Executive Summary

The global motorcycle market in 2025 presents a complex and bifurcated landscape. While overall global market value and unit sales are projected to exhibit growth, specific regions, notably the United States and parts of Europe, are experiencing a severe downturn characterized by plunging demand, a substantial volume of unsold inventory, and escalating financial pressures.1

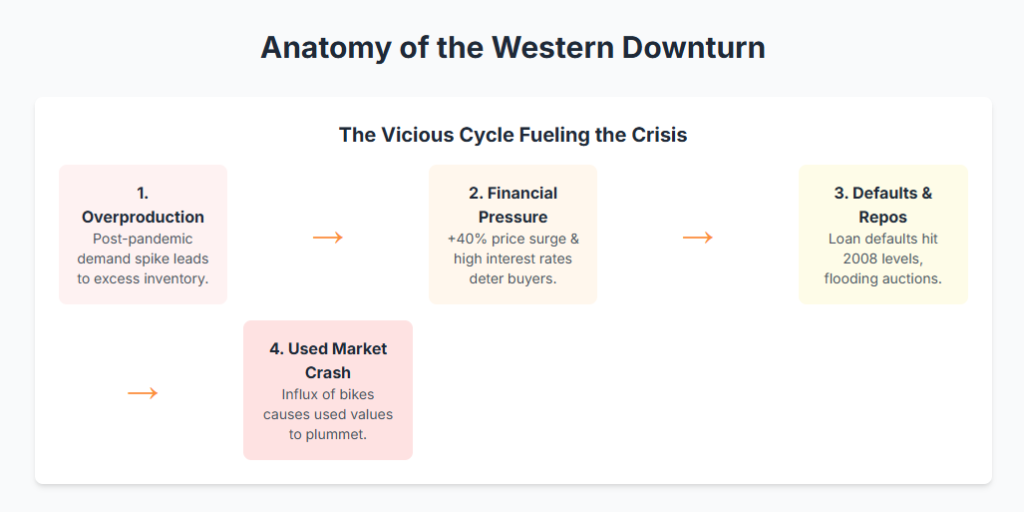

The primary challenges confronting the industry include a significant inventory glut stemming from post-pandemic overproduction, which has led to a “full-blown crisis” in certain markets.2 Concurrently, tightening credit conditions have resulted in higher interest rates and a marked increase in loan defaults and repossessions, further exacerbating market instability.2 This financial strain, coupled with an influx of repossessed vehicles, has driven a sharp decline in used motorcycle prices in affected regions.2

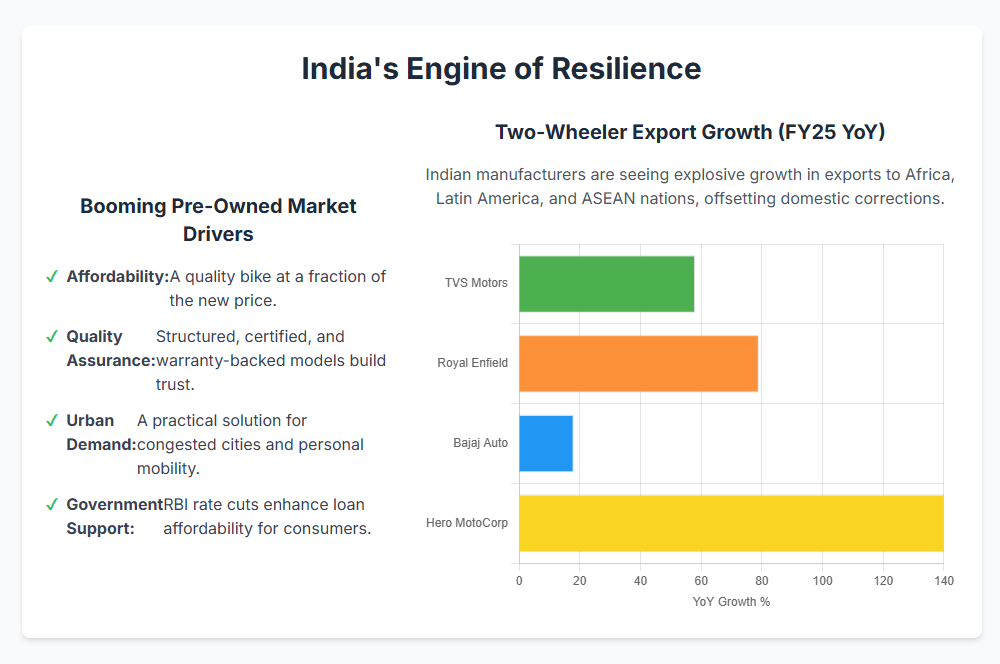

In stark contrast, emerging markets such as India demonstrate considerable resilience. This is evidenced by robust export growth, particularly to Africa, Latin America, and ASEAN nations 8, a booming pre-owned and refurbished segment 9, and domestic retail sales that show an upward trend despite some wholesale corrections.10 Supportive government policies, including Reserve Bank of India (RBI) rate cuts designed to enhance loan affordability 12, and various incentives promoting electric vehicle (EV) adoption, are playing a crucial role in mitigating some of the broader market challenges.13

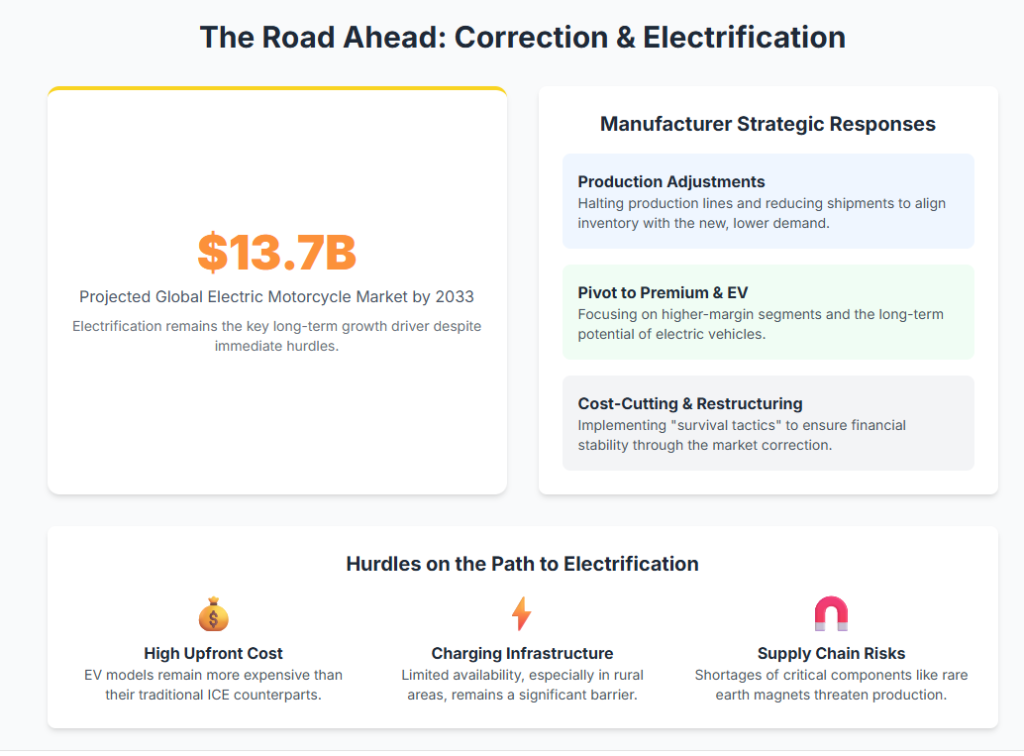

The accelerating shift towards electrification remains a powerful long-term growth driver across the industry. However, this transition faces immediate headwinds from supply chain vulnerabilities, most notably a critical shortage of rare earth magnets, which are essential for EV production.11 In response to these diverse market conditions, manufacturers are actively recalibrating their strategies. This involves significant production adjustments, aggressive cost-cutting measures, and a strategic diversification into premium and electric motorcycle segments. The prevailing sentiment indicates that the industry is undergoing a “once-in-a-generation correction” 2, which necessitates leaner operations, a more cautious approach to pricing, and a fundamental reassessment of production volumes to adapt to the evolving demand landscape.

1. Introduction: The Motorcycle Market Landscape in 2025

Global Market Overview and Divergent Trends

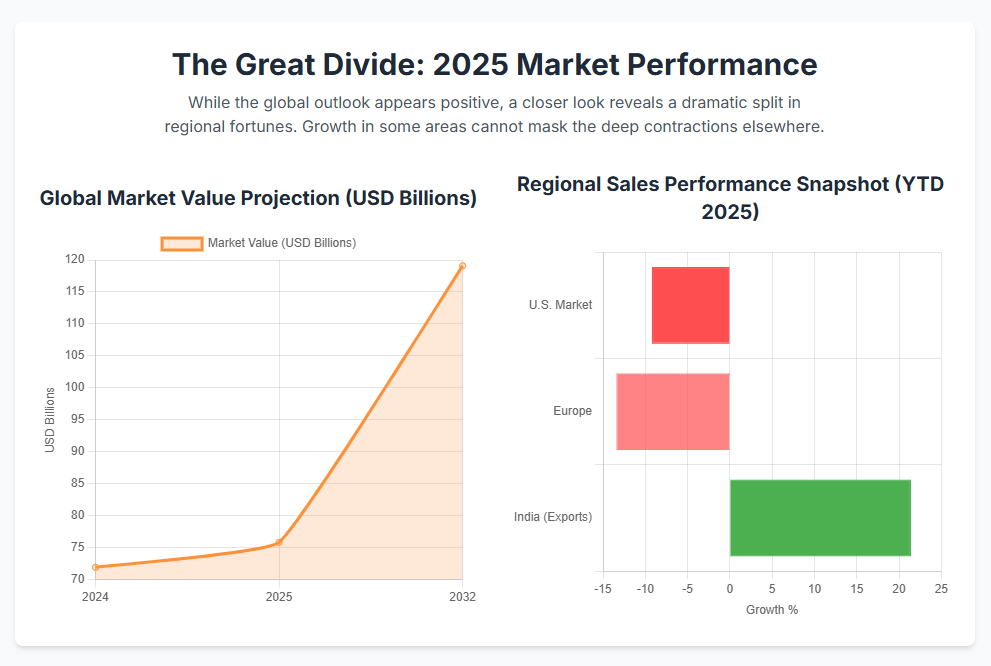

The global motorcycle market, while exhibiting an overarching growth trajectory, presents a nuanced picture in 2025, characterized by significant regional disparities. The market was valued at USD 71.92 billion in 2024 and is projected to expand to USD 75.82 billion in 2025, with a further forecast to reach USD 119.09 billion by 2032, demonstrating a Compound Annual Growth Rate (CAGR) of 6.7% from 2025 to 2032.16 This expansion is supported by a reported 3.0% increase in global motorcycle sales, reaching 15 million units in Q1 2025.4 Major players like Honda have seen their global sales hit new records in the first half of 2025, contributing to an industry-wide projection of 60 million global unit sales by 2030, including electric vehicles.4

Despite these positive global forecasts, 2025 is also marked by a severe downturn, described by some as a “full-blown crisis,” in certain developed markets, particularly the United States and parts of Europe.2 The U.S. market, which ranks as the 14th largest globally, has historically been stable but reported a weak performance in the previous year, with a 4.6% decline.1 The beginning of 2025 has been particularly challenging for the U.S. domestic market, showing a rapid decrease in consumer demand. Year-to-date sales through June stood at 271,205 units, representing a 9.2% decline, with monthly sales dropping significantly across April, May, and June.1 This stark contrast highlights a bifurcated market where growth in some regions is offset by severe contractions in others, creating a complex environment for manufacturers and stakeholders.

2. Market Challenges in 2025

2.1. Inventory Glut and Oversupply

A central issue plaguing the motorcycle market in 2025, particularly in developed economies, is a substantial inventory glut, a direct consequence of overproduction that occurred during and immediately following the COVID-19 pandemic.2 During the pandemic, consumer demand for powersports vehicles, including motorcycles, surged unexpectedly. Manufacturers, caught off guard, aggressively ramped up production to meet this spike in orders.5 Dealerships, which had previously struggled with limited stock, found their lots overflowing with vehicles. However, the post-pandemic reality brought a sobering realization: the elevated demand was not sustainable.5

This disparity between inflated inventory levels and declining consumer demand has created immense financial pressure across the industry. In the United States, tens of thousands of new motorcycles are reportedly sitting unsold in dealerships, some for nearly a year.2 Despite aggressive promotional efforts, including discounts and zero-down financing, these bikes are not moving.2 This situation has led to an “eerie calm” in dealerships, with significantly reduced foot traffic (down nearly 40% year-on-year) and online inquiries (halved).2

Major brands such as Harley-Davidson, Honda, Indian, Yamaha, Ducati, and BMW are all grappling with this plunging demand.2 The financial repercussions are evident in reported profit declines for major powersport manufacturers, including Polaris, KTM’s parent company Pierer Mobility AG, and Harley-Davidson.5 For instance, Polaris saw an 82% decline in profits from 2022 to 2023.5 Harley-Davidson specifically revised its annual projections, anticipating global shipments to fall by 16% to 17%, a significant adjustment from earlier forecasts.5

Manufacturers are responding to this oversupply by scaling back production. Harley-Davidson has halted two production lines, Indian Motorcycle is suspending some dealer allocations, and Honda is slashing U.S. shipments.2 Even electric motorcycle companies like Zero Motorcycles are trimming their workforce, indicating that these are not temporary adjustments but rather “survival tactics” for an industry in turmoil.2 KTM, for example, paused production to realign its supply and successfully reduced inventory levels at dealerships and importers by approximately 40,000 units.18

In India, the situation regarding inventory is somewhat different. While the Indian two-wheeler market experienced a 6.2% decline in wholesale sales in Q1 FY2025-26 due to “some inventory correction in the Industry,” retail registrations actually increased by 5% during the same period, driven by the marriage season and positive demand sentiments.19 This suggests that while manufacturers adjusted their dispatches to dealers, consumer-level demand remained relatively robust, preventing a severe inventory glut comparable to Western markets.11 The general sentiment in India is that manufacturers are being cautious and slowing production to avoid ending up with unsold stock, rather than facing a widespread collapse in demand.11

2.2. Rising Costs and Financing Issues

The motorcycle market in 2025 is also significantly constrained by escalating costs and increasingly challenging financing conditions, particularly in developed markets. The average price of a motorcycle has surged by over 40% since 2020, with entry-level models now starting near $10,000 and touring bikes easily exceeding $30,000.2 This substantial increase in vehicle cost is compounded by the rising expense of financing, with interest rates reaching levels not seen in over 15 years.2 For many riders, the combined burden of monthly payments, insurance, and maintenance can push total costs beyond $700 per month, making new motorcycle purchases prohibitively expensive.2

This financial strain has direct consequences for loan performance. Default rates are climbing rapidly, leading to a spike in repossessions, reaching the highest levels since the 2008 financial crisis.2 These repossessed bikes then flood auction markets, further depressing used motorcycle prices and creating a vicious cycle that undercuts private sellers.2 Financial institutions are reportedly tightening credit requirements, making it increasingly difficult for average consumers to secure motorcycle loans.3 Harley-Davidson, acknowledging these market shifts, announced a strategic partnership in July 2025 with KKR and PIMCO. This partnership aims to transform Harley-Davidson Financial Services (HDFS) into a capital-light and de-risked business by selling over $5 billion of existing retail loan receivables at a premium and agreeing to sell approximately two-thirds of future retail loans originated annually for at least five years.20 This move is designed to unlock discretionary cash for Harley-Davidson and maintain HDFS’s strategic value while reducing the company’s exposure to credit risk.20

In contrast to the tightening credit conditions in Western markets, India’s two-wheeler loan segment is experiencing a different dynamic. The Reserve Bank of India (RBI) has implemented cumulative rate cuts totaling 100 basis points since February 2025, including a 50 basis points reduction in the week prior to a June 2025 report.12 These rate cuts are specifically intended to enhance the affordability of vehicle loans and stimulate demand.12 CareEdge Ratings projects a healthy volume growth of 8-9% for India’s two-wheeler sector in FY26, partly attributed to these RBI actions.12 This demonstrates a direct governmental intervention aimed at bolstering consumer purchasing power in a market where 75% of two-wheeler purchases are funded by loans.14

Two-wheeler loan interest rates in India typically range from 7.70% to 28.30% per annum, depending on various factors.21 Key determinants of interest rates and loan approval include the borrower’s credit score (a score of 750 or above is considered good), loan amount (larger amounts may pose higher risk), loan tenure (shorter tenures often have lower rates but higher EMIs), income level (higher, steady income is favorable), employment status (stable jobs are preferred), and the borrower’s relationship with the lender.21

Despite the generally positive outlook bolstered by RBI rate cuts, India’s two-wheeler loan market is not without its challenges. Retail credit growth in India decelerated in Q2FY25, with low-cost two-wheeler loans (under Rs 75,000) experiencing a 10% decline in originations.24 Conversely, higher-value two-wheeler loans (above Rs 1.5 lakh) grew by 11%, indicating a shift towards higher-income borrowers.24 Overall two-wheeler loan balances grew by 29%, a sharp drop from 38% in the previous year.24 A report from July 2025 also noted that two-wheeler loan delinquencies increased across all lender types from March 2024 to March 2025, with Public Sector Banks (PSU Banks) seeing a rise from 1.27% to 1.61% and private banks from 3.27% to 3.62%.6

This suggests that while the market is growing in value, there are underlying stresses, particularly among sub-prime borrowers, leading to tighter credit policies aimed at managing default risks.6 Non-Banking Financial Companies (NBFCs) play a significant role, holding 40% of the market share, and are often seen as more flexible for borrowers with limited credit history, offering competitive rates and quicker processes.14 The Indian two-wheeler loan segment is projected to be worth $12.3 billion by 2025, growing at a CAGR of 11% or more.14

2.3. Declining Used Motorcycle Prices

The plummeting value of used motorcycles is another critical challenge, particularly in markets experiencing a demand downturn. In the United States, bikes that commanded over $12,000 just two years ago are now struggling to fetch $7,500, if they sell at all.2 This sharp depreciation is a direct consequence of several interconnected factors. The influx of repossessed bikes, resulting from rising loan defaults, floods auction markets, creating an oversupply that drives prices down.2 This creates a disincentive for potential private sellers, as waiting could lead to an even greater financial hit.2

The decline in used prices is also attributed to an increased supply of both new and used motorcycles, following COVID-related production interruptions and supply chain disruptions that had previously constrained inventory.7 As new motorcycle inventories become more readily available, and in some cases overstocked, the demand for used models naturally eases.7 Consumer uneasiness over inflation and a potential recession further contributes to this price pressure, as buyers become more cautious about discretionary purchases.7 There is a discernible shift in consumer behavior, with more individuals reverting to pre-COVID patterns, prioritizing work and finances over leisure activities and hobbies, which impacts the demand for recreational vehicles like motorcycles.7

In stark contrast, India’s pre-owned and refurbished two-wheeler market is experiencing a significant boom, accelerating growth in 2025.9 Analysts predict this segment to reach a colossal 55.8 million units by 2027, potentially surpassing the market for brand-new bikes.9 This unexpected shift in consumer behavior in India is driven by a confluence of factors:

- Affordability: Refurbished bikes offer a significantly lower price point compared to new ones, making them an attractive and accessible option without compromising on quality.9

- Structured Industry Evolution: The market is rapidly evolving from an unorganized resale sector to a structured, showroom-driven industry operating at OEM standards. These refurbished bikes undergo rigorous multi-point inspections, high-quality restoration, and standardized certification, ensuring performance and reliability comparable to new vehicles.9 Dedicated showrooms now offer warranty-backed models, instilling greater consumer confidence.9

- Environmental Consciousness: Choosing pre-owned vehicles aligns with growing environmental awareness by extending the lifespan of existing vehicles, reducing carbon footprints, and promoting a circular economy.9

- Increased Trust and Quality Assurance: Certified pre-owned programs from manufacturers and dealerships, including thorough inspection checkpoints and warranties, are addressing historical concerns about quality and reliability in the used market.9

- Convenience of Online Presence: The expanding online presence in the pre-owned market simplifies the buying process, allowing consumers to browse listings, access detailed vehicle information, and explore financing options.9

- Urbanization and Demand for Personal Transport: Rapid urbanization, rising disposable incomes, and the ongoing demand for personal transportation in congested cities fuel the growth of the used market, especially in urban areas where 75% of used two-wheelers are sold.9

- Technological Advancements: Technology enhances transparency, allowing buyers to access complete service histories and even utilize virtual reality tours to inspect vehicle conditions remotely.9

The Indian used two-wheeler market is expected to grow steadily at a 12.5% CAGR from FY2023 to FY2028, reflecting increasing trust in refurbished two-wheelers as a smart and affordable choice.9 This contrasts sharply with the challenges faced by the used market in Western countries, where oversupply and financial pressures are driving prices down.

3. Regional Dynamics

3.1. United States and Europe: A Market in Crisis

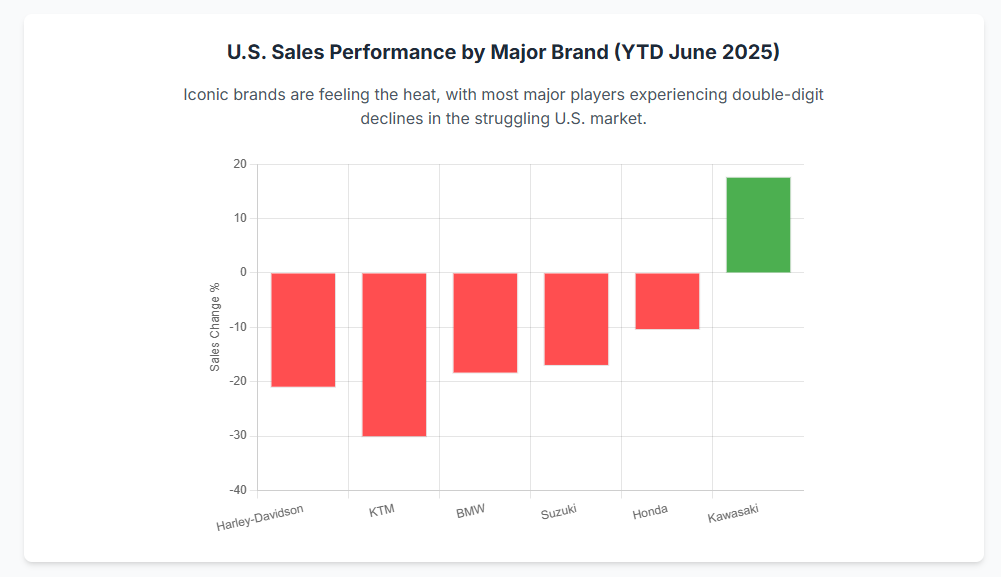

The motorcycle markets in the United States and parts of Europe are experiencing a profound downturn in 2025, characterized by significantly declining sales and a widespread sense of crisis. In the U.S., the market, typically stable, reported a weak performance in the previous year with a 4.6% decline.1 The start of 2025 has been particularly challenging, with a rapid decrease in consumer demand. Year-to-date sales through June stood at 271,205 units, representing a 9.2% decline, with monthly sales dropping by 6.3% in April, 5.6% in May, and 11.4% in June.1

This decline has reshaped the competitive landscape. Kawasaki has notably overtaken Honda as the market leader in the U.S., with sales improving by a substantial 17.7% year-on-year. In contrast, Honda lost its leadership position, experiencing a 10.5% decrease in sales.1 The American icon, Harley-Davidson, appears to be a significant victim of the new economic wave, recording a deep 21.1% loss in sales. Other brands like KTM (-30.2%), Suzuki (-17.1%), and BMW (-18.5%) also faced substantial declines.1

The crisis is attributed to a confluence of factors, including a mountain of unsold inventory, surging average motorcycle prices (up 40% since 2020), and increasingly expensive financing, with interest rates at levels not seen in over 15 years.2 This has led to climbing default rates and a spike in repossessions, further depressing used bike prices.2 Beyond economic factors, demographic shifts are playing a role; the aging out of the baby boomer generation, historically the backbone of motorcycle culture, combined with a slower entry of younger generations who view motorcycles as an optional luxury rather than a lifestyle staple, contributes to the plunging demand.2 High insurance premiums, licensing challenges, and shifting urban living preferences further deter new riders.2

European markets also reflect this challenging environment. Europe’s motorcycle market lost 13.4% during the first four months of 2025.4 The United Kingdom reported its worst performance in years in the first half of 2025, and Germany’s motorcycle market also lost sharply during the first half.4 While some countries like Spain (+5.8%) and Italy (positive in June after five months down) show pockets of growth, the overall trend in developed Western markets is one of contraction and significant challenges.4

Manufacturers are responding with “survival tactics,” including production halts and workforce reductions. Harley-Davidson has stopped two production lines, Indian Motorcycle is suspending some dealer allocations, and Honda is slashing U.S. shipments.2 Dealerships are burdened by floor plan financing for unsold inventory and rising overhead costs, leading to permanent closures.2 The industry anticipates a “once-in-a-generation correction” that will result in fewer dealers, leaner inventories, and a more cautious approach to pricing and production.2

3.2. India: Resilience and Growth Drivers

In stark contrast to the struggles in Western markets, India’s two-wheeler market demonstrates remarkable resilience and significant growth potential in 2025, driven by a unique set of economic and demographic factors. The India Two-Wheeler Market is estimated at USD 315.9 billion in 2025 and is projected to reach USD 347.4 billion by 2029, growing at a Compound Annual Growth Rate (CAGR) of 2.40%.13 This growth reflects a recovering economy and increasing consumer demand for personal mobility solutions.13

Key Growth Drivers:

- Urbanization and Traffic Congestion: Rapid urbanization, coupled with increasing road congestion and a lack of parking spaces in Indian cities, has spurred demand for compact and fuel-efficient two-wheelers as essential mobility solutions.16

- Affordable Transportation: Motorcycles and scooters remain a cost-effective and fuel-efficient mode of transportation, particularly for commuting, making them highly attractive in a price-sensitive market.16

- Growing Young Population and Disposable Income: India’s large and growing young population, coupled with increasing income levels and a rising penchant for riding, fuels demand, especially for high-performance and long-distance models.14 The Indian economy is forecast to expand by 6.6% in 2025, driven by strong public investment and resilient private consumption, with an average growth of 6.5% between 2025 and 2030.27

- Post-Pandemic Demand and Personal Mobility: The increased need for personal mobility post-COVID-19 has revived interest in two-wheelers, as consumers seek alternatives to public transport.16

- Introduction of New Models: The market’s growth is supported by the continuous launch of new models with advanced features, catering to a wide range of consumer preferences.13

Sales Performance and Trends:

While the overall Indian two-wheeler market saw a 2.9% decline in June 2025, with year-to-date June sales down 3.2% to 9.45 million units, this follows a record growth in 2024, which saw 20.5 million sales.27 The first quarter of 2025 ended with 4.6 million sales, indicating high volume despite some moderation.27

- Export Surge: India’s two-wheeler exports experienced a significant surge in June 2025, driven by robust demand from Africa, Latin America, and ASEAN regions, reflecting strong economic recovery in these overseas markets.8 Total two-wheeler exports grew by 21.4% in FY25 to 4,197,517 units, recovering from steep declines in FY23 and FY24.8 Bajaj Auto, India’s largest exporter, recorded an 18% year-on-year jump in exports, TVS Motors saw an impressive 58% growth, Hero MotoCorp’s exports skyrocketed by 140%, Royal Enfield grew by 79%, and Honda Motorcycle & Scooter increased by approximately 10%.8 FY26 is anticipated to be the best year for overseas sales, potentially surpassing the FY2022 high of 4.44 million units.8

- Domestic Sales Dynamics: Domestic sales continue to show steady growth for most major manufacturers.8 Hero MotoCorp maintained its leadership in June 2025 with 525,136 units sold, a 6.9% year-on-year rise, driven by strong rural demand and effective product mix management.28 However, Honda Motorcycle & Scooter India (HMSI) experienced a notable decline, with a 19.4% year-on-year drop in June 2025 sales, facing increased competition and vulnerability to urban market saturation.28 TVS Motor demonstrated a balanced performance, with a 9.9% year-on-year growth in June, largely propelled by its strong performance in the electric segment.28 Royal Enfield also saw stable growth, with a 16.4% year-on-year increase in June, driven by popular models like the Hunter 350 and Classic 350.29 The overall domestic two-wheeler sales for April-May 2025-26 declined by 7.6% compared to the previous year, with motorcycles specifically recording an 11.8% cumulative decline, while scooters showed marginal growth.10 This indicates a mixed picture, with some segments facing headwinds while others, particularly scooters and premium motorcycles, show resilience.10

Impact of Government Policies and Electrification:

Government initiatives are significantly shaping the Indian two-wheeler market, particularly in accelerating the shift towards electric and hybrid models.13

- FAME India Scheme: Launched in 2015, this scheme, particularly Phase 2, has been instrumental in promoting vehicle electrification through subsidies. For example, subsidies for electric two-wheelers (E2Ws) were increased to up to Rs 15,000 per kWh, with an upper limit of 40% of the purchase price.14

- GST Reduction: The Indian government reduced the Goods and Services Tax (GST) for electric vehicles from 12% to 5% to accelerate adoption.16

- RBI Rate Cuts: The cumulative 100 basis points rate cut by the RBI since February 2025 is expected to enhance affordability of vehicle loans and boost demand, especially for commuter motorcycles in rural areas.12

- Vehicle Scrappage Policy: Introduced in August 2021 and set for implementation by 2024, this policy aims to phase out polluting vehicles, encouraging a shift towards cleaner alternatives, including electric two-wheelers.13

The electric two-wheeler segment in India is gaining significant traction, projected to grow by 8-10% per annum.14 Sales of high-speed battery-driven two-wheelers reached approximately 30,000 units from January 2021, with Hero Electric and Okinawa Autotech leading the market.14 The electric two-wheeler sector is expected to constitute 80% of the Indian two-wheeler market by 2030.14 However, the industry faces challenges, notably a looming issue of rare earth magnet availability due to China’s export restrictions, which could significantly impact EV production if unresolved.8 Monthly sales of electric two-wheelers in India slid for the first time in FY26 in July, attributed to supply constraints from rare earth magnet shortages and reduced subsidies.15

4. Strategic Responses and Future Outlook

The motorcycle industry, particularly in regions facing a downturn, is undergoing a significant strategic recalibration to navigate the current challenges and prepare for future market dynamics.

4.1. Manufacturer Responses

In response to the inventory glut and plunging demand, manufacturers are implementing critical adjustments. Production scale-backs are widespread, with companies like Harley-Davidson halting production lines and Indian Motorcycle suspending dealer allocations.2 Honda is also slashing U.S. shipments, and even electric motorcycle companies are trimming their workforces.2 These are not merely short-term adjustments but fundamental “survival tactics”.2 KTM, for instance, proactively reduced its inventory levels at dealerships by approximately 40,000 units by pausing production to realign supply.18

Beyond production cuts, manufacturers are focusing on cost-cutting measures, restructuring operations, and in some cases, layoffs, to mitigate financial repercussions from inflated inventories and declining profits.5 There is a strategic shift towards premium and electric vehicle (EV) segments, which are showing more resilience or long-term growth potential. In India, while the commuter segment has borne the brunt of sales declines, higher-capacity and premium motorcycles have fared better, indicating a consumer shift towards aspirational, feature-rich bikes.30 TVS Motor, for example, has seen its Apache RTR series grow significantly in the 150-200cc segment, and its Ronin model propelled growth in the 200-250cc category.30 Royal Enfield dominates the 250-350cc category with a 95% market share, driven by strong demand for its Classic 350 and Meteor 350.30

Honda is actively reassessing its EV strategy and roadmap, including product lineup and investment timing, due to a slowdown in EV market expansion influenced by changing environmental regulations and trade policies.31 The company now expects its global EV sales ratio in 2030 to fall below its previously announced target of 30%.31 Consequently, Honda is positioning Hybrid Electric Vehicles (HEVs) as a key powertrain during the transition period towards widespread EV adoption, planning to introduce next-generation HEV models from 2027 onward.31 Honda is also focused on establishing a flexible production system capable of optimizing output based on demand fluctuations, ensuring a resilient supply chain not easily swayed by shifts between EVs and HEVs or unforeseen policy changes.31 The company aims to secure a stable supply of electrified components, particularly batteries, and leverage its extensive sales network for enhanced after-sales services and charging infrastructure, especially in markets like India.17

4.2. Dealership Adaptations

Dealerships, facing a “mountain of unsold inventory” and quiet showrooms, are forced to adapt aggressively.2 This includes offering deeper discounts, zero-down financing deals, and flashy promotions to move bikes.2 Many dealerships are burdened by floor plan financing—short-term loans for inventory that become increasingly costly as bikes sit unsold—and rising overhead costs, leading to permanent closures.2

To survive, dealerships are cutting costs aggressively and embracing online sales to reach a wider customer base.2 Some are also pivoting their business models, shifting focus away from solely new motorcycle sales towards servicing, parts, or even diversifying into other powersports vehicles like ATVs or electric scooters.2 This adaptation reflects a recognition that the market will look “very different on the other side,” with fewer dealers and leaner inventories.2

4.3. Long-term Market Evolution

The current market turmoil is seen as a “once-in-a-generation correction” 2, signaling a fundamental shift in the motorcycle industry. The long-term outlook points towards a market characterized by fewer dealers, leaner inventories, and a more cautious approach to pricing and production.2

Despite the immediate challenges, the accelerating shift to electrification remains a significant long-term growth driver. Governments worldwide are offering tax benefits, developing infrastructure, and implementing stricter emission norms, all of which support the rising demand for electric models.16 The global electric motorcycle market was valued at USD 7.78 billion in 2024 and is projected to grow to USD 13.71 billion by 2033, exhibiting a CAGR of 6.5% during the forecast period.32 This growth is propelled by increasing demand for sustainable transportation, government incentives, and advancements in battery technology.32 Urban areas are experiencing the highest demand for electric motorcycles due to their convenience in congested cities.32

However, the transition to EVs is not without its hurdles. The higher upfront cost of electric motorcycles compared to traditional models remains a challenge, as does limited charging infrastructure, particularly in rural areas.32 Furthermore, the industry is grappling with supply-side challenges, most notably the recent export licensing requirement from China on rare earth magnets, which are crucial components for EV motors and could significantly impact vehicle production.8 This rare earth magnet shortage has already contributed to a decline in electric two-wheeler sales in India in July 2025.15

Manufacturers like Honda are committed to carbon neutrality for all motorcycle products by the 2040s, accelerating electrification while also continuing to advance internal combustion engines (ICE).17 Honda plans to introduce 30 electric models globally by 2030, aiming for 4 million annual electric motorcycle sales by that year, and is actively expanding its charging and battery-swapping infrastructure in key markets like India.17

The overall industry outlook for Q2 (July – Sept 2025) remains cautiously optimistic, with expectations of a gradual recovery driven by the upcoming festive season, an above-normal monsoon forecast (benefiting rural demand), and the positive impact of RBI repo rate cuts on affordability.11 While the market is adjusting to a “new, lower level of demand” and shifting to “more sustainable production rates” 5, the emphasis on premiumization and electrification is expected to offset some short-term weaknesses.30 The industry is not in a “full-blown breakdown” but rather a “pit-stop,” with cautious shoppers and manufacturers adjusting to changing dynamics.11

Conclusion

The motorcycle market in 2025 presents a landscape of stark contrasts and significant transitions. While global market value and overall unit sales are projected to grow, driven by urbanization, the need for cost-effective personal mobility, and the long-term shift towards electrification, key developed markets, particularly the United States and parts of Europe, are experiencing a severe downturn. This crisis is fundamentally rooted in a post-pandemic inventory glut, exacerbated by rising vehicle prices and tightening credit conditions that have led to increased loan defaults and a sharp decline in used motorcycle values.

In contrast, emerging markets like India demonstrate remarkable resilience. Strong export performance, robust domestic demand, and a booming pre-owned segment are bolstered by supportive government policies, including interest rate cuts and EV incentives. However, even in these growing markets, challenges persist, such as supply chain vulnerabilities related to rare earth magnets impacting EV production.

The industry is undergoing a profound “correction,” compelling manufacturers to implement aggressive production scale-backs, cost-cutting measures, and a strategic pivot towards premium and electric segments. Dealerships are adapting by offering deeper discounts and exploring diversified business models. The long-term trajectory points towards a leaner, more cautious industry, with electrification as a dominant future driver, despite immediate hurdles related to infrastructure and component supply.

Ultimately, the motorcycle market in 2025 is a testament to the need for agility and strategic recalibration. Survival and future growth will depend on the industry’s ability to navigate these bifurcated market realities, optimize inventory management, adapt to evolving consumer preferences, and invest strategically in sustainable and technologically advanced mobility solutions.

Sources

- United States Motorcycles Market – Data & Insight 2025 | MotorcyclesData, accessed August 3, 2025, https://www.motorcyclesdata.com/2025/07/24/united-states-motorcycles-market/

- The Motorcycle Market Crisis of 2025: An Industry in Free Fall – KiWAV motors, accessed August 3, 2025, https://kiwavmotors.com/en/blog/the-motorcycle-market-crisis-of-2025-an-industry-in-free-fall

- August 2025 Motorcycle Market MELTDOWN – It’s Worse Than Expected – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=L21fMH-h7ZU

- Motorcycles Global Data, Insights, Facts, Forecasts, accessed August 3, 2025, https://www.motorcyclesdata.com/

- Motorsports Industry Pandemic Overproduction Crisis | Deals on New Motorcycles, accessed August 3, 2025, https://motorcycleshippers.com/2024/11/motorsports-industry-covid-overproduction-crisis-deals-on-new-motorcycles

- Personal loan volume spikes, year-on-year growth drops in FY 2025: Report | Mint, accessed August 3, 2025, https://www.livemint.com/money/personal-finance/personal-loan-volume-spikes-year-on-year-growth-drops-in-fy-2025-report-11753693247621.html

- Used motorcycle prices revisited: Easing trend solidifies – RevZilla, accessed August 3, 2025, https://www.revzilla.com/common-tread/used-motorcycle-pricing-trend

- India’s two-wheeler exports surge in June 2025 on strong demand …, accessed August 3, 2025, https://www.newindianexpress.com/business/2025/Jul/02/indias-two-wheeler-exports-surge-in-june-2025-on-strong-demand-from-africa-latin-america-asean

- India’s refurbished two-wheeler market accelerates growth in 2025 – ET Edge Insights, accessed August 3, 2025, https://etedge-insights.com/industry/auto-and-transportation/indias-refurbished-two-wheeler-market-accelerates-growth-in-2025/

- Passenger vehicles stable in May 2025, SIAM reports 2.2% growth in two-wheelers, accessed August 3, 2025, https://auto.hindustantimes.com/auto/news/passenger-vehicles-stable-in-may-2025-siam-reports-2-2-growth-in-twowheelers-41750054416449.html

- Indian Auto Industry Faces Q1 2025 Slowdown, Two Wheelers & Passenger Vehicle Sales Dip – Cartoq, accessed August 3, 2025, https://www.cartoq.com/car-news/indian-auto-industry-faces-q1-2025-slowdown-amid-changing-market-dynamics/

- India’s two-wheeler industry: Growth to surpass Covid-19 levels …, accessed August 3, 2025, https://timesofindia.indiatimes.com/business/india-business/indias-two-wheeler-industry-growth-to-surpass-covid-19-levels-soon-driven-by-rbi-rate-cuts-and-robust-domestic-demand/articleshow/121724922.cms

- India Two Wheeler – Market Share Analysis, Industry Trends …, accessed August 3, 2025, https://www.giiresearch.com/report/moi1693639-india-two-wheeler-market-share-analysis-industry.html

- Two Wheeler Loan Market Trends & Opportunity in India | Shriram …, accessed August 3, 2025, https://www.shriramfinance.in/article-market-trends-and-development-in-indias-two-wheeler-loan-segment

- Two-wheeler EV sales skid for first time in FY26 in July, legacy cos retain lead – Mint, accessed August 3, 2025, https://www.livemint.com/news/twowheeler-ev-sales-skid-for-first-time-in-fy26-in-july-legacy-cos-retain-lead-11754056237218.html

- Motorcycle Market Size, Share, Value | Growth Report [2032], accessed August 3, 2025, https://www.fortunebusinessinsights.com/motorcycle-market-105164

- Summary of Briefing on Honda Motorcycle Business | Honda Global Corporate Website, accessed August 3, 2025, https://global.honda/en/newsroom/news/2025/2250128eng.html

- KTM surpasses 100000 units sold in first half of 2025 – Powersports Business, accessed August 3, 2025, https://powersportsbusiness.com/news/ktm/2025/07/10/ktm-surpasses-100000-units-sold-in-first-half-of-2025/

- Auto Industry Sales Performance of June 2025 and Q1 (April–June 2025) – Society of Indian Automobile Manufactures, accessed August 3, 2025, https://www.siam.in/pressrelease-details.aspx?mpgid=48&pgidtrail=50&pid=583

- Harley-Davidson Announces Strategic Partnership with KKR and PIMCO, accessed August 3, 2025, https://investor.harley-davidson.com/news/news-details/2025/Harley-Davidson-Announces-Strategic-Partnership-with-KKR-and-PIMCO/default.aspx

- Two Wheeler/Bike Loan Interest Rate 2025 @12.5% – Tata Capital, accessed August 3, 2025, https://www.tatacapital.com/vehicle-loan/two-wheeler-loan/rates-and-charges.html

- Two Wheeler Loan – Apply for Bike Loan Online – Axis Bank, accessed August 3, 2025, https://www.axisbank.com/retail/loans/two-wheeler-loans

- Two Wheeler Loan Interest Rates 2025 Starting @10.25%* – ICICI Bank, accessed August 3, 2025, https://www.icicibank.com/personal-banking/loans/two-wheeler-loan/interest-rate

- Retail credit cools as demand slumps – The Times of India, accessed August 3, 2025, https://timesofindia.indiatimes.com/business/india-business/retail-credit-cools-as-demand-slumps/articleshow/117615859.cms

- Benefits of Choosing Two-Wheeler Finance From a Leading NBFCs, accessed August 3, 2025, https://www.shriramfinance.in/article-benefits-of-choosing-two-wheeler-finance-from-a-leading-nbfcs

- Global Motorcycle Market Research Report, Competitive, Technology and Forecast Analysis 2025-2032, accessed August 3, 2025, https://www.marketresearch.com/Deep-Insights-Research-Co-DIR-v4285/Global-Motorcycle-Research-Competitive-Technology-41683464/

- Indian Motorcycles Market – Facts & Data 2025 | MotorCyclesData, accessed August 3, 2025, https://www.motorcyclesdata.com/2025/07/07/indian-motorcycles-market/

- Hero Dominates, TVS Electrifies, and Honda Falters: A Deep Dive into India’s Two-Wheeler Sales – June 2025 Analysis, accessed August 3, 2025, https://www.topgearmag.in/news/industry/hero-dominates-tvs-electrifies-and-honda-falters-a-deep-dive-into-indias-two-wheeler-sales-june-2025-analysis

- Two-Wheeler Sales Overview(June 2025): Hero Leads As Honda Continues Worrying Slide, accessed August 3, 2025, https://www.drivespark.com/two-wheelers/2025/indian-two-wheeler-sales-june-2025-report-011-073191.html

- Indian Motorcycle Industry Faces Challenging Start to FY2026 – ACKO Drive, accessed August 3, 2025, https://ackodrive.com/news/indian-motorcycle-industry-faces-challenging-start-to-fy-2026/

- Summary of 2025 Honda Business Briefing | Honda Global Corporate Website, accessed August 3, 2025, https://global.honda/en/newsroom/news/2025/c250520eng.html

- Electric Motorcycle Market Size, Share 2033 | Research Report – Global Growth Insights, accessed August 3, 2025, https://www.globalgrowthinsights.com/market-reports/electric-motorcycle-market-108803

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter