I. Executive Summary: The Anatomy of a Market Collapse

The U.S. motorcycle market in 2025 is grappling with a severe structural contraction, characterized by an unprecedented convergence of supply excess and sustained demand deficiency. Industry reports define the current situation not as a cyclical dip but as a full-blown crisis.1 The turbulence is quantified by a significant decline in sales volume, reflecting a fundamental shift in consumer behavior away from discretionary purchases.2 Through the first half of 2025, the U.S. domestic market sold 271,205 units, marking a 9.2% decrease year-over-year and representing the weakest start to the year in over a decade.2

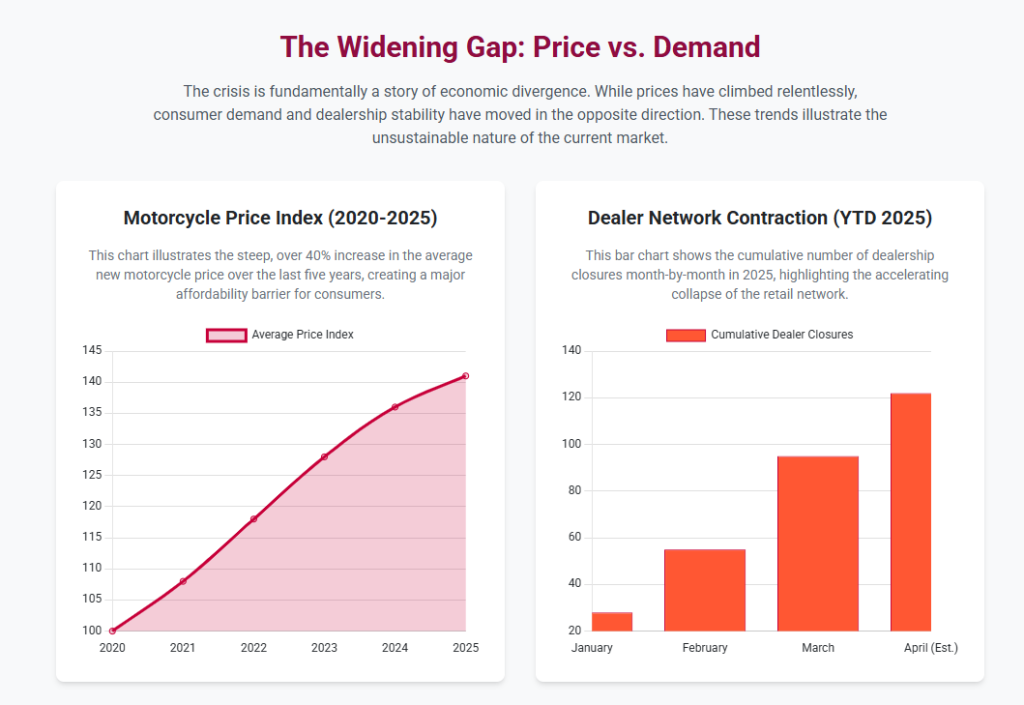

The crisis is fueled by a toxic convergence of three primary vectors: the pricing shock, the credit squeeze, and post-pandemic overproduction. Average motorcycle prices have surged by over 40%, reaching up to 47% since 2020, severely outpacing typical wage and inflation growth for the core consumer base.1 Simultaneously, elevated interest rates have made financing prohibitive, with prime borrowers facing rates in the 10 to 15% range, driving high monthly payments and spiking repossession rates.1 This financial inaccessibility has met a massive inventory glut, resulting from manufacturers miscalculating the longevity of the 2021-2022 leisure boom.6

Major manufacturers have responded with drastic actions. Harley-Davidson, for instance, strategically decreased global motorcycle shipments by 28% in Q2 2025 to reduce dealer stock.7 This contraction is taking a severe toll on the retail layer, with nearly 120 dealerships closing since January and attrition estimated to reach 400 powersports retailers by year-end, driven primarily by unsustainable floorplan financing costs on stagnant inventory.4 Market analysis suggests that stabilization is not forecast until late 2026, contingent on a significant reduction in Federal Reserve interest rates and sustained OEM production discipline.3

II. Quantitative Analysis of the Demand Shock and Inventory Glut

2.1. The Sales Freefall: H1 2025 Metrics

The start of 2025 was described as awful for the domestic market, signaling rapidly declining consumer demand.3 Year-to-Date (YTD) sales through June totaled 271,205 units, representing a 9.2% year-over-year decline.3 The first quarter was particularly challenging, with March registrations plummeting by 10.6%.2 This marks the worst overall start to the U.S. domestic market in the last decade, reflecting consumer anxiety levels comparable to those seen immediately following the 2008 financial crisis.2

Critically, the downturn accelerated even as the industry entered its traditional peak selling season. April saw a sales drop of 6.3%, May declined by 5.6%, and June delivered the most severe monthly contraction at 11.4%.2 The consistency and acceleration of these negative figures across the most crucial sales months suggest that the crisis is a deeply rooted structural problem rather than a Q1 anomaly. The fact that the rate of decline increased during the spring and early summer confirms that underlying macroeconomic pressures, such as high prices and high financing costs, are overwhelming typical seasonal enthusiasm, signaling a fundamental, sustained rejection of current pricing models.

2.2. Retail Velocity and Traffic Contraction

The demand shock is profoundly evident at the retail level. Dealership foot traffic has reportedly dropped nearly 40% compared to the previous year 1, indicating a massive collapse in organic customer engagement. This is compounded by reports that online inquiry levels have halved.1

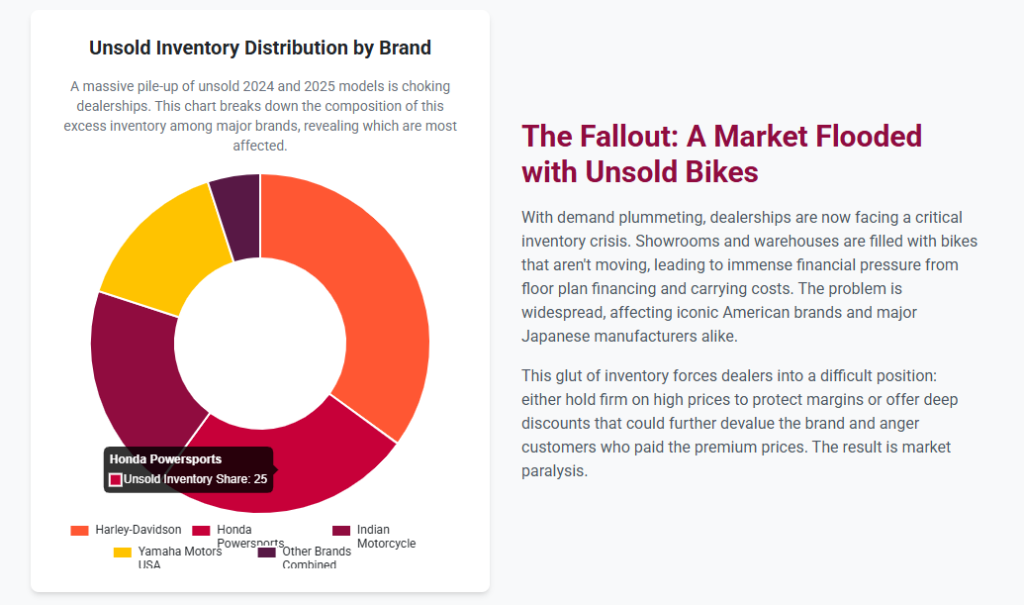

The misalignment between manufacturing output and sales has created a critical inventory crisis, with estimates suggesting some dealers are now holding over 280 days of supply of unsold units.5 This level of inventory overhang necessitates aggressive liquidation. Some reports suggest that the inventory spike reached 195% in certain market segments.9 This situation forces new motorcycle pricing downward via massive incentives, with deals reportedly reaching 30 to 40% off in desperate dealer liquidation efforts.10 This intense discounting and high days of supply ensure significant profit erosion throughout the supply chain for the foreseeable future and guarantees that the value of existing used inventory will collapse, creating a destructive cycle for the entire market ecosystem.

Table 1: U.S. New Motorcycle Market Performance and Inventory Metrics (H1 2025)

| Metric | Value / Rate of Change | Baseline Comparison | Significance |

| YTD Sales Volume (H1 2025) | 271,205 units | -9.2% Year-over-Year (YOY) | Weakest start in over a decade 2 |

| Average Motorcycle Price Surge (2020-2025) | >40% (up to 47%) | Pre-Pandemic Levels (2019) | Primary barrier to entry for consumers 1 |

| Peak Monthly Decline (June 2025) | -11.4% YOY | March (-10.6%) | Crisis is accelerating into peak season 2 |

| Dealer Foot Traffic Decline | Approx. -40% YOY | Previous Year (2024) | Indicates collapse of organic demand 1 |

III. Macroeconomic Headwinds and the Affordability Barrier

3.1. Inflation, Pricing, and Disposable Income Erosion

The structural affordability crisis is defined by the fact that the average motorcycle price has surged by over 40% since 2020, changing the fundamental financial equation for consumers.1 Motorcycles are classified as discretionary purchases—representing leisure and lifestyle rather than essential transportation—making their demand acutely sensitive to tightening household budgets and anxieties about overall economic stability.2 When consumer finances are squeezed, these purchases are among the first to be deferred entirely.

3.2. The Credit Crunch: Financing as the Primary Demand Obstacle

High interest rates are cited as a particularly potent force dampening motorcycle sales.2 Motorcycle loan rates are typically higher than those for comparable automobile loans.12 In the current environment, prime borrowers face effective annual percentage rates (APR) that can range from 10% to 15%.5 This cost is compounded by lenders tightening approval standards due to heightened risk.6 The cumulative effect of the high sticker price and elevated interest rates means that monthly payments for new motorcycles often exceed $700 once insurance and maintenance are included, making ownership financially untenable for the mass market.1

This pressure has a disproportionate effect on the middle market. For many potential buyers, the middleweight motorcycle that cost $8,000 in 2019 now costs $12,000 or more, plus the increased financing cost.4 This price inflation pushes otherwise upgrade-ready consumers out of the new market and either into the collapsing used market or out of motorcycling entirely, crippling the pipeline of future high-margin premium buyers.

3.3. The Repossession Cycle and Collapse of the Used Market

The extreme financial strain on consumers is resulting in rapidly climbing default rates, leading to a spike in repossessions—levels not seen since the 2008 financial crisis.1 This influx of repossessed bikes into the wholesale auction market is systematically crashing used motorcycle prices across nearly every segment.6

Data from the National Powersports Auctions indicates that used bike wholesale prices showed significant year-over-year declines in July: metric cruisers fell 6%, and the broad sport/street bike category dropped 11%.13 Even the domestic cruiser category, a traditional strength, saw a sharp 13% decline in average prices between April and July, suggesting acute distress in what was previously a solid category.13

This collapse in used prices drives a destructive negative equity feedback loop. Owners who purchased or refinanced their motorcycles during the price inflation and rising rate period of 2020–2022 are now severely “underwater,” owing more than their motorcycle is worth.6 This negative equity eliminates a massive segment of potential new buyers (upgrade buyers) who cannot afford to trade in their current bike, thereby accelerating the new bike sales freefall.

Table 2: Key Financial Pressure Points on Consumers and Dealers (2025)

| Financial Vector | Observed Impact / Rate | Market Segment Affected | Causal Factor |

| Consumer Interest Rates (Financing) | 10% – 15% (for prime borrowers) | All discretionary purchases | Sustained elevated central bank rates 2 |

| Used Motorcycle Price Collapse | -2% to -11% YOY (Sport/Street worst hit) | Used inventory, existing owner equity | Repossession flood and new bike discounting 6 |

| Repossession Rate | Highest since 2008 crisis | Financed vehicles purchased at peak prices | Negative equity and payment strain 1 |

| Floorplan Expense Burden | Severely elevated cost of carrying debt | Powersports dealers with high DoSD | Inventory stagnation + high interest rates 4 |

IV. The Dealership Financial Ecosystem Under Pressure

4.1. Floorplan Financing: The Ticking Clock

Floorplan financing serves as the core line of credit that allows dealers to stock inventory.14 The dealer is required to pay interest on this debt until the motorcycle is sold. With inventory stagnation estimates reaching 280+ days of supply 5, the dealer is forced to pay recurring interest for extremely long periods. In the context of elevated interest rates, these floorplan interest expenses balloon into overwhelming operating costs, rapidly eroding already tight dealer margins and creating severe financial strain.4 The inventory glut, which originated from OEM overproduction, has been effectively transferred to the dealer network, forcing retailers to absorb the prohibitive financing burden.6

4.2. The Retail Attrition and Consolidation Wave

The severe financial strain created by high floorplan costs and low sales velocity is causing a rapid consolidation wave. Approximately 120 motorcycle dealerships had already closed their doors since January 2025 4, and industry estimates anticipate a total of about 400 powersports retail closures by the end of the year.8 This attrition disproportionately eliminates “weaker players” and smaller, less diversified dealers, leading to market consolidation and a reduction in the geographical reach of manufacturers.8

The crisis has also exacerbated the underlying structural tension between manufacturers and retailers. Some analysts suggest that the ongoing high attrition rate is enabling manufacturers to thin out underperforming or financially weak dealerships, potentially as a precursor to shifting toward a hybrid direct-to-consumer sales model.10 Consolidating sales volume into fewer, larger, and better-capitalized dealers simplifies distribution logistics and grants OEMs greater control over pricing and inventory, mirroring trends observed in the wider vehicle market.

4.3. Mitigation Strategies: The Shift to Service-Centric Models

Dealers positioned to survive the crisis must pivot away from new unit sales dependence toward maximizing non-transactional revenue streams. The current environment demands maximizing customer relations, emphasizing value-added factors, and prioritizing high-margin service departments, parts, and accessories sales.17 This revenue stream is crucial for covering fixed operating costs and mitigating the burden of floorplan interest. The long-term viability of the physical dealer model will be determined by its ability to execute these fixed operations successfully, as these non-transactional revenue streams—service, maintenance, and community building—are the elements that a direct-to-consumer model struggles to replicate.17

V. OEM Response Strategies and Performance Divergence

5.1. Harley-Davidson (H-D): Strategic Retreat and Financial Pain

Harley-Davidson has implemented a strategic retreat to correct inventory imbalances, but at a significant financial cost. The company reported a 19% decrease in consolidated revenue in Q2 2025, driven by a dramatic 69% decline in operating income for its motorcycle segment (HDMC).19 To actively reduce the global dealer inventory glut, H-D decreased global motorcycle shipments by 28% year-over-year.7 Global retail sales were down 15%, with North American retail sales declining 17%, confirming that customers are adopting a “pause or wait and see approach” due to higher interest rates and general macro uncertainty.19 The bulk of this sales decline was concentrated specifically within the large cruiser category, reflecting the market’s aversion to high-priced, high-interest financing.20 H-D’s strategy involves sacrificing short-term profitability to ensure the long-term health of the dealer network by lowering their floorplan financing exposure.

5.2. Japanese Majors: Volume Adjustments and Market Leadership Shift

Major Japanese manufacturers are experiencing significant volume adjustments. Honda lost its market leadership position, recording a 10.5% decrease in sales year-over-year.3 Honda is reportedly slashing US shipments and may be targeting significant reductions in its dealer count through an internal initiative.10 Yamaha also reported a decline in both Q1 2025 revenue and profits due to lower unit sales and elevated labor and administrative costs. The company has explicitly implemented flexible production adjustments aligned with inventory levels and demand trends.23 Yamaha also cited global tariff uncertainty, which, as H-D also noted 7, forces OEMs to choose between absorbing higher import costs (further hurting margins) or passing them to consumers (exacerbating the affordability crisis), creating a psychological barrier that delays purchase decisions.

5.3. Indian Motorcycle and the Outlier: Kawasaki

Indian Motorcycle issued a “STOP SALE” dealer hold on specific VINs of its 2025 Scout motorcycles due to an ongoing investigation into a potential safety concern.24 While a recall/safety concern, this action nonetheless compounds the existing market distress by interrupting the sales flow of a key new model.

In stark contrast, Kawasaki was the single major manufacturer to thrive, achieving the historical top spot in the U.S. market by improving sales a substantial 17.7% year-over-year.3 This robust growth suggests that Kawasaki’s product focus on accessible, mid-range, and entry-level models—such as the Ninja 500 and Z900RS 21—is perfectly aligned with the current consumer shift toward affordability.

Table 3: Select OEM Performance and Strategic Adjustments (Early 2025)

| Manufacturer | Sales Change (YTD/Q2) | Shipment Change (Q2) | Primary Affected Segment | Key Strategic Action |

| Kawasaki | +17.7% (YTD) | N/A | Entry-level/Mid-Range | Captured market leadership via affordability 3 |

| Harley-Davidson | -17% (NA Retail Q2) | -28% (Global Shipments) | Large Cruiser | Drastic inventory reduction; significant margin sacrifice 7 |

| Honda | -10.5% (YTD) | Slashing Shipments (US) | N/A (Volume Brands) | Production/distribution alignment; loss of leadership 3 |

| Indian Motorcycle | N/A | Stop Sale / Allocation Halt | 2025 Scout (Specific VINs) | Safety recall compounded by market distress 24 |

VI. Market Restructuring: Segmentation and Future Trends

6.1. The Great Segment Shift

The U.S. market is undergoing a structural segmentation shift. The largest sales declines are hitting the premium and large cruiser segments, where H-D reported the bulk of its retail losses.20 Simultaneously, affordability-driven segments are showing relative resilience: entry-level models (200–400cc) are growing 26, and adventure-tourer and dual-sport bikes are offsetting declines in traditional categories.25

This market divergence is driven by an accelerated demographic shift. The Baby Boomer generation, the foundational demographic for the large cruiser segment, is aging out of riding.1 New riders are overwhelmingly price-sensitive and favor versatile platforms over traditional cruising. The inability of high-priced, high-interest premium models to attract this replacement demographic mandates a long-term pivot by high-end OEMs toward producing more accessible machines.

6.2. The Electric Vehicle (EV) Conundrum in the U.S.

Globally, the electric two-wheeler market experienced growth of 7.2% in the first half of 2025 28, demonstrating global momentum. However, the U.S. market remains resistant, with electric motorcycles estimated to hold only 3–5% market share in 2025.21 This low adoption rate stems from deep-seated cultural preferences for internal combustion engines, particularly in the cruiser segment, as well as high costs and underdeveloped charging infrastructure.27 Because the crisis is concentrated in the high-margin ICE premium segment, the lack of traction for EVs in the U.S. means manufacturers cannot rely on technological or environmental policy drivers to offset current financial losses, further complicating the stabilization strategy.

6.3. Global Context: U.S. as an Anomaly

The U.S. market contraction is not entirely mirrored globally. The worldwide motorcycle market is projected for moderate long-term growth, with a 3.9% CAGR between 2025 and 2035, driven by strong growth in Asia due to urbanization and utility needs.30 China’s market is recovering, with sales up 5.8% YTD August 2025, driven by the expanding middle class’s growing appetite for premium leisure two-wheelers (over 250cc).31 Europe, while also negative in 2025, faces challenges primarily related to manufacturers having to quickly clear dealer stock due to mandatory Euro 5 emissions regulation deadlines, a factor distinct from the generalized demand destruction seen in the U.S..32

VII. Strategic Implications and Stabilization Outlook (2026-2028)

7.1. Path to Inventory Correction and Market Normalization

The necessary inventory correction requires manufacturers to maintain the current production discipline, following the lead of actions such as H-D’s 28% shipment cuts 7, in order to absorb the immense glut of units. However, relief from macroeconomic headwinds will be slow. U.S. GDP growth is projected to moderate from 2.6% in 2025 to 2.1% in 2026, and real consumer spending growth is expected to slow from 2.9% to 1.4% over the same period.3 Furthermore, the Federal Reserve is forecasted to manage only 75 basis points of interest rate cuts over the next 24 months.3 Given the depth of the inventory overhang and the moderate pace of expected financial improvement, the market correction cycle is expected to extend well into 2026, with full stabilization likely not achieved until 2027 or 2028.

7.2. Long-Term Credit and Retail Constraints

The structural financing constraint poses a critical long-term bottleneck. As high interest rates persist, lenders, having incurred significant losses from the current wave of repossessions, will become structurally more selective in granting credit for discretionary purchases like motorcycles. Lenders may only approve financing at higher rates or longer terms, which increases the inherent credit risk. This prolonged restriction on credit access will suppress effective demand, independent of improvements in economic growth or normalized inventory levels.

For the retail sector, the inevitable outcome is a market served by a smaller, better-capitalized dealer network. The remaining dealerships must operate under the model validated by the current crisis: their success will be measured by revenue capture from high-margin service, parts, and accessories operations, rather than volume throughput of new units. The example set by Kawasaki’s success—efficient production of affordably priced, desirable platforms—establishes the blueprint for market growth in a permanently price-sensitive American consumer landscape.3 OEMs dependent on high average transaction prices must accept permanent volume contraction or execute a radical downward pivot in pricing strategy.

Sources

- The Motorcycle Market Crisis of 2025: An Industry in Free Fall – KiWAV motors, accessed on October 9, 2025, https://kiwavmotors.com/en/blog/the-motorcycle-market-crisis-of-2025-an-industry-in-free-fall

- The American Motorcycle Market Decline: What the 9.2% Drop Reveals About – C.S.M., accessed on October 9, 2025, https://www.csm-research.com/the-american-motorcycle-market-decline-what-the-9-2-drop-reveals-about-consumer-sentiment/

- United States Motorcycles Market – Data & Insight 2025 | MotorcyclesData, accessed on October 9, 2025, https://www.motorcyclesdata.com/2025/07/24/united-states-motorcycles-market/

- The Affordability Crisis: Why Entry-Level Motorcycles Are Thriving While – C.S.M., accessed on October 9, 2025, https://www.csm-research.com/the-affordability-crisis-why-entry-level-motorcycles-are-thriving-while-premium-brands-collapse/

- 2025 Motorcycle Market CRASH: Dealers Closing, Prices Collapsing & Repos Soaring, accessed on October 9, 2025, https://www.youtube.com/watch?v=SuFirSA5L0w

- EVERYONE IS BROKE And The Motorcycle Market Is SCREAMING IT – YouTube, accessed on October 9, 2025, https://www.youtube.com/watch?v=kOdT27Opwqg

- Harley-Davidson Delivers Second Quarter Financial Results and Announces HDFS Transaction with KKR and PIMCO, accessed on October 9, 2025, https://investor.harley-davidson.com/news/news-details/2025/Harley-Davidson-Delivers-Second-Quarter-Financial-Results-and-Announces-HDFS-Transaction-with-KKR-and-PIMCO/default.aspx

- About 400 powersports retail closures anticipated for 2025 – Auto Finance News, accessed on October 9, 2025, https://www.autofinancenews.net/allposts/powersports/about-400-powersports-retail-closures-anticipated-for-2025/

- IT BEGINS! The Motorcycle Market CRASH of 2025 – Inventory SPIKES 195% – YouTube, accessed on October 9, 2025, https://www.youtube.com/watch?v=qeKua6q85wA

- IT’S STARTING The Great Motorcycle Dealer Shutdown of 2025 – YouTube, accessed on October 9, 2025, https://www.youtube.com/watch?v=6DX-hR_cG80

- Motorsports Industry Pandemic Overproduction Crisis | Deals on New Motorcycles, accessed on October 9, 2025, https://motorcycleshippers.com/2024/11/motorsports-industry-covid-overproduction-crisis-deals-on-new-motorcycles

- Motorcycle Loan Benefits: Affordable Rates & Financing Options, accessed on October 9, 2025, https://www.envisioncu.com/Education/Learning/Financial-Education/Life-Changers/March-2025/Why-Choose-a-Motorcycle-Loan-Exploring-the-benefits-of-financing-your-dream-bike

- Seasonal trend in used motorcycle prices differs from the norm in 2025 – RevZilla, accessed on October 9, 2025, https://www.revzilla.com/common-tread/signs-of-weakness-in-used-motorcycle-sales

- Rising Interest Rates and Dealership Financial Strain – Dealerslink, accessed on October 9, 2025, https://public.dealerslink.com/rising-interest-rates-and-dealership-financial-strain/

- What you need to know about floorplan financing | Powersports Business, accessed on October 9, 2025, https://powersportsbusiness.com/blogs/dealer-consultants/2016/10/27/what-you-need-to-know-about-floorplan-financing/

- One Small (but Mighty) Win for Floor plan Lenders in the Big Beautiful Bill – Blog | Vero – Insights on Wholesale Lending & Asset Finance, accessed on October 9, 2025, https://www.vero-technologies.com/news/one-small-but-mighty-win-for-floorplan-lenders-in-the-big-beautiful-bill

- Motorcycle Economics: Brick and Mortar Compression | Moto Adventurer, accessed on October 9, 2025, https://motoadventurer.com/2023/03/24/motorcycle-economics-brick-and-mortar-compression/

- Looking to Sell Your Dealership? Why Systems Outweigh Inventory – YouTube, accessed on October 9, 2025, https://www.youtube.com/watch?v=6xe4zmwQ5H0

- Earnings call transcript: Harley-Davidson sees 19% revenue drop in Q2 2025, accessed on October 9, 2025, https://www.investing.com/news/transcripts/earnings-call-transcript-harleydavidson-sees-19-revenue-drop-in-q2-2025-93CH-4160744

- Harley-Davidson Delivers Fourth Quarter and Full Year Financial Results and 2025 Outlook, accessed on October 9, 2025, https://investor.harley-davidson.com/news/news-details/2025/Harley-Davidson-Delivers-Fourth-Quarter-and-Full-Year-Financial-Results-and-2025-Outlook/default.aspx

- 2025 New Model Motorcycle Trends: Innovations & Market Shifts – Accio, accessed on October 9, 2025, https://www.accio.com/business/trend-of-novomodel-motorcycles

- Honda Dealerships are PULLING Motorcycles in 2025 (Here’s Why) – YouTube, accessed on October 9, 2025, https://www.youtube.com/watch?v=T6nNMiQhxJM

- Consolidated Business Results Summary – First Three Months of the Fiscal Year Ending December 31, 2025 – News releases | Yamaha Motor Co., Ltd., accessed on October 9, 2025, https://global.yamaha-motor.com/news/2025/0513/result.html

- DEALER HOLD – nhtsa, accessed on October 9, 2025, https://static.nhtsa.gov/odi/tsbs/2025/MC-11016250-0001.pdf

- A tale of two markets: Slow sales for big motorcycles – RevZilla, accessed on October 9, 2025, https://www.revzilla.com/common-tread/sales-of-expensive-motorcycles-slow-down

- accessed on October 9, 2025, https://www.accio.com/business/trend-in-new-motorcycles#:~:text=Premium%20motorcycles%20(e.g.%2C%20Harley%2D,grew%20due%20to%20affordability%208%20.

- Top-Selling Motorcycles in the USA (2025) – Naked Racer Moto Co, accessed on October 9, 2025, https://nrmotoco.com/top-selling-motorcycles-in-the-usa/

- Electric Motorcycles Market 2025 – Data & Facts | MotorCyclesData, accessed on October 9, 2025, https://www.motorcyclesdata.com/2025/08/05/electric-motorcycles-market/

- Beyond Range Anxiety: The Hidden Barriers to Electric Motorcycle Adoption – C.S.M., accessed on October 9, 2025, https://www.csm-research.com/beyond-range-anxiety-the-hidden-barriers-to-electric-motorcycle-adoption-in-2025/

- Motorcycle Market Share and Industry Forecast 2025–2035 – Fact.MR, accessed on October 9, 2025, https://www.factmr.com/report/7/motorcycle-market

- China Motorcycles Market 2025 – Data, Insight | MotorCyclesData, accessed on October 9, 2025, https://www.motorcyclesdata.com/2025/09/17/chinese-motorcycles-market/

- European Motorcycles Sales – Data & Facts 2025 MotorCyclesData, accessed on October 9, 2025, https://www.motorcyclesdata.com/2025/10/06/european-motorcycles-sales/

- Europe’s Motorcycle Industry Is Down On Paper, But Is It Really? – RideApart.com, accessed on October 9, 2025, https://www.rideapart.com/features/767537/european-motorcycle-decline-because-euro5-plus/

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity