1. The Big Picture: Unpacking GST 2.0, The Diwali Gift That Keeps on Giving

1.1 Introduction: A Ride into a New Era

In the bustling landscape of India, the two-wheeler stands as more than just a vehicle; it is a symbol of personal mobility, economic aspiration, and independence. It is the great equalizer of daily commute, navigating the narrowest lanes and connecting the farthest villages. Yet, for years, this quintessential mode of transport has been classified and taxed as a luxury item, saddled with a hefty tariff that seemed to defy its purpose. This is poised to change dramatically.

The Indian government is reportedly preparing a deep-dive overhaul of its indirect tax framework, a grand initiative being hailed as “GST 2.0”.1 Prime Minister Narendra Modi himself referred to the coming reforms during a recent address, calling them a “Diwali gift” for the people of the country.4 This is not a simple rate adjustment; it is a strategic government gambit to reboot an entire industry and, by extension, stimulate the national economy. The proposed reform, which would significantly reduce the tax burden on two-wheelers, is the catalyst the automotive sector has long been waiting for, promising to make personal mobility more affordable as the festive season approaches.6

1.2 The Tax Labyrinth: Untangling a Confusing Past

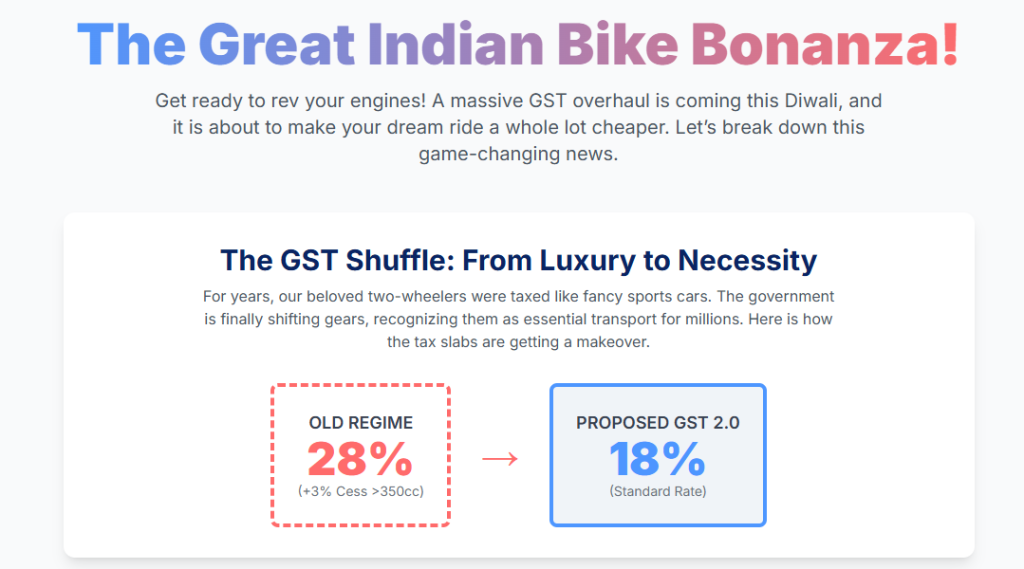

The current tax structure on two-wheelers is a complex system that has drawn sharp criticism from manufacturers and industry bodies alike. For the vast majority of petrol-powered two-wheelers with engine capacities below 350cc, the tax rate is a substantial 28 percent. For their more powerful, larger-engine siblings that exceed the 350cc threshold, a 3 percent compensatory cess is added on top, pushing the total tax incidence to 31 percent.6 This tiered structure has been in place since the GST regime was rolled out, and its impact has been felt across the industry, with high taxes acting as a major deterrent for budget-conscious buyers.7 This high tax rate also extends to many essential components and spares, such as brake pads, clutch cables, and batteries, which all attract a 28 percent GST.9 Furthermore, the insurance premiums that are a mandatory part of a vehicle’s cost of ownership are taxed at 18 percent, adding to the overall financial burden on consumers.7

1.3 The Great Simplification: GST 2.0, A Blueprint for Clarity

The proposed solution is a radical simplification of the entire GST framework. The “GST 2.0” initiative seeks to eliminate the existing 12 and 28 percent tiers, transitioning to a streamlined two-slab system.3 Under this new regime, a 5 percent rate would apply to essentials and a standard 18 percent rate would be levied on other goods and services.5 According to government sources, about 90 percent of goods currently taxed at 28 percent are expected to shift to the proposed 18 percent bracket.3 The significance of this change for the two-wheeler industry is immense. By moving from a luxury tax of 28 percent to a standard tax of 18 percent, two-wheelers are poised to become significantly more affordable, with a direct 10 percent reduction in tax. This move is a long-awaited demand from the automotive sector, which has consistently argued that two-wheelers are an essential and not a luxury item.6

1.4 Deeper Insights: The Hidden Agenda of Simplification

The GST 2.0 overhaul extends far beyond the mere reduction of rates. As officials have stated, this is a “deep-dive overhaul” that aims to resolve a number of systemic issues that have plagued businesses since the initial rollout eight years ago.1 For manufacturers and the supply chain, the current multi-slab system has led to complex “classification disputes,” where different varieties of similar goods are taxed at varying rates, leading to ambiguity and legal challenges.1 For instance, taxing a food item based on whether it is “extrusion-based or non-extrusion-based” is a complexity that the new regime seeks to end.1 The proposal also aims to address “inverted duty structures” and other procedural issues, providing a more stable and predictable tax environment for businesses.1 By moving from a state of constant “work in progress” to a “holistic and comprehensive” reform 1, the government is making a clear statement that it wants to empower the industry. A stable, unambiguous tax regime reduces litigation, operational complexity, and the financial burden of managing multiple tax tiers. This stability frees up resources for innovation and production, which ultimately translates to better value and prices for the end consumer.

2. The Buyer’s Bottom Line: From Sticker Shock to Sweet Deals

2.1 The Savings Story: Making Mobility Affordable

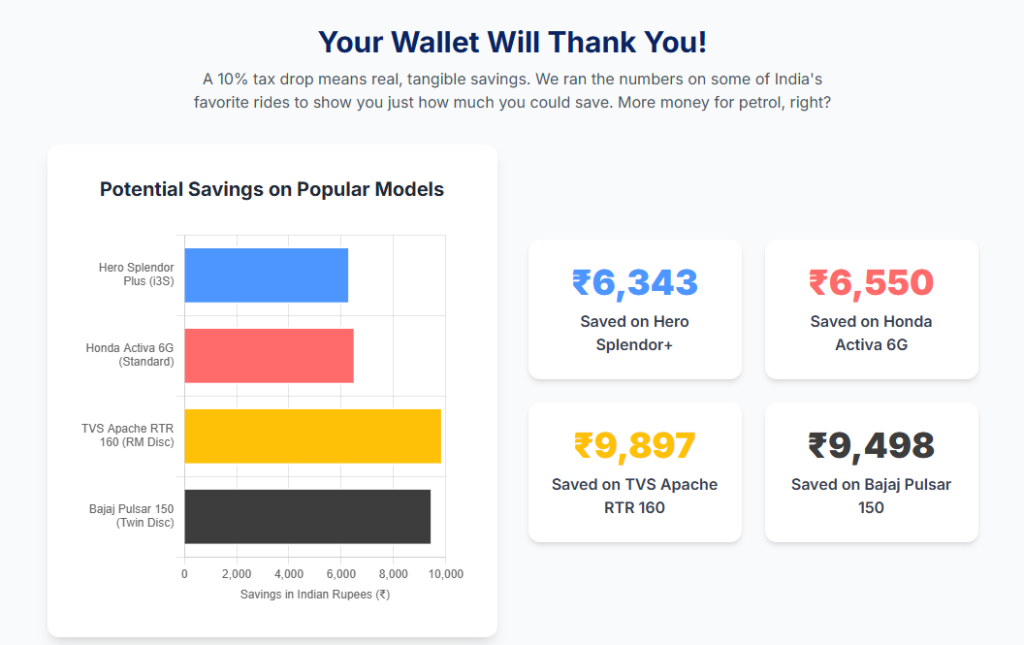

The proposed GST reduction is not just an abstract policy change; it translates into tangible savings for the consumer. The shift from a 28 percent to an 18 percent GST rate could result in savings of up to 5-10 percent on the overall vehicle cost.4 For the entry-level and mass-market two-wheelers that are the backbone of the Indian market, this reduction could bring about a significant price drop. To illustrate the impact, a simple calculation on the ex-showroom price shows how a reduction in the tax component can create a noticeable difference in the final price tag.

The following table provides a clear picture of the potential savings on some of India’s most popular two-wheelers. The current ex-showroom price is based on data for a specific city, Pune, and the potential new price reflects the impact of a 10 percent reduction in the GST portion of the cost.

2.2 Valuable Table: The Price Drop in Action: Potential Savings on Popular Two-Wheelers

| Model | Ex-Showroom Price in Pune (Current) | Current GST Component (28%) | New GST Component (18%) | Potential New Ex-Showroom Price | Estimated Savings per Unit |

| Hero Splendor Plus (i3S) | ₹ 80,646 16 | ₹ 17,700 | ₹ 11,357 | ₹ 74,303 | ₹ 6,343 |

| Honda Activa 6G (Standard) | ₹ 83,097 17 | ₹ 18,252 | ₹ 11,702 | ₹ 76,547 | ₹ 6,550 |

| TVS Apache RTR 160 (RM Disc) | ₹ 125,720 18 | ₹ 27,610 | ₹ 17,713 | ₹ 115,823 | ₹ 9,897 |

| Bajaj Pulsar 150 (Twin Disc) | ₹ 120,646 19 | ₹ 26,494 | ₹ 16,996 | ₹ 111,148 | ₹ 9,498 |

Note: The prices and calculations are based on a simplified model and are for illustrative purposes. Actual savings may vary based on other charges and dealer promotions.

2.3 Deeper Insights: A Remedy for Rural Woes

The sales dip in the Indian two-wheeler industry, especially in early FY2026, has a distinct cause: a decline in demand from rural markets.20 The research shows that this traditionally strong segment for two-wheeler sales has been under stress due to a combination of factors, including cautious spending during elections, a delayed monsoon, and rising vehicle costs.20 Entry-level commuter bikes, which are the lifeblood of rural transport, have been particularly affected.21

The proposed GST reduction serves as a direct policy intervention to address this specific market challenge. By making new bikes more affordable, the government is aiming to ease the financial strain on price-sensitive rural buyers. The policy effectively acts as a fiscal stimulus for the rural economy, where two-wheeler sales are directly linked to agricultural output and farm incomes. This move could not only make personal mobility more accessible but also provide a significant boost to a market segment that has been pulling back, leading to a ripple effect on national consumption and economic health.

3. The Market’s Pulse: A Forecast of Sales and Sentiment

3.1 A Tale of Two Quarters: The Current Headwinds

The Indian two-wheeler industry has recently faced a challenging period. The April-June quarter saw a 6.2 percent year-on-year decline in overall two-wheeler sales, with the affordable commuter segment bearing the brunt of the downturn.20 This slowdown can be attributed to several factors. Industry reports cite inventory correction and a dip in rural demand as key reasons.21 Additionally, the cost of owning a vehicle has been on the rise, with prices for two-wheelers increasing by nearly 20 percent since 2020 due to new safety and emission norms, such as the Onboard Diagnostics 2 (OBD2) Phase B norms.20 Despite these headwinds, industry observers view the situation as a “pit-stop rather than a full-blown breakdown,” with shoppers remaining interested but more cautious.20

3.2 The Revival Roadmap: A Festive Season Acceleration

With the proposed GST reduction, the industry is now poised for a significant revival. The timing of the reform, targeted for the Diwali festive season, is strategic. This period is traditionally a strong time for vehicle sales, and the added incentive of lower prices is expected to fuel a new wave of demand.6 The GST cut, combined with other potential macroeconomic improvements, such as a strong monsoon season boosting rural incomes and the possibility of more affordable loans due to recent RBI rate cuts, creates a perfect storm for a market turnaround.21 Manufacturers and economists alike are cautiously optimistic that these combined factors will help the industry regain traction and push for a healthier sales trajectory in the coming months.

3.3 Deeper Insights: The Laffer Curve in Action

Economists have largely voiced support for the proposed GST reforms.2 The underlying economic principle at play here is a crucial one. While a tax rate reduction might seem to entail a direct loss in government revenue per unit, the expectation is that this loss will be more than offset by a massive increase in sales volume and improved tax compliance.13 By making two-wheelers more affordable, the government aims to bring more people into the market who were previously held back by high prices. This increased purchasing activity would lead to a larger tax base and greater total tax collections over time. This strategic economic maneuver is designed to bolster domestic consumption, which is a key driver of India’s resilience against global headwinds.23 According to one economist, the boost to nominal GDP growth could be as high as 0.6 percentage points over 12 months, a significant lift for the economy.23

4. The Battle for Market Share: Competitive and Sectoral Analysis

4.1 Valuable Table: A Tale of Two Tiers: India’s Two-Wheeler Market Share (FY24)

The Indian two-wheeler market is highly competitive, dominated by a few key players. The GST reduction is likely to shake up the existing market dynamics, particularly in the mass-market commuter segment. The following table illustrates the market share distribution among the top players in fiscal year 2024, providing a baseline for analysis of future shifts.25

| Manufacturer | FY 2024 Market Share |

| Hero MotoCorp | 30.8% |

| Honda (HMSI) | 23.4% |

| TVS Motor Company | 16.9% |

| Bajaj Auto | 12.0% |

| Suzuki Motorcycle India | 4.8% |

| Royal Enfield | 4.5% |

| Yamaha Motor India | 3.5% |

4.2 The Big Four’s Gambit: Why Manufacturers Rejoice

The GST reduction has been a long-standing demand from the Indian automotive industry. Industry bodies like the Society of Indian Automobile Manufacturers (SIAM) have repeatedly petitioned the government for a tax cut, arguing that the 28 percent rate is inappropriate for a vehicle that serves as essential transport for the masses.6 Major firms have echoed this sentiment. Hero MotoCorp, TVS, and HMSI have consistently highlighted that two-wheelers are a necessity and should not be taxed as a luxury good.6 The proposed reform is a direct response to this industry-wide plea, and manufacturers are now well-positioned to capitalize on the renewed market demand.

4.3 Deeper Insights: A Race for Volume and a Premiumization Push

The GST reduction is poised to create a fascinating competitive dynamic across different segments. Hero MotoCorp and HMSI, which collectively commanded over 55 percent of the market in FY24, dominate the high-volume commuter segment.25 The tax cut will have the most significant impact on this price-sensitive category, allowing these market leaders to consolidate their position and fuel a massive increase in sales volume. Simultaneously, manufacturers like TVS and Bajaj, which have been gaining market share by focusing on the premium segment (125cc and above) 21, will find a new opportunity. The GST reduction will make their aspirational and feature-rich models more accessible, potentially accelerating the “premiumization” trend that is already underway.21 This means that the fight for market share will intensify not only in the entry-level segment but also in the mid- and premium-tier categories, as manufacturers compete on price, features, and value propositions.

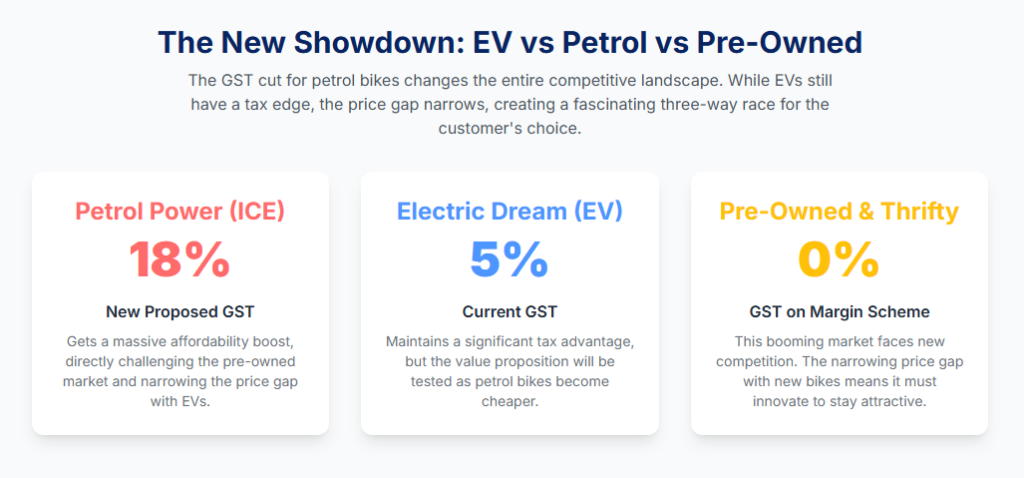

4.4 A Tale of Two Fuels: The EV vs. ICE Showdown

While the proposed GST cut provides a much-needed boost to the conventional internal combustion engine (ICE) two-wheeler market, it is important to note the persistent tax disparity with their electric counterparts. Electric two-wheelers continue to enjoy a significantly lower GST rate of just 5 percent, a policy designed to promote eco-friendly transportation and reduce reliance on fossil fuels.7 The new proposal places conventional bikes at 18 percent, a positive change but one that maintains a clear tax advantage for electric vehicles. This indicates a delicate balancing act on the government’s part. It aims to give a vital shot in the arm to the legacy ICE market to ensure short-term stability while continuing to incentivize the long-term transition towards electric mobility.

4.5 The Booming Pre-Owned Market: The New Competitor

The challenging market conditions of the past few years, coupled with rising prices for new vehicles, have fueled a remarkable surge in the pre-owned and refurbished two-wheeler market.20 This segment has become a viable and trusted alternative for many consumers, especially in urban areas, driven by affordability and quality assurance.33 The proposed GST reduction on new bikes could directly challenge this growth. By narrowing the price gap between a new vehicle and a pre-owned one, the policy forces the pre-owned market to recalibrate its value proposition. Going forward, the new-bike market will be in direct competition with the used-bike segment, pushing both to innovate on pricing, warranties, and after-sales service to win over the price-sensitive buyer.

5. The Brand Story: Marketing the New Era of Mobility

5.1 The Art of the Campaign: Crafting the Narrative

The proposed GST reduction offers a golden opportunity for two-wheeler brands to craft a powerful and engaging marketing narrative. Rather than simply announcing a “Price Reduced!” campaign, manufacturers can frame the event as a celebration of a new era of affordable mobility. The timing is a perfect gift from the government, and the industry is merely passing on the cheer to its customers, making the purchase not just a transaction but a joyous milestone. This approach allows brands to tap into the festive spirit and present themselves as enablers of their customers’ aspirations.

5.2 Winning the Narrative: Key Messages and Channels

The messaging around this tax cut should be celebratory and benefit-oriented. The core message is clear: personal mobility is now more accessible than ever before. Key campaign messages can include: “Your Diwali Ride Just Got More Affordable,” “Unbox a New Beginning, Unbox a New Bike,” or “The Tax is Down, The Savings are Up.” The campaign should be multi-channel. Digital platforms are ideal for reaching the tech-savvy urban and semi-urban youth, leveraging social media, influencer marketing, and targeted ads. Simultaneously, traditional channels like local dealership events, print media, and radio campaigns remain crucial for penetrating the rural markets, which are the primary beneficiaries of this price reduction. To maximize online visibility, an effective SEO strategy is crucial. Brands should strategically weave high-impact keywords such as “GST on two-wheelers,” “Bike price reduction India,” “Diwali bike offers,” and “Two-wheeler GST cut” throughout their online content.7 Other key terms to use include “New GST slabs” and “Affordability of bikes,” along with model-specific phrases like “Hero Splendor price drop,” “Honda Activa GST,” “Bajaj Pulsar new price,” and “TVS Apache GST reduction” to directly reach potential buyers.

6. Final Verdict: The Likes, The Dislikes, and The Road Ahead

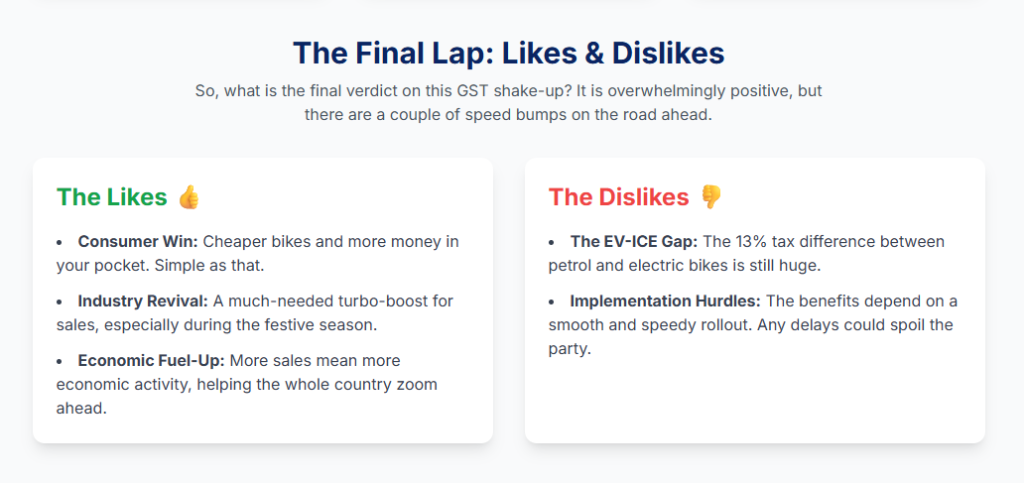

6.1 The Likes: A Triple Win

The proposed GST reduction for two-wheelers is a masterstroke of policy. It represents a triple win, creating a positive feedback loop for the consumer, the industry, and the government. For the consumer, it means lower prices, greater savings, and a newfound ability to retain more spending capacity. For the industry, it promises a much-needed sales revival, a boost to domestic demand, and a clear path to regaining market momentum after a difficult period. And for the government, this is a strategic move that, while reducing the per-unit tax, is expected to drive higher sales volume and compliance, leading to greater long-term revenue collection.

6.2 The Dislikes: A Few Bumps in the Road

While the reform is largely positive, it does come with a few unresolved complexities. The significant tax disparity between conventional ICE bikes (18 percent) and electric two-wheelers (5 percent) remains, and while it serves to incentivize the transition to EVs, it also places the legacy market at a disadvantage. Furthermore, the success of the reform hinges on a smooth and swift implementation, as any delays could dampen consumer enthusiasm and push back the expected market revival.

6.3 The Final Word: A New Dawn for Indian Mobility

The proposed GST reform is a landmark moment poised to reshape the Indian two-wheeler market. By recognizing the two-wheeler as a necessity for the masses and not a luxury, the government is making a fundamental shift in its approach to mobility. This policy change, timed to perfection with the festive season, is more than a tax cut; it is an economic stimulus package designed to boost consumption, drive growth, and make personal mobility more accessible than ever before. It is a new dawn for the industry, and the road ahead looks ready for a truly compelling ride.

Credible Sources:

- https://economictimes.indiatimes.com/news/economy/policy/gst-2-0-to-offer-treatment-for-other-pain-points-too/articleshow/123337880.cms

- https://www.bikewale.com/news/two-wheelers-may-see-gst-cut-to-18-percent-by-diwali/

- https://www.indiatoday.in/business/story/removal-of-12-tax-slab-among-key-reforms-to-be-discussed-in-gst-council-meetings-in-september-sources-2771661-2025-08-15

- https://auto.hindustantimes.com/auto/cars/passenger-cars-two-wheelers-could-get-cheaper-under-next-gen-gst-reform-41755345669935.html

- https://economictimes.indiatimes.com/news/economy/policy/govt-mulls-gst-simplification-with-two-slabs-of-5-and-18/articleshow/123322054.cms

- https://timesofindia.indiatimes.com/business/india-business/12-28-gst-slabs-set-to-go-sin-goods-face-40-levy/articleshow/123327848.cms

- https://www.researchandmarkets.com/report/india-two-wheeler-market

- https://www.marketresearchfuture.com/reports/india-two-wheeler-market-21400

- https://www.bikeleague.in/motorcycle-articles/motorcycle-analysis-articles/two-wheeler-sales-in-india-fy-2023-24-analysis-of-top-brands/

- https://m.economictimes.com/markets/stocks/news/5-year-market-share-trends-for-top-2-wheeler-cos-check-who-gained-and-who-slipped/indias-two-wheeler-market/slideshow/120567986.cms

- https://www.cartoq.com/car-news/indian-auto-industry-faces-q1-2025-slowdown-amid-changing-market-dynamics/

- https://ackodrive.com/news/indian-motorcycle-industry-faces-challenging-start-to-fy-2026/

- https://taxo.online/latest-news/12-06-2024-siam-seeks-gst-reduction-on-two-wheelers/

- https://ackodrive.com/news/siam-requests-government-to-reduce-gst-on-two-wheelers-to-12-18/

- https://www.livemint.com/market/stock-market-news/gst-reforms-what-may-get-cheaper-after-narendra-modis-next-generation-goods-and-services-tax-in-india-11755315915136.html

- https://groww.in/p/tax/gst-on-bikes

- https://ackodrive.com/news/hmsi-director-requests-for-lesser-gst-on-scooters-and-motorcycles/

- https://www.livemint.com/news/india/will-the-proposed-gst-reforms-make-cars-and-suvs-cheaper-in-india-here-s-what-to-now-11755416776065.html

- https://scanx.trade/stock-market-news/stocks/india-mulls-engine-based-gst-restructure-for-automobiles-small-cars-may-see-tax-cut/16957273

- https://economictimes.indiatimes.com/news/economy/policy/growth-to-get-lift-boost-for-demand-after-gst-rationalisation-say-economists/articleshow/123338221.cms

- https://etedge-insights.com/industry/auto-and-transportation/indias-refurbished-two-wheeler-market-accelerates-growth-in-2025/

- https://timesofindia.indiatimes.com/business/india-business/two-wheeler-industry-races-15-17-ahead-moderate-growth-of-2-4-seen-in-2025-from-a-high-base/articleshow/117109407.cms

- https://timesofindia.indiatimes.com/business/india-business/gst-rationalisation-proposed-lower-slabs-to-lift-domestic-consumption-aid-essentials-durables-what-economists-say/articleshow/123343806.cms

- https://www.heromotocorp.com/en-in/motorcycles/practical/splendor-plus-price-in-pune-in-mah.html

- https://www.zigwheels.com/hero-bikes/splendor-plus/on-road-price-pune

- https://www.autox.com/new-bikes/honda/activa-6g/price-in-pune/

- https://www.91wheels.com/scooters/honda/activa-6g/price-in-pune

- https://www.tvsmotor.com/tvs-apache/apache-rtr-160-4v/price-in-pune

- https://www.autox.com/new-bikes/tvs/apache-rtr-160/price-in-pune/

- https://bikes.tractorjunction.com/en/bajaj-bikes/pulsar-150/price-in-pune

- https://www.91wheels.com/bikes/bajaj/pulsar-150-twin-disc/price-in-pune

- https://www.team-bhp.com/forum/indian-car-scene/298002-gst-reforms-will-gst-cars-go-up-down-remain-same.html

- https://www.mobilityoutlook.com/features/pre-owned-two-wheelers-gain-traction-in-india/

- https://www.kenresearch.com/industry-reports/india-used-two-wheeler-industry-research

- https://www.aroscop.com/consumer-outlook-towards-buying-preowned-electric-2-wheelers/

Works cited

- GST 2.0 to offer treatment for other pain points too, accessed August 18, 2025, https://economictimes.indiatimes.com/news/economy/policy/gst-2-0-to-offer-treatment-for-other-pain-points-too/articleshow/123337880.cms

- GST Council may drop 12% slab, more tax reforms in September meeting: Sources, accessed August 18, 2025, https://www.indiatoday.in/business/story/removal-of-12-tax-slab-among-key-reforms-to-be-discussed-in-gst-council-meetings-in-september-sources-2771661-2025-08-15

- GST reforms: Govt mulls 5% slab for common man items; Luxury, sin goods to face 40% tax, accessed August 18, 2025, https://economictimes.indiatimes.com/news/economy/policy/govt-mulls-gst-simplification-with-two-slabs-of-5-and-18/articleshow/123322054.cms

- Passenger cars & two-wheelers could get cheaper under next-gen GST reform | HT Auto, accessed August 18, 2025, https://auto.hindustantimes.com/auto/cars/passenger-cars-two-wheelers-could-get-cheaper-under-next-gen-gst-reform-41755345669935.html

- GST reforms: What may get cheaper after Narendra Modi’s next-generation Goods and Services Tax in India? | Stock Market News – Mint, accessed August 18, 2025, https://www.livemint.com/market/stock-market-news/gst-reforms-what-may-get-cheaper-after-narendra-modis-next-generation-goods-and-services-tax-in-india-11755315915136.html

- Two-Wheelers May See GST Cut to 18 percent by Diwali – BikeWale, accessed August 18, 2025, https://www.bikewale.com/news/two-wheelers-may-see-gst-cut-to-18-percent-by-diwali/

- GST on Bikes/Two Wheelers 2025 – Groww, accessed August 18, 2025, https://groww.in/p/tax/gst-on-bikes

- GST on Bikes in India 2024: Latest GST Rates on Two-Wheelers …, accessed August 18, 2025, https://www.bajajfinserv.in/gst-rate-on-bikes-in-india

- GST on Bikes and Two-Wheelers: GST Rates for 100cc, 125cc …, accessed August 18, 2025, https://razorpay.com/learn/gst-on-bikes/

- GST Rates and HSN Code 8711 for Motorcycles – Swipe, accessed August 18, 2025, https://getswipe.in/blog/article/gst-rates-and-hsn-code-8711-for-motorcycles

- GST rates to come down drastically! 99% of items in 12% bracket may move to 5%; here’s how you will benefit, accessed August 18, 2025, https://timesofindia.indiatimes.com/business/india-business/gst-rates-to-come-down-drastically-99-of-items-in-12-bracket-may-move-to-5-heres-how-you-will-benefit/articleshow/123322030.cms

- 12% & 28% GST slabs set to go, sin goods face 40% levy, accessed August 18, 2025, https://timesofindia.indiatimes.com/business/india-business/12-28-gst-slabs-set-to-go-sin-goods-face-40-levy/articleshow/123327848.cms

- Next-gen GST reforms by Diwali, says PM Modi; just two rates: 5% & 18% | Business News, accessed August 18, 2025, https://indianexpress.com/article/business/gst-reforms-diwali-pm-modi-independence-day-speech-10190655/

- GST 2.0 to treat more than rate cuts: Revamp to fix classification disputes, duty inversions- What officials say, accessed August 18, 2025, https://timesofindia.indiatimes.com/business/india-business/gst-2-0-to-treat-more-than-rate-cuts-revamp-to-fix-classification-disputes-duty-inversions-council-meet-on-september-18-19/articleshow/123342943.cms

- GST reforms push: PM’s Diwali GST rate cut plan seen as timely; experts say it will boost economy, accessed August 18, 2025, https://timesofindia.indiatimes.com/business/india-business/gst-reforms-push-pms-diwali-gst-rate-cut-plan-seen-as-timely-experts-say-it-will-boost-economy/articleshow/123321331.cms

- Splendor + Price in Pune | Explore Variants & Features – Hero MotoCorp, accessed August 18, 2025, https://www.heromotocorp.com/en-in/motorcycles/practical/splendor-plus-price-in-pune-in-mah.html

- Honda Activa 6g Price in Pune – autoX, accessed August 18, 2025, https://www.autox.com/new-bikes/honda/activa-6g/price-in-pune/

- Tvs Apache Rtr 160 Price in Pune – autoX, accessed August 18, 2025, https://www.autox.com/new-bikes/tvs/apache-rtr-160/price-in-pune/

- Bajaj Pulsar 150 Twin Disc On Road Price in Pune – 91Wheels, accessed August 18, 2025, https://www.91wheels.com/bikes/bajaj/pulsar-150-twin-disc/price-in-pune

- Indian Auto Industry Faces Q1 2025 Slowdown, Two Wheelers & Passenger Vehicle Sales Dip – Cartoq, accessed August 18, 2025, https://www.cartoq.com/car-news/indian-auto-industry-faces-q1-2025-slowdown-amid-changing-market-dynamics/

- Indian Motorcycle Industry Faces Challenging Start to FY2026, accessed August 18, 2025, https://ackodrive.com/news/indian-motorcycle-industry-faces-challenging-start-to-fy-2026/

- Two-wheeler industry races 15-17% ahead; moderate growth of 2-4% seen in 2025 from a high base – The Times of India, accessed August 18, 2025, https://timesofindia.indiatimes.com/business/india-business/two-wheeler-industry-races-15-17-ahead-moderate-growth-of-2-4-seen-in-2025-from-a-high-base/articleshow/117109407.cms

- Growth to get lift, boost for demand after GST rationalisation, say economists, accessed August 18, 2025, https://economictimes.indiatimes.com/news/economy/policy/growth-to-get-lift-boost-for-demand-after-gst-rationalisation-say-economists/articleshow/123338221.cms

- GST rationalisation proposed! Lower slabs to lift domestic consumption, aid essentials & durables— what do economists say, accessed August 18, 2025, https://timesofindia.indiatimes.com/business/india-business/gst-rationalisation-proposed-lower-slabs-to-lift-domestic-consumption-aid-essentials-durables-what-economists-say/articleshow/123343806.cms

- Two wheeler Sales in India FY 2023-24 | Analysis of Top Brands …, accessed August 18, 2025, https://www.bikeleague.in/motorcycle-articles/motorcycle-analysis-articles/two-wheeler-sales-in-india-fy-2023-24-analysis-of-top-brands/

- 5-year market share trends for top 2-wheeler cos. Check who gained and who slipped, accessed August 18, 2025, https://m.economictimes.com/markets/stocks/news/5-year-market-share-trends-for-top-2-wheeler-cos-check-who-gained-and-who-slipped/indias-two-wheeler-market/slideshow/120567986.cms

- 12.06.2024: Siam seeks GST reduction on two-wheelers – Taxo Online, accessed August 18, 2025, https://taxo.online/latest-news/12-06-2024-siam-seeks-gst-reduction-on-two-wheelers/

- SIAM Requests Government To Reduce GST On Two-Wheelers To …, accessed August 18, 2025, https://ackodrive.com/news/siam-requests-government-to-reduce-gst-on-two-wheelers-to-12-18/

- HMSI Director Requests For Lesser GST On Scooters And Motorcycles – ACKO Drive, accessed August 18, 2025, https://ackodrive.com/news/hmsi-director-requests-for-lesser-gst-on-scooters-and-motorcycles/

- Two-wheelers not luxury, tax cut needed to spur demand: HMSI – The Economic Times, accessed August 18, 2025, https://m.economictimes.com/industry/auto/two-wheelers-three-wheelers/two-wheelers-not-luxury-tax-cut-needed-to-spur-demand-hmsi/articleshow/117572042.cms

- razorpay.com, accessed August 18, 2025, https://razorpay.com/learn/gst-on-bikes/#:~:text=GST%20on%20Electric%20Bikes,slab%2C%20which%20is%20significantly%20higher.

- India’s refurbished two-wheeler market accelerates growth in 2025 – ET Edge Insights, accessed August 18, 2025, https://etedge-insights.com/industry/auto-and-transportation/indias-refurbished-two-wheeler-market-accelerates-growth-in-2025/

- Pre-Owned Two-Wheelers Gain Traction In India – Mobility Outlook, accessed August 18, 2025, https://www.mobilityoutlook.com/features/pre-owned-two-wheelers-gain-traction-in-india/

- India Used Two Wheeler Market Outlook to FY 2030 – Ken Research, accessed August 18, 2025, https://www.kenresearch.com/industry-reports/india-used-two-wheeler-industry-research

- Consumer Outlook towards buying preowned & electric 2-wheelers Digital Advertising Services | Ad Serving Platform in India – Aroscop, accessed August 18, 2025, https://www.aroscop.com/consumer-outlook-towards-buying-preowned-electric-2-wheelers/

- Cars, SUVs, Two-Wheelers Could Attract GST Cut Soon – Details – NDTV, accessed August 18, 2025, https://www.ndtv.com/auto/cars-suvs-two-wheelers-could-attract-gst-cut-soon-details-9101368

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter