I. Executive Summary and Strategic Outlook

The Indian electric vehicle (EV) market is undergoing a fundamental transformation, moving beyond the initial phase of disruptive volume growth led by startups toward a phase defined by rigorous operational efficiency, policy-driven quality mandates, and consolidation. The two-wheeler (E-2W) segment remains the volumetric driver of this transition.1 Strategic success in this mature environment is inextricably linked to optimizing the Total Cost of Ownership (TCO), both by reducing initial capital expenditure and by ensuring long-term operational predictability and service reliability.

1.1. Market Thesis

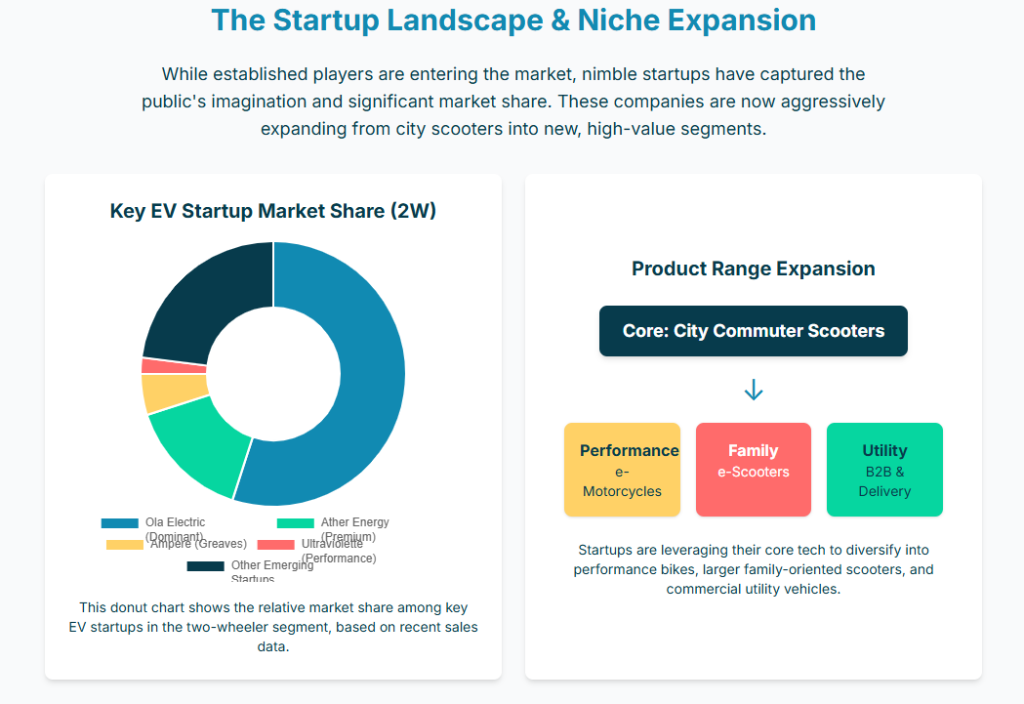

The prevailing market dynamic is characterized by the strategic retreat of new-age disruptors from mass-market dominance, allowing established legacy Original Equipment Manufacturers (OEMs) to leverage their deep distribution networks and brand trust to reclaim market leadership.2 This dynamic forces startups, such as Ultraviolette Automotive, to thrive in highly specialized, premium, and technology-forward niches, while established challengers like Ampere (Greaves Electric Mobility) must focus on delivering exceptional TCO and quality in the mid-range volume segment.3

1.2. Key Findings Snapshot

The market is exhibiting critical trends that define the competitive landscape:

- Bifurcated Competition: Legacy OEMs, including TVS Motor Company and Bajaj Auto, now collectively dominate the majority segment of the E-2W market, demonstrating that established trust and expansive service infrastructure outweigh aggressive initial pricing for many consumers.2

- TCO Innovation Imperative: High upfront capital costs are being mitigated through innovative financial models. These include Battery-as-a-Service (BaaS) for private users and aggressive battery swapping strategies for high-utilization commercial fleets, which are essential to achieving TCO parity with traditional Internal Combustion Engine (ICE) vehicles.5

- Policy as a Quality Filter: Government schemes, particularly the third phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME III), are transitioning from simple incentive structures to mandating stringent quality and safety standards (e.g., AIS-156 certification), thereby raising the barrier to entry and accelerating market consolidation.7

- Geopolitical Supply Chain Risk: India’s ambitious localization strategy, supported by the Production-Linked Incentive (PLI) scheme, faces immediate pressure due to a formal complaint filed by China at the World Trade Organization (WTO). The outcome of this dispute poses a significant geopolitical risk that could undermine India’s push for domestic manufacturing and increase supply chain volatility.8

II. Market Context: State of the Indian EV Ecosystem

2.1. Current Market Metrics and Penetration

India’s transition to electric mobility is accelerating across multiple segments. The overall EV market achieved a significant milestone in Calendar Year 2024, surpassing 2 million units sold for the first time.10 This robust growth pushed EV penetration across the overall vehicle market to approximately 8%, up from 6.8% the preceding year.10

The acceleration continued into the first half of Fiscal Year 2026 (H1 FY26). In the electric passenger vehicle (E-PV) segment, sales growth was particularly strong, with the segment’s share nearly doubling from 2.6% at the end of FY25 to approximately 5% in H1 FY26.11 Sales volumes grew by 108% to 91,726 units in H1 FY26 compared to 44,172 units in the same period the previous year.11

Within the electric two-wheeler market, penetration increased from 5.5% of total two-wheeler sales in April 2025 to 6.1% in May 2025.12 However, the most profound penetration success remains concentrated in the commercial three-wheeler (3W) segment. In Q4 FY24-25, EV penetration in the 3W passenger L5 category reached an impressive 26.32%.13 This high rate of commercial adoption is directly attributable to the high utilization rates of these vehicles and the immediate, quantifiable TCO benefits derived from innovative business models like battery swapping.14

2.2. The Consolidation Wave: Legacy OEMs’ Resurgence

A significant realignment is occurring in the E-2W sector, where established automakers are rapidly reclaiming market share that was initially captured by aggressive new-age startups. During H1 FY26, traditional giants—TVS Motor Company, Bajaj Auto, and Hero MotoCorp—collectively accounted for 51% of total electric two-wheeler registrations in India. This marks a substantial proportional increase from their combined share of 37% just a year prior.2

TVS Motor has emerged as the clear market leader among legacy players, growing its market share to 23% in H1 FY26, primarily driven by the expanding popularity of its iQube series.2 Bajaj Auto also saw vigorous growth, with its share rising from 16% to 19% in the same period.2 This resurgence is powered by their ability to leverage extensive dealer networks, deep brand trust, and reliable access to financing—assets that younger, venture-backed rivals often lack.2

In-depth Case Study: The Ola Electric Correction

The competitive shift is sharply illustrated by the performance of previously dominant new-age startups. Ola Electric, which had aggressively disrupted the market, saw its market share plunge from a peak of 40% to 18% in H1 FY26.2 This correction was driven by systemic operational deficiencies, indicating that success in the mass market requires more than just bold ambition and high-tech products.

Ola’s sales decline was linked to severe customer service and quality issues, including reports of thousands of scooters stranded at service centers awaiting spare parts for months.16 The company’s initial choice of a company-owned, direct sales model proved incapable of scaling effective after-sales service, leading to the collapse of its sales network in multiple cities.17 This systemic failure demonstrates that the primary constraint to mass adoption is no longer purely related to technology or initial price, but to the fundamental issue of customer trust and reliable after-sales operational execution.17 Legacy players succeed precisely because their established, decentralized service infrastructure immediately neutralizes the consumer anxiety associated with servicing a new technology.15 Startups that fail to invest equally heavily in robust, reliable service infrastructure risk being marginalized, regardless of product innovation or pricing.

| Vehicle Category | Q4 FY24-25 Penetration % | H1 FY26 Penetration % | Key 2W Market Share Trend | Supporting Source Snippet |

| E-2 Wheelers | ~5.5% (April 2025) 12 | 6.1% (May 2025 monthly) 12 | Legacy OEMs capture 51% (H1 FY26) 2 | 2 |

| E-3 Wheelers (Passenger L5) | 26.32% 13 | Growth in units sold 12 | YC Electric holds high sales share in E-rickshaws 18 | 12 |

| E-4 Wheelers (Passenger) | 3.17% 13 | ~5% (H1 FY26) 11 | Tata Motors maintains 62% dominance 10 | 10 |

III. Deep Dive: Next-Generation Product Launches and Segmentation

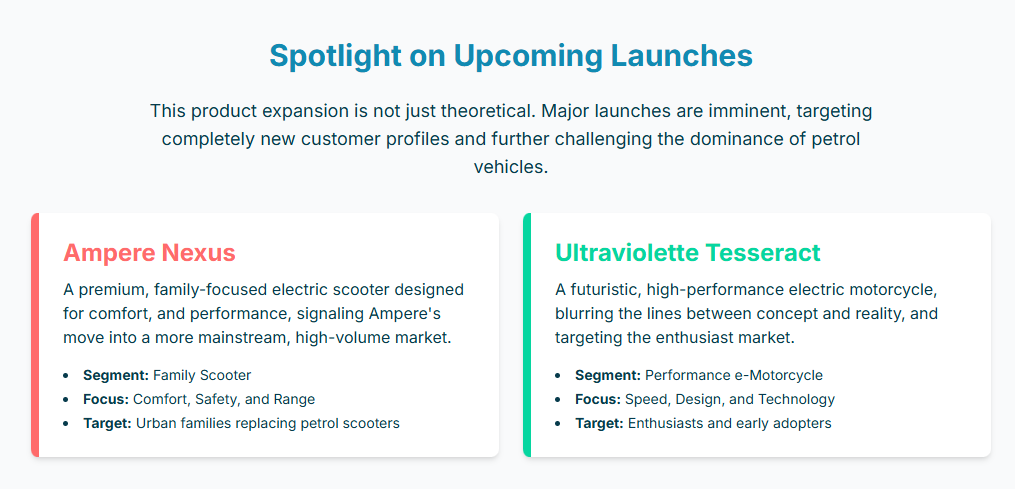

The recent product introductions by Ampere and Ultraviolette highlight the market’s strategic bifurcation, targeting vastly different consumer segments and demonstrating contrasting approaches to achieving market relevance against the dominant legacy OEMs.

3.1. Ampere Nexus: Capturing the Family Commuter Segment

The Ampere Nexus, introduced by Greaves Electric Mobility, is strategically positioned as India’s first “high-performance family electric scooter”.3 This launch directly targets the crucial mid-range volume segment that underpins the E-2W market. The Ampere Nexus is priced competitively, starting at Rs 1,09,900, with the top variant, Nexus ST, reaching Rs 1,29,900 (ex-showroom).3

The product’s technical specifications reflect a strong emphasis on reliability and longevity over maximum speed. Key features include the utilization of Lithium Iron Phosphate (LFP) chemistry, known for its superior cycle life and intrinsic safety benefits compared to other chemistries.3 The Nexus also boasts a 4x stronger chassis with Nex.Armor™ technology, best-in-class aerodynamics, and rapid charging capability, achieving a full charge in approximately 3 hours 22 minutes.3

This focus on safety, durability, and a longer cycle life over raw energy density is a mature strategic choice for the mass commuter segment, where consumers prioritize long-term predictability and lower replacement risk. Ampere requires a successful volume product, as its overall market share had declined to 3.5% in FY24-25.18 The Nexus is intended to challenge the established mid-market leaders like the TVS iQube and Bajaj Chetak by offering high performance and safety attributes at a highly competitive price point, essential for regaining ground lost to rivals.

3.2. Ultraviolette Tesseract: The Niche of Premium Performance

In stark contrast to Ampere’s volume play, Ultraviolette Automotive positions the Tesseract at the high end, focusing on design, technology, and performance, analogous to Ather Energy’s premium niche. The scooter was launched in India starting at Rs 1.45 lakh (ex-showroom).20

Despite the premium pricing, the Tesseract has demonstrated significant pre-market traction, accumulating 70,000 bookings, which underscores a healthy demand for differentiated, high-technology electric vehicles in India.20 However, the Tesseract’s execution timeline presents a substantial operational risk. Following its launch, delivery expectations have been repeatedly postponed, with the latest timeline projecting commencement in the second quarter of 2026.20

Ultraviolette’s strategy is built on high-margin, technological differentiation rather than TCO competition. However, this lengthy delay, extending over a year past some initial projections, exposes the company to rapid market obsolescence. As the market accelerates, rivals—both established players and agile startups—are constantly introducing new, advanced models (e.g., Ather 450 Apex 22), potentially neutralizing the Tesseract’s technological edge before it achieves scale deliveries. Maintaining customer faith and competitive positioning until Q2 2026 will be critical for Ultraviolette’s long-term viability.

3.3. Broader Product Portfolio Expansion

The launch of these high-profile E-2Ws occurs alongside a broad portfolio expansion across the entire EV ecosystem, signaling industry maturity. In the electric four-wheeler (E-4W) segment, major domestic players are gearing up for launches in late 2025 and 2026, including the Tata Sierra EV, the Maruti e-Vitara, and the Mahindra XEV 7e.22 These higher-value, longer-range models, alongside premium offerings from brands like BMW, Mercedes-Benz, and Audi, are responding to consumer demand and the implementation of stricter emission standards set for 2027.24 This parallel expansion across vehicle classes reinforces overall consumer confidence in the long-term viability of the Indian EV market.

Comparative Analysis of Next-Generation EV Two-Wheeler Launches

| Model/Variant | Manufacturer | Primary Positioning | Launch Price (INR Ex-Showroom) | Key Technology/USP | Strategic Goal |

| Ampere Nexus ST | Ampere (Greaves) | High-Performance Family Commuter | 1,29,900 19 | LFP Chemistry, Nex.Armor™, Quick Charging 3 | Volume challenge to legacy mid-market |

| Ultraviolette Tesseract | Ultraviolette | Premium Performance/Enthusiast | 1,45,000 20 | Advanced Design, High Power, Strong Pre-Bookings (70k) 20 | High-margin, technology differentiation |

| Ather Rizta (BaaS) | Ather Energy | Urban/Family Commuter | 75,999 (Vehicle Shell) 25 | Battery-as-a-Service (BaaS), Dedicated Charging Network 25 | Reducing upfront TCO, premium service experience |

| TVS iQube | TVS Motor Co. | Mass Market Reliability/Trust | Competitive 4 | Brand Trust, Extensive Dealer Network, Service Reliability 15 | Market Share Dominance |

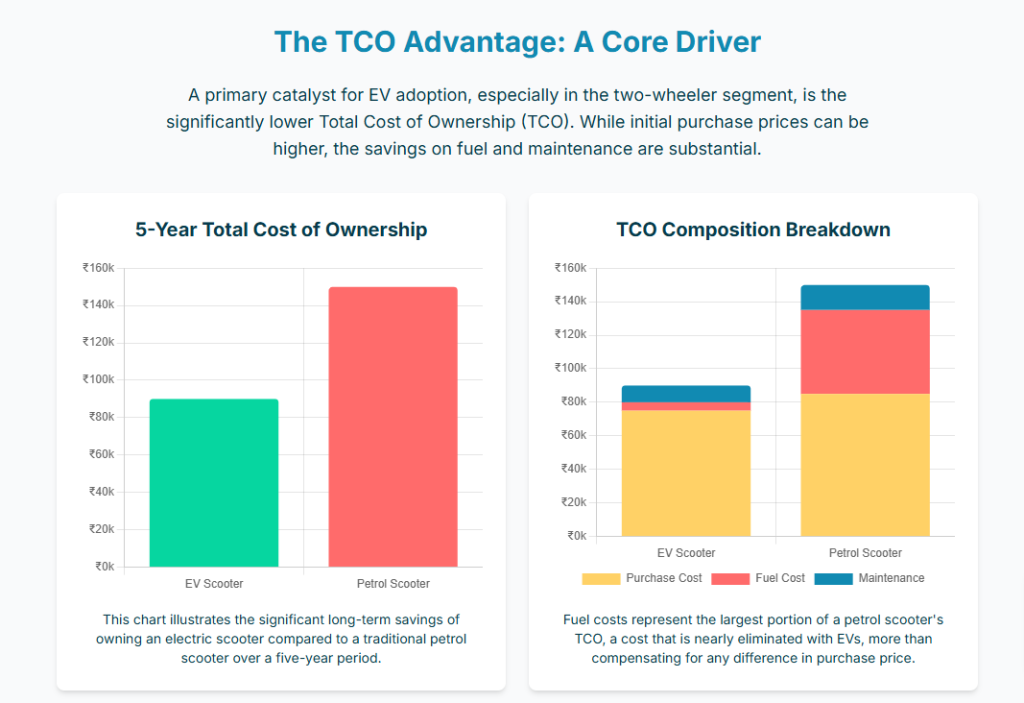

IV. Total Cost of Ownership (TCO) as the Primary Market Catalyst

For the Indian consumer, TCO parity with equivalent ICE models is the most critical factor driving the viability of mass EV adoption.26 While electric vehicles inherently offer significant operational advantages, including low running costs (estimated at ₹0.15–₹0.20 per km) and drastically reduced maintenance needs due to fewer moving parts, the higher initial capital outlay remains a formidable barrier.7 Consequently, innovative financial engineering and policy interventions focused on shifting capital costs to operating costs are essential.

4.1. The TCO Imperative: Upfront Cost vs. Operational Savings

The long-term financial benefits of EVs are undeniable. The service requirements for EVs are significantly less frequent and simpler than those for conventional petrol or diesel vehicles, contributing to low yearly running costs.27 These long-term savings are compelling, but they often fail to overcome the psychological barrier of the high initial purchase price.

To address this, policy frameworks aim to mitigate upfront costs through various financial mechanisms, including interest subvention, reintroduction of accelerated depreciation, and product restructuring designed to improve cash flow profiles for buyers.29 Furthermore, the industry is increasingly focusing on technologies like LFP batteries which, as seen with the Ampere Nexus 3, reduce the perceived risk of premature battery replacement, thereby improving product resale value and overall TCO predictability.29

4.2. Innovative Financing: Battery-as-a-Service (BaaS) Models

Battery-as-a-Service (BaaS) represents a strategic shift that structurally addresses the high upfront cost of EVs, where the battery is the single largest component expense.6 This model separates the battery from the vehicle shell, allowing the buyer to purchase the EV at a significantly lower upfront price while subscribing to the battery service monthly.5

Ather Energy, a leader among new-age startups, has aggressively deployed BaaS. Under this model, consumers can acquire the vehicle shell (such as the Rizta or Ather 450) starting at substantially reduced prices (e.g., ₹75,999 for the Rizta).25 Customers then subscribe to a battery plan that matches their usage, starting from rates as low as ₹1 per kilometer.25 This not only reduces the capital cost for the consumer but also eliminates their anxiety surrounding battery degradation, longevity risk, and eventual replacement cost, as these risks are transferred back to the service provider.6

From a financing perspective, BaaS reduces the ticket size and tenor of loans, thereby decreasing exposure and default risk for lenders. This aligns EV purchase costs closer to those of ICE vehicles, serving as a powerful driver for market penetration, particularly in the private two-wheeler segment.6

4.3. Battery Swapping: Maximizing Commercial Utilization

For high-utilization commercial sectors—specifically three-wheelers (3Ws) and last-mile delivery fleets—battery swapping offers a superior TCO solution. Companies like Battery Smart have successfully implemented models that charge a predictable, flat fee per swap.14

The fundamental advantage of swapping is maximizing operational uptime. Drivers utilizing the Battery Smart network report increasing their daily income by approximately 50%, often rising from ₹700–800 to ₹1,200–1,500.14 This substantial increase is achieved because the driver eliminates the hours of downtime required for charging, keeping the vehicle on the road longer. The increase in driver income effectively offsets the cost of the swap service.14

However, the necessary infrastructure for swapping still requires massive scaling. India currently lags behind key markets like Taiwan, which boasts over 2,500 swapping stations, compared to India’s approximately 1,500.26 This infrastructure deficit represents both a market constraint and a significant investment opportunity.

Summary of Key TCO Reduction Strategies and Policy Levers (FAME III)

| Strategy/Policy Lever | Mechanism | Impact on TCO | Relevant Segment | FAME III Incentives |

| Battery-as-a-Service (BaaS) | Separates battery from vehicle shell cost (subscription model) 6 | Reduces high upfront capital cost, transfers battery risk 6 | Private 2W, 4W | Subsidy up to ₹15,000 per kWh (2W) 30 |

| Battery Swapping | Pay-per-swap, flat fee structure 14 | Maximizes operational uptime, increases driver earnings (50%) 14 | Commercial 3W/Fleet | NA (Indirect operational benefits) |

| FAME III Scheme | Direct subsidies, GST reduction 30 | Increases immediate affordability for entry-level models 7 | All segments | Mandatory AIS-156 safety certification 7 |

| PLI Scheme | Incentives for domestic component manufacturing 31 | Long-term reduction in manufacturing/component costs (localization) | Supply Chain | PM E-DRIVE support (Rs 10,900 Cr) 32 |

V. Competitive Analysis: Startups vs. Legacy Giants

The market consolidation is a direct consequence of operational failures among early disruptors and the natural competitive advantages held by established automotive firms. The competition is no longer solely focused on product specifications, but increasingly on operational density, service reliability, and financing structures.

5.1. Legacy OEMs: Leveraging Trust and Distribution

Traditional automotive players are successfully leveraging their long-established assets to dominate the E-2W market.2 Their core strengths lie in decades of consumer trust, proven supply chain resilience, and, critically, vast dealership and service networks that can provide reliable support across urban and rural markets.15

TVS Motor has successfully positioned itself as the market leader, capitalizing on the popularity of the iQube.2 Meanwhile, Bajaj Auto achieved a remarkable 112% Year-over-Year (YoY) growth in E-2W sales in FY24-25.18 This rapid scale-up by Bajaj demonstrates the capability of legacy players to rapidly integrate EV production into their established manufacturing and sales processes once strategically committed.

The structural advantage of legacy players is their ability to integrate new EV products seamlessly into existing service chains, thereby instantly achieving the service parity necessary to complement TCO parity.15 This capability directly addresses the primary anxiety point for consumers, which was acutely exposed by the service failures of new-age rivals.

5.2. New-Age Startups: The Need for Differentiation and Resilience

For surviving new-age startups, viability depends on either aggressive vertical integration or finding highly profitable technological niches. Ather Energy has executed the former, maintaining a resilient market share of 15–18% in the premium segment.4 Ather’s success stems from its integrated approach, focusing on premium performance, advanced technology (AtherStack), and the establishment of its own proprietary charging infrastructure (over 4,700 fast charging points).25 The BaaS model, a form of financial vertical integration, further insulates Ather from the volume-driven price wars.25

Startups like Ultraviolette must successfully execute their differentiated, high-margin strategies. The Tesseract’s focus on the premium segment suggests a necessity to scale quality and brand identity before attempting volume, a strategy that mitigates the immediate strain on operational service networks that proved fatal for rivals.16

The competitive landscape confirms a critical strategic shift: early competition was driven by product innovation (range, speed), but the current battle is defined by process and operational innovation (service network density, robust financing, and adherence to new safety protocols). Startups must fundamentally transform from nimble technology creators into robust mobility logistics and financing enterprises to survive the market’s consolidation phase.

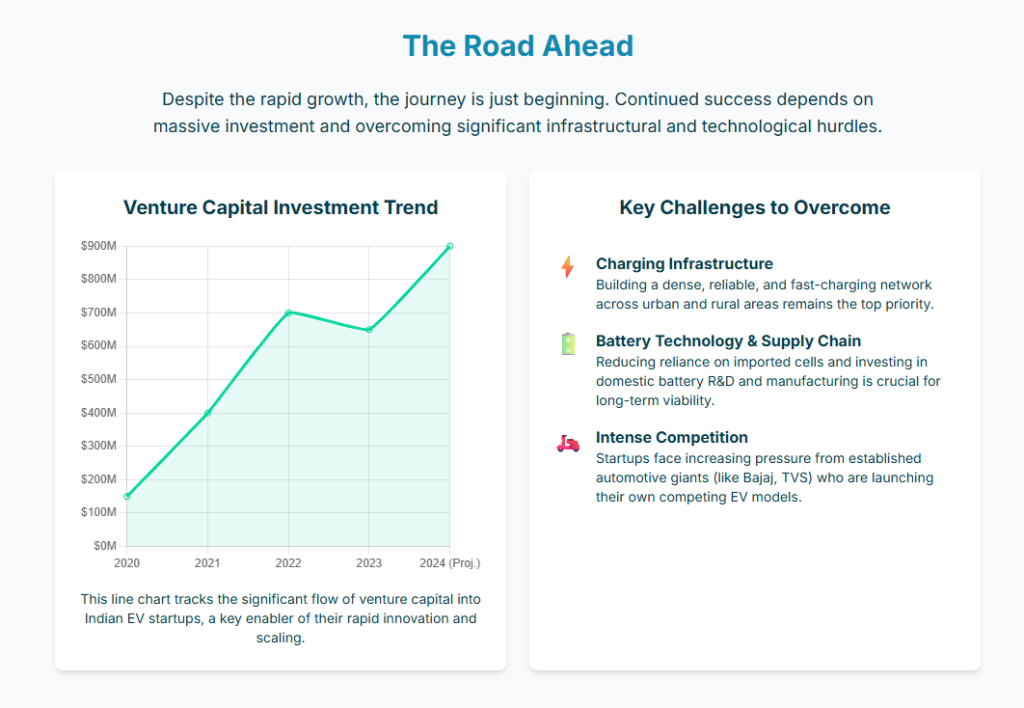

VI. Policy, Subsidies, and Geopolitical Risk

Government intervention through subsidies and manufacturing incentives has been vital in accelerating EV adoption, but these policies are now creating increased regulatory complexity and triggering international trade disputes.

6.1. FAME III Scheme (2025): Shifting Focus from Volume to Quality

The FAME III scheme represents the government’s commitment to accelerating the EV revolution, offering substantial buyer incentives: up to ₹15,000 per kWh for two-wheelers, up to ₹50,000 for three-wheelers, and up to ₹1.5 lakh for four-wheelers.30

The economic impact of FAME III is forecast to be significant. The subsidies are expected to make entry-level scooters ₹8,000–₹15,000 cheaper, thereby bolstering penetration in semi-urban and rural areas where affordability is the major hurdle.7 The government aims to increase E-2W penetration from approximately 6% in 2024 to 15–20% by 2026 under this scheme.7

Crucially, FAME III introduces a stringent quality mandate. Only scooters with AIS-156 certified batteries, which comply with fire safety and battery management system standards, qualify for the subsidy.7 This regulatory maturation point acts as a quality filter, benefiting manufacturers with established safety protocols and raising the compliance and development cost for smaller, struggling startups. By standardizing safety, the policy ensures responsible growth and reinforces the accelerating market consolidation based on product quality.

6.2. Localization Drive: PLI and PM E-DRIVE

India’s long-term goal is to achieve self-reliance and cost reduction through scale manufacturing. This is supported by the Production-Linked Incentive (PLI-AUTO) Scheme, approved with an outlay of ₹25,938 crore, specifically targeting the domestic manufacturing of Advanced Automotive Technology (AAT) products, particularly Zero Emission Vehicles (ZEVs).31 This scheme incentivizes deep localization and the creation of domestic supply chains over a five-year period (FY 2022-23 to FY 2026-27).31

Complementing this is the PM E-DRIVE umbrella scheme, extended until March 31, 2028, with an outlay of ₹10,900 crore.32 This initiative focuses on accelerating EV adoption, establishing infrastructure (over 9,332 public charging stations have been developed), and strengthening localization efforts across all vehicle categories.1

6.3. Geopolitical Risk: The China-WTO Dispute

India’s aggressive push for domestic manufacturing has triggered significant geopolitical friction. China has filed a formal complaint with the World Trade Organization (WTO), alleging that India’s EV and battery subsidy schemes—implicitly targeting PLI and FAME—violate global trade rules by favoring domestic production over imports.9 Specifically, China claims that India’s measures breach obligations under the Subsidies and Countervailing Measures (SCM) Agreement, the General Agreement on Tariffs and Trade (GATT 1994), and the Trade-Related Investment Measures (TRIMs) Agreement.8

The timing of this complaint is highly strategic. Chinese EV manufacturers are currently dealing with overcapacity domestically and facing protectionist measures abroad, such as the 27% tariff imposed by the European Union.8 India’s burgeoning market, therefore, becomes a strategically vital area for expansion.

The WTO dispute represents a severe supply chain stress test for India. If the WTO rules against India, the government may be compelled to dilute its localization mandates and domestic content requirements, jeopardizing the goal of reducing import dependence and potentially increasing the competitive advantage of international players importing cheaper components. This legal challenge introduces significant uncertainty for foreign investments intended for India’s domestic supply chain build-up.

VII. Strategic Recommendations and Future Outlook

7.1. Strategic Recommendations for OEMs

The market is rewarding operational resilience and financial innovation. Strategic mandates for OEMs must reflect this new competitive reality:

- For Startups (e.g., Ultraviolette, Ather): The paramount focus must be on flawless execution and reliable service. For Ultraviolette, converting the 70,000 bookings into timely deliveries by Q2 2026 is critical to maintaining brand trust and premium pricing power.20 Startups must continue to differentiate through proprietary technology and financial innovation like BaaS to overcome TCO barriers.25

- For Legacy Players and Mid-Range Challengers (e.g., Ampere/Greaves): The primary advantage lies in service network leverage. Ampere must integrate the Nexus launch seamlessly into existing dealer networks, prioritizing superior, decentralized after-sales service to capitalize on the profound consumer trust deficit created by failed disruptors.15

- TCO Optimization: All OEMs must aggressively expand support for battery leasing and swapping models, particularly in the commercial and fleet segments. The ability to accelerate TCO payback for high-utilization users (3Ws and last-mile delivery) remains the most scalable pathway to volume growth in the near term.14

7.2. Recommendations for Investors and Policymakers

Investment and regulatory strategy must shift focus from product subsidies to ecosystem enablement to ensure sustainable, long-term growth:

- Investment Focus: Capital should be strategically directed toward critical enabling infrastructure. There is an immediate need to rapidly scale battery swapping networks to bridge the current infrastructure gap.26 Furthermore, investing in local cell manufacturing and innovative, modular EV financing platforms (AI-driven loans, green credit lines) is crucial to unlock access for the mass market and the informal sector.6

- Policy Defense and Acceleration: India must mount a robust defense of its PLI/FAME localization policies at the WTO to protect nascent domestic supply chains.8 Simultaneously, accelerating the scaling of public charging infrastructure (which showed a 72% CAGR but requires 400,000 installations yearly to meet 2030 targets) and R&D funds is necessary to solidify the country’s position as a global manufacturing hub.1

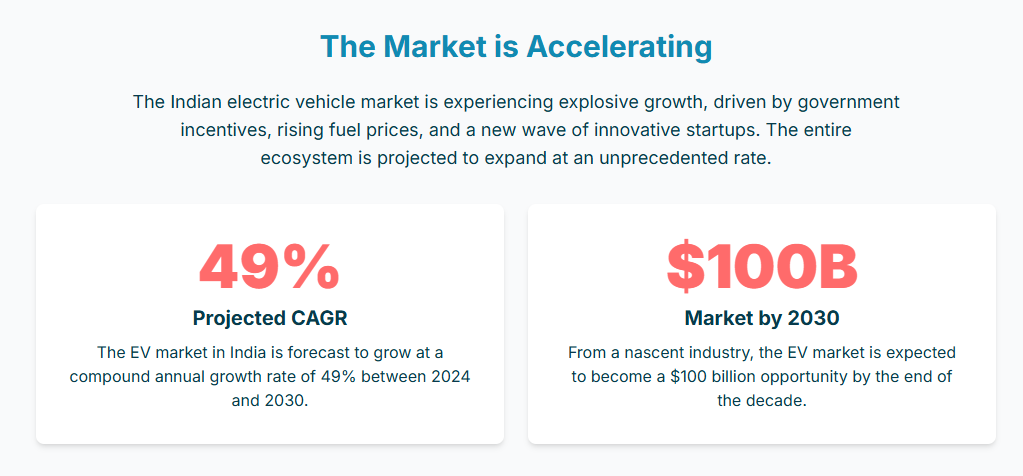

7.3. Market Forecast

The Indian EV market is on a trajectory of sustained, high-growth expansion, projected to reach US$ 113.99 billion by 2029.1 The E-2W segment is likely to settle into a consolidated structure where a few legacy players (TVS, Bajaj) control the majority of volume, competing primarily on distribution and TCO. New-age startups will survive and thrive by occupying profitable, high-technology niches (Ather, Ultraviolette) that prioritize performance and differentiated user experience. The ultimate success of India’s transition hinges on the effective resolution of the supply chain risks posed by the China-WTO dispute and the comprehensive scaling of TCO-reducing financial and physical infrastructure.

Sources

- Electric Vehicle Industry in India and its Growth – IBEF, accessed October 26, 2025, https://ibef.org/industry/electric-vehicle

- Legacy two-wheeler giants ride ahead in India’s electric race – ET Auto, accessed October 26, 2025, https://auto.economictimes.indiatimes.com/news/two-wheelers/legacy-two-wheeler-giants-leading-in-indias-electric-vehicle-market/124328835

- Ampere Nexus, at a starting price of Rs 1,09900 – Greaves Electric Mobility, accessed October 26, 2025, https://ampere.greaveselectricmobility.com/press-releases/nexus-launch

- Ola vs TVS vs Ather: Who’s Winning the EV War in India?, accessed October 26, 2025, https://www.carnbikecafe.com/news/Electric-bike/ola-vs-tvs-vs-ather-whos-winning-the-ev-war-in-india

- Exploring Cost-Reduction Strategies For Electric Vehicle (EV) Batteries Infographic – Shakti Sustainable Energy Foundation, accessed October 26, 2025, https://shaktifoundation.in/wp-content/uploads/2020/05/Exploring-Cost-Reduction-Strategies-For-Electric-Vehicle-EV-Batteries-Infographic.pdf

- EV Financing in India: AI, BaaS, Subscriptions & Green Loans – GrowthJockey, accessed October 26, 2025, https://www.growthjockey.com/blogs/modular-ev-financing-ai-subscription-loans

- FAME III Subsidy Update 2025 – New Rates & Models for Electric Scooters, accessed October 26, 2025, https://thexpressholidays.in/fame-iii-electric-scooter-subsidy-2025/

- China drags India to WTO over EV and auto incentives, accessed October 26, 2025, https://auto.economictimes.indiatimes.com/news/industry/china-lodges-complaint-against-india-at-wto-over-ev-and-auto-incentives/124716829

- China wants India to stop copying its playbook – The Economic Times, accessed October 26, 2025, https://m.economictimes.com/industry/renewables/china-wto-complain-against-india-ev-manufacturing-scheme-china-wants-india-to-stop-copying-its-playbook/articleshow/124598355.cms

- Electric Vehicle Sales in India Surpass 2 Million Mark in CY2024 – JMK Research, accessed October 26, 2025, https://jmkresearch.com/indias-electric-vehicle-sales-crossed-2-million-in-cy2024/

- At 5%, EV share in car sales nearly doubles in year, accessed October 26, 2025, https://timesofindia.indiatimes.com/business/india-business/at-5-ev-share-in-car-sales-nearly-doubles-in-yr/articleshow/124797006.cms

- India’s Electric Vehicle sales trend | May 2025 – EVreporter •, accessed October 26, 2025, https://evreporter.com/indias-electric-vehicle-sales-trend-may-2025/

- Quarterly India EV Sales Trend for Q4 FY2024-25 – EVreporter •, accessed October 26, 2025, https://evreporter.com/quarterly-india-ev-sales-trend-for-q4-fy2024-25/

- Hidden in Plain Sight: How Two IITians Electrified India’s Last Mile, One Battery Swap at a Time – Blume Ventures, accessed October 26, 2025, https://blume.vc/commentaries/hidden-in-plain-sight-how-two-iitians-electrified-indias-last-mile-one-battery-swap-at-a-time

- EV War 2025: Ola vs Ather vs Bajaj – Who Will Be the Tesla of India? – CarnBikeCafe, accessed October 26, 2025, https://www.carnbikecafe.com/news/Electric-bike/ev-war-2025-ola-vs-ather-vs-bajaj-who-will-be-the-tesla-of-india

- Rise & Fall of Ola Electric: Success & Failures Explained – DriveSpark News, accessed October 26, 2025, https://www.drivespark.com/two-wheelers/2025/rise-fall-of-ola-electric-success-failures-5-key-points-075087.html

- Ola Electric’s Shocking Collapse: 5 Reasons Ather, Bajaj & TVS Won 2025 – Mechhelp, accessed October 26, 2025, https://mechhelp.in/ola-electric-sales-crash/

- India EV Sales – EVreporter •, accessed October 26, 2025, https://evreporter.com/wp-content/uploads/2025/05/EVreporter-India-EV-Report-FY24-25.pdf

- Ampere Nexus Price, Weight, Range, Specifications – BikeDekho, accessed October 26, 2025, https://www.bikedekho.com/ampere/nexus

- Ultraviolette Tesseract Price – Range, Images, Colours | BikeWale, accessed October 26, 2025, https://www.bikewale.com/ultraviolette-bikes/tesseract/

- Ultraviolette Tesseract Price, Mileage, Range, Weight – BikeDekho, accessed October 26, 2025, https://www.bikedekho.com/ultraviolette/tesseract

- 5 Upcoming Electric Vehicles Set to Shake Up the Indian Market – All India EV, accessed October 26, 2025, https://allindiaev.com/5-upcoming-electric-vehicles-set-to-shake-up-the-indian-market/

- Upcoming Electric Cars in India with Expected Prices, Launch Dates – CarDekho, accessed October 26, 2025, https://www.cardekho.com/upcomingcars/electric

- India’s EV Market: Trends and Future Prospects | S&P Global, accessed October 26, 2025, https://www.spglobal.com/automotive-insights/en/blogs/2025/03/india-ev-market-trends-future

- Ather Battery as a Service, accessed October 26, 2025, https://www.atherenergy.com/ather-battery-rental

- India Electric Vehicle Report 2023 | Bain & Company, accessed October 26, 2025, https://www.bain.com/insights/india-electric-vehicle-report-2023/

- BENEFITS OF ELECTRIC VEHICLES – e-AMRIT, accessed October 26, 2025, https://e-amrit.niti.gov.in/benefits-of-electric-vehicles

- The Costs of Maintaining an Electric Vehicle in India – Ayvens, accessed October 26, 2025, https://www.ayvens.com/en-in/about-us/blog/trends/ev-maintenance-costs-india/

- DRIVING AFFORDABLE FINANCING FOR ELECTRIC VEHICLES IN INDIA – NITI Aayog, accessed October 26, 2025, https://www.niti.gov.in/sites/default/files/2023-07/ADB-EV-Financing-Report_VS_compressed.pdf

- FAME III EV Subsidy 2025: Buyer Benefits & Dealer Checklist – Exam Media, accessed October 26, 2025, https://exammedia.in/fame-iii-ev-subsidy-2025/

- PLI Scheme for Automobile and Auto Component Industry, accessed October 26, 2025, https://heavyindustries.gov.in/pli-scheme-automobile-and-auto-component-industry

- India’s Automobile Industry: Growth & Trends – IBEF, accessed October 26, 2025, https://ibef.org/industry/india-automobiles

- China cries foul over India’s EV push: WTO war brews over ‘Made in India’ power play, accessed October 26, 2025, https://www.businesstoday.in/latest/economy/story/china-cries-foul-over-indias-ev-push-wto-war-brews-over-made-in-india-power-play-499108-2025-10-22

- China Unhappy Over ‘Made In India’ EV Push; Calls It ‘Discriminating Against Foreign Players’ – YouTube, accessed October 26, 2025, https://www.youtube.com/watch?v=ZuRSDtNfXiA

- Electric Vehicles in India – NITI Aayog, accessed October 26, 2025, https://niti.gov.in/sites/default/files/2025-08/Electric-Vehicles-WEB-LOW-Report.pdf

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity