Executive Summary

India’s burgeoning Electric Vehicle (EV) sector, a cornerstone of the nation’s green mobility aspirations, faces significant headwinds due to a critical shortage of rare earth magnets. This report examines the immediate impact on major manufacturers like Bajaj Auto, whose recent production shortfalls serve as a stark indicator of systemic vulnerabilities within the broader Indian EV supply chain. The core of the issue lies in the indispensable role of rare earth elements (REEs) in high-performance EV motors and China’s near-monopoly over their global supply and processing. Recent export restrictions imposed by China have exacerbated this dependency, compelling India to accelerate its strategic response.

The analysis delves into the technical necessity of REEs in EV propulsion, distinguishing their use from batteries, and explores the complex geopolitical landscape that underpins their supply. It highlights the ripple effect on smaller Indian EV makers and the broader industry’s efforts to manage inventory and seek alternatives. Critically, the report details India’s multi-pronged strategy to achieve rare earth independence and enhance supply chain resilience. This includes ambitious government initiatives to boost domestic mining and manufacturing, the proactive engagement of public and private sector entities, and intensified international collaborations through alliances like the Minerals Security Partnership (MSP). Furthermore, the report explores the frontier of innovation in rare-earth-free motor technologies, a promising long-term solution being pursued by Indian original equipment manufacturers (OEMs).

The current challenges underscore the intricate interplay between technological advancement, economic growth, and geopolitical stability. While short-term disruptions are evident, India’s comprehensive strategic response aims to transform this vulnerability into an opportunity for domestic innovation and global leadership in sustainable mobility. The report concludes with actionable recommendations for both government and industry stakeholders, emphasizing the need for accelerated policy implementation, diversified sourcing, and sustained investment in indigenous research and development to secure India’s EV future.

1. The Indian Electric Vehicle Market: A Landscape of Ambition and Emerging Hurdles

The Indian electric vehicle market is positioned for substantial expansion, propelled by growing environmental awareness, supportive government policies, and an increasing consumer inclination towards sustainable transportation. However, this ambitious growth trajectory is now encountering significant challenges stemming from vulnerabilities in the supply chain.

1.1 Overview of India’s EV Sector: Growth Drivers, Market Segments (2W, 3W, Commercial)

India’s EV market, valued at approximately $2 billion in 2023, is projected to experience considerable growth, with forecasts indicating a rise to $7.09 billion by 2025.1 Projections suggest that annual EV sales could reach 10 million units by 2030 1, with EVs expected to constitute 30% of new vehicle sales by 2025.3 This rapid expansion is particularly notable in specific market segments. Lightweight motorcycles and scooters represent a substantial portion of the total vehicles on Indian roads, making the country a crucial growth area for battery-powered vehicles, especially given the prevalence of congested urban environments [User Query]. This observation is further supported by the expectation that two-wheelers will be among the earliest adopters in the electric vehicle domain.4

A significant aspect of India’s EV adoption pathway, which distinguishes it from many Western markets, is the strong emphasis on the 2-wheeler and 3-wheeler segments, including e-rickshaws. This focus highlights a pragmatic approach to electrification, driven by a robust demand for affordable, utility-oriented EVs tailored for last-mile mobility and urban congestion. Bajaj Auto, a prominent player in the automotive sector, is strategically expanding its presence in the e-rickshaw market, a segment estimated to encompass 45,000 units per month, thereby deepening its engagement in the last-mile mobility sector.5 The company has already demonstrated strong performance in commercial vehicles, with volumes increasing by 7% year-on-year, and has maintained its leadership in electric 3-wheelers, where retail volumes have nearly tripled compared to the previous year.5 This strategic market segmentation towards high-volume, practical segments underscores that India’s EV revolution is not solely about personal transport but also about transforming commercial and public mobility for a broad consumer base. The demand-side pull for practical, cost-effective EV solutions appears to be a primary driver, rather than solely performance or luxury-driven adoption.

Despite the widely reported supply chain challenges affecting EV production, the underlying demand and profitability within the EV segment, particularly for premium models, remain robust enough to serve as a significant growth catalyst. This has helped cushion the impact from other sluggish market segments, such as entry-level motorcycles.5 For instance, Bajaj Auto’s overall financial performance in Q1 FY26, which saw a 5% year-on-year rise in net profit and a 6% rise in revenue, was substantially bolstered by strong export performance and an increasing share of premium and electric vehicles.5 This nuanced financial picture indicates that while EV production is indeed constrained by supply issues, the value generated from EV sales remains high. This suggests a healthy underlying market for EVs, even amidst supply-side limitations, and illustrates how a diversified portfolio and strong export performance can act as buffers against localized disruptions.

1.2 Government Policies and Incentives Driving EV Adoption (FAME II, PLI, State Initiatives)

The Indian government’s proactive stance, manifested through various incentive schemes, is a pivotal factor stimulating the early adoption of electric vehicles.4 Policies such as the FAME II scheme and the Production Linked Incentive (PLI) initiatives are actively accelerating India’s transition towards EVs.3 These programs offer financial incentives, including customs duty exemptions on EV batteries and tax breaks for EV buyers, specifically designed to enhance affordability and boost sales.3

However, the efficacy of these well-intentioned policies can be significantly undermined by challenges in their implementation. A notable example is the delayed reimbursement of state EV subsidies by the Maharashtra government. This situation has left Bajaj Auto, despite having passed on the benefits to its customers, with almost no returns for the past two years.7 Such delays create substantial policy gaps and introduce industry uncertainty.7 This highlights a crucial point: the mere existence of supportive policies is insufficient; their consistent, transparent, and timely execution is equally, if not more, vital for cultivating a stable and attractive investment environment for the nascent EV industry. Without predictable and timely disbursements, manufacturers face cash flow issues and reduced confidence, potentially deterring further investment in the EV ecosystem.

Furthermore, government incentives, while effective in stimulating demand, can paradoxically expose the industry to heightened vulnerability when coupled with fragile supply chains. If demand, artificially boosted by subsidies, outstrips the constrained supply of critical components like rare earth magnets, it can lead to market dissatisfaction, unfulfilled orders, and a potential loss of momentum. This scenario could, ironically, undermine the very growth that the policies aim to achieve. The current struggles of Bajaj Auto, where demand exists but production is hampered by supply shortages [User Query], exemplify this imbalance. This situation underscores the need for incentives to be part of a holistic strategy that also robustly addresses supply-side constraints. Otherwise, a significant disconnect between market demand and production capacity can emerge, threatening the sustainable growth of the EV sector.

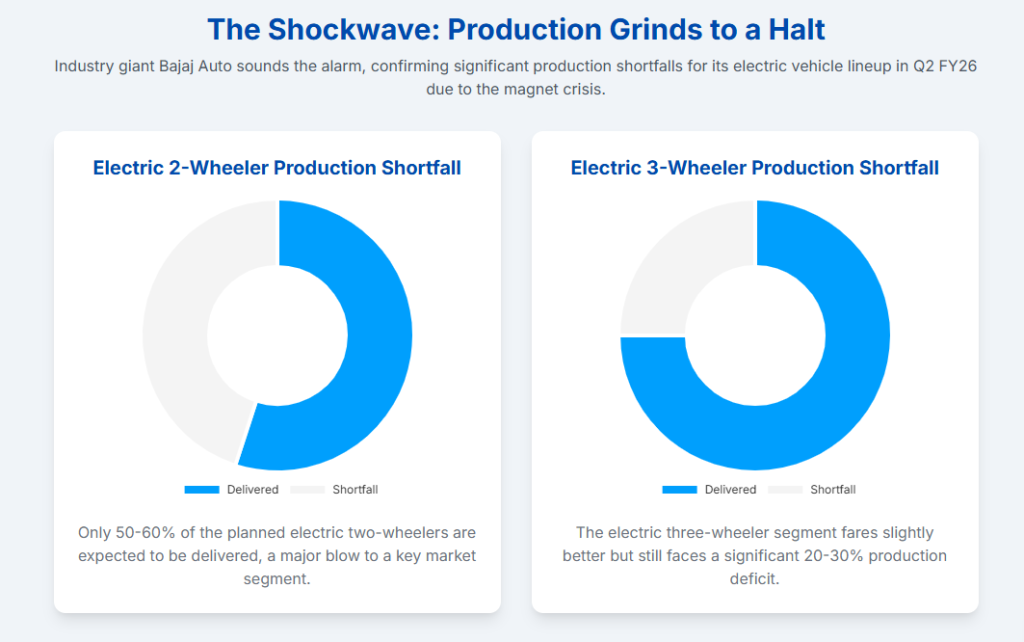

1.3 The Criticality of EV Components: Beyond Batteries to Motors

A common misconception in the public discourse, and sometimes at the policy level, is that rare earth elements (REEs) are primarily used in lithium-ion batteries. However, this is inaccurate; EV battery packs predominantly comprise lithium and cobalt, not rare earths.8 The true and often overlooked criticality of rare earths lies in their indispensable role within electric motors, which are the fundamental components responsible for propelling electric vehicles.8

These electric motors rely fundamentally on powerful magnets, where REEs such as neodymium and samarium, often augmented with additions of terbium or dysprosium for enhanced performance or heat resistance, play an essential part.8 The two leading types of rare-earth magnets in this domain are neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo) magnets. These materials are highly prized for their compact size, exceptional power, and suitability for the demanding high-performance requirements of EV propulsion systems.8 Data indicates that approximately 80-90% of electric vehicles sold in the past half-decade have incorporated rare earth permanent magnets in their rotors.13

The prevalent focus on EV batteries, often due to their weight, cost, and environmental implications, inadvertently obscures the equally, if not more, critical function of rare earth magnets in achieving motor efficiency and performance. This misdirection can lead to inadequate strategic planning and insufficient investment in securing the supply chains for these essential magnet materials. The current crisis affecting Bajaj Auto, which is directly linked to magnet shortages rather than battery component issues [User Query], clearly illustrates this hidden vulnerability. If the critical points of dependency are misunderstood, strategic efforts to mitigate risks will be misdirected, thereby making the industry more susceptible to disruptions.

The widespread adoption of rare earth magnets, specifically NdFeB and SmCo, in EV motors is a direct consequence of their superior performance attributes, including compactness, high power density, and exceptional efficiency.8 However, this pursuit of optimal performance has inadvertently created a profound supply chain vulnerability. This is due to the highly concentrated geographical control over rare earth mining and processing, which is predominantly held by China.8 This situation highlights a fundamental engineering and strategic trade-off that manufacturers must continuously navigate: balancing the desire for peak performance with the imperative of supply chain security and resilience. The reliance on these powerful materials, while delivering significant technological advantages, directly exposes the automotive industry to geopolitical risks and supply chain fragilities.

2. Bajaj Auto’s Production Impairment: A Bellwether for India’s EV Supply Chain

Bajaj Auto’s current production challenges serve as a crucial indicator of broader systemic vulnerabilities within India’s rapidly expanding EV manufacturing ecosystem. These challenges underscore the profound impact that global supply chain disruptions can have on domestic industrial ambitions.

2.1 Analysis of Bajaj Auto’s Stated Production Shortfalls (Q2 FY26 Targets vs. Actuals)

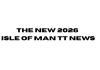

Dinesh Thapar, Chief Financial Officer of Bajaj Auto, confirmed during a recent post-earnings call that the company anticipates delivering only “about 50%-60% of our (electric) two-wheeler plan for this quarter and about 70%-80% of the (electric) three-wheeler plan”.8 This substantial shortfall has been directly attributed to a scarcity of rare earth minerals.8 Earlier, Rajiv Bajaj, Managing Director of Bajaj Auto, had expressed even more severe concerns, describing a “dire crisis” and stating, “I am afraid that we are looking at a zero-production month in August as of now” due to the rare earth magnet shortage.5 Production was indeed significantly affected, experiencing a 50% reduction in July.6 Bajaj Auto is a large enterprise, employing an estimated 8,800 people and producing over 6 million vehicles in 2024.8

The trajectory from an anticipated “zero-production month” 5 to a partial fulfillment of 50-80% of targets 8 demonstrates Bajaj Auto’s notable agility and rapid response capabilities in mitigating a severe supply shock. While the situation remains challenging, the ability to avert a complete halt underscores the effectiveness of immediate operational adjustments. This agility, however, does not diminish the substantial impact on planned output and market momentum. The initial dire warning, followed by a less severe outcome, points to active crisis management where quick corporate action, such as sourcing alternative magnets, can prevent total collapse, even if it cannot fully restore planned output. This highlights the critical importance of responsive supply chain management in volatile environments.

The fact that a company of Bajaj Auto’s immense size and operational scale 8 is struggling to meet EV production targets due to supply constraints reveals a critical paradox. While large corporations typically possess greater negotiating power and resource buffers, their sheer volume of production means that any disruption to a critical component supply chain results in a significantly larger absolute deficit. This amplifies the systemic vulnerability, making Bajaj’s struggle a clear bellwether for the broader Indian EV industry. If a company of this magnitude faces such difficulties, it indicates a widespread fragility that will inevitably impact smaller players more severely, given their more limited resources and leverage.

Table 2.1: Bajaj Auto’s EV Production Targets vs. Expected Actuals (Q2 FY26)

| Vehicle Type | Original Production Plan | Expected Delivery Percentage | Implied Shortfall Percentage |

| Electric Two-wheelers | 100% | 50-60% | 40-50% |

| Electric Three-wheelers | 100% | 70-80% | 20-30% |

This table provides a concise, quantitative summary of Bajaj Auto’s production shortfalls, clearly illustrating the immediate impact of the rare earth magnet crisis. The data, derived from the company’s financial disclosures, highlights the differential impact across vehicle types and underscores the severity of the problem for a major manufacturer.

2.2 Financial Implications and Operational Adjustments in Response to Shortages

Despite the significant challenges in its domestic sales and EV supply chain, Bajaj Auto reported a 5% year-on-year rise in net profit for the first quarter ended June (Q1 FY26), reaching ₹2,096 crore. This positive financial performance was substantially aided by robust export performance and an increasing share of premium and electric vehicles in its portfolio.5 Revenue from operations also increased by 6% year-on-year to ₹12,584 crore, with an EBITDA margin of 19.7%.5 The company generated ₹1,200 crore in free cash flow during the June quarter, which increased its surplus funds to ₹16,726 crore.5

Bajaj Auto’s ability to maintain profitability and even achieve net profit growth despite significant EV production shortfalls is largely attributable to its robust export performance and the increasing contribution of its premium vehicle segments, including premium electric models.5 This demonstrates the strategic importance of a diversified product portfolio and geographical market presence in mitigating the financial risks arising from localized supply chain disruptions in emerging sectors like EVs. The company’s financial health is not solely dependent on its constrained EV production, as other business segments are compensating, highlighting a key risk management strategy for large, diversified manufacturers.

In response to supply constraints, Bajaj Auto has strategically shifted its focus to the premium Chetak 35 series, priced above ₹1 lakh, which now accounts for 85% of its EV sales.5 This tactical pivot towards higher-margin products allows the company to maintain profitability and market share within specific segments, even as overall production volumes are curtailed. This strategic allocation of scarce resources to more profitable product lines is a pragmatic approach to navigating supply chain bottlenecks.

However, the timing of the magnet shortage, occurring just before the crucial festive season—a period when demand typically spikes—raises significant concerns about potential inventory shortages and adverse impacts on revenue and market share.7 This situation could lead to a disconnect between consumer demand and product availability during peak sales periods, potentially undermining market momentum built through government incentives and advertising. The festive season is a critical sales window, and a production freeze or severe reduction could translate into missed sales opportunities and a loss of market share to competitors who might be less affected or have better inventory management.

2.3 Immediate Mitigation Strategies: The Shift to Light Rare Earth (LRE) Magnets

To counteract the severe impact of the rare earth magnet shortage, Bajaj Auto has implemented immediate mitigation strategies, primarily involving a shift from high rare earth (HRE) magnets to low rare earth (LRE) magnets.5 This swift action was crucial in averting a potential “zero-production month” in August for its electric vehicle portfolio, a scenario that had been anticipated due to restricted availability of HRE magnets from China.5 Rakesh Sharma, Executive Director at Bajaj Auto, confirmed that thanks to quick action on sourcing LRE magnets and adapting components, the company was able to achieve about 50–60% of planned two-wheeler production and up to 75% in three-wheelers.5

The classification of rare earth magnets into light and heavy categories is significant. While heavy rare earths have been subject to export restrictions by China, light rare earth magnets continue to be exported.6 The general understanding is that the heavier the magnet, the better the performance of the motor running the vehicle.6 However, Bajaj Auto’s management has stated that the use of LRE magnets does not significantly impact the performance of their EVs, and the cost difference is minimal.5 This suggests that engineering teams are actively working on matching the performance characteristics using more readily available LRE magnets, an adaptive measure in the face of uncertainty regarding the resumption of HRE imports.6 The company has no information from the government or suppliers regarding when the flow of heavy rare earth magnets will resume.6

This strategic pivot to LRE magnets represents a tactical compromise that prioritizes production continuity over potentially marginal performance gains. It demonstrates a pragmatic approach to supply chain resilience, where the immediate goal is to keep production lines running and meet at least a portion of market demand. The ability to quickly adapt component sourcing and engineering specifications to accommodate different material grades is a testament to the company’s operational flexibility. However, this reliance on LRE magnets from China still leaves the company susceptible to future disruptions, as China continues to control a significant portion of the global rare earth market and can impose export controls at will. This immediate solution, while effective in averting a complete shutdown, highlights the ongoing need for more fundamental, long-term supply chain diversification and technological independence.

2.4 Strategic Business Decisions: E-Rickshaw Market Entry and Chetak EV Launch Delays

In addition to operational adjustments, Bajaj Auto has made strategic business decisions in response to the evolving EV market and supply chain realities. The company is actively entering the e-rickshaw segment, a market with a substantial volume of 45,000 units per month, to further strengthen its position in the last-mile mobility sector.5 This move involves the planned launch of a new e-rickshaw model, specifically targeting customers currently using lower-quality, lead-acid battery-powered vehicles, and positioning the new offering on premium quality and reliability.5 This expansion into a high-volume, utility-driven segment aligns with India’s unique EV adoption trends, focusing on practical and accessible solutions for a broader demographic.

Conversely, Bajaj Auto has decided to postpone the launch of its new entry-level Chetak EV. This delay is a direct consequence of the ongoing supply chain issues caused by the shortage of rare earth magnets from China.16 The company is prioritizing the recovery of production for its existing electric vehicle lineup before introducing any new models.16 Earlier in the year, Bajaj had announced plans for a more accessible version of the Chetak electric scooter, anticipated around June, aimed at the entry-level EV segment.16 However, the global shortage of heavy rare earth magnets, critical for the permanent magnet motors used in electric two-wheelers, has compelled the company to put this launch on hold.16

This decision reflects a calculated trade-off between expanding market reach and ensuring the stability of existing operations. By delaying the entry-level Chetak, Bajaj Auto aims to consolidate its production capacity and allocate scarce resources to its more premium and currently profitable EV models, such as the Chetak 35 series.5 This strategic choice prioritizes maintaining profitability and market share in existing segments over immediate expansion into new, potentially more price-sensitive, categories that would place further strain on already constrained supply chains. The delay also allows the company to focus its engineering and procurement efforts on long-term solutions, including increasing the use of light rare earth magnets and developing next-generation motor technologies that eliminate rare earths altogether, which are crucial for long-term EV scale-up.16 This approach highlights a pragmatic adaptation to supply chain realities, where new product introductions must be carefully timed to avoid exacerbating existing production bottlenecks.

3. Rare Earth Elements in Electric Vehicle Propulsion: The Technical Imperative

The widespread adoption of electric vehicles hinges significantly on the performance of their electric motors, which in turn are heavily reliant on specific materials. Rare earth elements, despite their name suggesting scarcity, are crucial for achieving the high efficiency and power density required for modern EV propulsion systems.

3.1 Fundamental Role of Rare Earth Elements in EV Motors (Magnets vs. Batteries)

A common misunderstanding persists regarding the application of rare earth elements (REEs) in electric vehicles. It is often mistakenly believed that these elements are integral to lithium-ion batteries, which form the power source of EVs. However, EV battery packs are primarily composed of materials such as lithium and cobalt, with rare earths not being a component of their chemistry.8 The true and central role of REEs in electric vehicles lies within the electric motors—the components that convert electrical energy into the mechanical motion necessary to propel the vehicle.8

Electric motors fundamentally depend on magnets to generate the rotational force (torque) that drives the vehicle. It is in these magnets that rare earth elements prove indispensable.8 The interaction between magnetic fields generated by these powerful magnets and the electric current in the motor’s coils is what creates the movement.12 For optimal battery usage and efficiency, the motor must operate with high precision and minimal energy loss, a design requirement heavily influenced by the choice of magnets.12

The preference for rare earth magnets in EV motors stems from their ability to generate exceptionally strong magnetic fields within a compact volume.12 This characteristic is vital for creating smaller, lighter, and more energy-efficient motor systems, which are critical for maximizing EV range and overall vehicle performance.11 Without the powerful magnetic properties of REEs, achieving the desired torque and efficiency in a compact form factor, comparable to internal combustion engines, would be significantly more challenging [User Query]. This fundamental reliance on rare earth magnets underscores a core technical imperative in the design and performance of contemporary electric vehicles, making their consistent supply a strategic concern for the entire industry.

3.2 Key Rare Earth Elements (Neodymium, Dysprosium, Terbium, Samarium) and Their Unique Properties

Several specific rare earth elements are crucial for the performance of electric vehicle motors, each contributing unique properties that enhance magnetic strength, thermal stability, and overall efficiency.

- Neodymium (Nd): This is a key component in the production of high-strength permanent magnets, particularly in neodymium-iron-boron (NdFeB) magnets, which are widely utilized in EV motors.8 Neodymium magnets are prized for their ability to generate strong magnetic fields while remaining lightweight, which is essential for electric vehicles that prioritize fuel economy and overall vehicle weight.11 Neodymium, though classified as a “light” rare earth element, fundamentally alters the crystal structure of iron, significantly improving magnetic strength and stability when alloyed with iron and boron.10

- Praseodymium (Pr): Often combined with neodymium to form NdFeB magnets, praseodymium contributes to even greater magnetic strength, enabling the design of smaller and more efficient electric motors.9 This combination is frequently referred to as NdPr oxides in supply chain discussions.13

- Dysprosium (Dy): This element is added to neodymium-based magnets to enhance their thermal stability.9 Electric car motors generate considerable heat during operation, and dysprosium helps the magnets maintain their magnetic properties at elevated temperatures, ensuring optimal motor performance and preventing demagnetization.9 Even small amounts, typically 1–2% when introduced into the neodymium-boron alloy, can significantly distort the crystal lattice, helping to “lock in” magnetic alignment under thermal stress and allowing reliable performance at over 200°C.10

- Terbium (Tb): Similar to dysprosium, terbium is another rare earth element used to improve the performance of neodymium-based magnets, particularly in maintaining magnetization at high temperatures.8 This is crucial for electric car motors subjected to demanding operating conditions, contributing to the durability and long-term efficiency of the motor.9

The inclusion of these specific rare earth elements is not arbitrary; it is a direct result of their unique physical and chemical properties that enable significant advancements in energy consumption reduction, miniaturization, durability, and thermal stability in various technological devices.17 The ability of these elements to create powerful, compact, and heat-resistant magnets is what makes them indispensable for the high-performance demands of modern EV propulsion systems.

3.3 Permanent Magnet Technologies (NdFeB, SmCo) and Their Advantages in EV Performance (Efficiency, Torque, Compactness)

The two primary permanent magnet technologies that dominate the electric vehicle motor landscape are Neodymium-Iron-Boron (NdFeB) and Samarium-Cobalt (SmCo) magnets. These materials are central to the performance and design of modern EV propulsion systems due to their superior magnetic properties.

- Neodymium-Iron-Boron (NdFeB) Magnets: Often referred to as “neo magnets,” these are the most powerful type of rare earth magnet available and are widely used in traction motors, which are the primary power source for propelling electric vehicles.12 Their exceptional magnetic strength allows for the generation of significant torque (rotational force) within a compact volume.11 This high power density is crucial for EVs, enabling powerful acceleration and efficient energy conversion from electrical to mechanical energy.11 NdFeB magnets also contribute to improved motor efficiency, as more electrical energy is converted into mechanical energy, and their lightweight nature adds minimal additional weight to the vehicle, which is important for overall fuel economy.11 The ability to create a strong magnetic field in a small space leads to compact motor designs, which are advantageous for vehicle packaging and design flexibility.12

- Samarium-Cobalt (SmCo) Magnets: While less common than NdFeB in mainstream EVs due to their higher cost, SmCo magnets offer superior heat resistance.12 This property makes them suitable for applications where motors operate at very high temperatures, ensuring magnetic stability and performance over extended periods. Despite their expense, their high resistance to heat makes them a viable option for specific high-performance or high-temperature EV motor designs.12

The advantages of permanent magnet motors, particularly those utilizing rare earth elements, are significant for EV performance:

- Efficiency: Permanent magnet machines benefit from “pre-excitation” from the magnets, leading to efficiency gains compared to induction motors or motors with field windings.19 This means they have “free” magnetic energy from the start, giving them an advantage in efficiency, especially at low to mid-speeds, which dominate most real-world driving conditions.10 This translates to better energy utilization and extended vehicle range.

- Torque Delivery: The powerful magnetic fields generated by rare earth magnets enable high torque output, which is essential for the rapid acceleration and responsive driving experience expected from EVs.11

- Compactness and Lightweight Design: The ability to achieve high magnetic strength in a small size allows for compact and lightweight motor designs.11 This is critical for EV packaging, as it frees up space for batteries or other components and minimizes overall vehicle weight, contributing to better energy efficiency.

- Reliability: Rare earth magnets are generally considered more reliable than alternatives like electromagnets, which require a power supply and have a risk of degradation on rotating electrical connections.13

Approximately 80-90% of electric vehicles sold in the past five years have used rare earth permanent magnets, with an average of 1.5 kg per vehicle, although this can vary significantly from 0 to 4 kg per vehicle.13 This widespread adoption underscores their perceived superiority in meeting the high-performance demands of EV propulsion systems.

3.4 Diverse Applications of Rare Earth Magnets Across EV Systems (Power Steering, Regenerative Braking, Thermal Management)

Beyond their primary role in traction motors, rare earth magnets, particularly neodymium magnets, are integrated into various other critical systems within electric vehicles, enhancing overall performance, efficiency, and safety.

- Traction Motors: As previously discussed, neodymium magnets are widely used as the primary power source for propelling electric vehicles. They generate the magnetic field necessary for motor operation, enabling efficient conversion of electrical energy into mechanical energy to drive the vehicle.18

- Electric Power Steering (EPS) Systems: Neodymium magnets are employed in EPS systems to provide precise and responsive assistance to the driver during steering maneuvers.11 Their strong magnetic fields enable fine control over power steering mechanisms, improving responsiveness and overall maneuverability, especially at slower speeds or during parking.11 This also contributes to reduced energy consumption compared to traditional hydraulic systems.18

- Regenerative Braking Systems: These systems convert kinetic energy produced during braking into electrical energy, which is then stored in the vehicle’s battery, thereby improving energy efficiency and extending the vehicle’s range.11 Neodymium magnets play a crucial role in enabling this efficient energy conversion, enhancing electric brake performance through shorter stopping distances and increased energy regeneration rates.11

- Battery Management Systems (BMS): Neodymium magnets are utilized in BMS to monitor and regulate the performance and state of charge of the vehicle’s battery pack.11 They facilitate accurate detection of battery parameters such as voltage, temperature, and current, ensuring safe and efficient battery operation and prolonging battery life.11

- Electric Air Conditioning Compressors: These compressors regulate the temperature inside electric vehicles. Neodymium magnets are integrated into these components to enable efficient operation, contributing to the vehicle’s overall energy efficiency and passenger comfort.18

- Electric Cooling Fans: Used for thermal management, electric cooling fans employ neodymium magnets to help dissipate heat generated by critical vehicle components, such as the battery pack and power electronics. This ensures optimal operating temperatures and prolongs the lifespan of these systems.18

- Electric Brake Actuators: Neodymium magnets are utilized in these actuators, which control the braking force applied to the vehicle’s wheels. They enable precise and responsive brake actuation, enhancing safety and performance while potentially reducing maintenance requirements compared to traditional hydraulic brake systems.18

- Electric Powertrain Components: Beyond the motor, neodymium magnets are incorporated into various components of the electric powertrain, including inverters, converters, and motor controllers. These magnets enable the efficient conversion, control, and distribution of electrical power within the vehicle’s propulsion system, optimizing performance and energy efficiency.18

The pervasive use of neodymium magnets across these diverse EV systems highlights their fundamental importance to the electric vehicle revolution. Their strength, lightweight nature, and efficiency properties make them critical for enhancing performance, extending range, and improving the overall driving experience of electric vehicles.11

Table 3.1: Key Rare Earth Elements and Their Functions in EV Motors

| Rare Earth Element | Primary Function in EV Motors | Specific Contribution |

| Neodymium (Nd) | Core magnetic strength | Enables powerful, compact, and efficient motor designs; forms primary component of NdFeB magnets. |

| Praseodymium (Pr) | Enhances magnetic strength | Often combined with Neodymium to create even stronger NdFeB magnets, leading to smaller motors. |

| Dysprosium (Dy) | Thermal stability | Improves heat resistance of magnets, preventing demagnetization at high operating temperatures. |

| Terbium (Tb) | Thermal stability | Aids in maintaining magnetization at high temperatures, crucial for demanding operating conditions. |

This table succinctly outlines the specific roles of key rare earth elements within EV motors, illustrating why their unique properties are technically indispensable for achieving high performance and durability in electric vehicle propulsion systems.

4. Geopolitical Dynamics: China’s Rare Earth Hegemony and Global Vulnerabilities

The global supply chain for rare earth elements is profoundly shaped by geopolitical dynamics, with China holding a dominant position that creates significant vulnerabilities for nations reliant on these critical minerals for advanced technologies, particularly electric vehicles.

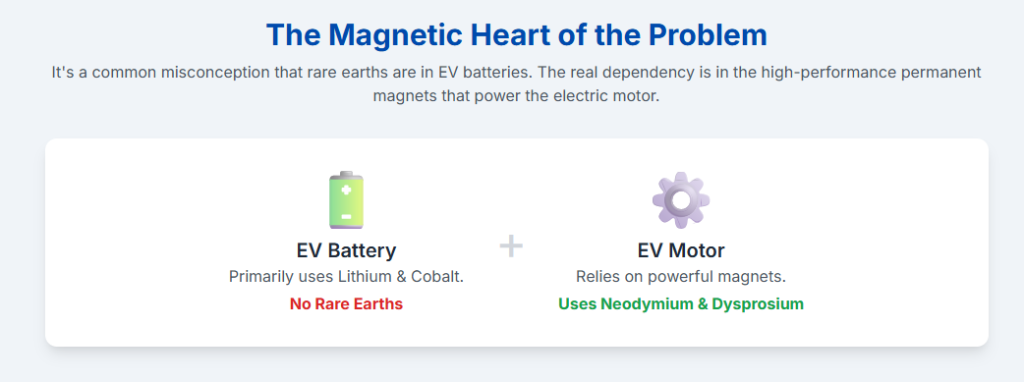

4.1 China’s Dominance: Control Over Global Rare Earth Reserves, Mining, and Processing

China possesses the largest reserves of rare earth minerals globally, with approximately 44 million metric tons.20 This constitutes a significant portion of the world’s known rare earth resources, far exceeding other countries. For comparison, Vietnam and Brazil each hold about half of China’s tonnage, with 22 million and 21 million metric tons respectively. Russia and India also have substantial reserves, with 10 million and 6.9 million metric tons respectively.20

Beyond its vast reserves, China has established a commanding monopoly over the entire rare earth value chain. It produces more than 60% of global rare earth elements and, more critically, accounts for over 90% of the world’s rare earth processing and refining capacity.21 Some sources even indicate that approximately 96% of rare earth minerals are sourced from China.25 This overwhelming advantage in refining and processing capacity means that even countries with their own rare earth reserves often depend on China for the crucial step of converting raw minerals into usable forms for advanced industries. The Bayan Obo mine in Inner Mongolia, China, stands as the largest rare earth element mine globally and is the biggest producer of these elements.20

This dominance is not accidental; it is the result of decades of strategic state intervention, including government subsidies for mining and processing, relaxed environmental regulations, strategic investments in technology, and vertical integration of supply chains.22 China’s mining strategy is coordinated through state-owned enterprises and long-term industrial policy, positioning it as a “mineral gatekeeper” for critical technologies such as semiconductors, EVs, and renewable energy.21 This comprehensive, whole-of-government approach has allowed China to exert significant control over global rare earth markets.

Table 4.1: Global Rare Earth Reserves by Country (2025)

| Country | Rare Earth Reserves (Million Metric Tons) | Global Percentage (Approx.) |

| China | 44.0 | 38.3% |

| Vietnam | 22.0 | 19.2% |

| Brazil | 21.0 | 18.3% |

| Russia | 10.0 | 8.7% |

| India | 6.9 | 6.0% |

| Australia | 5.7 | 5.0% |

| United States | 1.8 | 1.6% |

| Greenland | 1.5 | 1.3% |

| Tanzania | 0.89 | 0.8% |

| Canada | 0.83 | 0.7% |

| South Africa | 0.79 | 0.7% |

| Thailand | 0.0045 | <0.1% |

| Other Countries | 0.28 | 0.2% |

| Total Global Reserves | 114.79 | 100% |

Note: Percentages are approximate based on the provided reserve figures for 2025.20 Estimated reserves can vary significantly due to advances in mineral detection and methodology.

This table illustrates China’s substantial lead in rare earth reserves, which forms the foundation of its global market dominance. However, the concentration of processing capacity in China is even more pronounced than its raw reserves, creating a critical choke point in the global supply chain.

4.2 China’s Export Controls: Historical Context and Recent Restrictions (April 2023/2025)

China has historically leveraged its dominant position in rare earth production and processing for geopolitical gain, demonstrating a willingness to use export restrictions as a strategic tool. A notable instance occurred in 2010 when China restricted rare earth exports during a maritime dispute with Japan, leading to a 10- to 20-fold increase in material prices and prompting other nations to seek diversification.26

More recently, China has again tightened its control over supply. In April 2023, Beijing imposed non-automatic export licenses on seven critical heavy rare earths, including dysprosium and terbium, and related magnets, specifically targeting U.S. defense firms.28 This move directly impacted industries reliant on these materials, including India’s EV, auto, and electronics sectors.5 In April 2025, China again implemented stricter export licensing requirements for critical REEs like terbium and dysprosium, essential components in NdFeB magnets used in EVs, wind turbines, and defense systems.29

While a U.S.-China trade deal in June 2025 temporarily eased some restrictions, leading to a 32% surge in China’s rare earth exports that month 2, this “truce” is widely perceived as fragile. Military-use elements like samarium reportedly remain under control, and licensing delays persist.28 This recalibration by China appears to be a pragmatic move to avoid alienating global buyers while retaining leverage over critical markets.28 However, the underlying strategic intent to use rare earths as a geopolitical chess piece remains evident.

These export controls have immediate and severe consequences for importing nations. For India, which sources approximately 80% of its rare earth magnet imports from China 5, the restrictions caused a crisis in its EV, auto, and electronics industries.5 The disruption has been so significant that some Indian EV manufacturers have warned of production disruptions as early as July 2025.24 The impact is particularly acute for vehicles equipped with Permanent Magnet Synchronous Motors (PMSMs), which account for over 70% of electric vehicle motor architectures in India.31 The cessation of consignment dispatches in April meant that for over two months, the industry received no rare earth elements, raising fears of shutdowns by July or August 2025.31 This demonstrates how China’s control over critical mineral processing creates significant supply chain vulnerabilities and concerns about potential industrial disruptions globally.32

4.3 The Impact of Geopolitical Tensions on Global Rare Earth Supply Chains

The geopolitical landscape significantly influences the stability and security of global rare earth supply chains. China’s dominant position, coupled with its willingness to use export controls as a strategic lever, has transformed rare earths from mere economic commodities into national security assets.26 This has spurred a global race among nations to secure and diversify their critical mineral supplies.

Global tensions and trade anxiety are explicitly cited as contributing factors to the issues faced by companies like Bajaj Auto.8 The recent export restrictions by China, for example, have been framed as a response to U.S. tariffs, illustrating the tit-for-tat nature of trade disputes impacting critical materials.34 This environment of strategic competition means that supply chain stability is constantly under threat from political decisions and international relations.

The impact extends beyond direct trade restrictions. Geopolitical conflicts, such as the Russia–Ukraine war, Israel–Iran tensions, and even India–Pakistan dynamics, strain global supply lines, leading to higher freight costs, rising insurance premiums, and delays in manufacturing and exports for automotive inputs and finished vehicles.35 Chokepoints like the Strait of Hormuz, if closed, could affect not only oil shipments but also raw materials and auto components, further highlighting the fragility of globalized supply chains.35

The concentration of rare earth production in a few countries, particularly China, makes supply chains inherently vulnerable to such geopolitical uncertainties.9 This vulnerability is amplified by the fact that the extraction and processing of rare earth elements, if not managed responsibly, can also have significant environmental and social impacts.9 The pursuit of secure supply chains often involves navigating complex environmental regulations and social considerations in potential new mining regions.

In response to these vulnerabilities, countries are increasingly coordinating their approaches. The formation of new alliances around resource security, such as the Minerals Security Partnership (MSP) and the Quad Critical Minerals Initiative, reflects a recognition that no single nation can achieve self-sufficiency alone.26 These initiatives aim to diversify sources, reduce reliance on dominant suppliers, and establish more resilient supply chains. However, the process of developing alternative mines and processing capacities is time-consuming and capital-intensive, meaning that the industry will continue to navigate a complex geopolitical minefield for the foreseeable future.24 The competition for rare earth minerals is reshaping international relations, driving new forms of cooperation and competition as nations balance immediate access needs against long-term sustainability and national security concerns.26

5. Systemic Impact on the Indian EV Ecosystem: Beyond Bajaj Auto

The rare earth magnet shortage, while acutely felt by a major player like Bajaj Auto, has a far-reaching systemic impact across the entire Indian EV ecosystem, affecting smaller manufacturers, exacerbating existing supply chain dependencies, and highlighting domestic policy challenges.

5.1 The Ripple Effect: Challenges Faced by Smaller Indian EV Manufacturers (e.g., Ather Energy, TVS Motor, Ultraviolette)

The struggles faced by Bajaj Auto, a company of significant scale and operational capacity, serve as a clear indicator that India’s numerous smaller electric motorcycle makers and EV startups are also experiencing considerable pressure.8 If a vast company like Bajaj, which produced over 6 million vehicles in 2024 and employs 8,800 people, is grappling with supply issues, smaller players with less purchasing power and fewer resource buffers are likely feeling an even more intense pinch.8

Indeed, the ripple effect is already evident across the industry. Ather Energy, another prominent Indian EV manufacturer, has issued warnings of temporary disruptions in vehicle supply to its dealerships due to a shortage of rare earth magnets sourced from China.37 Ather anticipates that this supply chain issue could impact its ability to meet dealer demand for up to seven days during the July-September quarter of the current financial year.37 While Ather is attempting to leverage existing channel inventory to cushion the blow, limited stock buffers mean that retail operations may still experience short-term setbacks.37 The ongoing supply crunch comes at a critical juncture for Ather, as the company aims to ramp up production ahead of the festive season and expand its retail footprint across India.37

TVS Motor Company, India’s third-largest two-wheeler manufacturer, has also confirmed ongoing supply chain disruptions and is actively working on mitigation strategies, indicating that it is just able to manage “day-to-day production”.6 The combined sales of Bajaj, Ather, TVS, and Ola Electric account for a substantial 80% of India’s electric two-wheeler market.30 The fact that three of these four major players are facing production cutbacks due to the magnet shortage poses a significant threat to the sector’s robust growth trajectory, which saw an impressive 34% year-on-year growth in Q1 FY26.30 Industry executives warn that if the constraints in heavy rare earth (HRE) magnet supply persist, this momentum could be severely undermined.30

The impact extends beyond manufacturers to small suppliers and EV dealerships, many of whom have invested based on expectations of policy continuity and sustained growth.7 A prolonged disruption could severely impact their viability. The situation underscores that the rare earth magnet shortage is not an isolated incident but a systemic challenge affecting the entire value chain, from large OEMs to smaller component manufacturers and retail outlets. This widespread vulnerability necessitates an industry-wide, coordinated response to secure critical inputs and stabilize production.

5.2 Broader Supply Chain Dependencies: Critical Minerals for Batteries and Other Components

While the immediate crisis for Bajaj Auto and other EV manufacturers centers on rare earth magnets for motors, the Indian EV ecosystem faces broader supply chain dependencies for other critical minerals and components, particularly those related to batteries. India’s EV revolution is heavily reliant on imports, with over 85% of battery cell components and magnet-grade rare earths still sourced from overseas.38 This high import dependency leaves Indian manufacturers highly vulnerable to global shocks and geopolitical tensions.38

Beyond rare earth magnets, critical minerals such as lithium, cobalt, and nickel are essential for EV batteries and other clean energy technologies.23 India is 100% import-dependent for most of these critical minerals, including lithium, nickel, cobalt, and germanium.31 The import of copper, another key element for high-tech industries like automobiles, has also significantly increased in recent years, rising tenfold in a decade, while domestic production has declined.31

The fragility of these supply chains is compounded by global geopolitical conflicts and trade restrictions. China’s attempt to corner rare earth metals, for instance, could squeeze Indian auto firms, leading to surging production costs and extended lead times, directly impacting profitability.35 The recent decision by China to cut rare-earth export quotas by 75%, coupled with rising geopolitical tariffs from the US and Europe, has deeply impacted EV supply chains.38 This broader dependency means that even if the rare earth magnet issue is mitigated, other critical mineral shortages could emerge as bottlenecks for the burgeoning EV industry.

The situation highlights that building a resilient domestic supply chain for critical materials is paramount for sustainable growth.38 Without it, the momentum generated by aggressive marketing and government policies risks being undercut.38 While some companies are working with trusted global suppliers to fill gaps, long-term security will require concerted government and industry collaboration on strategic mining and trade partnerships.38 The challenge for India is not just to secure rare earth magnets but to develop an integrated strategy for all critical minerals essential for its green transition and advanced manufacturing ambitions.

5.3 Domestic Policy Challenges: Delayed Subsidies and Regulatory Uncertainties

Beyond the direct impact of global supply chain disruptions, India’s EV sector faces significant domestic policy challenges, particularly concerning delayed subsidies and regulatory uncertainties. The delayed reimbursement of state EV subsidies by the Maharashtra government is a prime example of this issue. Despite Bajaj Auto passing on the benefits of these subsidies to customers, the company has received almost no returns for the past two years.7 This situation creates substantial financial strain for manufacturers, as they effectively front the subsidy amount to consumers but face prolonged delays in receiving the promised government support. Such delays can significantly impact a company’s working capital and profitability, particularly for a capital-intensive industry like automotive manufacturing.

These policy gaps and the resulting industry uncertainty 7 undermine investor confidence and the financial viability of EV operations. The timing of such issues is particularly detrimental, as the rare earth magnet crunch hit just ahead of the crucial festive season, a period when demand typically spikes.7 A production freeze or significant reduction due to material shortages, combined with delayed subsidies, could lead to severe inventory shortages during key sales months, directly denting both revenue and profitability for OEMs.7

Furthermore, the magnet crunch has exposed a major vulnerability in India’s EV roadmap, indicating that manufacturers require clarity, not confusion, from the government.7 The industry’s efforts to seek relaxation of domestic value addition (DVA) norms under the Production Linked Incentive (PLI) program have reportedly not yielded conclusive information from relevant ministries or regulatory authorities.15 This lack of clear and timely policy responses adds another layer of uncertainty, making it difficult for manufacturers to plan long-term investments and adapt their supply chains effectively.

The cumulative effect of these domestic policy challenges, combined with global supply chain disruptions, creates a precarious environment for the Indian EV industry. It suggests that while there is strong government intent to promote EVs, the execution and responsiveness of regulatory frameworks need significant improvement to provide the stability and predictability necessary for sustained growth and investment in this critical sector. The financial exposure of banks linked to these sectors could also be impacted if supply disruptions lead to elongation of working capital cycles, idle capacity, and volatility in demand.17

5.4 Industry-Wide Responses: Inventory Management and Search for Alternatives

In response to the rare earth magnet shortage, the Indian EV industry is implementing a range of strategies, including proactive inventory management and an intensified search for alternative materials and technologies.

Some major players, like Ola Electric, have demonstrated a degree of resilience by preemptively stockpiling rare earth magnets. Ola Electric reportedly possesses sufficient inventory to sustain production for the next five to six months, making it the only major player seemingly unaffected by the current shortage.30 This proactive inventory building has allowed Ola Electric to maintain production and potentially gain a competitive edge in the Indian EV market.40 Similarly, Mahindra & Mahindra has successfully built up its inventory through alternative sources, securing its supply for approximately nine months and cushioning against immediate disruptions.41 This strategic move reflects a recognition of the volatile global supply landscape and the necessity of creating buffers.

Beyond immediate inventory management, there is an industry-wide acceleration in the development of long-term solutions. Many companies are actively exploring magnet-free motor technologies and shifting towards ferrite-based magnets.37 Ferrite magnets are more readily available and less susceptible to supply chain volatility compared to rare earth magnets.37 Bajaj Auto, for instance, is not only increasing its use of light rare earth magnets but also working on developing next-generation motor technologies that completely eliminate rare earths.16 This dual approach aims to reduce dependency on constrained supply chains for the long term.16

Other companies are also pursuing this path. Sterling Tools, a significant auto component supplier, has signed a technology licensing deal with UK-based Advanced Electrical Machines (AEM) to manufacture rare-earth-free motors in India.27 This partnership supports “Make in India” efforts and aims to reduce import dependency by focusing on sustainable, magnet-free electric motor technology.27 Another Indian company, Conifer, claims to have developed motors with less than 30 horsepower that outperform rare-earth counterparts in power density, efficiency, and cost, utilizing ferrite magnets.27 Academic institutions are also involved, with Numeros Motors partnering with IIT Bhubaneswar for a two-year research initiative to develop rare-earth-free motor technologies, exploring robustness, cost, and sustainability.27

These efforts reflect a strategic shift from merely reacting to supply shocks to fundamentally redesigning components and supply chains for greater resilience. While these long-term solutions require significant investment in research and development and may take years to commercialize, they are crucial for India’s ambition to become self-reliant in critical EV technologies.

6. India’s Strategic Response: Towards Rare Earth Independence and Supply Chain Resilience

Recognizing the critical vulnerabilities exposed by the rare earth magnet shortage, India has initiated a multi-faceted strategic response aimed at achieving greater independence in critical minerals and building a resilient supply chain for its burgeoning EV and clean energy sectors.

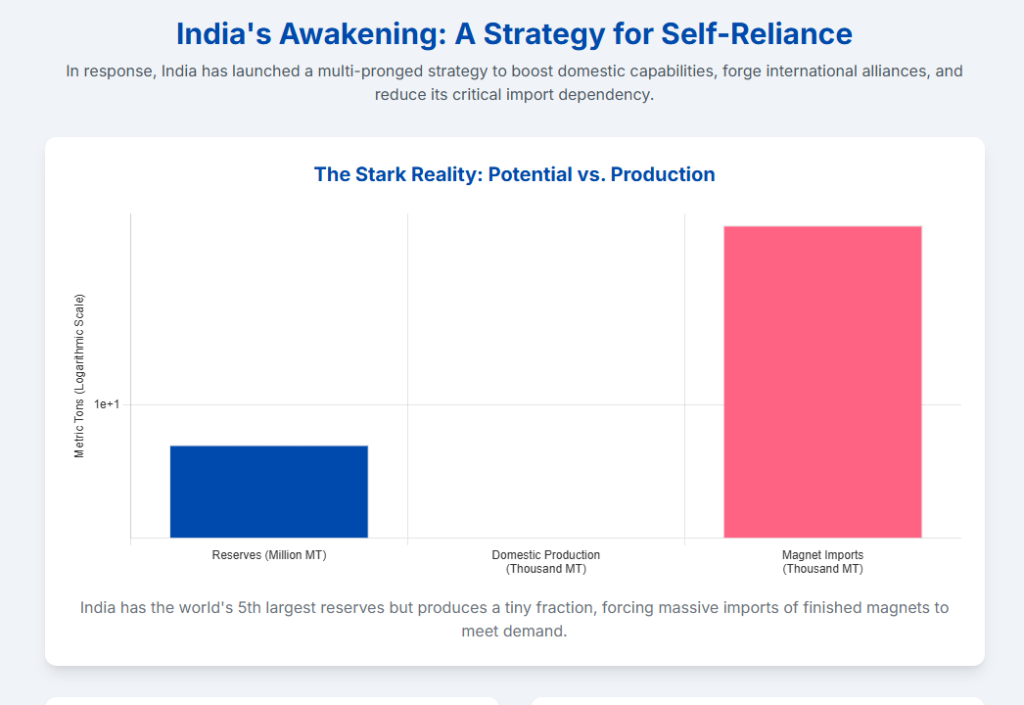

6.1 India’s Domestic Rare Earth Potential: Reserves vs. Current Production Capabilities

India possesses significant rare earth element (REE) reserves, ranking among the top five countries globally. The nation holds an estimated 6.9 million metric tons (MMT) of rare earth reserves.20 More detailed figures indicate India has approximately 7.23 million tonnes (MT) of Rare Earth Elements Oxide (REO) contained in 13.15 MT of monazite, a mineral found in coastal beach, teri and red sand, and inland alluvium across several states including Andhra Pradesh, Odisha, Tamil Nadu, Kerala, West Bengal, Jharkhand, and Gujarat.44 Additionally, an estimated 1.29 MT of rare earths are found in hard rock deposits in Gujarat and Rajasthan.44 The Geological Survey of India (GSI) has augmented 482.6 MT of REE ore resources through 34 exploration projects.44 Recent GSI exploration projects in Purulia, Bankura, and Darjeeling districts of West Bengal have identified significant deposits, with one block in Purulia found to contain 0.67 million tonnes of REE with a grade of 0.19%.45

Despite these substantial reserves, India’s current rare earth mining and processing capabilities are minimal, creating a stark contrast between potential and actual output. In 2024, India mined only 2,900 tonnes of rare earths.29 This low domestic production is particularly concerning given the surging demand for rare earth magnets. Imports of rare earth magnets surged to 53,000 tonnes in FY25 36, with some reports indicating imports of over 540 tons in FY24, and projections of 700 tons for FY25, driven by growing EV volumes.27 The import value of rare earths also increased by 5% to ₹1,744 crore in FY25.29 India remains a major importer, ranking 17th globally in 2023 for rare earth compound imports, valued at $13.1 million.23

The discrepancy between India’s vast reserves and minimal production is largely due to the capital-intensive nature and long gestation period required for setting up rare earth mines, often taking nearly a decade.23 Until recently, Indian OEMs were almost entirely reliant on importing finished magnets from China, exposing them to significant geopolitical and economic vulnerabilities.24 Currently, IREL (India) Ltd. is the sole public sector firm involved in rare earth mining and refining.43 While IREL has established a plant capacity of about 1 million tons per annum for mineral processing and a Rare Earths Extraction Plant in Odisha to produce about 11,000 tons of Rare Earth Chloride, its processing capabilities for advanced separation technologies and magnet manufacturing lag behind.46

This situation underscores a critical challenge: India possesses the raw materials but lacks the comprehensive domestic value chain, particularly in advanced processing and magnet manufacturing, to meet its rapidly growing demand for critical minerals. This necessitates a strategic shift towards leveraging domestic resources for industrial development rather than remaining primarily an exporter of raw materials.49

Table 6.1: India’s Rare Earth Reserves, Production, and Import Trends (FY24-FY25)

| Category | Value (Metric Tons/FY) | Source |

| Rare Earth Reserves | ||

| Total Estimated Reserves | 6.9 million (MMT) | 20 |

| REO in Monazite | 7.23 million (MT) | 44 |

| Hard Rock Deposits (Gujarat & Rajasthan) | 1.29 million (MT) | 44 |

| GSI Augmented Resources | 482.6 million (MT) | 44 |

| Kalapathar-Raghudih Block (Purulia) | 0.67 million (MT) | 45 |

| Domestic Production | ||

| Mined in 2024 | 2,900 tonnes | 29 |

| Exports (last 10 years) | 18 tonnes | 44 |

| Imports (Rare Earth Magnets) | ||

| FY24 Imports | 540 tonnes (approx.) | 27 |

| FY25 Imports | 53,000-53,748 tonnes | 29 |

| Projected FY25 Imports | 700 tonnes (for REEs) | 31 |

| FY25 Import Value | ₹1,744 crore | 29 |

This table clearly illustrates the significant disparity between India’s substantial rare earth reserves and its minimal domestic production, highlighting the nation’s heavy reliance on imports, particularly for finished rare earth magnets.

6.2 Government Initiatives: The National Critical Minerals Mission (NCMM) and the New Rare Earth Magnet Manufacturing Scheme (Budget, Targets, Participant Eligibility)

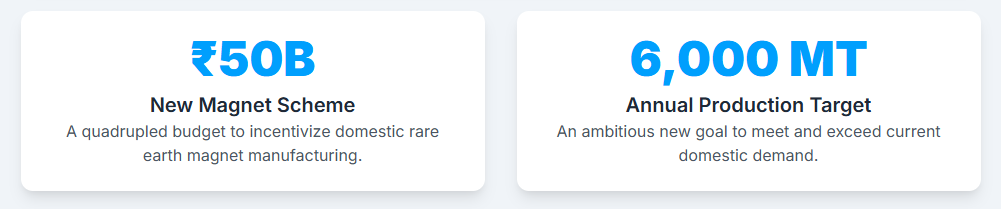

In response to the critical mineral supply chain vulnerabilities, the Indian government has launched several ambitious initiatives, most notably the National Critical Minerals Mission (NCMM) and a new, significantly expanded rare earth magnet manufacturing scheme.

The NCMM, announced earlier this year with an outlay of ₹34,300 crore ($4 billion), aims to secure a long-term sustainable supply of critical minerals and strengthen India’s critical mineral value chains, encompassing all stages from mine exploration and mining to beneficiation, processing, and recovery from end-of-life products.39 The mission’s objective is to transform India from a vulnerable importer to a leader in the critical minerals ecosystem, with a target to reduce import dependency by 30-40% by 2035.39 Under this mission, the Geological Survey of India (GSI) has been tasked with conducting 1,200 exploration projects by 2030.39

A key component of this strategy is the new rare earth magnet manufacturing scheme, which has seen a significant boost in its budget and production targets. The budget for this scheme is being substantially increased to over ₹50 billion (US$ 577 million), a sharp rise from the earlier proposed ₹13.5 billion.36 Concurrently, the annual production target for rare earth magnets is set to quadruple, from an initial 1,500 metric tonnes (MT) to approximately 6,000 MT.36

The primary objective of this enhanced scheme is to strengthen domestic manufacturing capabilities, attract more industry players, and significantly reduce India’s dependence on imports for critical sectors such as electric vehicles, wind turbines, electronics, and defense systems.36 The revised plan is designed to encourage broader participation and mitigate the risk of project delays or failures. Instead of limiting incentives to just two companies, the scheme will now accommodate at least five manufacturers, each eligible for incentives on up to 1,200 MT of annual production.36 This change follows recommendations from the Prime Minister’s Office to widen the scheme’s scope and is open to both public and private sector entities capable of end-to-end magnet production.36 The scheme is planned to run for seven years.36

Industry estimates place India’s current annual demand for rare earth magnets at around 4,000 MT, with a potential to double by 2030.36 The upgraded production target is specifically designed to meet this anticipated growth while simultaneously fostering a stronger domestic industrial base.43 This comprehensive government push aims to build entire new value chains, from raw materials to manufacturing and control software, leading to domestic job creation, intellectual property ownership, and long-term industrial resilience.24

6.3 Role of Public Sector Undertakings (IREL) and Private Sector Engagement (Hindustan Zinc, Sona Comstar, Mahindra & Mahindra)

India’s strategic response to the rare earth challenge involves a concerted effort from both public sector undertakings (PSUs) and private industrial players.

Public Sector Undertakings (PSUs):

IREL (India) Ltd. is currently the sole public sector firm engaged in rare earth mining and refining in India.43 IREL has established significant mineral processing capacity, with about 1 million tons per annum, and operates a Rare Earths Extraction Plant in Odisha, capable of producing approximately 11,000 tons of Rare Earth Chloride annually.46 Its Rare Earths Division (RED) in Aluva, Kerala, refurbished in 2012, produces high-purity individual rare earth oxides such as Lanthanum, Cerium, Neodymium-Praseodymium, Samarium, Europium, Gadolinium, and Yttrium (with over 99% purity).47

The Indian government has recently instructed IREL to halt rare earth exports and prioritize domestic supply chains instead.48 This strategic pivot aims to conserve critical materials like neodymium for domestic use, particularly for manufacturing permanent magnets essential for EVs and wind turbines.49 While India had a 13-year supply agreement with Japan, under which IREL supplied rare earth materials to Toyota Tsusho’s Indian subsidiary for export to Japan, the new directive signals a shift towards “Atmanirbhar Bharat” (self-reliant India).48 IREL is currently awaiting statutory clearances to proceed with four new mines to increase production volume and diversify its element mix.49

Private Sector Engagement:

The Indian government’s new rare earth magnet manufacturing scheme is designed to attract broader private sector participation, with incentives now available for at least five manufacturers.36 Several leading Indian conglomerates have expressed interest in shaping India’s rare earth future:

- Sona Comstar: A leading Indian automotive technology company, Sona Comstar has announced plans to produce rare earth magnets domestically to reduce dependence on Chinese imports.34 This strategic move aims to strengthen the local supply chain for EV components, enhance resilience, and support India’s EV industry growth.52 The company, which supplies gears and motors to carmakers like Tesla and Stellantis, imported around 120 MT of magnets from China in the last financial year.36 Sona Comstar’s CEO, Vivek Vikram, has stated the company is working closely with the government to ensure India’s self-sufficiency in magnets.34 The company plans to begin magnet production by the end of 2025.29

- Mahindra & Mahindra (M&M): As one of India’s largest automobile and tractor manufacturers, M&M is taking proactive steps to address the rare earth magnet shortage. While short-term supply is secured through alternative sourcing and inventory building for the next nine months 41, the company is focusing on long-term engineering solutions to meet growing demand across its expanding product lines.36 This includes prioritizing deeper, long-term efforts in technology and material innovation to manage the shortage beyond tactical measures.36

- Hindustan Zinc Ltd (HZL): A subsidiary of Vedanta and India’s leading zinc-lead producer, Hindustan Zinc is making a strategic shift into critical minerals, including rare earth elements. The company plans to mine and process neodymium, a key rare earth element for EVs, wind turbines, and electronics.36 Hindustan Zinc was the only private company to win a mining block for monazite, a mineral containing neodymium, through a government auction in May.36 While these plans are ambitious, the company estimates it could take up to five years before production begins, indicating that it is a long-term solution rather than an immediate fix.36

The combined efforts of IREL, alongside private sector players like Sona Comstar, M&M, and Hindustan Zinc, reflect a comprehensive national strategy to build a robust domestic rare earth value chain. This multi-stakeholder approach aims to reduce import dependence, foster indigenous innovation, and ensure long-term supply chain resilience for India’s critical industries.

6.4 International Collaboration and Diversification Efforts

Recognizing that domestic efforts alone may not suffice to meet its ambitious critical mineral requirements, India is actively pursuing a strategy of international collaboration and diversification of supply chains. This involves engaging with various multilateral platforms, bilateral agreements, and overseas asset acquisitions.

Khanij Bidesh India Limited (KABIL) for Overseas Asset Acquisition

Khanij Bidesh India Limited (KABIL) is a joint venture company established by the Ministry of Mines with the specific objective of identifying and acquiring overseas mineral assets that hold critical and strategic significance.44 KABIL’s primary focus is on minerals such as Lithium, Cobalt, and rare earth elements.39 This initiative marks a decisive shift in India’s strategic thinking, moving from being a passive importer to an active overseas investor in upstream extraction.55

KABIL has already made significant strides in this direction. It has signed an Exploration and Development Agreement with CAMYEN, a state-owned enterprise of Catamarca province of Argentina, for the exploration and mining of five lithium blocks in Argentina.39 Furthermore, KABIL is actively interacting with the Critical Mineral Office in Australia to acquire critical and strategic mineral assets there.44 These acquisitions are crucial for diversifying India’s supply sources and reducing its heavy reliance on a single country for critical minerals.

Participation in Multilateral Alliances (Minerals Security Partnership – MSP, Indo-Pacific Economic Framework – IPEF)

India has strategically engaged with several multilateral platforms to strengthen its critical minerals value chain and enhance supply chain resilience.

- Minerals Security Partnership (MSP): India became the first developing country to join the MSP, a US-led alliance of 14 developed countries launched in June 2022.33 Also known as the ‘Critical Minerals Alliance,’ the MSP was established to ensure that critical minerals are produced, processed, and recycled in a manner that secures their supply chains and aims to weaken China’s grip on global supplies.54 India’s membership provides it with greater international balance and access to knowledge sharing, allowing it to engage with countries using advanced exploration and extraction technologies.54 This partnership is crucial for India’s energy security and its ambitious shift towards e-vehicles and associated battery requirements.54 The MSP emphasizes high environmental, social, and governance (ESG) standards in mining, which aligns with India’s broader sustainability goals.33

- Indo-Pacific Economic Framework (IPEF): India is also part of the IPEF, a US-led initiative that aims to strengthen critical mineral supply chains and promote a region free from coercion.32 The IPEF, along with the G7 Critical Minerals Action, provides platforms for India to amplify its strategic positioning as a rising economic power and collaborate on critical mineral security.39

These multilateral engagements provide India with a platform to pool capital, technology, and diplomacy, helping to address its financial and technological gaps in critical mineral exploitation and processing.57 They also facilitate the establishment of secure supply chains and enhance economic sovereignty by reducing risks and improving resilience.57

Bilateral Agreements and the Quad Critical Minerals Initiative

In addition to multilateral efforts, India is actively pursuing bilateral agreements and participating in specific initiatives like the Quad Critical Minerals Initiative to diversify its rare earth and critical mineral sources.

- Bilateral Agreements: The Ministry of Mines has entered into bilateral agreements with various countries having rich mineral resources, including Australia, Argentina, Zambia, Peru, Zimbabwe, Mozambique, Malawi, and Côte d’Ivoire.39 These agreements aim to provide an overarching framework for cooperation in research, development, and innovation in mining, with a particular focus on rare earth elements and other critical minerals.44 Furthermore, the Ministry has initiated the process of entering into Government-to-Government (G2G) MoUs with Brazil and the Dominican Republic for cooperation in the field of rare earth and critical minerals.44 India has also jointly invested in five critical minerals exploration projects in Australia, a country that produces almost half of the world’s lithium, is the second-largest producer of cobalt, and the fourth-largest producer of rare earth elements.56

- Quad Critical Minerals Initiative: On July 1, 2025, during the 10th Quad Foreign Ministers’ Meeting, the United States, India, Japan, and Australia jointly announced the launch of the Quad Critical Minerals Initiative.32 This initiative signals a commitment to securing and diversifying global critical mineral supply chains, specifically targeting China’s influence in the Indo-Pacific and aiming to reduce reliance on a single source for strategic minerals like lithium and nickel.32 The Quad ministers have expressed serious concerns about supply chains reliant on a single source and criticized China’s economic pressure tactics.32 This initiative represents significant growth in Quad cooperation and aims to diminish Beijing’s regional authority.32

These international collaborations, encompassing both asset acquisition through KABIL and participation in various alliances and bilateral pacts, are integral to India’s strategy for mitigating supply chain risks. They aim to secure access to critical minerals, facilitate technology transfer, and build a more resilient and diversified global supply network, thereby supporting India’s ambitious clean energy and EV goals.

Table 6.2: India’s Key International Collaborations for Critical Minerals Security

| Initiative/Entity | Type of Collaboration | Key Objectives | Partner Countries/Organizations |

| Khanij Bidesh India Limited (KABIL) | Overseas Asset Acquisition | Identify & acquire critical mineral assets (Lithium, Cobalt, REEs); reduce import dependence. | Argentina (Lithium blocks), Australia (Critical Mineral Office) |

| Minerals Security Partnership (MSP) | Multilateral Alliance | Secure critical mineral supply chains; weaken China’s grip; knowledge sharing on exploration/extraction. | US, Australia, Canada, Finland, France, Germany, Japan, Republic of Korea, Sweden, UK, European Commission, Italy |

| Indo-Pacific Economic Framework (IPEF) | Multilateral Framework | Strengthen critical mineral supply chains; promote region free from coercion. | US, and other IPEF member countries |

| Quad Critical Minerals Initiative | Multilateral Initiative | Diversify sources of strategic minerals (Lithium, Nickel, REEs); counter China’s influence. | US, Japan, Australia |

| Bilateral Agreements (Ministry of Mines) | Government-to-Government (G2G) | Cooperation in mining R&D, REEs, and critical minerals; secure supply. | Australia, Argentina, Zambia, Peru, Zimbabwe, Mozambique, Malawi, Côte d’Ivoire, Brazil, Dominican Republic |

This table provides a comprehensive overview of India’s strategic international engagements aimed at enhancing its critical mineral security, highlighting the diverse approaches taken to diversify supply chains and reduce reliance on dominant suppliers.

7. The Frontier of Innovation: Rare-Earth-Free Motor Technologies

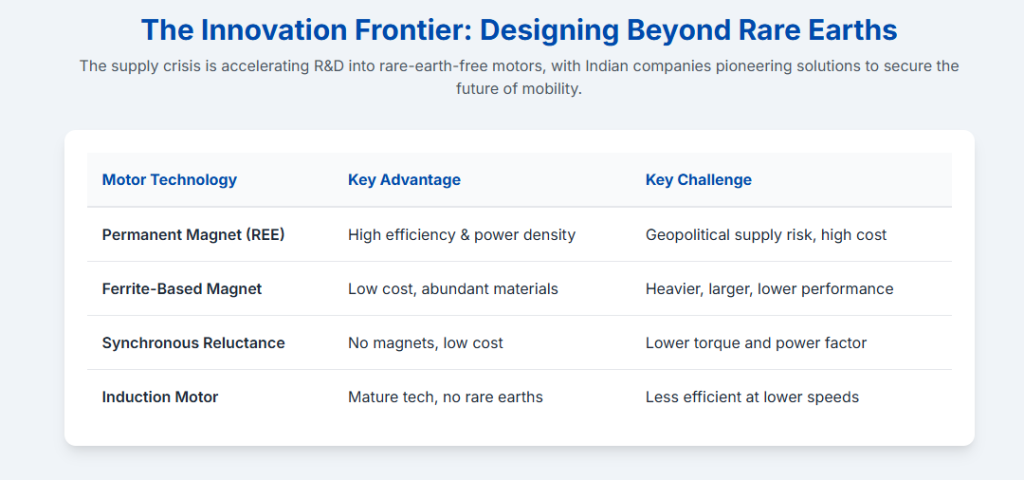

The vulnerabilities exposed by the rare earth magnet shortage have spurred significant innovation in the electric vehicle industry, with a growing focus on developing motor technologies that reduce or entirely eliminate the reliance on these geopolitically sensitive materials. This represents a crucial frontier in achieving long-term supply chain resilience.

7.1 Exploring Alternatives: Reluctance Motors, Ferrite-Based Designs, and Novel Materials (e.g., Niron)

The search for rare-earth-free motor technologies is exploring several promising avenues, each with its own technical characteristics and potential for commercialization.

- Reluctance Motors: These motors, particularly Synchronous Reluctance Motors (SynRM), operate on the principle of magnetic reluctance, where the rotor is designed to align with the magnetic field of the stator to minimize magnetic reluctance. They do not require permanent magnets or field windings on the rotor, making them inherently rare-earth-free and simpler in structure.58 While SynRMs generally have lower torque density and power factor compared to permanent magnet motors, their cost is significantly lower, and their weight can be about 50% less than induction motors.58 A variant, Permanent-Magnet-Assisted Synchronous Reluctance Motors (PMA-SynRM), incorporates permanent magnets (which can be ferrite-based) to improve electromagnetic performance, such as power factor and output torque.58

- Ferrite-Based Designs: Ferrite magnets, which are ceramic and do not contain rare earth elements, are being actively explored as alternatives.27 These magnets are significantly more abundant and less susceptible to supply chain volatility.37 While cost-effective, ferrite magnets have lower magnetic strength compared to rare earth magnets.12 This often translates to heavier and larger motors to achieve comparable performance, as they are at least 30% heavier than REE magnets even with optimized designs.59 Ferrite-assisted SynRMs offer a balance of performance and cost, being much cheaper than IPMs (Internal Permanent Magnet motors) and having better electromagnetic performance than pure SynRMs, though they face risks of irreversible demagnetization under overload conditions due to weaker magnetic properties.58

- Novel Materials (e.g., Niron): Research is also advancing into entirely new material compositions for magnets that do not rely on rare earths. One exciting development is Niron, a nitrogen-iron compound.10 Niron magnets use nitrogen to distort the iron lattice, a different approach from using rare earths to achieve magnetic properties.10 Early lab tests indicate that Niron magnets have the potential to rival or even exceed the performance of neodymium-based designs, without any rare earth content.10 If scalable for production, this technology could revolutionize motor manufacturing, offering a truly rare-earth-free alternative.10

- Electrically Excited Synchronous Motors (EESM): Companies like Valeo are developing the next generation of EESMs, which are electric motors without magnets and thus without rare earth elements.60 These motors offer benefits such as reduced carbon footprint (by 30% at the motor level compared to PMSMs), high efficiency, especially on highway driving cycles, and improved power density.60 Their rotor field is controllable, offering drag-loss free operation and reduced system costs by potentially allowing for smaller batteries.60

Beyond magnets, other material innovations include high-silicon steel to enhance magnetic efficiency in REE-free motors, and high-conductivity copper alloys or ultraconducting copper strands to reduce electrical losses and improve motor performance.59 These diverse approaches demonstrate a concerted global effort to overcome the supply chain vulnerabilities associated with rare earth elements.

7.2 Technical Feasibility and Performance Trade-offs of Rare-Earth-Free Solutions for EVs

The development of rare-earth-free motor technologies for EVs involves navigating complex technical feasibility challenges and inherent performance trade-offs compared to established permanent magnet motors.