I. Executive Summary

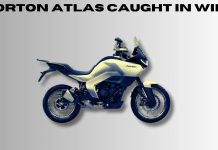

The recently signed Comprehensive Economic and Trade Agreement (CETA) between India and the United Kingdom marks a pivotal moment in their bilateral economic relationship. Formally inked on July 24, 2025, this agreement is designed to significantly expand two-way trade, with an ambitious joint goal of doubling bilateral trade from its current approximate $56 billion to $112 billion or even $120 billion by 2030.1 The automotive sector has been explicitly identified as a crucial contributor to achieving this ambitious growth target.3

This agreement is not merely a volume-driven trade pact but a strategic instrument aimed at aligning India’s burgeoning manufacturing and research and development (R&D) capabilities with the UK’s advanced technological landscape and sustainability objectives. This implies a deeper industrial policy coherence, positioning India as a global manufacturing and innovation hub, particularly in future-oriented sectors like electric vehicles (EVs) and sustainable technologies. It signals a move beyond traditional goods exports to a more integrated and value-added partnership.

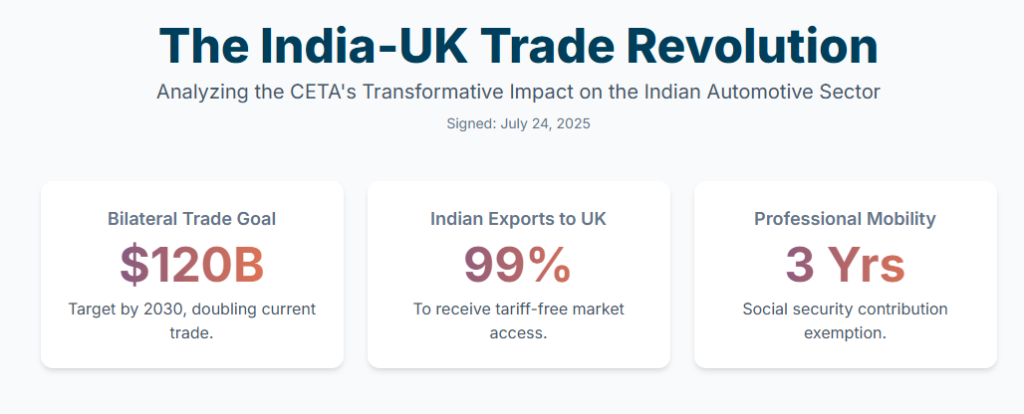

A cornerstone of CETA is the unprecedented 99% duty-free access granted for Indian exports to the UK market, specifically encompassing critical segments such as automotive components, engineering goods, and electric mobility components.1 This provision is set to substantially enhance India’s export competitiveness. Furthermore, the agreement introduces liberalized visa processes and a crucial social security exemption for Indian professionals, a vital measure for facilitating talent mobility in automotive R&D, design, and technical services.3

Conversely, India has made strategic concessions on UK automotive imports. Duties on premium British cars and electric vehicles will be reduced to 10% under specified quotas.1 This is expected to introduce new competitive dynamics within India’s high-end automotive market. The specific provisions and outcomes of CETA, particularly concerning sensitive sectors like automobiles, are likely to exert considerable influence on India’s ongoing and future Free Trade Agreement (FTA) negotiations with other major global economies. This suggests a strategic evolution in India’s broader trade policy landscape, where CETA serves as a benchmark for future liberalization efforts.

Overall, the deal is strategically positioned to benefit Indian auto component manufacturers, Micro, Small and Medium Enterprises (MSMEs), and Electric Vehicle (EV) startups through enhanced market access, streamlined regulatory processes, and significant opportunities for joint ventures and sustainable manufacturing collaborations.3

II. Introduction: CETA – A New Chapter in India-UK Economic Relations

The formal designation of the agreement, the Comprehensive Economic and Trade Agreement (CETA), underscores its broad and deep scope. This landmark pact was officially signed in London on July 24, 2025, with the presence of Prime Ministers Narendra Modi and Keir Starmer. The agreement was formally inked by India’s Commerce and Industry Minister Piyush Goyal and UK Secretary of State for Business and Trade Jonathan Reynolds.1

The primary objective driving CETA is a substantial increase in two-way trade, aiming to elevate the current trade volume of nearly $56 billion to $112 billion 1 or $120 billion 2 by 2030. This agreement represents a significant milestone, as it is India’s first major FTA with a developed European economy and is considered the UK’s most ambitious trade deal since Brexit.7 Projections indicate the deal could contribute an additional £25-30 billion (approximately $35 billion) annually to bilateral trade by 2040.7 Beyond trade figures, CETA also introduces the India-U.K. Vision 2035 framework, which supersedes the earlier ‘Roadmap 2030’ and outlines six key pillars for strengthening bilateral cooperation across various sectors.9

CETA is structured as a comprehensive pact, integrating tariff reductions, simplified rules for trade, robust provisions for services, and measures aimed at facilitating professional mobility between the two nations.13 A cornerstone of the agreement is the elimination or reduction of tariffs across 99% of Indian export lines to the UK, effectively covering nearly 100% of India’s trade value.1 In a reciprocal move, India has committed to significantly lowering its import duties on UK goods, with changes impacting 90% of tariff lines. Of these, approximately 85% of products will become entirely tariff-free over a ten-year implementation period.4

This agreement is not merely a conventional trade agreement focused on the exchange of physical goods. Instead, it represents a strategic partnership designed to integrate the two economies across multiple dimensions, including human capital, technology, and regulatory alignment. This holistic approach is expected to generate compounding positive effects on various sectors, including the automotive industry, by fostering deeper collaboration and mutual growth. The agreement is structured into 30 chapters, addressing a wide array of areas including trade in goods, services, rules of origin, customs procedures, sanitary and phytosanitary (SPS) measures, technical barriers to trade (TBT), digital trade, intellectual property rights, innovation, government procurement, provisions for Small and Medium-Sized Enterprises (MSMEs), labor standards, and environmental considerations.10

The CETA signifies a significant evolution in India’s global trade strategy. It demonstrates a move towards deeper integration with developed economies and showcases a more confident and nuanced approach to trade negotiations. This involves a willingness to liberalize certain sectors while strategically safeguarding others, implying a broader strategic intent to leverage FTAs for national economic modernization and enhanced global competitiveness. As Commerce Secretary Sunil Barthwal noted, this agreement “stands apart from India’s previous free trade deals, as it reflects the country’s evolution into a more mature economy,” engaging in areas previously untouched and striking a balance between “sensitivities and strengths”.14

III. CETA’s Direct Impact on the Indian Automotive Sector

A. Tariff Liberalization and Market Access

99% Tariff-Free Access for Indian Automotive Exports to the UK

A key provision of CETA is the guarantee of duty-free entry for 99% of Indian exports into British markets. This comprehensive coverage explicitly includes “automotive, engineering goods, and electric mobility components,” which is set to provide India with substantial benefits.1 This tariff elimination is expected to significantly enhance India’s competitiveness in the British market, particularly for high-value auto components, EV sub-assemblies, and precision-engineered parts, aligning seamlessly with the UK’s sustainability objectives.3

Leading Indian auto component manufacturers, such as Bharat Forge, Motherson Sumi, and Sona Comstar, are anticipated to directly benefit from zero or significantly reduced tariffs on their exports to the UK. This provides them with a crucial cost advantage in one of Europe’s premier automotive markets.7 The explicit mention of these high-value components and specific, advanced manufacturing companies indicates a deliberate strategic focus. This moves beyond simply increasing export volume to enhancing export value, incentivizing Indian manufacturers to invest further in advanced manufacturing processes, cutting-edge technology, and R&D to meet the sophisticated demands of the UK automotive industry. This transformation aims to elevate India’s role in global automotive supply chains from a low-cost supplier to a high-value, specialized partner.

Furthermore, the provision of tariff-free access for Indian automotive exports directly aligns with the broader national objective of establishing India as a global manufacturing hub through the ‘Make in India’ campaign.15 CETA provides a critical and preferential export market for products manufactured under this initiative. This not only validates the government’s push for domestic manufacturing but is also likely to attract more foreign direct investment into India’s automotive and component manufacturing sector, specifically targeting the UK market as a key export destination.

Impact of Reduced Tariffs on UK Automotive Imports to India

Under the CETA, import duties on UK-built vehicles, encompassing both petrol/diesel and electric models, will be drastically reduced from over 100% to approximately 10%.1 This significant reduction is, however, subject to a defined annual quota. For electric vehicles specifically, an annual quota of around 22,000 premium models will be eligible for the reduced 10% duty, with any imports exceeding this threshold reverting to standard duty rates.7

Premium British automotive manufacturers, including Rolls-Royce, Jaguar Land Rover, Bentley, and Aston Martin, along with premium motorcycle brands such as Triumph, Norton, and BSA, are expected to see reduced prices in the Indian market, thereby facilitating their enhanced entry.1 To qualify for these reduced rates, vehicles must adhere to strict “Rules of Origin” requirements, ensuring a specified share of value-addition takes place in the UK. This measure is designed to prevent transshipment and ensure that only genuine UK products benefit from the agreement.7

While CETA presents clear benefits for Indian exports, the reduction of import duties on UK luxury and EV models directly gives rise to concerns about potential disruption to India’s domestic premium market.16 This highlights the inherent tension in trade agreements, where market opening can lead to both opportunities and competitive pressures for domestic industries. Indian luxury and EV manufacturers will need to proactively enhance their competitiveness. This could involve strategies such as increased localization of production, intensified R&D efforts, and the development of unique value-added features to effectively counter the increased competition from more affordably priced UK imports. This dynamic is expected to spur innovation but also demands strategic adaptation from domestic players.

The agreement by India to reduce the duty on imported automobiles to 10% also sets a significant precedent. This decision is expected to influence “high-stakes negotiations that New Delhi is currently engaged in,” particularly with EU member nations such as France, Germany, and Italy.17 The automotive import provisions within the CETA deal could therefore serve as a significant benchmark for India’s future trade agreements. This may lead to similar tariff reductions for premium vehicles from other major automotive manufacturing regions, thereby reshaping the competitive landscape of India’s luxury and high-end EV market in the long term and potentially influencing global automotive trade flows into India.

The following table summarizes the key tariff reductions for automotive goods under CETA:

Table 1: Key Tariff Reductions for Automotive Goods under CETA

| Category | Current Tariff (Approximate) | CETA Tariff (Approximate) | Key Limitations / Phased Implementation |

| Indian Automotive, Engineering Goods, EV Components Exports to UK | Varied (up to 21.5% for some marine products, 12% for textiles) 4 | 0% / Duty-Free 1 | 99% of Indian exports covered 1 |

| UK Premium Cars & Petrol/Diesel Vehicles Imports to India | >100% 4 | 10% 4 | Subject to defined annual quota 4 |

| UK Premium Electric Vehicles (EVs) Imports to India | >100% 1 | 10% 1 | Annual quota of ~22,000 premium models; beyond this, standard duties apply 7 |

| UK Premium Motorcycles Imports to India | >100% 7 | Concessional duty relief 7 | Similar duty relief as premium cars 7 |

B. Enhanced Professional Mobility and Talent Exchange

Liberalized Visa Processes

The CETA pact is designed to significantly boost opportunities for Indian automotive professionals, including engineers, designers, and R&D experts, by streamlining their movement between the two countries.3 The agreement incorporates liberalized visa processes and simplified entry categories, which are expected to reduce bureaucratic hurdles for a range of professionals, including engineers, architects, IT professionals, and financial analysts, seeking roles in either country.3 It also aims to streamline processes for short-term work visas and consulting opportunities, facilitating easier cross-border engagements for recent graduates and experienced professionals alike.15

Chapter 10 of the CETA document, titled “Temporary Movement of Natural Persons,” specifically outlines commitments for temporary entry. This includes provisions for “managers and specialists” with a temporary stay for a period not exceeding three years (with possible extension) and “graduate trainees” with a temporary stay for a period not exceeding one year.10 The liberalization of visa processes for these key personnel directly addresses the necessity for “global design and technology networks” (as highlighted by Piyush Goyal 3) and enables “real-time knowledge exchange”.5

This provision goes beyond mere labor mobility; it is about fostering the seamless flow of specialized expertise. This aspect of CETA is critical for accelerating innovation within the Indian automotive sector, particularly in burgeoning areas like electric vehicles and green technologies. It enables Indian firms to deploy teams to the UK for collaborative R&D, design support, and technical services, thereby fostering a robust two-way flow of advanced skills, best practices, and technological advancements.

Social Security Exemption

A significant provision within CETA is the exemption for Indian professionals and their employers from UK social security contributions for a period of up to three years, under the Double Contribution Convention.3 This exemption is specifically designed to enhance cost competitiveness for Indian firms and make overseas employment opportunities more financially viable and attractive for Indian professionals.3

This directly translates into a tangible reduction in operational costs for Indian companies deploying their professionals to the UK. This is not merely an individual benefit but a strategic cost advantage for Indian service firms operating internationally. This provision makes Indian IT-led automotive services, engineering consultancies, and design firms significantly more competitive in the UK market. It encourages greater deployment of Indian talent and facilitates stronger Business-to-Business (B2B) partnerships, thereby providing a substantial boost to India’s services exports within the automotive domain.

Mutual Recognition of Qualifications and Streamlined Work Opportunities

While not explicitly detailed for the automotive sector in the provided information, CETA is broadly expected to bring improvements in the mutual recognition of qualifications, which could help reduce bureaucratic hurdles for various professionals.15 Furthermore, India and the UK have agreed to negotiate specific mutual recognition agreements (MRAs) to facilitate the movement of professionals, citing examples like nurses, accountants, and architects.14 Although specific MRAs for automotive professionals are not explicitly detailed, the general commitment to MRAs and improved mutual recognition of qualifications signals an underlying intent to dismantle non-tariff barriers related to human capital. This implies a systemic effort to harmonize professional standards.

This suggests a long-term trajectory towards greater professional integration and harmonization of standards between India and the UK. If and when extended to the automotive sector, such recognition would further streamline cross-border project collaboration, talent acquisition, and the establishment of Indian automotive R&D centers or design studios in the UK, fostering deeper industry linkages.

The following table summarizes the key provisions for professional mobility under CETA:

Table 2: CETA Provisions for Professional Mobility in the Automotive Sector

| Professional Category | Visa Process / Entry Category | Maximum Stay Duration | Key Financial Benefit | Other Relevant Benefits |

| Engineers, Designers, R&D Experts | Liberalized visa processes, simplified entry categories 3 | Not explicitly detailed for all, but Managers/Specialists up to 3 years (extendable), Graduate Trainees up to 1 year 18 | Exemption from UK Social Security Contributions (up to 3 years) 3 | Facilitates knowledge transfer, collaborative innovation, real-time knowledge exchange 3 |

| Managers, Specialists | Temporary entry under Chapter 10 18 | Up to 3 years, with possible extension 18 | Exemption from UK Social Security Contributions (up to 3 years) 18 | Reduced bureaucratic hurdles, improved cost competitiveness for Indian firms 3 |

| Graduate Trainees | Temporary entry under Chapter 10 18 | Up to 1 year 18 | Exemption from UK Social Security Contributions (up to 3 years) 18 | New bilateral programs, alignment with industry needs 15 |

| Short-term Business Visitors | Temporary entry without work permit 18 | Not exceeding 90 days in any 6-month period 18 | Not explicitly detailed | Meetings, consultations, research, training, attending conferences 18 |

| All Indian Professionals | Streamlined short-term work visas, consulting opportunities 15 | Varies by category | Exemption from UK Social Security Contributions (up to 3 years) 3 | Expected improvements in mutual recognition of qualifications (general) 15 |

IV. Strategic Opportunities and Sectoral Growth Drivers

A. Boosting Export Opportunities and Global Value Chain Integration

Identification of Key Indian States and Regions Poised for Export Growth in Auto Components

Several Indian states are strategically positioned to derive substantial economic benefits from CETA. Specifically, Maharashtra (with hubs like Pune and Mumbai), Tamil Nadu (Chennai), Punjab (Ludhiana), and Haryana (Gurgaon and Faridabad) are identified for anticipated higher exports of auto components and parts.20 The agreement’s provision of zero-duty access for 99% of Indian exports directly includes auto components and engineering products, bolstering these regions’ export potential.3 The explicit identification of specific states and their established automotive manufacturing hubs indicates that the benefits of CETA are not merely national but are expected to catalyze localized economic growth and reinforce existing regional industrial clusters. This implies that CETA will foster increased regional specialization within India’s automotive supply chain. This could lead to a concentrated surge in investment and job creation in these identified areas, further solidifying India’s position as a globally competitive manufacturing hub for specific auto components and parts.

Facilitating Deeper Integration into Global Automotive Supply Chains

The CETA deal is anticipated to usher in a new era of economic cooperation, fostering greater market access, technology partnerships, and deeper value chain integration between the Indian and British automotive industries.8 This agreement is perceived as a critical step in enabling India to evolve “from an exporter of parts to a partner in mobility innovation,” signifying a qualitative shift in its global role.5 The emphasis on “technology partnerships,” “value chain integration” 8, and India becoming a “partner in mobility innovation” 5 suggests a qualitative shift from a purely transactional export relationship. This indicates a move towards a more collaborative and integrated model of production and innovation. This implies that CETA could facilitate joint R&D initiatives, co-development of cutting-edge automotive technologies (particularly in green mobility), and shared intellectual property. Such collaboration would lead to the creation of more resilient, innovative, and globally integrated automotive supply chains that effectively leverage both India’s manufacturing prowess and the UK’s technological leadership.

Streamlined Regulatory Processes

The agreement incorporates specific provisions aimed at reducing non-tariff barriers and streamlining regulatory processes, with a particular focus on areas such as electric mobility, precision engineering, and lightweight materials.3 Simplified Rules of Origin (RoO) are a key feature, allowing exporters to self-certify the origin of products, which significantly reduces administrative time and paperwork. For small consignments valued under £1,000, there is no requirement for origin documentation, a provision that particularly supports e-commerce and small businesses.13 Non-tariff barriers and complex regulatory procedures often pose as significant, if not greater, impediments to trade as tariffs themselves. The explicit commitment to streamline these processes 3 and simplify Rules of Origin 13 directly addresses these friction points, which frequently inflate the cost and complexity of international trade. This will lead to a substantial reduction in compliance costs and lead times for Indian automotive exporters. The improved efficiency and predictability of trade operations will, in turn, boost the overall competitiveness and attractiveness of Indian automotive products in the UK market. This is particularly beneficial for MSMEs and burgeoning e-commerce channels.

B. Fostering Sustainable Manufacturing and Innovation

Collaboration in Green and Digital Technologies, Clean Energy, and Advanced Materials

The CETA actively promotes collaboration in R&D, skilling initiatives, and innovation, with a strong emphasis on green and digital technologies. These areas are deemed crucial for the long-term competitiveness and sustainability of the automotive sector.8 India’s strategic focus on sustainable manufacturing and smart mobility finds a perfect synergy with the UK’s eco-focused policies. The agreement covers vital areas such as clean energy, hydrogen fuel technology, and precision engineering.5 The deal also creates significant opportunities for young professionals specializing in clean energy, ESG (Environmental, Social, and Governance) consulting, green finance, and climate-tech solutions, fostering a new generation of skilled talent.15

Anupam Kumar, co-founder and CEO of MiniMines, highlighted the FTA’s potential to influence the rare-earth and magnets ecosystem through tariff adjustments, which is critical for electric vehicle manufacturing.7 The repeated and explicit emphasis across multiple sources on “green mobility,” “clean energy,” “hydrogen fuel technology,” “climate-tech solutions,” and “sustainable manufacturing” 3 strongly indicates that CETA is deliberately designed to actively support and accelerate the global transition towards sustainable transport. This positions CETA as a significant enabler for India’s ambitious green automotive agenda. It will facilitate India’s access to the UK’s advanced green technologies, encourage investment in sustainable manufacturing practices, and foster collaborative R&D in critical areas like EV battery components and alternative fuels. Ultimately, this will accelerate India’s comprehensive shift towards a cleaner, more environmentally friendly automotive ecosystem.

Alignment with India’s ‘Make in India’ and Clean Mobility Initiatives

India’s national drive to become a global manufacturing hub through the ‘Make in India’ campaign finds strong resonance and support within the framework of the CETA.15 The agreement is specifically designed to accelerate the adoption of green and intelligent transport solutions in both countries.3 The explicit alignment of CETA’s provisions with India’s domestic industrial policies, such as ‘Make in India’ and its clean mobility initiatives 3, creates a highly coherent and supportive policy environment. This policy consistency, when combined with enhanced market access, significantly elevates India’s attractiveness as a destination for foreign investment in automotive manufacturing. CETA is highly likely to attract increased investment from UK and other international players into India’s automotive manufacturing sector, particularly in the production of electric vehicles and sustainable components. Investors can leverage India’s growing production capabilities for tariff-free access to the UK market, further bolstered by a supportive and aligned policy framework.

C. Empowering MSMEs and EV Startups

Easier Cross-Border Trade Access and Reduced Regulatory Burdens for MSMEs

A fundamental objective of CETA is to empower Micro, Small and Medium Enterprises (MSMEs) by providing them with significantly easier access to cross-border trade opportunities.15 MSMEs are specifically anticipated to benefit from reduced regulatory burdens and improved market access, which are critical for their global expansion.5 The agreement is designed to support MSMEs and stimulate job creation, particularly in labor-intensive sectors.6 Notably, simplified Rules of Origin for small consignments (under £1,000) eliminate the requirement for origin documentation, a provision that directly supports e-commerce and small businesses by reducing compliance friction.13

Traditional Free Trade Agreements often disproportionately benefit larger corporations with established international supply chains. CETA’s explicit and repeated focus on empowering MSMEs 5, including specific provisions like simplified rules for small consignments 13, signals a deliberate effort to make global trade more accessible to a broader base of Indian businesses. This strategic focus could lead to a significant increase in MSME participation in automotive component exports, fostering a more diversified and resilient export base for India. This, in turn, has the potential to drive substantial local economic growth and create employment opportunities in smaller, regional manufacturing hubs across the country.

New Avenues for EV Startups, Including Market Entry, Investment, and Joint Ventures in the UK

For Original Equipment Manufacturers (OEMs), MSMEs, and especially EV startups, the CETA offers unprecedented opportunities to scale operations, penetrate new export markets, and forge strategic joint ventures, thereby accelerating the adoption of green and intelligent transport solutions.3 EV startups are now given the “green light” to enter new markets and actively form partnerships or joint ventures with UK-based players, facilitating technology transfer and market access.5 A specific annual quota of 22,000 premium EVs has been established, allowing Indian companies to import or export under significantly reduced duties, providing a clear pathway for EV trade.7

The explicit mention of EV startups gaining market entry, investment, and joint venture opportunities 3, coupled with the specific quota for premium EVs 7, underscores a targeted effort to boost India’s nascent but rapidly growing electric vehicle industry. This indicates a strategic intent to nurture this sector. CETA is highly likely to act as a powerful accelerator for India’s EV ecosystem. It will encourage domestic innovation, attract foreign investment into Indian EV startups, and facilitate the rapid development of a robust EV supply chain by directly connecting Indian players with the more mature UK EV market and its advanced technologies.

V. Stakeholder Perspectives and Industry Outlook

Insights from Commerce and Industry Minister Piyush Goyal on CETA’s Benefits for the Auto Sector

Commerce and Industry Minister Piyush Goyal articulated that “CETA unlocks tariff-free access for key Indian sectors, including auto components and engineering goods. It enables smoother movement of skilled professionals, which is crucial for industries like automotive that depend on global design and technology networks”.3 Minister Goyal was a key signatory of the agreement alongside his UK counterpart, Jonathan Reynolds, signifying his direct involvement and endorsement of the pact’s benefits.1 Minister Goyal’s statement goes beyond a general endorsement of CETA. He explicitly links the benefits of tariff-free access and professional mobility to the automotive sector’s specific reliance on “global design and technology networks”.3 This indicates a nuanced understanding of the industry’s needs and how the agreement addresses them. This suggests a clear governmental strategy to leverage CETA not merely for increasing trade volume but for enhancing India’s technological capabilities and global integration within the automotive sector. This implies a commitment to continued policy support and strategic initiatives for these critical areas.

Dr. Anish Shah’s (Mahindra Group) Views on CETA’s Transformative Potential for Green Mobility and Job Creation

Dr. Anish Shah, the Managing Director & CEO of Mahindra Group, hailed CETA as a “transformative moment.” He emphasized its potential to “help create high-quality jobs and drive growth in future-friendly industries like green mobility”.5 The perspective from a prominent leader of a major Indian automotive conglomerate like Mahindra Group, focusing on “high-quality jobs” and “future-friendly industries like green mobility” 5, provides significant industry validation for the forward-looking aspects of CETA. This indicates that the agreement’s value extends beyond immediate financial gains to long-term strategic alignment and sustainability. This suggests that leading Indian automotive players view CETA as a crucial enabler for their strategic shift towards sustainable and advanced mobility solutions. This perspective indicates a strong potential for substantial private sector investment and the creation of high-value jobs in these emerging and critical areas within the automotive industry.

Broader Industry Sentiment and Future Growth Projections

The Automotive Component Manufacturers Association of India (ACMA) anticipates that CETA will lead to increased exports and streamlined processes, particularly in the high-growth areas of electric mobility, precision engineering, and lightweight materials.8 ACMA also expressed optimism that the agreement would foster greater collaboration in R&D, skilling initiatives, and innovation, especially concerning green and digital technologies, which are vital for the sector’s long-term competitiveness.8

While not specific to auto, the fisheries sector, for instance, projects a substantial 70% increase in exports to the UK due to improved cost competitiveness under CETA.6 This serves as an indicator of similar high growth potential for other sectors benefiting from duty-free access, including automotive. ACMA’s focus on “R&D, skilling, and innovation” 8, coupled with the general benefits to “labour-intensive industries” 1, suggests that the impact of CETA extends beyond direct manufacturing and trade. It implies a positive ripple effect across the broader automotive ecosystem. The agreement is expected to create a significant positive multiplier effect, stimulating growth in ancillary industries such as skill development programs, R&D services, and raw material suppliers that support the automotive sector. This will contribute to fostering a more comprehensive, technologically advanced, and robust industrial base in India, enhancing its overall global competitiveness.

VI. Challenges, Safeguards, and Recommendations

A. Potential Challenges and Competitive Dynamics

Increased Competition from UK Imports in Specific Segments

Indian manufacturers of luxury and electric vehicle (EV) models, including prominent players like Tata Motors, Mahindra, and Maruti’s premium segment, have expressed concerns that increased British imports could disrupt the high-end of the Indian market. Their apprehension is focused on a future scenario where UK cars enter at scale under preferential tariffs.16 British-manufactured vehicles, such as Jaguars and Land Rovers, are set to benefit significantly from tariff reductions, enabling their enhanced entry into India’s vehicle market and making these premium British vehicles more affordable for Indian consumers.4

While CETA presents clear benefits for Indian exports, the reduction of import duties on UK luxury and EV models 4 directly gives rise to concerns about potential disruption to India’s domestic premium market.16 This highlights the inherent tension in trade agreements, where market opening can lead to both opportunities and competitive pressures for domestic industries. Indian luxury and EV manufacturers will need to proactively enhance their competitiveness. This could involve strategies such as increased localization of production, intensified R&D efforts, and the development of unique value-added features to effectively counter the increased competition from more affordably priced UK imports. This dynamic is expected to spur innovation but also demands strategic adaptation from domestic players.

Need for Indian Exporters to Meet UK Standards and Certifications

While specific to seafood, the mention that states like Kerala, Tamil Nadu, Gujarat, Maharashtra, and Andhra Pradesh are well-positioned for export surges if they continue to align with the UK’s sanitary and phytosanitary standards 6 implies a broader requirement for Indian exporters across sectors, including automotive, to meet stringent UK quality and regulatory standards. To fully capitalize on the agreement, the Indian government must intensify awareness campaigns, actively assist exporters in complying with British standards, and invest significantly in upgrading port logistics, testing laboratories, and certification infrastructure.16

With the reduction of traditional tariff barriers, the focus of trade friction naturally shifts to non-tariff barriers, particularly compliance with the importing country’s standards and certifications.6 This underscores that market access is not solely determined by duties but equally by regulatory alignment and quality assurance. Indian automotive exporters, especially MSMEs, will require substantial support and investment to upgrade their manufacturing processes, quality control systems, and testing facilities to meet the stringent UK regulatory and technical standards. This compliance is absolutely crucial for fully capitalizing on the tariff advantages offered by CETA and ensuring long-term market penetration.

The UK’s Ratification Process and its Timeline

CETA has received approval from India’s Cabinet but requires ratification by the British Parliament before it can officially take effect.11 Commerce Secretary Sunil Barthwal noted that while the UK’s ratification process might take under a year, India intends to utilize this interim period to build the capacity of its exporters and educate them on how to effectively leverage the benefits of the deal.14 The mention of the UK’s ratification process and India’s proactive plan to use this period for exporter capacity building 11 highlights that the signing of the agreement is merely an initial step.

The true realization of economic benefits hinges on effective implementation and thorough preparation by all stakeholders. The actual economic benefits of CETA will only fully materialize once the agreement is ratified and becomes operational. The interim period is therefore critically important for Indian businesses to deeply understand the nuances of the agreement, adapt their strategic approaches, and ensure full compliance with new regulations. This underscores the vital need for continuous and proactive collaboration between government bodies and industry players.

B. Indian Safeguards and Phased Implementation

Overview of India’s Protective Measures for Sensitive Sectors

India has strategically protected several sensitive domestic sectors under the trade deal. These include dairy products, cereals, millets, pulses, vegetables, and high-value items such as gold, jewellery, lab-grown diamonds, and certain essential oils. Additionally, critical energy fuels, marine vessels, used clothing, important polymers and their monofilaments, smartphones, and optical fibers are also excluded from immediate tariff concessions.12 Specifically, India has confirmed that no tariff concessions were granted on highly sensitive items like dairy products, apples, oats, and edible oils.12 To prevent circumvention, product-specific Rules of Origin (RoO) have been meticulously established, incorporating value-addition requirements.

These rules are designed to prevent transshipment and ensure that goods from third countries do not unfairly benefit under the agreement.7 The detailed enumeration of protected sectors 12 and the strict adherence to Rules of Origin 7 clearly demonstrate India’s cautious and pragmatic approach to trade liberalization. This strategy is designed to ensure that domestic industries are not unduly harmed by sudden import surges resulting from the agreement. This balanced approach aims to maximize export gains for Indian industries while simultaneously minimizing internal disruption to sensitive domestic sectors. It reflects a mature trade policy that prioritizes national economic interests and strategically safeguards vulnerable segments, potentially setting a significant precedent for India’s future Free Trade Agreements.

Phased Tariff Reductions and Strict Rules of Origin

For strategically important goods, particularly those where domestic manufacturing is being actively strengthened under initiatives like ‘Make in India’ and Production-Linked Incentive (PLI) schemes, tariff concessions will be implemented gradually over periods of five, seven, or ten years.14 India has committed to considerably lowering its import duties, with changes impacting 90% of tariff lines. Approximately 85% of these products are slated to become entirely free from tariffs over a ten-year phased implementation period.4

The phased implementation of tariff reductions 4 for certain goods, especially those linked to ‘Make in India’ and PLI schemes, is a deliberate strategic choice. It ensures that Indian industries are not immediately exposed to the full force of international competition upon the agreement’s entry into force. This gradual approach provides a crucial window for Indian industries, including relevant segments of the automotive sector, to adapt, innovate, and build their competitiveness before facing complete tariff liberalization. This strategy aims to ensure a smoother transition and protect significant domestic investments, fostering sustainable growth rather than sudden disruption.

C. Recommendations for Maximizing CETA’s Benefits

Government Support for Awareness, Compliance, and Infrastructure Development

To maximize the benefits of CETA, the Indian government must proactively launch extensive awareness campaigns, provide comprehensive support to exporters for complying with British standards, and invest significantly in upgrading port logistics, testing laboratories, and certification infrastructure.16 Effective coordination between central and state governments is essential, particularly in managing potential impacts such as the transition in alcohol revenue and preparing MSMEs for increased competition in public procurement.16

India has committed to utilizing the UK’s ratification period to build the capacity of its exporters and educate them on how to effectively leverage the provisions of the deal.14 The recommendations explicitly emphasize non-tariff aspects such as awareness, compliance, infrastructure development, and inter-state coordination.14 This highlights that merely signing an FTA is insufficient for realizing its full potential; its success is critically dependent on robust trade facilitation mechanisms. Effective implementation of CETA requires substantial and sustained investment in trade-supporting infrastructure and services. Furthermore, proactive government outreach and capacity-building initiatives are crucial to ensure that Indian businesses, particularly MSMEs, can fully understand and utilize the agreement’s provisions, thereby overcoming practical hurdles and maximizing their gains.

Industry Strategies for R&D, Quality Enhancement, and Strategic Partnerships

The Indian auto component sector should strategically focus on capitalizing on enhanced export opportunities and leveraging streamlined regulatory processes, particularly in high-growth areas like electric mobility, precision engineering, and lightweight materials.8 Industry players are encouraged to promote deeper collaboration in R&D, skilling initiatives, and innovation, with a specific emphasis on green and digital technologies, which are vital for long-term competitiveness.8 For OEMs, MSMEs, and EV startups, the CETA deal presents a unique opportunity to scale operations, successfully enter new export markets, and forge strategic joint ventures with UK counterparts.3

While CETA provides a conducive policy and tariff framework, the ultimate responsibility for success rests with the industry’s proactive adaptation. The recommendations for increased R&D, stringent quality enhancement, and the formation of strategic partnerships 3 indicate that a passive reliance solely on tariff benefits will be insufficient for long-term growth. Indian automotive companies must strategically invest in adopting advanced technologies, continuously upskill their workforce, and actively seek collaborative partnerships with UK firms. This proactive approach will enable them to move up the global value chain, enhance product quality, and effectively capitalize on the green mobility transition, thereby ensuring sustained competitiveness in the global market.

VII. Conclusion: Charting the Future of India-UK Automotive Trade

The India-UK Comprehensive Economic and Trade Agreement (CETA) transcends the scope of a mere trade deal; it is envisioned as a strategic roadmap for the next chapter in Indian automotive growth, effectively opening doors to a global hub like the UK.5 The agreement is expected to deliver significant benefits to the Indian automobile and auto components industry through unparalleled tariff-free access, streamlined professional mobility, and substantial opportunities for global integration.3 CETA is designed to empower every segment of the automotive value chain, from burgeoning MSMEs and innovative EV startups to skilled designers and engineers.5

The deal sets an ambitious target to double bilateral trade by 2030, with the automotive sector explicitly identified as a key contributor to achieving this goal.3 It is poised to facilitate India’s evolution from primarily an exporter of parts to a full-fledged partner in mobility innovation, steering towards a greener, smarter, and more interconnected future.5 The concluding statements emphasize CETA not just as a trade agreement but as a “roadmap for the next chapter” and a catalyst for India’s transformation “from an exporter of parts to a partner in mobility innovation”.5 This language suggests a strategic vision that extends beyond mere bilateral trade figures, aiming to position India for a more prominent and influential role in the global automotive landscape.

As global automotive supply chains become increasingly interconnected and complex, India’s enhanced access to one of Europe’s most mature and technologically advanced markets under this robust FTA is expected to bring both strategic depth and significant commercial value to the sector’s global ambitions.3 CETA is therefore seen as a strategic enabler for India to achieve its long-term ambition of becoming a global leader in automotive manufacturing and innovation, particularly in sustainable and intelligent mobility solutions. By leveraging the UK market as both a gateway and a partner for advanced technology collaboration, India can accelerate its journey towards becoming a key player in the future of global mobility.

Sources

- India-UK trade deal: From cars, whisky to chocolates & cosmetics …, accessed July 27, 2025, https://timesofindia.indiatimes.com/business/india-business/india-uk-trade-deal-what-gets-cheaper-for-you-after-the-free-trade-agreement-check-list/articleshow/122887064.cms

- India-UK FTA: Trade deal to cut tariffs on UK goods from 15% to 3%; make imports affordable for Indian consumers, accessed July 27, 2025, https://timesofindia.indiatimes.com/business/india-business/india-uk-fta-trade-deal-to-cut-tariffs-on-uk-goods-from-15-to-3-make-imports-affordable-for-indian-consumers/articleshow/122879693.cms

- India–UK CETA set to boost auto industry through tariff-free access, mobility gains, accessed July 27, 2025, https://auto.economictimes.indiatimes.com/news/industry/india-uk-ceta-a-game-changer-for-the-auto-industry/122884778

- India-UK trade deal: How will the Free Trade Agreement benefit India? Top 10 takeaways for Indians, accessed July 27, 2025, https://timesofindia.indiatimes.com/business/india-business/india-uk-trade-deal-how-will-the-free-trade-agreement-benefit-india-top-10-takeaways-for-indians/articleshow/122880872.cms

- India–UK CETA Shifts Auto Sector Into Top Gear: Exports, EVs, and Talent to Soar!, accessed July 27, 2025, https://www.motoroids.com/news/india-uk-ceta-shifts-auto-sector-into-top-gear-exports-evs-and-talent-to-soar/

- India-UK trade deal: CETA opens duty-free access for Indian …, accessed July 27, 2025, https://timesofindia.indiatimes.com/business/india-business/india-uk-trade-deal-ceta-opens-duty-free-access-for-indian-seafood-exporters-eye-70-growth-boost/articleshow/122920869.cms

- Explained: What the India–UK FTA Means for the Auto Sector – Outlook Business, accessed July 27, 2025, https://www.outlookbusiness.com/economy-and-policy/explained-what-the-indiauk-fta-means-for-the-auto-sector

- India-UK trade deal to usher in economic cooperation, tech partnerships: ACMA, accessed July 27, 2025, https://m.economictimes.com/industry/auto/auto-components/india-uk-trade-deal-to-usher-in-economic-cooperation-tech-partnerships-acma/articleshow/122884908.cms

- India-UK FTA: Unlocking Economic Potential – Vision IAS, accessed July 27, 2025, https://visionias.in/blog/current-affairs/india-uk-fta-unlocking-economic-potential

- Comprehensive Economic and Trade Agreement between the …, accessed July 27, 2025, https://www.gov.uk/government/collections/comprehensive-economic-and-trade-agreement-between-the-united-kingdom-of-great-britain-and-northern-ireland-and-india

- India-UK Trade Deal Advances Delhi’s Manufacturing and Supply Chain and Strategy, accessed July 27, 2025, https://bowergroupasia.com/india-uk-trade-deal-advances-delhis-manufacturing-and-supply-chain-and-strategy/

- Explained: What is Free Trade Agreement? Why it matters to India’s economy, accessed July 27, 2025, https://timesofindia.indiatimes.com/business/india-business/explained-what-is-free-trade-agreement-and-why-it-matters-to-indias-economy/articleshow/122884691.cms

- 99% Tariff Elimination, Stronger Bilateral Trade, Catalyst for Inclusive Growth – PIB, accessed July 27, 2025, https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154945&ModuleId=3

- ‘Balancing strengths-sensitivities’: India secures safeguards for key sectors in UK FTA; import access to be phased, accessed July 27, 2025, https://timesofindia.indiatimes.com/business/india-business/balancing-strengths-sensitivities-india-secures-safeguards-for-key-sectors-in-uk-fta-import-access-to-be-phased/articleshow/122919468.cms

- CETA signed between India and UK: What it means for students and …, accessed July 27, 2025, https://timesofindia.indiatimes.com/education/study-abroad/ceta-signed-between-india-and-uk-what-it-means-for-students-and-young-professionals-in-both-countries/articleshow/122903995.cms

- Why the India-UK free trade pact is a calculated embrace – India Today, accessed July 27, 2025, https://www.indiatoday.in/india-today-insight/story/why-the-india-uk-free-trade-pact-is-a-calculated-embrace-2761663-2025-07-26

- How past FTAs shaped UK deal & how UK agreement will change past pacts, accessed July 27, 2025, https://timesofindia.indiatimes.com/business/india-business/how-past-ftas-shaped-uk-deal-how-uk-agreement-will-change-past-pacts/articleshow/122891336.cms

- UK-India CETA Annex 10A.ii: Schedules of Specific Commitments on Temporary Movement of Natural Persons, accessed July 27, 2025, https://assets.publishing.service.gov.uk/media/687f5e68ae8555bab409a0e5/uk-india-ceta-annex-10aii-schedules-of-specific-commitments-on-temporary-movement-of-natural-persons-schedule-of-the-united-kingdom.pdf

- UK-India CETA Chapter 10: Temporary Movement of Natural Persons – GOV.UK, accessed July 27, 2025, https://assets.publishing.service.gov.uk/media/687f5d4b791bb4d8c309a0bb/uk-india-ceta-chapter-10-temporary-movement-of-natural-persons.pdf

- India-UK trade deal: These states and sectors may benefit most from tariff cuts; full list here, accessed July 27, 2025, https://timesofindia.indiatimes.com/business/india-business/india-uk-trade-deal-these-states-and-sectors-may-benefit-most-from-tariff-cuts-full-list-here/articleshow/122919019.cms

- India-UK FTA: Key highlights – The Economic Times, accessed July 27, 2025, https://m.economictimes.com/news/economy/foreign-trade/india-uk-fta-key-highlights/articleshow/122881399.cms

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter