Key Points:

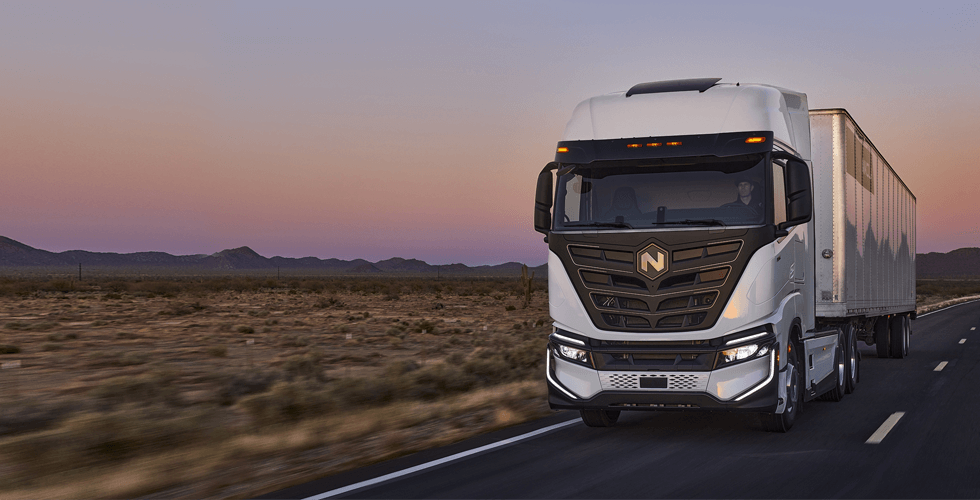

- Nikola’s shares fell more than 26% following a complicated second-quarter report, news of the CEO’s departure, and shareholder approval to issue new stock.

- CEO Michael Lohscheller stepped down immediately due to a family health matter, and Steve Girsky, former General Motors vice chairman and Nikola’s current board chair, took over as the new CEO.

- In the second quarter, Nikola reported a loss per share of 20 cents, slightly better than the estimated 22 cents loss. Revenue came in at $15.36 million, just below the expected $15.4 million.

- Nikola’s net loss for the quarter was $217.8 million, or 31 cents per share. This figure includes $77.8 million related to discontinued operations, including the closure of the former Romeo Power battery-pack factory in California, which Nikola acquired last year.

- Despite challenges, Nikola was able to raise $233.2 million in cash during the second quarter through stock sales and the sale of some physical assets.

- Shareholders approved the issuance of new stock, potentially doubling the total number of outstanding shares and raising additional cash later in the year.

Production stopped

- Nikola temporarily suspended production of its battery-electric truck to reconfigure its production line for both the battery-electric truck and a new longer-range version powered by a hydrogen fuel cell.

- Nikola has orders for 202 fuel-cell trucks from 18 fleet customers, with production for customers starting in July, and the first deliveries are expected in September.

- During the second quarter, Nikola delivered 45 battery-electric trucks to dealers, and 66 of those were sold to end customers, representing the company’s best quarterly retail result.

- For the third quarter, Nikola expects to deliver between 60 and 90 trucks, generating revenue between $18 million and $28 million. For the full year, the company anticipates delivering between 300 and 400 trucks, generating revenue between $100 million and $130 million, with total research and development expenses between $210 million and $220 million.

The shares of electric truck maker Nikola fell more than 26% following a complex second-quarter report, news of the CEO’s departure, and shareholder approval to issue new stock. Michael Lohscheller, the CEO of Nikola, stepped down immediately due to a family health matter, and the current board chair, Steve Girsky, took over as the new CEO. Lohscheller will continue in an advisory role until the end of September to assist with the transition.

Regarding the second-quarter earnings report, here are the key numbers compared to Refinitiv consensus estimates:

- Loss per share: 20 cents vs. 22 cents (better than expected)

- Revenue: $15.36 million vs. $15.4 million (slightly lower than expected)

Nikola’s net loss for the quarter was $217.8 million, or 31 cents per share. This figure includes $77.8 million related to discontinued operations, including the closure of the former Romeo Power battery-pack factory in California, which Nikola acquired last year.

In the same quarter of the previous year, Nikola lost $173 million, or 41 cents per share. Excluding the discontinued operations, Nikola had no adjustments in the second quarter of 2023. On an adjusted basis, it lost 25 cents per share in the year-ago quarter. Revenue also declined to $15.4 million from $18.1 million in the second quarter of 2022.

Challenges

Despite the challenges, Nikola was able to raise $233.2 million in cash during the second quarter through stock sales and the sale of some physical assets. Additionally, it won approval from shareholders to issue new stock, which could double its total number of shares outstanding and raise more cash later in the year. As of June 30, Nikola had $226.7 million in cash on hand, up from $121.1 million as of March 31.

Nikola recently announced plans to temporarily suspend production of its battery-electric truck to reconfigure its production line for both the battery-electric truck and a new longer-range version powered by a hydrogen fuel cell. The company expects the new fuel-cell truck to become its primary product in the future and plans to build the battery-electric version only when it has orders in hand.

The company currently has orders for 202 fuel-cell trucks from 18 fleet customers. Production of fuel-cell trucks for customers began on July 31, with the first deliveries expected to occur in September. During the second quarter, Nikola delivered 45 battery-electric trucks to dealers, and 66 of those were sold to end customers, representing the company’s best quarterly retail result.

For the third quarter, Nikola expects to deliver between 60 and 90 trucks, generating revenue between $18 million and $28 million. For the full year, the company anticipates delivering between 300 and 400 trucks, generating revenue between $100 million and $130 million, with total research and development expenses between $210 million and $220 million.