Suzuki Motorcycle India Q3 FY26 Performance: Analysis of the Dual-Vector Growth Strategy and Future Capacity Trajectory

I. Executive Summary: The Dual-Vector Growth Model

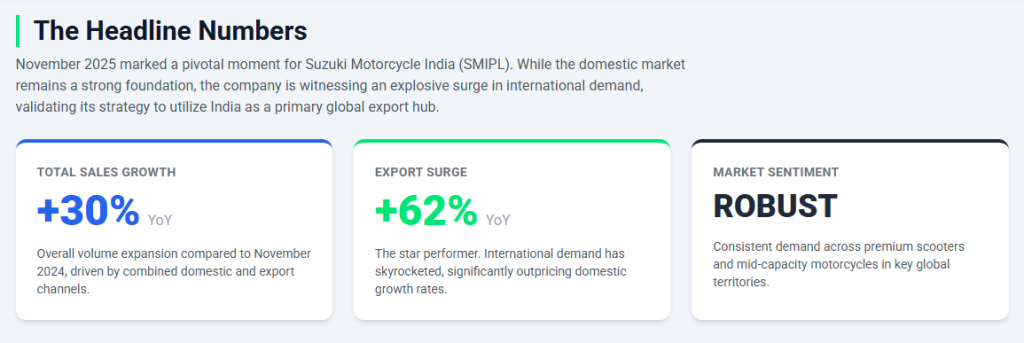

Suzuki Motorcycle India Pvt. Ltd. (SMIPL), the Indian subsidiary of Suzuki Motor Corporation, demonstrated exceptional operational strength in November 2025, reporting a substantial 30% Year-on-Year (YoY) increase in total sales volume. This performance, reaching 1,22,300 units for the month, significantly outpaced broad market averages and confirms a strategic shift toward aggressive volume targets.1

The overall growth trajectory is characterized by a successful “dual-vector” approach. The first vector is characterized by Export Dominance, evidenced by an exceptional 62% surge in international shipment volumes, totaling 25,940 units. This rapid acceleration confirms robust demand in international markets and positions SMIPL as an increasingly critical global export hub for Suzuki Motor Corporation.1 The second vector, Domestic Resilience, saw sales climb 23% to 96,360 units.1 This indicates a strong rebound following a slight contraction observed in October, validating the company’s focus on the high-growth, high-margin 125cc scooter segment.

Complementing the vehicle sales, the firm’s operational health is further underscored by the performance of its after-sales division, which achieved record spare parts sales totaling ₹95.5 crore (or ₹955 million) during the reporting month.1 This strong performance suggests deepening customer engagement and effective monetization of the expanding vehicle base.

The high simultaneous growth—23% domestically and 62% in exports—indicates that the increased demand is driven by structural factors rather than being purely a cyclical festive/seasonal boost. This structural conviction is reflected in the parent company’s capital deployment strategy, specifically the announcement of a new manufacturing plant in Haryana slated for 2027 commencement with an initial annual capacity of 750,000 units.6 This capital expenditure (CAPEX) validates the belief at Suzuki headquarters that the sustained growth is warranting substantial volume capacity augmentation, which serves to de-risk future volume targets and supports the company’s evolution beyond its niche player status.

Furthermore, the strong domestic performance, even as rivals like Bajaj Auto reported a domestic two-wheeler sales decline of 1% 8, suggests SMIPL’s successful focus on the premium 125cc scooter market (led by the Access 125 9) has created a profitable segment specialization. This strategy effectively insulates the company from the severe price competition typically seen in the mass-market, entry-level 100-110cc commuter categories.

II. Quantitative Sales Performance Review (November 2025)

The sales figures for November 2025 demonstrate a significant inflection point in SMIPL’s trajectory, characterized by sharp volume expansion across both domestic and international operations.

Data Validation and Volumetric Analysis (Nov 2025 vs. Nov 2024)

SMIPL’s total wholesales for November 2025 reached 1,22,300 units, a 30% increase compared to the 94,370 units sold in the corresponding period of 2024.1 This volumetric increase of nearly 28,000 units is broadly distributed between the two key markets:

- Domestic Sales: Domestic wholesales were 96,360 units, marking a 23% YoY surge from the 78,333 units sold in November 2024. This represents a volumetric addition of 18,027 units.1

- Export Performance: Export volumes showed the most dynamic percentage growth, surging 62% YoY. The company shipped 25,940 units, compared to 16,037 units shipped in November 2024, resulting in a volumetric increase of 9,903 units.1

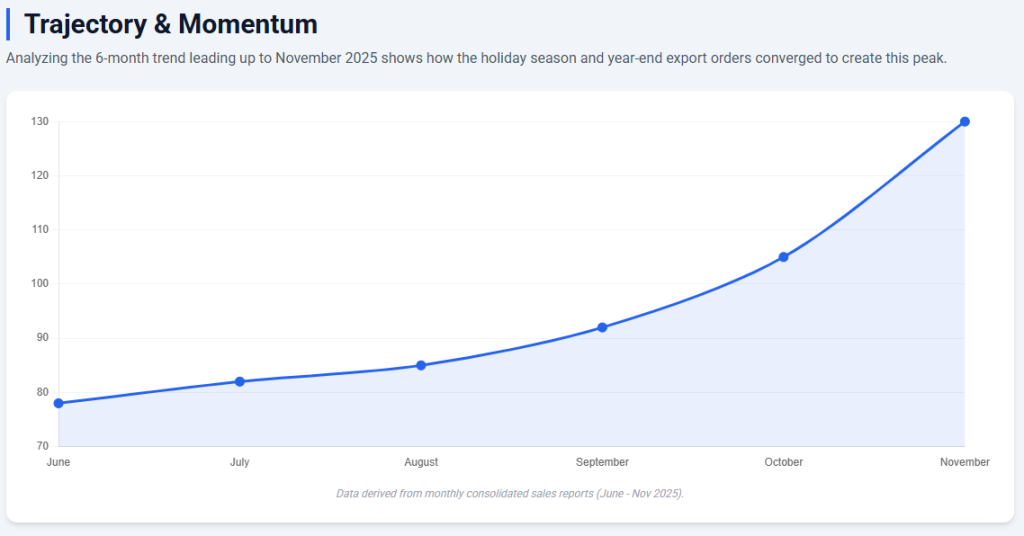

It is important to view November’s performance in the context of the preceding month. In October 2025, SMIPL had achieved its highest-ever monthly total sales of 1,29,261 units.13 November’s results, while marginally lower than the October peak, affirm a pattern of high, sustained momentum rather than the typical sharp decline often observed after the peak festive period.

The detailed breakdown of the sales figures is presented below:

SMIPL Sales Performance: November 2025 vs. November 2024

| Metric | November 2025 (Units) | November 2024 (Units) | Volumetric Change (Units) | Growth Rate (YoY) |

| Total Sales (Wholesales) | 1,22,300 | 94,370 | 27,930 | 30% |

| Domestic Sales | 96,360 | 78,333 | 18,027 | 23% |

| Exports | 25,940 | 16,037 | 9,903 | 62% |

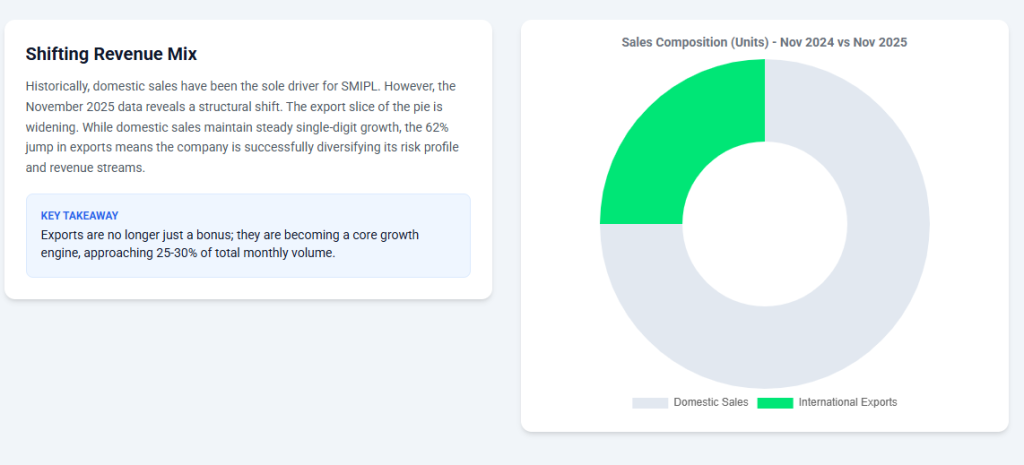

Differential Contribution and Export Volume Analysis

An analysis of the volumetric contributions reveals that while exports are the major acceleration component due to the impressive 62% growth rate, the domestic market remains the crucial volume foundation. Domestic sales contributed 64.5% of the total volumetric growth for the month (18,027 units out of 27,930 total units of growth). This indicates that the company is effectively executing high growth on two independent strategic fronts simultaneously, a challenging feat in the highly competitive two-wheeler market.

A detailed review of the export numbers further suggests a potential capacity constraint. October 2025 exports were 25,807 units, registering a 71% YoY growth.15 November exports were 25,940 units.1 The marginal difference of only 133 units between the absolute export volumes for October and November, despite the differing YoY growth rates, suggests that export volume may be nearing a temporary ceiling. This ceiling is likely imposed by current logistical capacity limitations or maximized operational utilization of the existing manufacturing plant. Sustaining future export growth rates above this 26,000-unit monthly threshold will require immediate logistical optimization or the activation of incremental capacity additions, further justifying the upcoming Haryana expansion plan.6

III. Analysis of Domestic Market Momentum (23% Growth)

The 23% surge in domestic wholesales to 96,360 units reflects not only favorable market conditions but also the success of SMIPL’s targeted product strategy. This growth is significantly higher than the domestic two-wheeler industry’s projected growth of around 15% for November 2025.16

Macroeconomic and Policy Tailwinds

The domestic market benefited substantially from two key drivers. First, the GST rate cuts on vehicles, enacted in September 2025, continued to positively influence consumer sentiment and affordability, leading to robust consumption spillover into November.16 This policy change stimulated demand across the entire automotive sector. Second, November benefited from strong seasonality, including improved rural demand, readily available financing, and the commencement of the marriage season, providing a collective tailwind for two-wheeler purchases.16

Product Segment Leadership and Specialization

SMIPL’s domestic strategy has focused on specialization, particularly within the 125cc scooter segment, successfully avoiding the cutthroat competition characterizing the high-volume 100-110cc commuter motorcycle segment. The 125cc category is currently growing faster than the 110cc segment.10 SMIPL’s lineup, including the Access 125, Burgman Street, and Avenis 125, has made the company a leader in this high-growth niche.10 The Access 125, a cornerstone product, was the third highest-selling scooter in the country earlier in 2025, registering sales of 75,778 units in May alone.9 This focus on premium, feature-rich scooters (offering advanced fuel injection, efficiency, and safety features 10) has allowed SMIPL to capture affluent, urban, and semi-urban buyers willing to pay a premium for performance.

The domestic growth figure confirms successful execution of post-festive inventory management. In October 2025, SMIPL’s domestic sales had seen a slight contraction, dropping to 1,03,454 units (a minor 1.42% YoY dip).4 This deviation from the general festive euphoria was quickly corrected, leading to the strong 23% rebound in November. This pattern—an October dip followed by a substantial November surge—indicates that SMIPL demonstrated strategic agility by potentially clearing older inventory or precisely timing dealer dispatches to align with the crucial November marriage season demand.

This success also highlights the consumer trend migration toward premiumization. The preference for 125cc products over 110cc models, supported by favorable macroeconomic conditions like GST cuts and easy finance 16, shows that consumers are increasingly prioritizing features, power, and refined technology over minimum acquisition cost. SMIPL is therefore optimally positioned within India’s two-wheeler market to benefit from higher Average Selling Prices (ASPs) and potentially achieve superior gross margins compared to manufacturers heavily invested in the entry-level commuter space.

IV. Deconstructing the Export Surge (62% Growth)

The 62% export growth, reaching 25,940 units in November 2025, is the most dynamic element of SMIPL’s performance and reflects a successful strategic focus on global market expansion.1

Comparative Export Benchmarking

When compared to key rivals, SMIPL’s export performance stands out significantly:

- TVS Motor Company reported strong growth in two-wheeler exports at 52% (132,233 units).18

- Honda Motorcycle & Scooter India (HMSI) total exports grew by 57% (57,491 units).17

- Bajaj Auto, traditionally India’s largest two-wheeler exporter, registered a modest 8% growth in total exports (1,77,204 units).19

While the overall two-wheeler industry was expected to deliver double-digit growth in exports, buoyed by demand from Asia, Africa, and Latin America 16, SMIPL’s 62% figure demonstrates substantial market share acquisition and aggressive penetration into these regions.

Key Competitor Two-Wheeler Sales Comparison: November 2025

| Manufacturer | Total Sales (Units) | Total Sales Growth (YoY) | Domestic Growth (YoY) | Exports Growth (YoY) |

| Suzuki Motorcycle India | 1,22,300 | 30% | 23% | 62% |

| TVS Motor Company (Total Sales) | 5,19,508 | 30% | 20% (2W Domestic) | 52% (2W Exports) |

| Honda Motorcycle & Scooter India (HMSI) | 5,91,136 | 25% | 22% | 57% |

| Bajaj Auto (Total Sales) | 4,53,273 | 8% | -1% (Domestic 2W) | 8% |

Note: Data for TVS and Bajaj includes total sales (2W/3W/CV) where two-wheeler specific domestic/export figures were not consistently available for all metrics.

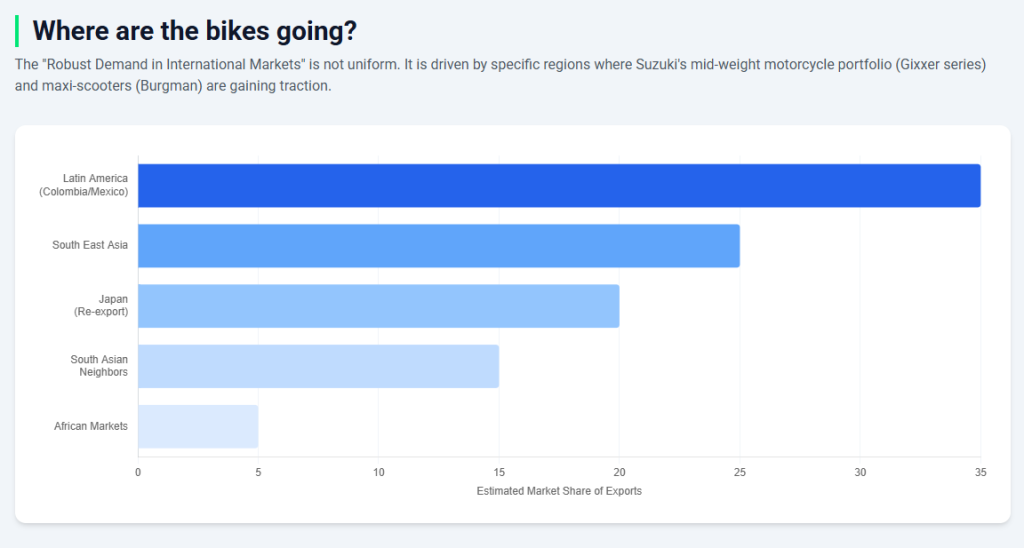

Geographic Strategy and Global Role

Global sales data confirms that Suzuki motorcycles are registering an “outstanding performance” in Latin America, which saw sales grow by 26.5% year-to-date in 2025, and strong momentum in Africa, reporting a 21.4% growth.20 The significant surge in Indian exports confirms that SMIPL is strategically leveraging its Indian manufacturing base to serve these high-growth regions, benefiting from competitive operational costs and adherence to Suzuki’s global quality mandates.7

The extraordinary 62% growth implies aggressive stocking of international distribution channels, potentially to clear accumulated backlogs or to capitalize ahead of seasonal peaks in specific export markets. This could be viewed as an exceptional month of channel filling following efficiency improvements in the supply chain. Consequently, analysts must closely monitor the sustainability of this growth rate in December and Q4 FY22 to differentiate between a structural demand increase and maximized bulk dispatches.

Critically, this performance is reflective of a major strategic shift by the parent company. Global production reports indicate that Suzuki Motor Corporation’s overseas production reached a record high in October 2025, primarily driven by the record high production reported in India.21 This centralization of production and fulfillment responsibilities confirms that Suzuki views its Indian subsidiary as a critical, reliable, and cost-effective global manufacturing hub for its two-wheeler portfolio. This elevated status reinforces the necessity and justification for the announced multi-million dollar capital expenditure for capacity expansion.

V. Operational and After-Sales Business Momentum

Sustained market growth is critically dependent on robust after-sales infrastructure, a factor SMIPL appears to be leveraging effectively, enhancing customer lifetime value (CLV) through superior service and parts availability.

Record After-Sales Revenue

A key indicator of operational efficiency and customer retention is the record performance of the spare parts business. SMIPL reported record spare parts sales of ₹95.5 crore (₹955 million) in November 2025.1 This represents substantial sequential growth, marking an approximately 11.4% Month-on-Month (MoM) increase over the ₹85.7 crore (₹857 million) recorded in October 2025.14

This acceleration in spare parts revenue, occurring concurrently with high vehicle wholesales, suggests two phenomena: first, the overall vehicle fleet size (installed base) is expanding rapidly; and second, the existing customer base is maintaining a high rate of service bay utilization at authorized dealerships. Since spare parts sales are typically a higher-margin revenue stream compared to new vehicle wholesales, this ancillary income is vital for enhancing dealer profitability and ensuring the financial viability of the expanded distribution network.

Strategic Role of Customer Lifetime Value

Deepak Mutreja, Vice President for sales and marketing at SMIPL, highlighted the company’s commitment to continuous investment in “enhancing accessibility, after-sales experience, and community-building” for sustained growth.1 This focus is strategically sound, as industry analyses confirm that the availability of genuine spare parts and the quality of after-sales service are paramount drivers of customer satisfaction and loyalty, which are essential for maintaining a steady market position in India.23

SMIPL After-Sales Business Momentum: Q3 FY26

| Month | Spare Parts Sales (INR Crore) | Spare Parts Sales (INR Million) | Context |

| October 2025 | 85.7 | 857 | Strong festive performance baseline |

| November 2025 (Record) | 95.5 | 955 | MoM increase (11.4%), indicative of strong after-sales traction |

The commitment to investing in after-sales directly addresses the inherent risks associated with rapid network expansion. As SMIPL expands its footprint, establishing new 3S (Sales, Service, Spares) dealerships (such as the one opened in Roorkee in October 15), high-quality service assurance becomes the mechanism for mitigating the risk of quality degradation. By prioritizing service excellence alongside volume growth, the company is establishing the necessary infrastructure to confidently manage the substantial increase in vehicle volume expected after the 2027 capacity expansion.

VI. Competitive Landscape and Industry Context

SMIPL’s performance must be contextualized within the highly competitive Indian two-wheeler market, currently benefiting from positive macroeconomic factors.

November 2025 Two-Wheeler Industry Review

The broader Indian auto sector exhibited resilience and strong growth in November 2025, largely supported by the spillover benefits of GST cuts and favorable financing conditions.16 However, growth was uneven across manufacturers:

- SMIPL and TVS: Both achieved a high overall sales growth rate of 30%.1 TVS reported total two-wheeler sales up 27% and maintained strong segment growth in motorcycles (34%) and scooters (27%).18

- HMSI: Maintained its immense scale, with total sales rising 25% to 5,91,136 units.17

- Bajaj Auto: Demonstrated significant competitive vulnerability in the domestic segment, registering a 1% YoY drop in domestic two-wheeler sales, relying almost entirely on commercial vehicles and modest export growth (8%) for overall volume stability.8

Strategic Positioning and Market Segmentation

The contrast between SMIPL/TVS and Bajaj Auto highlights the critical importance of specialization versus reliance on high-volume, entry-level segments. SMIPL’s profitable focus on the premium 125cc scooter segment allows it to capitalize on the current upward movement in consumer discretionary spending and premiumization, providing a competitive shield against the severe pricing pressures prevalent in the basic commuter motorcycle segments where Bajaj has a large presence.

In the export arena, SMIPL’s 62% growth, which vastly exceeds Bajaj Auto’s 8% export growth 19, signifies aggressive market share reallocation in international markets. While Bajaj traditionally holds the highest export volume, the rapid scaling achieved by SMIPL positions it as a significant challenger. The data suggests that the global surge in two-wheeler demand post-pandemic normalization is triggering a substantial shift in export market share, with SMIPL effectively gaining ground, likely leveraging differentiated product offerings and capitalizing on the structural demand in regions like Latin America and Africa.20

VII. Strategic Outlook and Manufacturing Expansion

The robust sales figures, particularly the stretched export volumes, bring the issue of long-term capacity into sharp focus, making the recently announced capital expenditure essential for sustaining trajectory.

Capacity Constraints and Investment Justification

SMIPL’s ability to sustain wholesales above 1.2 lakh units (1,22,300 in Nov 2025) and achieve record volumes in October (1,29,261 units) implies that the existing Gurugram plant is operating at near-maximal utilization.13 The ceiling observed in export volumes between October and November (around 26,000 units) further suggests the operational limits of the current infrastructure are being tested.

This structural constraint has been anticipated and addressed by Suzuki Motor Corporation. In May 2025, the corporation greenlit the construction of a second major manufacturing facility in Haryana.6 The initial annual production capacity of this new plant is set at 750,000 units.6

Analysis of the Haryana Expansion

The decision to add 750,000 units of annual capacity (which equates to approximately 62,500 units monthly) represents a substantial commitment, likely increasing SMIPL’s total production capability by more than 50%. The commencement of operations is targeted for 2027.6 This investment is not a reactive response to the 2025 festive boost; rather, it is based on a fundamental, long-term strategic outlook that forecasts sustained high demand in both domestic and export markets. This expansion confirms that SMIPL is positioning itself for sustained volumes well exceeding 150,000 units per month by 2027/2028.

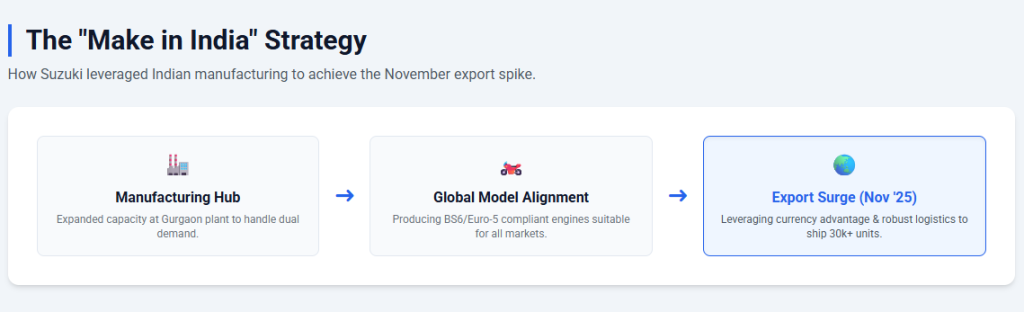

The construction of the new facility aligns with corporate goals to continue providing diverse mobility options in India and contributes directly to the Indian government’s “Make in India” initiative.7 This capital deployment justifies the company’s evolution from a niche domestic player to a global sourcing hub.

However, the 2027 operational date creates a critical capacity gap risk. If the current high demand (1.2-1.3 lakh units/month) accelerates further in 2026, SMIPL will face a 1-2 year window where demand may significantly outstrip current capacity. This scenario could result in lost sales opportunities, extended waiting periods, and strain on the dealer network, particularly for high-volume export markets. Therefore, the efficient management of inventory and logistics in the interim period until 2027 is crucial. The current aggressive export dispatches observed in November may, in fact, be an operational strategy to prioritize high-margin international orders and manage accumulated backlogs during this constrained period.

VIII. Conclusion and Strategic Recommendations

Suzuki Motorcycle India’s November 2025 performance underscores exceptional strategic clarity. The simultaneous achievement of 30% overall growth, fueled by a 23% domestic resurgence in the lucrative 125cc segment and a powerful 62% export acceleration, confirms optimal alignment between specialized product development and favorable global market conditions. This momentum is recognized as structural, validated by the record after-sales performance and the decisive, massive capacity expansion planned for 2027.

Based on this analysis, the following strategic recommendations are pertinent for sustaining high growth and maximizing shareholder value:

- Solidify Export Logistics and Channel Management: Given that export volumes have potentially reached a temporary utilization ceiling (around 26,000 units/month) and the capacity expansion is distant (2027), immediate attention must be directed toward fortifying the global supply chain. The priority should be establishing robust, flexible shipping contracts and optimizing transit times to capitalize fully on the extraordinary international demand observed in Latin America and Africa.20 Minimizing logistical friction is paramount to ensure that surging international demand translates directly into fulfilled orders rather than accumulated backlog.

- Deepen 125cc Market Penetration and Premiumization: SMIPL must continue to leverage its segment leadership in the 125cc scooter category. This requires ongoing product refinement, such as the recent refreshes to the Gixxer and Gixxer SF models 14, focusing on premium features, technology (e.g., advanced fuel injection), and connectivity. Maintaining specialization in this segment is vital, as it protects margins from the intense competition present in the entry-level commuter market and ensures SMIPL captures the highest return from India’s ongoing premiumization trend.

- Integrate After-Sales Excellence with Capacity Expansion: The robust growth in the after-sales business, evidenced by the record ₹95.5 crore spare parts sales 1, must be strategically integrated into the expansion plan. When the new Haryana plant commences operations in 2027, the rollout of capacity must be synchronized with the establishment of adequate, high-quality 3S facilities across all newly targeted markets. Prioritizing service and spares availability ensures high customer retention and long-term brand confidence, providing the essential foundation required to sustain the massive projected sales volumes of the enlarged production capacity post-2027.

Sources

- Suzuki India Sales Rise 30% in November: Rediff Moneynews, accessed on December 2, 2025, https://money.rediff.com/amp/news/market/suzuki-india-sales-rise-30-in-november/37880420251201

- Suzuki Motorcycle India Revs Up with 30% Sales Surge | Business – Devdiscourse, accessed on December 2, 2025, https://www.devdiscourse.com/article/business/3715756-suzuki-motorcycle-india-revs-up-with-30-sales-surge

- Suzuki Motorcycle India records 30% growth in November, sales rise to 1,22300 units, accessed on December 2, 2025, https://www.indiatoday.in/amp/auto/latest-auto-news/story/suzuki-motorcycle-india-records-30-growth-in-november-sales-rise-to-122300-units-2828941-2025-12-01

- Two Wheeler Sales Oct 2025 – Hero, Honda, TVS, Bajaj, Royal Enfield, Suzuki – RushLane, accessed on December 2, 2025, https://www.rushlane.com/two-wheeler-sales-oct-2025-hero-honda-tvs-bajaj-royal-enfield-suzuki-12533814.html

- Suzuki Motorcycle India sales rise 30 pc to 1 22 300 units in Nov, accessed on December 2, 2025, https://www.theweek.in/wire-updates/business/2025/12/01/dcm91-biz-auto-sales-suzuki-motor.html

- Suzuki Motorcycle India Begins Work On Second Manufacturing Plant In Haryana, accessed on December 2, 2025, https://www.carandbike.com/news/suzuki-motorcycle-india-begins-work-on-second-manufacturing-plant-in-haryana-3217096

- Suzuki Lays Foundation for India’s New Motorcycle Plant | GLOBAL NEWS, accessed on December 2, 2025, https://www.globalsuzuki.com/globalnews/2025/0520.html

- Bajaj Auto domestic two-wheeler sales degrow in November 2025, exports up 8 per cent, accessed on December 2, 2025, https://auto.hindustantimes.com/auto/news/bajaj-auto-domestic-two-wheeler-sales-degrow-in-november-2025-exports-up-8-per-cent-41764569656153.html

- Auto Sales June 2025: Suzuki Registers 8 Per Cent Growth – ACKO Drive, accessed on December 2, 2025, https://ackodrive.com/news/auto-sales-june-2025-suzuki-registers-8-per-cent-growth/

- Suzuki Scooters Dominate the 125cc Segment: Here’s Why – Finance ki Baat, accessed on December 2, 2025, https://financekibaatein.com/2025/03/13/suzuki-scooters-dominate-the-125cc-segment-heres-why/

- Suzuki 2 Wheelers November 2025 Sales: 1,22,300 Units Sold, Grows 30% YoY – GaadiKey, accessed on December 2, 2025, https://blog.gaadikey.com/suzuki-2-wheelers-november-2025-sales-122300-units-sold-grows-30-yoy/

- Suzuki Motorcycle India sales rise 30 pc to 1 22 300 units in Nov, accessed on December 2, 2025, https://www.theweek.in/wire-updates/business/2025/12/01/dcm91-biz-auto-sales-suzuki-motor.amp.html

- Suzuki Motorcycle India Media & Press Kit, accessed on December 2, 2025, https://www.suzukimotorcycle.co.in/media-kit

- Suzuki Motorcycle India records 1.03 lakh domestic sales in October; monthly exports jump 71% YoY, accessed on December 2, 2025, https://auto.economictimes.indiatimes.com/news/two-wheelers/suzuki-motorcycle-india-achieves-record-sales-with-103-lakh-domestic-units-and-71-yoy-export-growth/125029934

- Suzuki achieves highest-ever monthly two-wheeler sales in October 2025 – India Today, accessed on December 2, 2025, https://www.indiatoday.in/auto/latest-auto-news/story/suzuki-achieves-highest-ever-monthly-two-wheeler-sales-in-october-2025-2812541-2025-11-03

- Auto industry set for double-digit growth across segments in November: Report, accessed on December 2, 2025, https://auto.economictimes.indiatimes.com/news/industry/indian-auto-industry-forecasts-double-digit-growth-in-november-2025/125608343

- Auto sales in November 2025: Who sold how much in the month gone by – Hindustan Times, accessed on December 2, 2025, https://www.hindustantimes.com/business/india-auto-sales-in-november-2025-101764560758423.html

- TVS Two-Wheeler Sales Report for November 2025: Show 27% Growth – BikeJunction, accessed on December 2, 2025, https://thebikejunction.com/news/tvs-two-wheeler-sales-report-for-november-2025

- GST benefits propel November auto wholesales – The Hindu, accessed on December 2, 2025, https://www.thehindu.com/business/gst-benefits-propel-november-auto-wholesales/article70346292.ece

- Suzuki Motorcycles Global Sales 2025 | MotorCyclesData.com, accessed on December 2, 2025, https://www.motorcyclesdata.com/2025/08/01/suzuki-motorcycles/

- Suzuki October 2025 Automobile Production, Sales, and Export Figures | GLOBAL NEWS, accessed on December 2, 2025, https://www.globalsuzuki.com/globalnews/2025/1127.html

- Suzuki Motorycles Creates History, Highest-Ever Monthly Sales in Oct 2025 – Bike advice, accessed on December 2, 2025, https://bikeadvice.in/suzuki-motorycles-creates-history-highest-ever-monthly-sales-in-oct-2025/

- IMPACT ASSESSMENT OF CUSTOMER MOTIVATION ON MARKET BEHAVIOUR OF TWO- WHEELER AUTOMOBILE INDUSTRY – Allied Business Academies, accessed on December 2, 2025, https://www.abacademies.org/articles/Impact-assessment-of-customer-motivation-on-market-behaviour-of-two-wheeler-automobile-industry-1532-5806-24-5-273.pdf

- India CX Report’25: Two wheelers – KPMG International, accessed on December 2, 2025, https://kpmg.com/in/en/insights/2025/03/india-cx-report-2025/automotive/two-wheelers.html

- TVS Motor November Sales Jump to 5.19 Lakh Units Driven by Motorcycles, Scooters and EVs | India Infoline, accessed on December 2, 2025, https://www.indiainfoline.com/news/companies/tvs-motor-november-sales-jump-to-5-19-lakh-units-driven-by-motorcycles-scooters-and-evs

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity