Executive Summary

The global adventure motorcycle market is undergoing a significant transformation, shifting its focus from the traditional dominance of large-displacement machines to a rapidly expanding mid-size segment, particularly around the 400-450cc range. This pivot is a direct response to evolving rider demographics in established Western markets and the burgeoning demand from younger, upwardly mobile consumers in Asian and Indian economies.

Current market projections indicate substantial growth for the adventure motorcycle sector, with its valuation expected to reach between $18.2 billion and $64.5 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 5.5% to 7.5% from 2023.1 This robust expansion underscores a profound market opportunity. Major manufacturers such as Triumph and BMW are strategically adapting their product lines, while agile Chinese brands like CFMoto and the emerging QJMotor are aggressively introducing competitive, feature-rich, and accessibly priced models. These new entrants are directly challenging the established order by offering compelling alternatives that cater to the segment’s evolving requirements. The strategic imperative for industry players is clear: adapt product portfolios to meet diverse global rider preferences by balancing performance, manageability, affordability, and integrated advanced features, with pricing emerging as a critical competitive differentiator, especially in high-growth emerging markets.

The Evolving Global Adventure Motorcycle Market

For nearly two decades, the adventure motorcycle segment was largely defined by the formidable liter-plus machines, with BMW’s R-series GS boxers consistently leading global sales.3 These motorcycles were engineered for grand, long-distance expeditions and challenging off-road ventures, characterized by their extensive suspension travel, substantial fuel capacities, and dual-purpose tires designed for both paved roads and rugged terrains. Equipped with sophisticated rider aids, including multiple riding modes, they offered enhanced safety and control across diverse conditions such as gravel, mud, and sand.1 This era established a perception where “bigger” often equated to “better” in the adventure touring realm.

Global Market Size, Growth Projections, and Segmentation by Engine Capacity

The global adventure motorcycle market is poised for significant expansion. Valued at $31.8 billion in 2022, it is projected to reach $64.5 billion by 2032, exhibiting a strong Compound Annual Growth Rate (CAGR) of 7.5% from 2023.1 This growth is largely fueled by an increasing global interest in adventure travel and tourism.2 Another analysis similarly forecasts robust growth, estimating the market size at approximately $11 billion in 2023, with a projected rise to $18.2 billion by 2032 at a CAGR of 5.5%.2 While the absolute figures vary between reports, both consistently point to a substantial and sustained upward trajectory for the adventure motorcycle market.

The market is broadly categorized by engine capacity into “Less than 500cc,” “500cc-1000cc,” and “Above 1000cc”.1 The current market dynamics underscore the increasing importance of the sub-500cc and 500-1000cc categories. These segments strike a compelling balance between power and manageability, appealing to a wider spectrum of riders who seek versatility without the bulk or complexity of larger engines.2

Table 1: Global Adventure Motorcycle Market Overview (2022-2032)

| Aspect | Details (Allied Market Research) 1 | Details (Data Intelo) 2 |

| Market Size (2022/2023) | $31.8 billion (2022) | ~$11 billion (2023) |

| Projected Market Size (2032) | $64.5 billion | $18.2 billion |

| CAGR (2023-2032) | 7.5% | 5.5% |

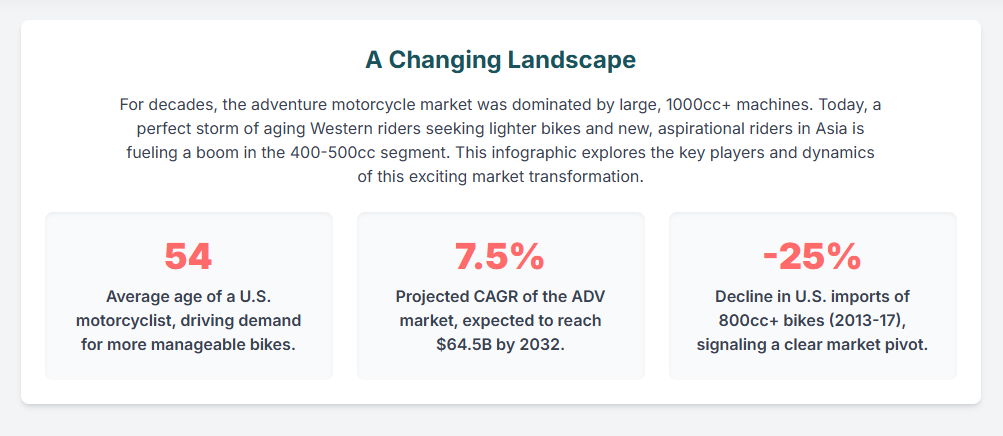

Demographic Shifts in Western Markets: The Aging Rider and Demand for Lighter Machines

A notable shift is evident in affluent Western markets, where an aging demographic of motorcyclists is increasingly finding liter-plus adventure machines unwieldy.3 In the U.S., for instance, the average rider is reportedly 54 years old.4 This demographic, often in the later stages of their riding careers, shows a growing preference for smaller, lighter motorcycles that are significantly easier to handle and maneuver. This includes the crucial aspect of managing the bike if it falls off-road, reducing the physical exertion required to right a heavy machine.5 Dealerships have observed this trend firsthand, with many riders trading in large adventure bikes for lighter alternatives. Some riders even acknowledge that the long-held belief of needing a “big bike” is often a misconception.5

This demographic preference for more manageable machines is not merely about physical strength; it represents a desire to maintain the enjoyment and confidence inherent in riding. A large, heavy motorcycle, despite its power, can become a source of anxiety or physical strain for an older rider, detracting from the very essence of “adventure.” Smaller motorcycles, while perhaps offering less raw power, provide a higher degree of control and a reduced sense of risk, allowing riders to continue participating in their passion without the physical burden or the daunting prospect of recovering a fallen behemoth. This suggests a redefinition of “adventure” for this experienced rider segment—moving from conquering extreme terrains on massive machines to embracing accessible, comfortable, and less physically demanding exploration.

This shift has already impacted traditional manufacturers. Harley-Davidson, for example, has seen a decline in sales and market share for its 601+cc motorcycles.6 Data from 2013–2017 shows a 25% decline in U.S. imports of motorcycles exceeding 800cc, whereas smaller motorcycle imports saw only a 2% decline, clearly indicating a reduced market preference for larger machines.6 This market evolution underscores the need for manufacturers targeting this demographic to prioritize ergonomics, weight reduction, and overall user-friendliness over sheer power and size. The market is evolving from a pure performance-centric view to one that increasingly values comfort, accessibility, and long-term riding enjoyment for a significant portion of experienced riders.

Emerging Market Dynamics: Younger Riders and Affordability in Asia and India

Concurrently, a burgeoning population of upwardly mobile younger riders in Asian and Indian markets is fueling the demand for mid-size motorcycles.3 The Asia-Pacific region is experiencing rapid growth, driven by a burgeoning middle class and increasing urbanization, with adventure motorcycles gaining considerable popularity among the younger demographic.2

India’s two-wheeler market exemplifies this trend. Already the world’s largest, with 20.5 million sales in 2024 7, it is projected to grow substantially from $335.07 billion in 2024 to $472.75 billion by 2034, registering a CAGR of 3.50%.8 This growth is propelled by rising urbanization, a growing need for affordable and fuel-efficient transportation, and increasing disposable incomes that expand the middle-class population and foster aspirations for personal mobility.8

Mid-size motorcycles are particularly attractive in developing countries where affordability and fuel economy are paramount considerations for consumers.2 These bikes provide an entry point into the adventure lifestyle that was previously inaccessible due to the high cost of larger, specialized adventure motorcycles.1 This phenomenon extends beyond mere transportation; it represents the fulfillment of aspirations for leisure activities and travel as disposable incomes continue to rise.2 The mid-size segment enables these riders to engage in the “sense of adventure that comes with long-distance excursions and off-road expeditions” 1 without the prohibitive financial barrier associated with larger, more expensive machines. This confluence of factors presents a significant market opportunity for manufacturers capable of delivering desirable, capable, and cost-effective adventure motorcycles. The emphasis in these markets shifts towards value proposition, localized manufacturing (as seen with BMW’s F 450 GS production in India 9), and meeting specific regional needs that encompass both daily commuting and recreational adventure.

Technological Advancements and Rider Preferences Driving the Mid-Size Boom

Technological advancements are profoundly enhancing the capability and appeal of smaller motorcycles, moving them far beyond basic functionality. Modern adventure motorcycles are increasingly integrating sophisticated features such as GPS navigation, traction control, and Anti-lock Braking Systems (ABS), which significantly elevate rider safety and convenience.2

Even smaller displacement machines are now incorporating technologies once exclusive to premium, large-displacement models. For instance, Electronic Fuel Injection (EFI) has become standard on nearly all motorcycles sold in Western markets, eliminating the need for carburetor adjustments and simplifying maintenance.5 Traction control is also becoming a common feature on smaller twin-cylinder machines, offering riders enhanced peace of mind on slippery roads or challenging terrains.5 Furthermore, advancements in engine design, including improved engineering and thermal management, contribute to extended lifespans for these smaller, yet potent, powerplants.5 This widespread adoption of advanced rider aids means that individuals opting for mid-size or smaller adventure motorcycles no longer face significant compromises on safety or convenience features. This widespread availability of advanced features makes smaller bikes more attractive to a broader audience, including beginners who benefit immensely from these aids, and experienced riders who appreciate the enhanced safety and versatility without the prohibitive cost or bulk of larger machines. The presence of such features on more affordable platforms, exemplified by the CFMoto Ibex 450’s switchable ABS and traction control 10, further strengthens the value proposition of the mid-size segment.

This trend is pushing all manufacturers in the mid-size segment to incorporate advanced electronics, thereby raising the baseline expectation for features even on models considered “budget-friendly.” It also blurs the distinctions between entry-level and premium segments in terms of technological sophistication, fostering a more competitive and feature-rich market. This progressive integration of technology is likely to drive further innovation in the cost-effective implementation of advanced systems across the motorcycle industry. The market is witnessing a growing demand for “proper off-road capable lightweight and powerful small displacement adventure bikes,” indicating that manufacturers recognize the rapid development and significant potential of this evolving market segment.12

Deep Dive: Key Contenders in the 400-450cc Adventure Segment

The burgeoning mid-size adventure motorcycle segment is attracting significant attention from both established global players and rapidly expanding Chinese manufacturers. This section provides a detailed examination of three key contenders: the QJMotor SRT400X, the BMW F 450 GS, and the CFMoto Ibex 450, highlighting their specifications, strategic positioning, and anticipated market impact.

QJMotor SRT400X

The SRT400X is an anticipated adventure motorcycle from QJMotor, with its imminent official launch signaled by appearances in Chinese type-approval documents.3 This model is expected to debut in 2025.15

The motorcycle is powered by QJMotor’s existing 449cc parallel-twin engine, which boasts a claimed output of 52 hp.3 This positions the SRT400X with the highest peak horsepower among the three models examined in this report. The engine is housed within a conventional steel-tube frame, complemented by an upside-down fork, likely sourced from Marzocchi due to QJMotor’s parent company Qianjiang’s manufacturing partnership with the Italian brand. An aluminum swingarm supports the rear, suspended by a monoshock.3

The design of the SRT400X strongly suggests genuine off-road capability. It features additional bolt-on engine protection bars that follow the contour of the exhaust header, along with an aluminum bash plate underneath.3 For enhanced off-road performance, the bike is equipped with a 21-inch front wheel and an 18-inch rear wheel, fitted with 90/90-21 and 140/70-18 tires, respectively.3 Its curb weight, including fuel, is 405 pounds, increasing to 450 pounds when equipped with aluminum side cases and a top box.3 The wheelbase is listed at 59.4 inches.3

Styling elements of the SRT400X are noted to be reminiscent of the CFMoto Ibex, featuring a near-vertical screen and a flat front end that flows into deep side panels mirroring the fuel tank’s shoulders. However, its headlight arrangement is distinctive, with the main lamps integrated into the side panels (one on each side) and a single, smaller light positioned conventionally below the screen.3 Type-approval documents reveal two variants: one with a high front fender and another with a low-mounted hugger, along with options for luggage.3

QJMotor’s strategic aim for the SRT400X is direct competition with the upcoming BMW F 450 GS and CFMoto’s Ibex 450.3 A primary competitive advantage is expected to be its price, which is projected to substantially undercut the BMW F 450 GS and align closely with the CFMoto Ibex 450’s $6499 MSRP, particularly if it enters markets like the U.S..3 It is anticipated that European versions of the SRT400X will have their power restricted to 47 hp to comply with A2 license regulations, mirroring the BMW F 450 GS.3

QJMotor’s approach with the SRT400X demonstrates an aggressive strategy focused on delivering high power output at a highly competitive price point. The 52 hp figure is notably higher than the 44 hp of the CFMoto Ibex 450 and even surpasses the BMW F 450 GS’s planned 47 hp.3 When combined with a target price similar to or lower than the CFMoto Ibex 450’s $6499 MSRP, this strategy is designed to attract value-conscious buyers who prioritize performance specifications.

This is particularly relevant in markets where A2 license restrictions are not a primary concern, or for riders with full licenses seeking maximum performance for their investment. This could serve as a significant differentiator against established brands. This aggressive pricing and power strategy by QJMotor has the potential to intensify competitive pressures within the mid-size segment, possibly compelling competitors to re-evaluate their own pricing structures or accelerate feature development to maintain market relevance. It further highlights the increasing capacity of Chinese manufacturers to deliver strong performance specifications at lower costs, potentially disrupting existing brand hierarchies.

BMW F 450 GS

The BMW F 450 GS represents BMW’s highly anticipated entry into the sub-500cc multi-cylinder adventure motorcycle market. First unveiled as a concept at EICMA 2024 and subsequently at the Bharat Mobility Global Expo 2025 16, its official production model announcement is expected in Fall 2025, likely at EICMA, with global deliveries commencing by early 2026.18

At its core, the F 450 GS will feature a newly developed 450cc parallel-twin engine, engineered to produce a precise 47 hp.18 This power output is meticulously calibrated to maximize performance within the European A2 license regulations, which cap horsepower for restricted license holders at this figure.18 A standout characteristic of the F 450 GS is its targeted curb weight of only 175 kg (385 pounds).9 This makes it one of the lightest adventure motorcycles in its class, contributing to a class-leading power-to-weight ratio.24 This lightweight construction is achieved through innovative design solutions and the strategic use of advanced materials such as magnesium in the engine components.19

The motorcycle retains the steel trellis frame and bolt-on rear subframe seen on the concept model, coupled with an aluminum swingarm and monoshock suspension.9 While the concept showcased a fully adjustable upside-down fork and a load-sensing shock absorber 25, test mules have been observed with non-adjustable setups.9 The production model is anticipated to feature 19-inch front and 17-inch rear wheels, likely cast aluminum, though wire-spoked rims are a conceivable option for a more off-road focused variant.9

The F 450 GS is expected to inherit premium features from its larger GS siblings, including BMW Motorrad PRO ABS (with lean-angle sensitivity), high-performance brakes (Brembo/Bybre), freely configurable riding modes, a 6.5-inch TFT display with comprehensive connectivity, and an optional Automated Shift Assistant (ASA) gearbox.17 The availability of ASA would mark it as the first sub-500cc adventure motorcycle to offer an optional automatic transmission.24

A crucial element of BMW’s strategy is the manufacturing location: the F 450 GS will be produced in India by TVS Motor for global export.9 This strategic partnership allows BMW to effectively manage production costs while upholding its stringent quality standards for worldwide distribution.

BMW’s decision to specifically target the A2 license class and manufacture the F 450 GS in India represents a multi-faceted strategic initiative. By offering a premium, feature-rich, yet A2-compliant and relatively accessible (for a BMW) adventure motorcycle, BMW is not merely entering a new market segment; it is actively cultivating future brand loyalty. New riders entering the market via the A2 license system or those upgrading from smaller displacement bikes will experience BMW’s renowned “GS spirit” and advanced technology early in their riding journeys.9 This early, positive exposure to the brand’s capabilities and riding experience makes it highly probable that these riders will continue with BMW when they eventually seek larger, more expensive models, thereby securing a long-term customer base. The Indian manufacturing partnership significantly reduces production costs, making it feasible to offer a BMW-branded twin-cylinder motorcycle at a competitive price point. This broadens its appeal and ensures its relevance in rapidly expanding markets. This strategy underscores a proactive approach by a premium brand to adapt to evolving market demographics and regulatory landscapes, ensuring its sustained relevance and market share in the long term. It also highlights the increasing significance of emerging markets as both manufacturing hubs and consumer bases, influencing global product development and pricing strategies.

While official pricing for the F 450 GS is pending, estimates suggest a range of ₹4,00,000 to ₹5,00,000 in India.9 In the U.S., it is positioned above the existing G 310 GS (starting around $6,000) 31 and is expected to be competitively priced against the CFMoto Ibex 450 ($6,499) and Royal Enfield Himalayan 450 ($5,799).32

CFMoto Ibex 450 (450MT)

The CFMoto Ibex 450, also known as the 450MT, is already available in the U.S. with an MSRP of $6499.10 CFMoto boasts a substantial global presence, distributing its products through over 2000 partners across more than 100 countries and regions worldwide.34

Powering the Ibex 450 is a 449cc parallel-twin engine, featuring a 270-degree crankshaft. This engine delivers a claimed 44 hp at 8500 rpm and 32.5 lb-ft of torque at 6250 rpm.10 The engine is praised for its exceptional smoothness and minimal vibration, even at higher RPMs, attributed to its double counterbalancers.11 Power is transmitted via a 6-speed gearbox, utilizing a wet, multi-plate CF-SC slipper clutch.10 The bike operates with a conventional cable throttle.10

The chassis is constructed with a steel frame and subframe, complemented by a cast aluminum swingarm. The suspension system is a standout feature, comprising 41mm KYB inverted forks (offering adjustable preload, compression, and rebound) and a KYB rear monoshock (with preload and rebound adjustability) connected via a linkage system. Both front and rear suspension provide 7.9 inches of travel.10 This robust setup is explicitly designed to “handle jumps and rough terrain”.15 The Ibex 450 rides on true off-road wheel sizes: a 21-inch front and an 18-inch rear, both tubeless spoked wheels, fitted with CST tires.10

Braking performance is managed by J. Juan components, featuring a single 320mm disc with a dual-piston caliper at the front and a 240mm disc with a single-piston caliper at the rear. The system incorporates Bosch dual-channel ABS, with the rear wheel ABS being switchable via a handlebar-mounted control.10

The dry weight of the Ibex 450 is 386 pounds.11 Its wet weight, including fuel and optional accessories such as crash bars, skid plate, and soft bags, is approximately 440 pounds.10 Without accessories, its curb weight is around 426 pounds.35 The wheelbase measures 59.3 inches 10, and it offers 8.7 inches of ground clearance.10

Key features enhancing rider experience include an easily adjustable windscreen, adjustable handlebars, and an adjustable seat height ranging from 31.5 to 32.3 inches.10 The dashboard includes standard USB and USB-C ports, a clear 5-inch TFT display, and a full LED lighting system.10

Rider impressions generally commend the Ibex 450 for its approachable power, excellent suspension, and accessible seat height, delivering “middleweight comfort and capability at a price that undercuts the competition”.36 It is recognized as providing a “solid foundation to build upon”.35 While its 44 hp may not offer the most exhilarating performance on pavement for speed enthusiasts 10, its smooth engine and clear off-road bias make it a strong contender for average riders seeking versatility.37 The engine is described as “nearly vibeless,” and the suspension as “stout”.35 The 4.6-gallon fuel tank provides a practical riding range of over 200 miles in mixed street and dirt conditions.10 Some reviews note potential wind buffeting at highway speeds due to the windscreen design.35 Long-term reliability and comprehensive aftermarket support remain areas where more data is needed, posing potential considerations for prospective buyers.35

CFMoto’s strategy with the Ibex 450 is not simply to offer a cheaper alternative; it involves providing a comprehensive, well-equipped package at a price point ($6499) that significantly undercuts traditional Japanese or European middleweights, while simultaneously offering more advanced features than many entry-level single-cylinder bikes. This approach directly addresses the “affordability” driver in emerging markets and the “manageability and capability” needs in Western markets. The “nearly vibeless” engine and robust suspension indicate a clear focus on rider comfort and genuine off-road performance, extending beyond just a low price. CFMoto is establishing a new standard for value in the mid-size ADV segment, compelling established brands to either innovate more aggressively in features or adjust their pricing strategies to remain competitive. Their extensive global distribution network, spanning over 2000 partners in more than 100 countries, further amplifies their potential market impact and ability to capture significant global market share.

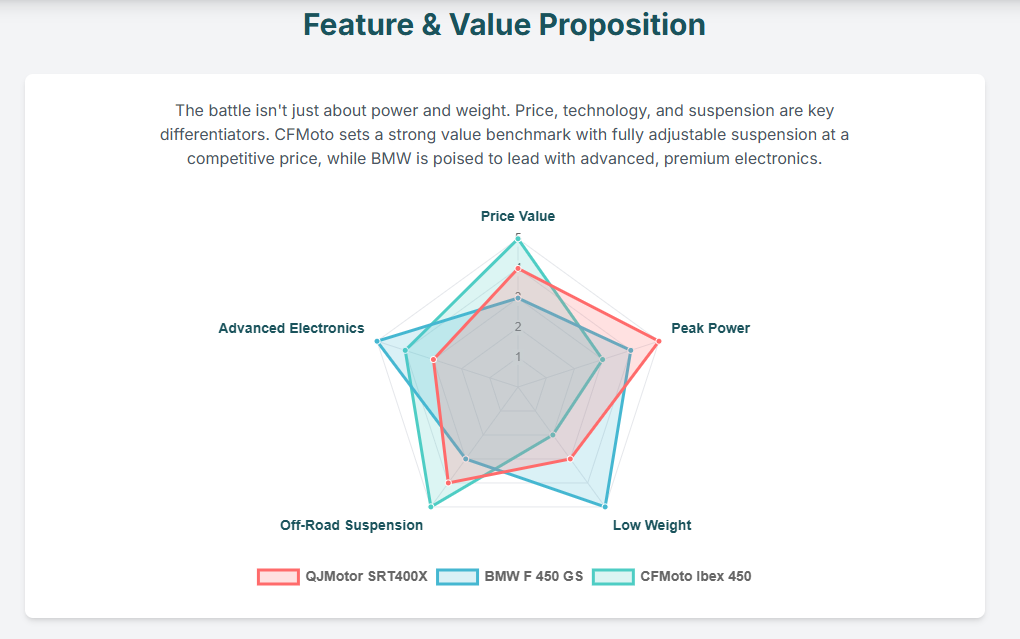

Comparative Analysis: Performance, Features, and Value

The mid-size adventure segment is a battleground where performance, features, and price converge to define market leadership. A direct comparison of the QJMotor SRT400X, BMW F 450 GS, and CFMoto Ibex 450 reveals distinct strategic approaches by each manufacturer.

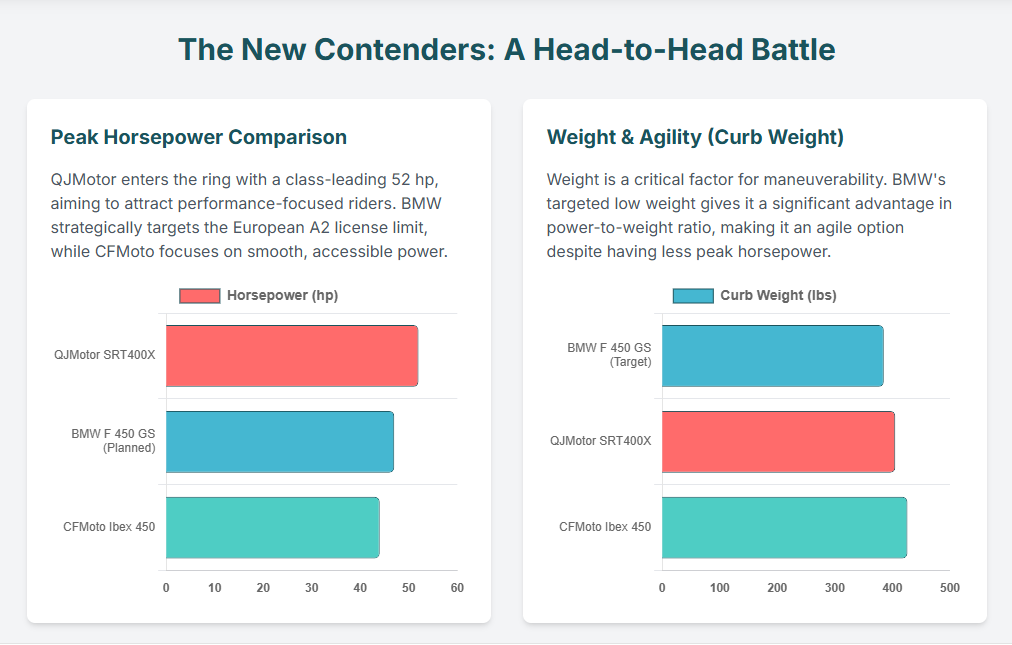

Engine Performance and Power-to-Weight Ratios

- QJMotor SRT400X: This model features a 449cc parallel-twin engine, claiming a robust 52 hp.3 With a curb weight of 405 pounds 3, it offers the highest peak horsepower in this comparison, which could be a significant draw for riders prioritizing raw power within the displacement class, especially in markets without strict A2 licensing regulations.

- BMW F 450 GS: The F 450 GS is equipped with a newly developed 450cc parallel-twin engine, engineered to produce a planned 47 hp.18 Its targeted curb weight is notably lighter at 175 kg (385 lbs) 23, resulting in a class-leading power-to-weight ratio.24 The 47 hp output is specifically tailored to comply with European A2 license rules.18

- CFMoto Ibex 450: Powered by a 449cc parallel-twin engine with a 270-degree crankshaft, it delivers 44 hp at 8500 rpm and 32.5 lb-ft of torque at 6250 rpm.10 Its wet weight ranges from approximately 432 to 440 lbs.10 The engine is highly regarded for its smoothness and minimal vibration 11, indicating a design philosophy that prioritizes ride comfort and usability over peak power figures.

Analysis: QJMotor leads in peak horsepower, which can be a strong selling point in regions without restrictive licensing. BMW focuses on an optimal power-to-weight ratio and A2 compliance, aiming for a balanced and accessible performance profile. CFMoto emphasizes a smooth and tractable power delivery, suitable for a wide range of riders and conditions. The A2 license compliance for BMW and the anticipated Euro versions of QJMotor highlight the significant influence of regulatory frameworks on engine tuning and market strategy.

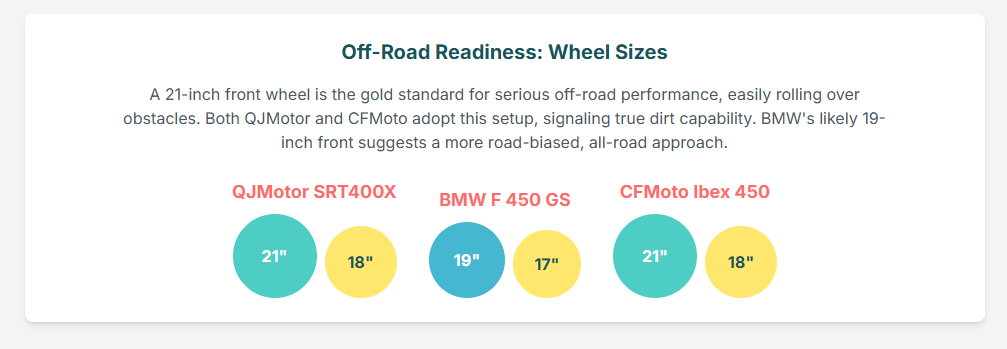

Chassis, Suspension, and Off-Road Capabilities

- QJMotor SRT400X: This model employs a conventional steel-tube frame, an upside-down fork (likely Marzocchi), and an aluminum swingarm paired with a monoshock. Its off-road readiness is emphasized by bolt-on engine protection, an aluminum bash plate, and a 21-inch front wheel coupled with an 18-inch rear wheel.3

- BMW F 450 GS: The F 450 GS features a steel trellis frame with a bolt-on subframe and an aluminum swingarm with a monoshock. While the concept showcased a fully adjustable USD fork and load-sensing shock 25, test models have been observed with non-adjustable setups.9 The production model is expected to feature 19-inch front and 17-inch rear wheels, likely cast aluminum, though wire-spoked rims are a conceivable option for a more off-road-oriented variant.9

- CFMoto Ibex 450: Built on a steel frame and subframe with a cast aluminum swingarm, the Ibex 450 distinguishes itself with fully adjustable KYB inverted forks and a KYB monoshock, both offering 7.9 inches of travel.10 It features genuine off-road wheel sizes—a 21-inch front and an 18-inch rear—with tubeless spoked wheels.10 This comprehensive setup is explicitly “built to handle jumps and rough terrain”.15

Analysis: CFMoto appears to offer the most comprehensive and explicitly stated off-road-ready suspension package, featuring full adjustability and significant travel, combined with true off-road wheel sizes (21/18 inches) and tubeless spokes. QJMotor also commits to 21/18-inch wheels and off-road protection, indicating serious intent, though specific suspension adjustability details are less clear. BMW’s likely choice of 19/17-inch wheels (and potentially cast alloys) suggests a more balanced road-biased adventure touring focus, although an off-road variant with spoked wheels is plausible to cater to diverse rider preferences.

Technology, Rider Aids, and Ergonomics

- QJMotor SRT400X: While specific details for the SRT400X are limited in the provided information, its sibling model, the SRK400, includes dual-channel ABS, a 5-inch TFT display, and LED lighting.38 It is reasonable to anticipate that the SRT400X will be similarly equipped with competitive modern rider aids.

- BMW F 450 GS: Positioned as a technologically advanced offering, it is expected to incorporate BMW Motorrad PRO ABS (lean-angle sensitive), high-performance brakes (Brembo/Bybre), freely configurable riding modes, a 6.5-inch TFT display with connectivity, and an optional Automated Shift Assistant (ASA).17 Its ergonomics are designed for touring comfort with customizable seat height.29

- CFMoto Ibex 450: Offers a robust and practical suite of essential rider aids, including Bosch dual-channel ABS with switchable rear ABS and traction control.10 Ergonomic features include an easily adjustable windscreen, adjustable handlebars, adjustable seat height (31.5-32.3 inches), standard USB and USB-C ports, and a clear 5-inch TFT dash.10

Analysis: BMW clearly leads in advanced rider aids and technology integration, with features like lean-sensitive ABS and an optional automatic transmission setting a new standard for the sub-500cc class. CFMoto provides a robust and practical suite of essential rider aids (ABS, TC) and ergonomic features. QJMotor’s offerings, while less explicitly detailed, are expected to be competitive, reflecting the rapid advancements in Chinese motorcycle technology.

Pricing Strategies and Market Accessibility

- QJMotor SRT400X: This model is expected to significantly undercut the upcoming BMW F 450 GS in price, with a likely target price around the CFMoto Ibex 450’s $6499 MSRP, particularly if it is introduced to the U.S. market.3 This aggressive pricing is a key competitive differentiator for QJMotor.

- BMW F 450 GS: The estimated price in India ranges from ₹4,00,000 to ₹5,00,000.9 While U.S. pricing is not yet confirmed, it is positioned above the G 310 GS, which starts around $6,000.31 It is expected to be competitive with the CFMoto Ibex 450 ($6,499) and Royal Enfield Himalayan 450 ($5,799).32

- CFMoto Ibex 450: This model has an established MSRP of $6499 in the U.S..10 It is widely recognized for offering “excellent value” compared to other small adventure motorcycles in the market.33

Analysis: CFMoto and QJMotor are clearly leveraging aggressive pricing as a primary competitive advantage, aiming to capture the value-conscious segment and attract new riders in both emerging and established markets. BMW, while likely positioned at a higher price point, aims to justify its cost with premium branding, advanced technology, and a comprehensive dealer network. The pricing strategy will be crucial for market penetration, particularly in price-sensitive emerging markets where affordability is a primary purchasing driver.

Manufacturing and Distribution Footprint

- QJMotor: The parent company, Qianjiang, maintains a manufacturing partnership with Marzocchi for parts production.3 QJMotor has experienced rapid expansion, with over 140 different models listed on its global website, though only a select range is offered in most countries.13 QJMotor models are explicitly entering the European market.39

- BMW: The F 450 GS will be manufactured in India by TVS Motor for global export.9 This strategic decision is pivotal for controlling production costs and enhancing market accessibility, leveraging India as a significant manufacturing hub. BMW also benefits from its established global dealer network, ensuring widespread distribution and robust after-sales support.

- CFMoto: Possesses a substantial global presence, with products distributed through over 2000 partners in more than 100 countries and regions worldwide.34 It has a strong and expanding presence in the U.S. market.10

Analysis: Both Chinese brands, QJMotor and CFMoto, demonstrate extensive manufacturing capabilities and are actively expanding their global distribution networks. CFMoto appears to have a more established global footprint for its adventure models, particularly in Western markets. BMW strategically leverages its partnership with TVS in India for cost-effective production and broad market reach, maintaining its premium brand image while expanding its accessible offerings. The manufacturing location and distribution network will play a critical role in market share acquisition and long-term customer satisfaction, especially concerning parts availability and service.

Table 2: Comparative Specifications: QJMotor SRT400X vs. BMW F 450 GS vs. CFMoto Ibex 450

| Feature | QJMotor SRT400X | BMW F 450 GS | CFMoto Ibex 450 |

| Engine | |||

| Displacement | 449cc | 450cc | 449cc |

| Type | Parallel-Twin | Parallel-Twin | Parallel-Twin (270-degree crankshaft) |

| Claimed HP | 52 hp 3 | 47 hp 18 | 44 hp @ 8500 rpm 10 |

| Torque | NA (37 Nm for SRK400 38) | ~45 Nm 19 | 32.5 lb-ft @ 6250 rpm 10 |

| Weight | |||

| Curb/Wet Weight | 405 lbs (450 lbs w/ luggage) 3 | 175 kg (385 lbs) targeted 23 | 426-440 lbs wet (386 lbs dry) 10 |

| Wheels | |||

| Front Wheel Size | 21-inch 3 | 19-inch (concept) 25 | 21-inch 10 |

| Rear Wheel Size | 18-inch 3 | 17-inch (concept) 25 | 18-inch 10 |

| Wheel Type | Spoked 3 | Cast Aluminum (likely, spoked option possible) 9 | Tubeless Spoked 10 |

| Suspension | |||

| Front | USD Fork (likely Marzocchi) 3 | USD Fork (adjustable concept, non-adjustable test) 9 | KYB Inverted (adjustable preload, comp, rebound) 10 |

| Rear | Monoshock 3 | Monoshock (load-sensing concept, non-adjustable test) 9 | KYB Monoshock (adjustable preload, rebound) 10 |

| Travel | NA | NA | 7.9 inches (both ends) 10 |

| Brakes | |||

| Front | Dual Disc 38 | Brembo/Bybre (high-performance) 25 | J. Juan 320mm single disc, dual-piston caliper 10 |

| Rear | Hydraulic Disc 38 | NA | J. Juan 240mm single disc, single-piston caliper 10 |

| ABS | Dual Channel 38 | BMW Motorrad PRO ABS (lean-angle) 25 | Bosch Dual-Channel (switchable rear) 10 |

| Key Features | |||

| TFT Display | 5-inch 38 | 6.5-inch 25 | 5-inch 10 |

| Adj. Windscreen | NA | NA | Yes 10 |

| Adj. Seat Height | NA | Yes 29 | Yes (31.5-32.3 inches) 10 |

| Connectivity | NA | Yes 25 | USB, USB-C 10 |

| Other Rider Aids | NA | Riding Modes, Optional ASA 24 | Traction Control 10 |

| Market Info | |||

| Est./MSRP Price | ~$6499 target 3 | ₹4-5 Lakh (India) 9 | $6499 (US MSRP) 10 |

| Launch/Availability | Upcoming 2025 (Chinese type-approval) 15 | Official Fall 2025, Global Early 2026 18 | Available (US) 10 |

Table 3: Estimated Pricing and Market Availability (Key Models)

| Model | Estimated/MSRP Price (USD/INR) | Launch/Availability | Key Market(s) |

| QJMotor SRT400X | ~$6,499 (target) 3 | Upcoming 2025 15 | Global, US (target) |

| BMW F 450 GS | ₹4,00,000 – ₹5,00,000 (India) 9 | Official Fall 2025, Global Early 2026 18 | Global, Europe, India, US |

| CFMoto Ibex 450 | $6,499 (US MSRP) 10 | Available | Global, US |

| Royal Enfield Himalayan 450 | $5,799 (US) 32 | Available | Global, India, US |

| KTM 390 Adventure R | $6,999 (US) 32 | Available | Global, US |

| Triumph Speed 400 / Scrambler 400 X | Competitive with segment [User Query] | Available | Global |

Market Outlook and Strategic Recommendations

The mid-size adventure segment, particularly the sub-500cc and 500-1000cc categories, is poised for continued robust growth, driven by evolving rider demographics and preferences globally.1 The increasing global trend of adventure travel and tourism will further fuel demand.2 The market is likely to witness a surge in manufacturers entering this space, offering diverse options that cater to both on-road comfort and genuine off-road capability, reflecting the dual-purpose nature inherent to adventure motorcycles. The trend towards lighter, more manageable, and technologically advanced bikes will accelerate, making adventure riding accessible to a broader audience, including beginners and aging riders who seek less cumbersome machines.5

Projected Trajectories for the Mid-Size Adventure Segment

A significant development in this market is the phenomenon of “segment compression” and “feature creep.” Smaller motorcycles are becoming increasingly capable and feature-rich, frequently incorporating technologies previously found exclusively on larger, premium models.2 This means the performance and feature gap between mid-size and larger adventure bikes is progressively narrowing. As mid-size bikes become more competent and comfortable for extended journeys without the inherent complexity of larger engines 2, they begin to exert pressure on the market. This could potentially lead to a reduction in sales for the lower end of the “above 1000cc” segment, especially among riders who do not require extreme power or weight. This dynamic also fosters “feature creep,” where advanced electronics such as ABS, traction control, TFT displays, and even optional automatic transmissions (like BMW’s Automated Shift Assistant) become standard or expected features on more affordable models.

This trend implies that manufacturers of larger motorcycles may need to differentiate their offerings more aggressively through extreme performance, luxury, or highly specialized niche capabilities (e.g., dedicated rally machines). Concurrently, mid-size manufacturers must continuously innovate to remain competitive in this rapidly evolving landscape. This could lead to a more clearly defined stratification of the adventure market, with distinct offerings tailored to specific rider needs rather than a simple hierarchy based solely on engine displacement.

Opportunities for Innovation and Market Penetration

To capitalize on these market shifts, manufacturers should consider several strategic opportunities:

- Targeted Product Development: Focus on developing models that prioritize ergonomic comfort, significant weight reduction, and advanced rider aids. These features should be specifically tailored for the diverse needs of urban commuting, light touring, and accessible off-road adventures, rather than solely on extreme performance.

- Value-Oriented Offerings: Emphasize competitive pricing, superior fuel efficiency, and lower overall maintenance costs. This approach will attract new riders and cater to the growing demand in price-sensitive emerging markets.

- Technological Integration: Continue to integrate smart technologies such as advanced connectivity, improved GPS navigation systems, Internet of Things (IoT) capabilities, and enhanced safety features (e.g., lean-sensitive ABS, adaptive cruise control) into mid-size platforms. This will make them more attractive to tech-savvy consumers.2

- Aftermarket Support & Customization: For newer entrants, particularly Chinese brands, establishing robust aftermarket support, ensuring parts availability, and fostering a vibrant ecosystem for customization options will be crucial for long-term success, building brand loyalty, and overcoming initial perception challenges.35

- Leverage Experiential Marketing: Capitalize on the increasing popularity of organized adventure tours and events, which significantly boost the appeal of adventure motorcycles.1 This can be achieved through partnerships with tour operators or the creation of brand-specific riding experiences.

Challenges: Brand Perception, Aftermarket Support, and Regulatory Compliance

Despite the opportunities, several challenges must be addressed:

- Brand Perception: Chinese manufacturers, despite offering competitive specifications and aggressive pricing, may encounter initial skepticism regarding long-term reliability, durability, and brand prestige in established Western markets.35 Building trust and establishing a strong, reliable dealer network will be paramount.

- Aftermarket Support: A significant challenge for newer Chinese models is the potential lack of robust aftermarket support for accessories, performance upgrades, or specialized parts.35 This can deter riders who value customization and easy maintenance.

- Regulatory Compliance: Adhering to diverse global regulatory norms, such as Europe’s A2 license restrictions that limit horsepower, necessitates careful product tuning and potentially requires regional variants. This adds complexity to manufacturing and distribution processes.3

- Cost of Ownership: While the initial purchase price of mid-size adventure motorcycles can be more accessible, the overall cost of ownership, including specialized maintenance, specific tire requirements, and fuel consumption, can still pose a barrier for some potential purchasers.1

Strategic Recommendations for Manufacturers and Investors

To navigate this evolving landscape and secure a strong position in the mid-size adventure motorcycle market, the following strategic recommendations are advised:

- Diversify Portfolios Strategically: Invest heavily in the mid-size adventure segment, offering a range of models that balance price, performance, and features. This should include distinct offerings, such as more road-biased adventure tourers versus more off-road capable dual-sport variants, to cater to diverse rider segments.

- Localize Production & Research and Development: For global players, strategic partnerships and local manufacturing (e.g., BMW with TVS in India) can significantly reduce production costs, improve market responsiveness, and facilitate the tailoring of products to specific regional preferences and regulations.

- Enhance Value Proposition Beyond Price: Beyond the initial purchase price, focus on clearly communicating and delivering a strong total cost of ownership. This includes highlighting superior fuel efficiency, ease of maintenance, and competitive insurance rates, which will appeal to a broader demographic seeking practical and economical transportation.

- Build Trust & Community: For newer entrants and Chinese brands, investing in robust dealer networks, comprehensive after-sales service, and fostering strong rider communities can effectively overcome brand perception challenges and build long-term customer loyalty.

- Prioritize Continuous Innovation: Leverage technological advancements to offer cutting-edge features that genuinely enhance safety, convenience, and the overall riding experience. This will ensure that mid-displacement categories remain competitive and desirable.

- Proactive Regulatory Monitoring: Maintain vigilance over evolving regulatory landscapes, particularly licensing requirements and emission standards, to ensure product compliance and facilitate smooth market entry and distribution across different regions.

Sources

- Adventure Motorcycle Market Trends, Share, Size, Analysis, accessed August 7, 2025, https://www.alliedmarketresearch.com/adventure-motorcycle-market-A14786

- Adventure Motorcycles Market Report | Global Forecast From 2025 To 2033 – Dataintelo, accessed August 7, 2025, https://dataintelo.com/report/adventure-motorcycles-market

- QJMotor SRT400X Expected – Cycle World, accessed August 7, 2025, https://www.cycleworld.com/motorcycle-news/qjmotor-srt400x-expected-soon/

- Why aren’t younger generations buying motorcycles? – YouTube, accessed August 7, 2025, https://www.youtube.com/watch?v=aXiqySmYxMM

- Why You Should Consider Riding A Small Bike For Your Adventures – ADV Pulse, accessed August 7, 2025, https://www.advpulse.com/adv-news/riding-small-adventure-bikes/

- U.S. Motorcycle Market Changes Gears – USITC’s, accessed August 7, 2025, https://www.usitc.gov/publications/332/executive_briefings/motorcycle_ebot-final.pdf

- Indian Motorcycles Market – Facts & Data 2025 | MotorCyclesData, accessed August 7, 2025, https://www.motorcyclesdata.com/2025/07/07/indian-motorcycles-market/

- India two-wheeler market Size, Share, Growth to 2034 – Market Research Future, accessed August 7, 2025, https://www.marketresearchfuture.com/reports/india-two-wheeler-market-21400

- BMW F 450 GS – What All Details We Know So Far – ACKO Drive, accessed August 7, 2025, https://ackodrive.com/news/bmw-f-450-gs-what-all-details-we-know-so-far/

- 2025 CFMOTO IBEX 450 Review (Updated With Video) – Cycle News, accessed August 7, 2025, https://www.cyclenews.com/2025/05/article/2025-cfmoto-ibex-450-review/

- 2025 CFMOTO IBEX 450 | Motorcycle Dealer, accessed August 7, 2025, https://www.cfmotousa.com/inventory/unit/ibex-450

- Why Your Small Adventure Bikes is STILL So Heavy | The Hidden Reason – YouTube, accessed August 7, 2025, https://www.youtube.com/watch?v=STajhMWXVh8&pp=0gcJCfwAo7VqN5tD

- QJMotor SRK 921 Nears Production – Cycle World, accessed August 7, 2025, https://www.cycleworld.com/motorcycle-news/qjmotor-srk-921-nears-production/

- Latest Type-Approval Documents Confirms Upcoming QJMotor 400cc Motorcycle, accessed August 7, 2025, https://www.bikesrepublic.com/english/archive/latest-type-approval-documents-confirms-upcoming-qjmotor-400cc-motorcycle/

- 2025 QJMOTOR SRT 400X Revealed New Budget Friendly Twin Cylinder Adventure Motorcycle – YouTube, accessed August 7, 2025, https://www.youtube.com/watch?v=uDFd3bizXEM

- BMW F 450 GS Final Design Revealed In Patent Images – NDTV, accessed August 7, 2025, https://www.ndtv.com/auto/bmw-f-450-gs-final-design-revealed-in-patent-images-9009716

- Near Production-ready BMW F 450 GS Spotted On Test In Europe – ACKO Drive, accessed August 7, 2025, https://ackodrive.com/news/near-production-ready-bmw-f-450-gs-spotted-on-test-in-europe/

- 2026 NEW BMW F 450 GS PRODUCTION MODEL REVEALED!! THERE ARE SOME NEW DETAIL CHANGES! – YouTube, accessed August 7, 2025, https://www.youtube.com/watch?v=5kkuy_mYdBg

- BMW F 450 GS, Expected Price Rs. 4,00,000, Launch Date & More Updates – BikeWale, accessed August 7, 2025, https://www.bikewale.com/bmw-bikes/f-450-gs/

- BMW F 450 GS to Launch in 2025 as Lightweight Adventure Bike – iMotorbike News, accessed August 7, 2025, https://news.imotorbike.com/en/2025/07/bmw-motorrad-f450gs-2025/

- 2026 BMW F 450 GS Production Model Revealed in Design Filings | Motorcycle.com, accessed August 7, 2025, https://www.motorcycle.com/bikes/new-model-preview/2026-bmw-f-450-gs-production-model-revealed-in-design-filings-44645671

- New 2026 BMW F 450 GS – Full Review, Specs, and Test Ride! – YouTube, accessed August 7, 2025, https://www.youtube.com/watch?v=oE5Lsl5FbGg

- BMW Concept F 450 GS | BMW Motorrad, accessed August 7, 2025, https://www.bmw-motorrad.com/en/articles/bmw-concept-f-450-gs.html

- Juicy Details Of The BMW F 450 GS Are Out, And They’ll Impress You – Top Speed, accessed August 7, 2025, https://www.topspeed.com/juicy-details-of-the-bmw-f-450-gs/

- BMW F 450 GS Concept 2025 – Motorcycle specifications, used – MotoPlanete, accessed August 7, 2025, https://www.motoplanete.us/bmw/10977/F-450-GS-Concept-2025/contact.html

- Thoughts on the BMW GS 450 Concept : r/Dualsport – Reddit, accessed August 7, 2025, https://www.reddit.com/r/Dualsport/comments/1j82omg/thoughts_on_the_bmw_gs_450_concept/

- BMW F 450 GS latest spy shots reveal production-ready design: What to expect? – HT Auto, accessed August 7, 2025, https://auto.hindustantimes.com/auto/two-wheelers/bmw-f-450-gs-spotted-in-production-ready-form-ahead-of-global-debut-later-this-year-41754389572274.html

- BMW F 450 GS Expected Launch Date, Price ₹ 5 Lakh | Latest Updates – BikeDekho, accessed August 7, 2025, https://www.bikedekho.com/bmw/f-450-gs

- 2025 BMW F 450 GS FINALLY LAUNCHED – This Changes Everything for Adventure Bikes!, accessed August 7, 2025, https://www.youtube.com/watch?v=ynOYZXHVwvs

- Production Version Of BMW F 450 GS Adventure Bike Looks Launch-Ready – Cartoq, accessed August 7, 2025, https://www.cartoq.com/bike-news/bmw-f-450-gs-production-version-spotted-testing-patent-images-revealed/

- 2025 BMW F 450 GS Concept Preview | Motorcyclist, accessed August 7, 2025, https://www.motorcyclistonline.com/news/bmw-f-450-gs-concept-preview/

- BMW F 450 GS Spied In Near Production Form – ADV Pulse, accessed August 7, 2025, https://www.advpulse.com/adv-news/bmw-f-450-gs-spied/

- CFMoto’s Ibex 450 Punches Above Its Class – Cycle World, accessed August 7, 2025, https://www.cycleworld.com/motorcycle-reviews/cfmoto-ibex-450-review/

- Owner’s Manual – CFMOTO USA, accessed August 7, 2025, https://www.cfmotousa.com/assets/cfmoto/images/owners_manuals/2025-cfmoto-ibex450-om-usa-20240408.pdf

- 2025 CFMOTO Ibex 450 long-term review: Living with a Chinese motorcycle – RevZilla, accessed August 7, 2025, https://www.revzilla.com/common-tread/2025-cfmoto-ibex-450-long-term-review-living-with-a-chinese-motorcycle

- How Much Abuse Can CFMoto’s Ibex 450 Take? – YouTube, accessed August 7, 2025, https://www.youtube.com/watch?v=trxjhL3-sVc

- CFMOTO Ibex 450 1000 Mile Review – YouTube, accessed August 7, 2025, https://www.youtube.com/watch?v=nvqC_GWhjt4&pp=0gcJCfwAo7VqN5tD

- QJMOTORS | SRK 400, accessed August 7, 2025, https://www.qjmotorph.com/srk400

- QJ Motor now also in Europe – Motorcycles.News, accessed August 7, 2025, https://motorcycles.news/en/qj-motor-now-also-in-europe/

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter