affordability that makes them suitable for both daily commuting and leisure riding.1 Models such as the Bajaj Pulsar NS200 and KTM Duke 390 exemplify this appeal, having seen increased sales in 2024.1

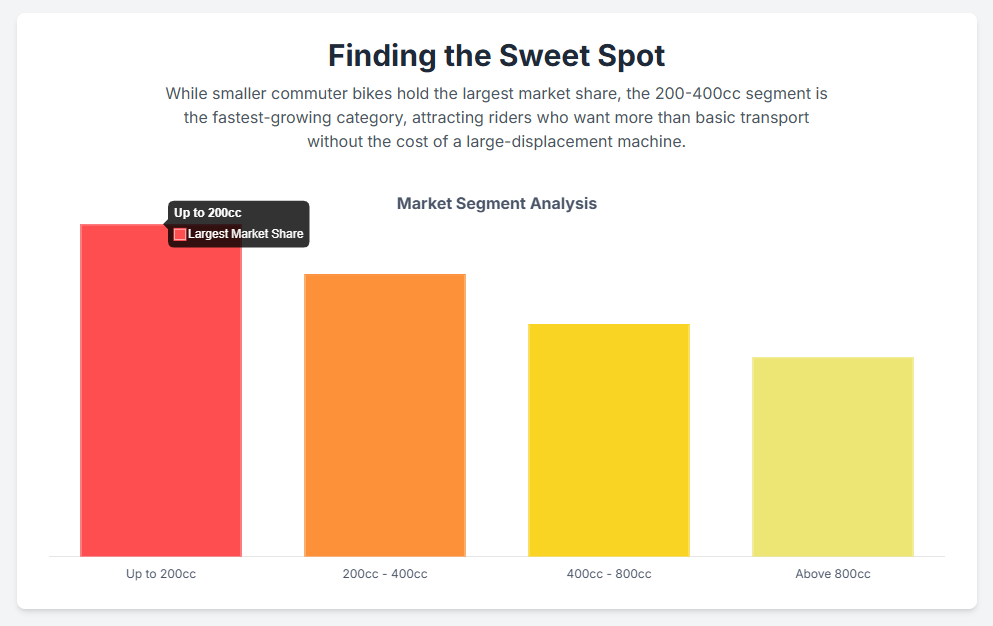

In 2024, the “up to 200cc” segment held the largest market share, primarily due to its affordability and suitability for urban commuting, which appeals strongly to first-time buyers and price-sensitive consumers.7 This strong performance at the lower end of the displacement spectrum, alongside the rapid growth of the 200-400cc segment, indicates a bifurcated market expansion. The market is not simply “downsizing” from large to middleweight; rather, it is witnessing continued robust demand for entry-level, highly economical commuter bikes, driven by urbanization and fundamental mobility needs, especially prevalent in the Asia-Pacific region.1

Concurrently, the middleweight segment is experiencing rapid expansion by attracting a different set of consumers: those who desire more performance and features than a basic commuter can offer, but without the prohibitive cost and complexity associated with larger displacement motorcycles. This suggests a diversification of consumer demand, necessitating manufacturers to cater to both ends of the market, potentially through distinct brand portfolios or sub-brands.

Looking ahead, the “400cc to 800cc” segment is projected to exhibit the fastest growth rate from 2025 to 2032.7 This anticipated growth is fueled by increasing interest in long-distance touring and mid-range sports bikes, particularly among riders in Europe and North America.7 This suggests a continued movement towards more capable, yet still manageable, motorcycles. The medium displacement motorcycle market (250cc-500cc) is particularly popular among beginners and intermediate riders due to its manageable power and affordability.4 This category also represents the largest segment by engine capacity within India’s Premium Bikes Market, serving as a crucial entry point into the premium motorcycle sector.11

The significant growth of the 350-500cc segment in India, as evidenced by sales figures, further underscores the importance of the Asia-Pacific region as the primary quantitative driver of the middleweight motorcycle boom.11 While the trend of experienced riders downsizing from larger bikes is observed in developed markets 13, the burgeoning middle class in Asia-Pacific, who are upgrading from smaller commuters but may not yet seek very large displacement bikes, are finding the middleweight “premium” segment to be an ideal balance of status, performance, and affordability. This positions Asia-Pacific, particularly India, as the critical battleground for market share in the middleweight category.

4. Drivers of the Middleweight Motorcycle Boom

The surging popularity of middleweight motorcycles is not a singular phenomenon but the result of several interconnected factors that collectively enhance their appeal to a broad spectrum of riders. These drivers include their inherent affordability, practical utility, the integration of advanced technologies, evolving consumer demographics, and prevailing economic conditions.

Affordability and Practicality

Middleweight motorcycles present a compelling value proposition, primarily due to their lower purchase prices and reduced running costs when compared to their larger displacement counterparts.4 For instance, in Thailand, the 111-125cc segment experienced an 8.8% increase in domestic sales in 2024, partly driven by their affordable price points, averaging THB 60,000–70,000, and lower fuel costs, making them an attractive primary mode of transport for lower- to middle-income consumers.15 Similarly, exports of 250-500cc motorcycles from Thailand saw a 1.9% increase, defying overall market sluggishness, precisely because of their lower prices and reduced costs relative to bigger models.15 Owners of middleweight adventure bikes explicitly acknowledge that these models are “easier on your wallet when it comes to consumables” such as tires, brake pads, and fuel, and feature a “lower price tag” for the initial purchase, potentially leading to lower insurance premiums as well.14 In India, “low cost of ownership and maintenance” and “fuel efficiency” are consistently cited as top reasons for two-wheeler ownership, significantly influencing brand preference and purchase decisions, particularly for budget-conscious consumers.20

Ease of Use and Accessibility

A significant draw of middleweight motorcycles lies in their enhanced ease of use and accessibility. These bikes are generally lighter, more manageable, and less intimidating to ride, making them an ideal choice for beginners.3 They are often described as “bikes you can grow into,” offering a capable platform that can accommodate seasoned riders while remaining approachable for novices.3 Their nimble handling and reduced weight contribute to their excellence in urban commuting, allowing riders to navigate traffic, execute tight turns, and park in confined spaces more effectively.18 Furthermore, features such as lower seat heights, exemplified by the Triumph Speed 400 at 790mm 24, significantly enhance accessibility for a broader range of riders, including those with shorter statures.26

Technological Advancements

The middleweight motorcycle segment has greatly benefited from the “trickle-down effect,” where sophisticated technologies initially developed for top-tier racing bikes are progressively integrated into more affordable models.3 Features that were once exclusive, such as cornering ABS, traction control, and multiple ride modes, are now commonplace in middleweight offerings.3 These electronic aids not only make middleweight bikes more forgiving and safer for less experienced riders but also allow for a more engaging and visceral riding experience when these aids are selectively disengaged.3 Examples include the Kawasaki Z650, which now incorporates KTRC (Kawasaki Traction Control System) and dual-channel ABS 3, and the KTM 790 Duke, which utilizes cutting-edge electronics to enable lower power modes for less experienced riders.3 The new Royal Enfield Himalayan 450 further exemplifies this trend, boasting ride-by-wire throttle control, selectable riding modes, switchable rear ABS, and an innovative Google Maps integration on its TFT console, a first in its segment.27

Changing Consumer Demographics

The evolving preferences of consumers, particularly within key emerging markets, are a powerful catalyst for the middleweight motorcycle boom. A growing young population with increasing disposable income is a primary driver for India’s Premium Bikes Market, prompting manufacturers to enhance their presence in the middleweight category to attract these younger consumers.11 Young individuals in India, Southeast Asia, and China are significant consumers, frequently opting for vehicles that incorporate advanced technologies, attractive aesthetics, and higher engine capacities.2

A notable trend is the rising demand for adventure touring bikes, which reflects a broader shift towards versatile machines capable of both on-road and off-road excursions.2 This segment is projected to experience the fastest growth rate from 2025 to 2032.7 Moreover, experienced riders are increasingly opting for middleweight motorcycles, recognizing that managing a heavy adventure bike can be physically demanding and exhausting.13 This realization positions middleweights as a viable and often more enjoyable alternative, offering nearly the same level of performance and arguably more fun than their heavier counterparts, without the associated drawbacks.14 This shift suggests a maturing rider base that prioritizes a balanced, enjoyable, and practical experience over sheer power or prestige, indicating a fundamental change in what constitutes a “desirable” motorcycle. The appeal of middleweight motorcycles extends beyond mere affordability or basic utility; it centers on optimizing the riding experience, finding a sweet spot where power is usable 3, handling is manageable 16, and the overall cost of ownership remains reasonable 14, all without compromising on modern features.3

Economic Factors

Broader economic conditions play a crucial role in shaping motorcycle purchasing decisions. Rising disposable incomes, particularly among the expanding middle class in emerging markets, are fueling the demand for a diverse range of motorcycles, including premium middleweights.1 These motorcycles are increasingly perceived as symbols of lifestyle and status.11

The escalating need for efficient personal mobility, especially in urban areas grappling with heavy traffic congestion, is driving demand for motorcycles as a quicker and more economical alternative to cars.2 Furthermore, the proliferation of ride-sharing and food delivery services, particularly in urban centers, is creating significant market opportunities for two-wheelers used in last-mile deliveries.2

A critical, often underestimated, economic factor influencing this trend is the financing environment. In Thailand, for instance, some lower- to middle-income consumers have increasingly shifted to 111-125cc motorcycles as their primary mode of transport, replacing larger motorcycles or passenger cars, which faced stricter loan approval processes from financial institutions.15 This illustrates how, beyond just the sticker price, the availability and ease of loan approvals can directly influence consumer choices, pushing buyers towards more affordable segments like middleweights. In economies experiencing tighter credit conditions or rising household indebtedness, this financial consideration could significantly accelerate the “downsizing” trend, making middleweights not just a preferred option but, for some buyers, an economic necessity. This highlights the intricate interplay between macroeconomic conditions and the growth of specific market segments.

The following table summarizes the key factors propelling the adoption of middleweight motorcycles:

Table 2: Key Drivers for Middleweight Motorcycle Adoption

| Driver Category | Specific Factors | Supporting Snippet IDs |

| Affordability | Lower purchase price, reduced running costs (fuel, maintenance, tires, brakes), potentially lower insurance. | 14 |

| Practicality & Ease of Use | Lighter weight, more manageable handling, less intimidating for beginners, nimble in urban traffic, lower seat heights. | 3 |

| Technological Advancements | “Trickle-down” of advanced features (ABS, traction control, ride modes), enhanced safety and versatility, improved rider experience. | 3 |

| Changing Demographics | Growing young population seeking performance and style, experienced riders downsizing for enjoyment/manageability, rising interest in adventure touring. | 2 |

| Economic Factors | Rising disposable incomes, demand for efficient personal mobility in urban areas, growth of delivery/ride-sharing services, stricter loan approvals for larger vehicles. | 1 |

5. Key Players and Competitive Strategies in the Middleweight Segment

The shift towards middleweight motorcycles has prompted leading global and regional manufacturers to recalibrate their product portfolios and strategic initiatives. This section examines the approaches of key players, particularly Triumph, Royal Enfield, and prominent Indian manufacturers like Bajaj Auto, Hero MotoCorp, and TVS.

Triumph’s Strategic Entry

Triumph has made a significant strategic entry into the middleweight segment with its new 400cc models, the Speed 400 and Scrambler 400X. These motorcycles are designed to strike a balance between being inviting and forgiving for new riders, while still offering a fun and engaging performance for more seasoned enthusiasts.26

The Triumph Speed 400 is a modern retro roadster powered by a 398.15cc liquid-cooled single-cylinder engine, delivering 39.5 bhp and 37.5 Nm of torque.24 It is equipped with dual-channel ABS, traction control, and a slipper clutch, enhancing both safety and rider comfort.24 Users consistently praise its usable performance, strong pickup, and nimble handling, making it well-suited for city traffic and cornering.24 With a seat height of 790mm, it is notably accessible for a wider range of riders, including those of shorter stature.24 Consumer reception has been overwhelmingly positive, reflected in a 4.7 out of 5 user rating.24 Riders appreciate its attractive styling, mature aesthetic, and perceived value for money.24 Owner-reported mileage averages around 30 kmpl.24 Positioned as a premium yet affordable entry into the Triumph brand, the Speed 400 carries an MSRP of $4,995 in the US 26 and an ex-showroom price of ₹2,94,304 in India.24 It directly competes with models such as the Harley-Davidson X440 and Honda CB350RS.24

The Triumph Scrambler 400X shares the same 398.15cc engine as the Speed 400 but is engineered with a distinct chassis, ergonomics, and riding experience tailored for light off-roading capabilities.26 Key differences include a longer wheelbase of 55.8 inches, extended suspension travel of 5.9 inches both front and rear, a larger 19-inch front wheel, and a more substantial 320mm front brake disc.26 It also features switchable ABS and a dedicated off-road mode to enhance its versatility.26 The Scrambler 400X has a higher seat height of 835mm, offering a roomier riding posture.26 Consumer reception is highly favorable, with an average user rating of 4.8 out of 5 stars.30 Riders commend its comfort, striking appearance, excellent handling, and ability to absorb road imperfections.25 It is often described as providing the sensation of riding a “big bike” while retaining the agility necessary for navigating traffic.25 Owner-reported mileage for the Scrambler 400X is approximately 26-27 kmpl.30 It is priced at $5,595 (MSRP) 26 and ₹3,27,460 in Pune, India 30, positioning it as a more progressive and feature-rich alternative to some existing models in the segment.30 Both the Speed 400 and Scrambler 400X are manufactured by Bajaj Auto in India, in collaboration with Triumph factories in Thailand and Brazil, ensuring adherence to Triumph’s quality standards despite their competitive pricing.26

Royal Enfield’s Continued Dominance

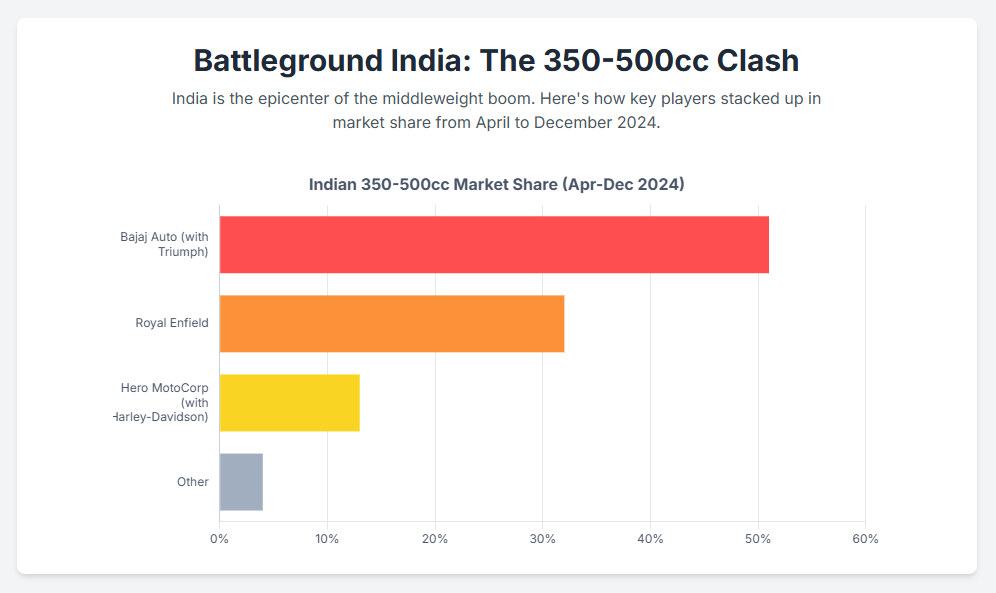

Royal Enfield maintains a strong position in the middleweight segment, particularly within the Indian market. From April to December 2024, Royal Enfield secured a 32% market share in India’s 350-500cc segment, with sales reaching 29,519 units, predominantly driven by its Himalayan 450 and Guerrilla 450 models.12 The brand also achieved a significant milestone, celebrating over 1 million sales in the fiscal year spanning April 2024 to March 2025.32

The Royal Enfield Himalayan 450 represents a substantial evolution from its predecessor, the Himalayan 411. It features a new 452cc liquid-cooled DOHC single-cylinder engine that produces 40 bhp and 40 Nm of peak torque, paired with a 6-speed gearbox and a slip/assist clutch.27 This marks a considerable performance upgrade from the older 411cc air-cooled engine’s 24.5 bhp.27 The Himalayan 450 is built on a lighter twin-spar tubular frame, incorporating 43mm USD Showa forks and increased rear suspension travel.27 It is also 3kg lighter than the previous model, weighing 196kg, and offers an adjustable seat height ranging from 825mm to 845mm.27 In terms of electronics, the new Himalayan 450 is significantly more advanced, featuring ride-by-wire, two riding modes (performance and eco), switchable rear ABS, and an industry-first Google Maps integration on its TFT console.27

Consumer feedback for the Himalayan 450 is generally positive, with users reporting strong reliability, exemplified by one owner covering 16,000 km without issues, and its ability to cruise effortlessly up to 90 kmph.34 It is lauded for its “head-turning” aesthetic appeal and its versatility as a “one bike to do everything” for both city commuting and highway touring.34 However, some common observations include a noticeable vibration on the right footpeg at speeds above 90 kmph, an uncomfortable stock seat for extended touring (often prompting upgrades), and minor issues with the side stand’s excessive lean and a somewhat tricky fueling process.34 The technological leap represented by the Himalayan 450 directly addresses weaknesses of the previous model, positioning it as a highly competitive middleweight adventure tourer and contributing significantly to Royal Enfield’s robust sales performance.12

Indian Manufacturers’ Focus: Bajaj Auto, Hero MotoCorp, and TVS

Indian manufacturers are strategically expanding their presence in the middleweight segment, recognizing its growth potential and the evolving preferences of the domestic market.

Bajaj Auto, a leading player in India, commanded the largest market share (51%) in the 350-500cc segment from April to December 2024, selling 47,766 units, which represents a substantial 51% increase from the previous year. This success is partly attributed to their collaboration on 400cc Triumph motorcycles.12 Bajaj is actively venturing into the premium two-wheeler segment, with aspirations to manufacture higher displacement (above 390cc) KTM bikes for both domestic and global markets.1 The company’s overarching strategy prioritizes value for money, affordability, fuel efficiency, robust build quality, and an extensive service network.20 Bajaj is also a proponent of electric mobility, developing its Chetak EV brand and planning for future electric motorcycles.20

Hero MotoCorp is making a strategic foray into the premium middleweight motorcycle market. The company has observed a substantial 77% rise in sales for its Harley-Davidson X440 and Hero Mavrick 440 models (totaling 12,188 units) from April to December 2024, securing a 13% share in the 350-500cc segment.12 Hero’s entry into the premium segment aims to bolster profitability, as its traditional dominance in the entry-level commuter segment (holding over 70% market share) typically yields smaller margins.37 As the official distributor of Harley-Davidson in India, Hero is also developing premium bikes for the American brand, with plans to sell at least one of these mid-capacity models under its own Hero MotoCorp badge.37

TVS Motor has reported impressive growth, with its premium motorcycle segment, spearheaded by the Apache series, growing by 20.6% to 0.48 million units in FY24-25.38 Overall motorcycle sales for TVS grew by 21% in Q1 FY26.39 The Apache RR 310, a key middleweight offering, has received updates including enhanced 38 PS power, a bi-directional quickshifter, and other advanced features.38 TVS plans to introduce new models in FY25-26, including an adventure tourer for the Indian market.38

6. Conclusions

The global motorcycle market is undeniably experiencing a significant shift towards middleweight motorcycles (126cc-500cc), driven by a confluence of economic, demographic, and technological factors. This movement is not merely a “downsizing” from larger bikes but represents a strategic optimization of the riding experience, where consumers seek a balanced combination of performance, practicality, and affordability.

The continued strong sales of small-displacement commuter bikes alongside the rapid growth of the middleweight segment indicates a diversification of market needs. Manufacturers must address the demand for both highly economical basic mobility and the burgeoning desire for more capable, feature-rich, yet still manageable, motorcycles. The Asia-Pacific region, particularly India, serves as the epicenter of this middleweight growth, fueled by its expanding middle class who are upgrading from entry-level models and finding the middleweight “premium” segment to be an ideal blend of status, performance, and accessibility.

The “Goldilocks Zone” appeal of middleweight bikes, characterized by usable power, manageable handling, reasonable ownership costs, and the integration of advanced technologies, is a key differentiator. Furthermore, macroeconomic factors, such as stricter loan approval processes for larger vehicles in some regions, can accelerate this trend by making middleweights a more financially viable option.

Leading manufacturers like Triumph and Royal Enfield have successfully capitalized on this trend by introducing compelling new models that offer modern features, refined performance, and competitive pricing. Indian manufacturers such as Bajaj Auto, Hero MotoCorp, and TVS are also making significant inroads into this segment, leveraging partnerships and developing their own premium offerings to capture market share.

The motorcycle industry’s future growth will increasingly depend on its ability to innovate within this middleweight space, providing models that meet the evolving demands for versatility, technological sophistication, and economic sensibility across diverse global markets.

Sources

- Motorcycle Market Size, Share, Value | Growth Report [2032], accessed August 3, 2025, https://www.fortunebusinessinsights.com/motorcycle-market-105164

- Motorcycle Market Size, Industry Trends & Analysis, 2032 – Persistence Market Research, accessed August 3, 2025, https://www.persistencemarketresearch.com/market-research/motorcycle-market.asp

- Three reasons why the middleweight naked bike segment is better than ever – MotoDeal, accessed August 3, 2025, https://www.motodeal.com.ph/articles/motorcycle-features/three-reasons-why-middleweight-naked-bike-segment-better-ever

- Medium and Large Displacement Motorcycles Market Size, Growth …, accessed August 3, 2025, https://www.globalgrowthinsights.com/market-reports/medium-and-large-displacement-motorcycles-market-103050

- Medium and Large Displacement Motorcycles Strategic Insights: Analysis 2025 and Forecasts 2033, accessed August 3, 2025, https://www.archivemarketresearch.com/reports/medium-and-large-displacement-motorcycles-120438

- Motorcycle Market Size & Share, Forecast Report 2024-2032, accessed August 3, 2025, https://www.gminsights.com/industry-analysis/motorcycle-market

- Global Motorcycles Market Size, Share, and Analysis Report 2032, accessed August 3, 2025, https://www.databridgemarketresearch.com/reports/global-motorcycles-market

- World Motorcycles Market Reached 15 Million Sales (+3.0%) in Q1 2025, accessed August 3, 2025, https://www.motorcyclesdata.com/2025/06/05/world-motorcycles-market/

- 4 The evolution of the motorcycle industry from golden age to green revolution – WIPO, accessed August 3, 2025, https://www.wipo.int/web-publications/world-intellectual-property-report-2024/en/4-the-evolution-of-the-motorcycle-industry-from-golden-age-to-green-revolution.html

- Motorcycle Helmet Market Size, Share | Industry Report 2030 – Grand View Research, accessed August 3, 2025, https://www.grandviewresearch.com/industry-analysis/motorcycle-helmet-market

- India Premium Bikes Market Size, Trend & Demand Analysis (2024 …, accessed August 3, 2025, https://www.blueweaveconsulting.com/report/india-premium-bikes-market

- Hero MotoCorp Achieves Major Sales Growth In Premium …, accessed August 3, 2025, https://www.drivespark.com/two-wheelers/2025/hero-motocorp-premium-middleweight-motorcycle-sales-growth-011-064805.html

- 6 Middleweight Bikes That Will Change Your Riding Forever! – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=AxWTScaLk6c

- Midweight vs Heavyweight ADV Bike: What’s Best for Me? – Lone Rider, accessed August 3, 2025, https://www.lonerider-motorcycle.com/blogs/loneriderblog/midweight-vs-heavyweight-adv-bike-whats-best-for-me

- Industry Outlook Motorcycle Industry, accessed August 3, 2025, https://www.krungsri.com/en/research/industry/industry-outlook/hi-tech-industries/motorcycles/io/motorcycles-2025-2027

- What is the point of a bigger bike? : r/motorcycles – Reddit, accessed August 3, 2025, https://www.reddit.com/r/motorcycles/comments/1e2n7nd/what_is_the_point_of_a_bigger_bike/

- 10 Perfect Middleweight Adventure Bikes That Won’t Break The Bank – Top Speed, accessed August 3, 2025, https://www.topspeed.com/perfect-middleweight-adventure-bikes-wont-break-the-bank/

- Top Motorcycles to Make the Most of City Riding – Cycle World, accessed August 3, 2025, https://www.cycleworld.com/bikes/top-motorcycles-for-city-riding/

- What Makes a Good Commuter Motorcycle? – NCY Motorsports, accessed August 3, 2025, https://www.ncy-motorsports.com/Good-Commuter-Motorcycle-Guide

- The Evolution and Success of Bajaj Auto in India – OTO Capital, accessed August 3, 2025, https://www.otocapital.in/article/success-of-bajaj-auto-in-india

- Factors Influencing Consumer Buying Behavior towards Purchase of Two- Wheeler in Delhi NCR – Gitarattan International Business School, accessed August 3, 2025, https://gitarattan.edu.in/wp-content/uploads/2022/04/Anusandhan-3-P1.pdf

- Factors Affecting Purchase Decision for Indian Two Wheelers in Sri Lankan Market, accessed August 3, 2025, https://www.researchgate.net/publication/295605921_Factors_Affecting_Purchase_Decision_for_Indian_Two_Wheelers_in_Sri_Lankan_Market

- Modern Adventure Bikes: What’s Best in the Heavyweight, Midweight, and Lightweight Classes? – Twisted Road, accessed August 3, 2025, https://www.twistedroad.com/blog/posts/modern-adventure-bikes-whats-best-in-the-heavyweight-midweight-and-lightweight-classes

- Triumph Speed 400 Price – Mileage, Images, Colours | BikeWale, accessed August 3, 2025, https://www.bikewale.com/triumph-bikes/speed-400/

- Triumph Scrambler 400 X ownership review including service experience – Team-BHP, accessed August 3, 2025, https://www.team-bhp.com/news/triumph-scrambler-400-x-ownership-review-including-service-experience

- 2024 Triumph Speed 400 and Scrambler 400 X Review | First Ride, accessed August 3, 2025, https://womanrider.com/2024/02/2024-triumph-speed-400-and-scrambler-400-x-review-first-ride/

- Royal Enfield Himalayan: Old vs New – carandbike, accessed August 3, 2025, https://www.carandbike.com/news/royal-enfield-himalayan-old-vs-new-3211041

- What type of motorcycles do Indians prefer? – Quora, accessed August 3, 2025, https://www.quora.com/What-type-of-motorcycles-do-Indians-prefer

- Large Displacement Motorcycle Market on Track for Strong – openPR.com, accessed August 3, 2025, https://www.openpr.com/news/4106826/large-displacement-motorcycle-market-on-track-for-strong

- Page 3 of 6 – Reviews of Triumph Scrambler 400 X | User Reviews …, accessed August 3, 2025, https://www.bikewale.com/triumph-bikes/scrambler-400/reviews/page/3/

- Triumph Scrambler 400 X vs Triumph Speed 400 – Know Which Is …, accessed August 3, 2025, https://www.bikewale.com/compare-bikes/triumph-scrambler-400-vs-triumph-speed-400/

- Indian Motorcycles Market – Facts & Data 2025 | MotorCyclesData, accessed August 3, 2025, https://www.motorcyclesdata.com/2025/07/07/indian-motorcycles-market/

- Comparisons on the Himalayan models 2018-2025 : r/royalenfield – Reddit, accessed August 3, 2025, https://www.reddit.com/r/royalenfield/comments/1l7kbns/comparisons_on_the_himalayan_models_20182025/

- Royal Enfield Himalayan 450 Review – Page 73 – Team-BHP, accessed August 3, 2025, https://www.team-bhp.com/forum/motorbikes/275280-royal-enfield-himalayan-450-review-73.html

- Royal Enfield Himalayan long term review – What we’ve learned over 1.5 years – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=N6buygeOgdM&pp=0gcJCfwAo7VqN5tD

- BAJAJ AUTO LTD Trade Ideas — NSE:BAJAJ_AUTO – TradingView, accessed August 3, 2025, https://in.tradingview.com/symbols/NSE-BAJAJ_AUTO/ideas/

- Hero MotoCorp to develop 350cc mid-capacity motorcycle – Team …, accessed August 3, 2025, https://www.team-bhp.com/forum/motorbikes/236948-hero-motocorp-develop-350cc-mid-capacity-motorcycle.html

- TVS Motor Clocks Record Growth In FY 2024-25 – Mobility Outlook, accessed August 3, 2025, https://www.mobilityoutlook.com/news/tvs-motor-clocks-record-growth-in-fy-2024-25/

- TVS Motors posts 21% YoY growth in motorcycle sales. Check e-scooter sales… – HT Auto, accessed August 3, 2025, https://auto.hindustantimes.com/auto/news/tvs-motors-posts-21-yoy-growth-in-motorcycle-sales-check-e-scooter-sales-41754015185708.html

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter