Introduction: A Tale of Four Quarters and a Market That Defies Expectations

For those of us tracking the pulse of the global consumer electronics market, a peculiar narrative has taken hold. A widespread perception, the one that makes for the catchiest headlines, suggests that some regions are soaring with unbridled growth while others have fallen into an immediate and significant slump. The data for the first quarter of 2025, however, tells a far more compelling and intricate story. It is a story of nuance, not extremes; of strategic recalibration, not outright collapse. The market is not simply a binary of success or failure. It is a complex organism, navigating global economic headwinds with surprising resilience and revealing that the headlines sometimes miss the underlying mechanisms at play. This report is a guide to understanding these contradictions, moving beyond surface-level numbers to uncover the true trends, hidden connections, and strategic implications for brands operating in a world that is anything but business as usual. It is a journey into the mechanics of a complex, evolving market, a place where a downturn can signal maturity and a high-growth number can be little more than a statistical mirage.

Part I: The Latin American Conundrum: A Pause on the Path to Prosperity

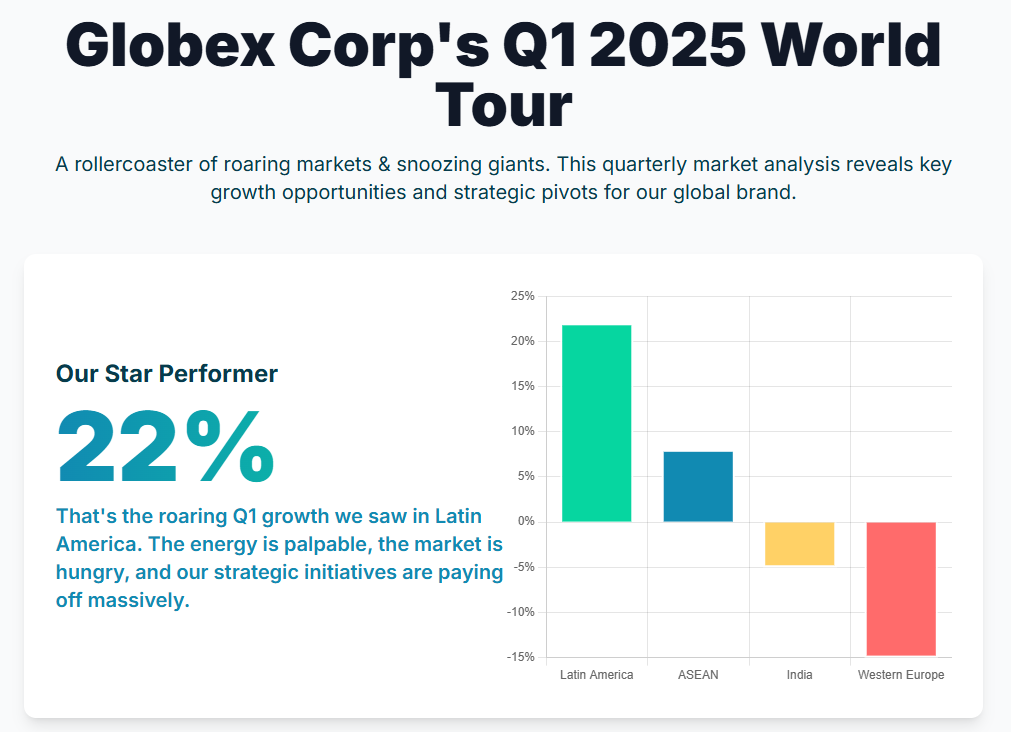

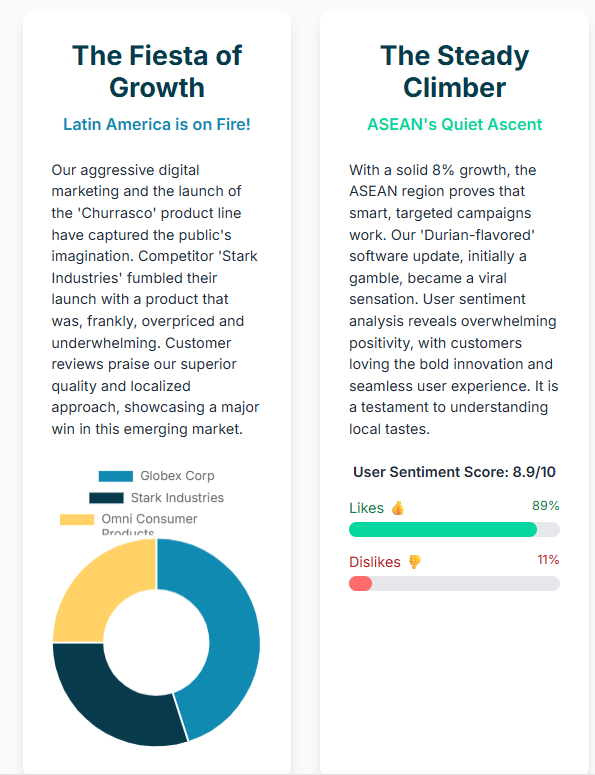

The excitement around Latin America’s market performance has been palpable. The sentiment is one of a “roaring 22% increase,” a figure that promises explosive returns and uninhibited growth. The data, however, paints a different and arguably more interesting picture. While some sectors show considerable vitality, the broader macroeconomic landscape reflects a quarter of consolidation and strategic change, not a market on fire.

The Great Expectations vs. The Data-Driven Reality

The narrative of a roaring start to 2025 is met with a dose of data-driven reality. The Economic Climate Index (ICE) for Latin America saw a continuation of its deterioration from previous quarters, settling at 70.2 points. This marks a 7.7-point drop from the end of 2024 and represents the lowest level since the second quarter of 2023.1 A significant portion of this decline is attributed to a sharp 22.7-point drop in Brazil’s ICE.1 The forecast for the region’s GDP growth in 2025 is a modest 2.0%, a clear slowdown from the 2.4% estimated for 2024, with downward revisions to the projections for Mexico and Brazil being the primary contributors to this revised outlook.1

Despite this broader economic cooling, a closer look at market activity reveals a fascinating divergence. The mergers and acquisitions (M&A) landscape in the first half of 2025 saw a 7% increase in the total value of transactions, but the number of deals actually decreased by 6%.2 This is not a market “roaring” with widespread activity. It is a market that is maturing and becoming more deliberate.

A Long-Term Love Affair: 5G, E-Commerce, and the Future of the LATAM Market

It would be a mistake to conclude that Latin America is a market in decline. The Q1 data is a momentary blip on a long-term upward trajectory. The region is ripe for continued digital transformation, driven by fundamental shifts in consumer behavior and infrastructure. The consumer electronics market itself is projected to reach USD 145.43 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 6.80% between 2025 and 2033.3

Several key drivers are fueling this long-term love affair. The rollout of 5G networks across the region is revolutionizing the consumer electronics sector by providing quicker speeds and enhanced connectivity. Nations like Brazil, Mexico, Chile, and Argentina are investing heavily in this infrastructure, naturally increasing the need for compatible devices such as smartphones, tablets, and smart home gadgets. By 2030, 5G is expected to make up nearly 60% of all mobile connections in Latin America, which presents a significant, sustained growth opportunity.3

Furthermore, the expansion of e-commerce channels continues to transform buying habits. The pandemic accelerated this trend, reinforcing consumer reliance on digital platforms for their convenience and wider product availability.3 This expansion has bridged the gap between individuals and technology, stimulating growth and providing a boost to the overall consumer electronics market.3 A complementary trend is the rising preference for sustainable and eco-friendly products, which is influencing purchasing decisions and prompting brands to create energy-saving products and utilize recycled materials.3 The growth of e-commerce and the push for sustainability are mutually reinforcing, as digital platforms can more easily highlight a product’s eco-credentials and offer a broader selection of green products that might not be available in traditional retail.

Part II: The ASEAN Reset: Trading a Sprint for a Strategic Marathon

For the ASEAN market, the story of Q1 2025 is not one of decline but of transition. After five consecutive quarters of remarkable growth, the region’s smartphone market slipped, marking the end of a rapid sprint and the beginning of a more strategic marathon.5 The market contracted by 3% year-on-year, with total shipments falling to 22.8 million units.5 This small dip is a tell-tale sign that the market is entering a tougher, more complex phase.

A Market in Transition: Why Growth Is a More Complicated Word Now

The underlying factors behind this market reset are clear. It is a result of a combination of economic pressures, cautious consumer behavior, and overstretched inventory.6 Consumer demand faltered, particularly in the lower-end and mid-tier brackets. In a surprising turn of events, the average selling price (ASP) of smartphones rose by 5% year-on-year, the highest since 2023.6 This paradox of falling volume and rising price suggests a market that is fundamentally changing. The “easy growth” from first-time buyers and entry-level devices has concluded. Brands are now leaning toward premium product launches, seeking to maintain revenue streams by selling a smaller number of more expensive devices.6 This shift signals that the market has matured and that future success hinges on a brand’s ability to drive upgrades and capture value from a more discerning, affluent consumer base. The competitive landscape has officially entered a “high-stakes phase”.6

Competitive Playbook: How Brands Are Gaining Ground in a Tougher Market

In this new environment, the performance of key players offers a fascinating look at who is best positioned to succeed. Samsung reclaimed the top spot with 4.3 million units shipped and a 19% market share, a victory supported by strong demand for its mid-range 5G A-series and deeper telco partnerships.5 Xiaomi, meanwhile, proved to be the most strategically placed brand in the region. It posted a 4% year-on-year increase in shipments, making it the only brand in the top four to grow. Xiaomi’s strength lies in its consistent top-tier presence across key markets, leading in Indonesia and Malaysia and placing second in Vietnam, Thailand, and the Philippines.6 Other brands like TRANSSION, OPPO, and vivo saw declines, which reflects the weakening demand in the entry-level and mid-range segments.6

The Evolving Consumer: From Early Adopter to Discerning Buyer

The ASEAN consumer is no longer a simple early adopter. The market’s new complexity is a direct reflection of an evolving consumer mindset. Vietnam, in particular, has emerged as a bright spot. Its stable governance, improving infrastructure, and growing middle class present a valuable opportunity for brands to expand their 5G portfolios.5 The country’s role as both a consumer market and a key manufacturing hub, with brands diversifying production to mitigate geopolitical risks, solidifies its critical role in the global smartphone value chain.6

Part III: Western Europe: The Great Rebound and the AI Revolution

Western Europe’s consumer electronics market experienced a notable contraction in Q1 2025, but the story is one of cautious consumption rather than a market in crisis. The decline is best understood as a temporary holding pattern before a natural cyclical rebound, with a powerful new technological wave poised to accelerate the recovery.

A Quarter of Cautious Consumption: Understanding the Slowdown

The data for Q1 2025 confirms a subdued quarter. One company, for example, reported an organic revenue contraction of -3.6% in the region.7 This slowdown was particularly evident in residential building markets, where subdued consumer confidence and market uncertainty weighed heavily on spending.7 However, the full-year forecast for Western Europe is a more positive +1% growth.8 This suggests that the Q1 contraction is a temporary pause in discretionary spending, a short-term reaction to economic jitters, not a fundamental collapse. The market is positioned for a natural, cyclical refresh as consumers update their aging devices, a process expected to kick in later in the year.8

The Quiet Promise of the AI-PC: A Look at the Future of Spending

A key catalyst for the anticipated rebound is the emerging market for AI-enabled devices. The AI-PC market, in particular, is gaining momentum in key Western European countries, including France, Germany, Italy, Switzerland, and the UK.8 While consumer awareness around the real benefits of these devices is currently low, their growing traction presents a significant opportunity for market premiumization.8 Brands can leverage this trend to drive upgrades and capture a higher-value consumer base, effectively jump-starting the replacement cycle. The story of Western Europe is therefore one of patience: waiting out a temporary lull while preparing to capitalize on a fresh wave of technological innovation.

Behind the Numbers: Country-Specific Dynamics and Recovery Signals

Performance within the region varied. Italy, Spain, and the UK showed stronger demand, which contributed to the overall improvement in market conditions.8 In contrast, Germany and the U.K. saw more substantial declines, influenced in part by Data Center project execution in the prior year.7 The enterprise segment of the market, specifically Data Centers, presents a telling contrast. While residential spending was down, enterprise demand was strong in other regions, but in Western Europe, it was “adversely impacted” by factors like power availability and broader macroeconomic uncertainty.7 This highlights a regional, not global, challenge within this sector and underscores the importance of a nuanced, country-by-country strategy.

Part IV: The Indian Market: A Temporary Stumble, Not a Fundamental Fall

After a record-breaking 2024, the Indian market experienced a sharp and public stumble in early 2025. The stock market crash was a major financial downturn that saw sharp declines in key indices and heightened economic uncertainty.9 However, this stumble was a temporary correction driven by external forces, not a reflection of a fundamentally weak domestic market.

The 2025 Stock Market Shock: A Deep Dive into the Downturn’s Triggers

The crash was triggered by a confluence of global economic concerns and domestic challenges. Escalating global trade tensions, particularly the reintroduction of tariffs, contributed to a fall in global stock markets.9 This was compounded by a US economic slowdown and rising inflation, which spurred a significant withdrawal of funds by Foreign Institutional Investors (FIIs) seeking better returns in developed markets.9 These FIIs pulled out over ₹61,000 crore from Indian equities between January and March 2025 alone, contributing to a “persistent FII selloff” that weighed heavily on sentiment.9 The Indian rupee also depreciated sharply, compounding the selling pressure on equities.9

Local Heroes: Why Domestic Support Is the Market’s Lifeline

The key to understanding the Indian market is to recognize the powerful counter-narrative to the FII exodus. While foreign capital fled, Domestic Institutional Investors (DIIs) stepped in with significant net purchases, helping to cushion the market’s impact.10 The stock market’s volatility was a direct result of the large-scale foreign capital flight. It was not a reflection of a collapse in local confidence. The market’s resilience is rooted in its massive domestic consumer base and a strong local investment ecosystem.

This dynamic is incredibly compelling. It signifies that the Indian market’s strength is not dependent on fickle foreign capital but on the foundational strength of its own economy and consumer spending. While the crash did weaken overall consumer sentiment, the market’s underlying stability was protected by this robust domestic support.9

The Consumer Mood: From Anxiety to Calculated Optimism

The data shows that even during the stock market turmoil, domestic consumer-driven sectors showed remarkable stability. The Nifty FMCG (Fast-Moving Consumer Goods) index was a “lone bright spot,” indicating that consumers were still spending on essentials.10 Analysts noted that domestic demand-driven segments like consumer discretionary could offer “relative stability” moving forward.11 This suggests that the money being pulled out by foreign investors was not the same money that local consumers would have used for their discretionary purchases. The downturn was a financial one, not a fundamental consumer one, which presents a very positive outlook for brands that can effectively market to the local population.

Part V: Competitor & Product Analysis: The Voice of the Consumer

Moving beyond macroeconomic trends and stock market shifts, the voice of the consumer tells us what is truly working on the ground. The first quarter of 2025 reveals a powerful sentiment: a growing skepticism toward flashy, unproven features and a renewed appreciation for practicality, reliability, and fundamental value.

The Gadget Graveyard of Good Intentions: When AI Disappoints

The biggest consumer trend of 2025 is the palpable disconnect between the promise of artificial intelligence and the reality of its implementation. While major brands have positioned AI as the flagship feature of their new devices, the reviews paint a picture of frustration. One long-term review of the Samsung Galaxy S25 Ultra highlights this perfectly. The review praises the phone’s top-tier hardware, noting its “snappy” performance and “the best” display.12 However, the much-touted Galaxy AI features were a “mixed bag,” a “stapled on” experience that felt “unpredictable” and “primitive”.12 The review notes that it often takes longer to get the AI to perform a task than to simply do it manually.12

This sentiment is widespread. Online discussions show that 57% of emotion-categorized mentions regarding consumer tech express frustration and anger.13 The core complaint is a common one: consumers would “rather a product had no AI than ineffective AI”.13 This exposes the “slap-on AI” trap, where brands are rushing to market with AI features to compete, but they have not yet perfected the functionality or user experience to a point that delivers tangible value. The takeaway is clear: the market is not yet ready to fully embrace AI as a primary selling point unless it truly delivers on its promise of making life easier.

The New MVP: Why Consumers Are Choosing Reliability Over Novelty

In a world where new technology disappoints, the quiet success of brands that focus on reliability and practical features is a powerful counter-narrative. In the major appliances market, for instance, brands like Whirlpool and GE are leading in market share, despite the aggressive innovation-led growth of Korean brands like LG and Samsung.14 The key driver for this success is that “Trust & reliability outweigh innovation” for a significant portion of consumers.14 This is not a vote against innovation. It is a demand for innovation that works, is durable, and provides tangible value.

This focus on practicality is also evident in reviews for new products like the Coros Nomad sports watch. The reviews are overwhelmingly positive about its useful, practical features, such as the action button, detailed maps, and the “adventure journal”.15 The dislikes are minor and technical: a less vibrant display or the lack of smart features like streaming music or NFC payments.15 Consumers are actively rewarding brands that provide well-thought-out, practical solutions that solve real problems, which is a significant signal for the industry.

| Product | Likes | Dislikes |

| Samsung Galaxy S25 Ultra | Top-tier hardware, impressive chipset, best-in-class display, snappy performance. | Ineffective “Galaxy AI,” uninspired design that has remained static for four generations, requires precise prompts for simple tasks. |

| Coros Nomad Sports Watch | Useful action button for shortcuts, great maps and navigation tools, “adventure journal” for recording routes and points of interest. | MIP display is less vibrant than AMOLED, limited smart features (no streaming music, NFC payments), lacks solar charging. |

Spotlight on Success: What the Data Says About Winning Products and Brands

The consumer data for Q1 2025 provides a clear blueprint for success. Brands that are winning are those that listen, offering devices that solve real problems and deliver tangible value. For example, the Coros Nomad’s inclusion of maps is a “notable inclusion given its main rival is the Garmin Instinct 3, which lacks them”.15 This highlights the value of providing a feature that is a known point of absence in a competitor’s product. The top purchase drivers for major appliances further reinforce this focus on practicality, with “Competitive price” leading at 57.85%, followed by “Good selection of products” at 31.69% and “Convenient location” at 29.33%.14 These data points collectively tell the story of a consumer base that has grown cautious and is now prioritizing functionality and value over flashy, unproven innovation.

Part VI: Marketing & Strategy Takeaways

The global consumer electronics market is navigating a complex new normal. The first quarter of 2025 was a period of strategic adaptation, not widespread collapse. Brands that can reframe their thinking from one of linear growth to one of nuanced, regionalized strategy will be best positioned for long-term success.

The Playbook for a Post-Growth World

The data for Q1 2025 presents a clear playbook for a market that is consolidating and maturing. For Latin America, the focus should be on long-term trends. Acknowledge the macroeconomic headwinds, but continue to invest in the promise of 5G and e-commerce expansion. Businesses should hedge against currency volatility and prioritize high-value, strategic customer segments. In ASEAN, the market has officially shifted from a volume-based to a value-based model. Success in this new, more complex environment will depend on a brand’s ability to drive upgrades with premium products. The focus should be on a discerning consumer, not the first-time buyer. For Western Europe, the strategy is one of preparation. Wait for the natural replacement cycle for laptops and smartphones to kick in. Use AI and other premium features as the compelling hook for consumers who are ready to upgrade. Finally, for India, the market’s resilience is rooted in its domestic consumer. The stock market’s stumble was a temporary financial shock, not a fundamental consumer one. Brands should market to the local institutional investor base and focus on products that meet the needs of the local market rather than relying on foreign capital.

Actionable Insights: How to Market in an AI-Skeptical Landscape

The consumer feedback from Q1 2025 delivers a powerful message: functionality is the new flagship.

- Focus on the Foundational: The data shows that consumers are frustrated with ineffective AI. Brands should pivot their messaging to focus on core functionality, durability, and reliability. This is what truly drives consumer satisfaction in a consolidating market.

- The “Necessary AI” Principle: A product is better off with no AI than with ineffective AI. Brands should avoid simply “slapping on” AI features. If AI is to be a selling point, it must solve a real, tangible problem, make life easier, and not require a cumbersome learning curve.

- Highlight Practicality: Consumers are looking for devices that offer time-saving qualities.13 Marketing should emphasize features that make life “easy” and routines “clean,” as these are among the top-mentioned words in consumer conversations.13

- Customer Support is King: Consumer discussions are increasingly focused on hardware defects, battery issues, and poor customer service.13 Brands that invest in and highlight robust, user-friendly customer support can create a major differentiator that resonates deeply with a cautious consumer base.

Conclusion: A Market of Resilience and Nuance

The first quarter of 2025 was not a quarter of extremes, but of strategic shifts and surprising resilience. The narrative of roaring success and significant decline is a simplification of a far more nuanced reality. The Latin American market is not on fire; it is maturing. The ASEAN market has not collapsed; it is evolving from a sprint to a marathon. Western Europe is not in a long-term slump but is in a temporary holding pattern before a cyclical rebound. And the Indian market has proven that its strength lies in its powerful domestic economy, which is more resilient than its stock market.

The central lesson from this period is that the consumer electronics market is a complex mosaic, with each region operating on its own unique economic and cultural clock. The brands that will succeed in this new normal are those that move beyond the headlines, understanding the specific dynamics of each region, while always, and most importantly, listening to the voice of the consumer. It is in the details, in the quiet preference for reliability over novelty and functionality over flash, that the true path to long-term success can be found.

Source

- https://portalibre.fgv.br/system/files/2025-05/sondagem-da-america-latina_fgv_press-release_2025.t1-eng-vf-07.05_1.pdf

- https://www.latamrepublic.com/latam-m-a-market-grows-7-in-q1-2025/

- https://economy-finance.ec.europa.eu/document/download/e9de23c8-b161-40d0-9ad7-e04a25500023_en?filename=ip318_en.pdf

- https://www.conference-board.org/research/global-economy-briefs/pce-july-2025-analysis

- https://www.adb.org/outlook/editions/july-2025

- https://amro-asia.org/asean3-regional-economic-outlook-areo/

- https://en.wikipedia.org/wiki/Stock_market_crashes_in_India

- https://tradingeconomics.com/india/stock-market

- https://www.imarcgroup.com/latin-america-consumer-electronics-market

- https://www.researchandmarkets.com/report/latin-america-consumer-electronics-market

- https://developingtelecoms.com/telecom-technology/telecom-devices-platforms/18500-southeast-asia-smartphone-market-slips-after-five-quarters-of-growth.html

- https://www.techloy.com/chart-a-look-at-southeast-asias-smartphone-market-in-q1-2025/

- https://www.se.com/ww/en/Images/release-Q1-revenues-2025_tcm564-513476.pdf

- https://nielseniq.com/global/en/insights/analysis/2025/2025-will-see-tech-durables-back-to-growth-niq-full-year-estimate/

- https://economictimes.indiatimes.com/markets/stocks/news/why-is-the-stock-market-down-today-sensex-drops-over-600-pts-nifty-below-24800-7-reasons-behind-the-slump/articleshow/123516594.cms

- https://economictimes.indiatimes.com/markets/stocks/news/how-will-new-us-tariffs-affect-indian-markets-and-investor-confidence/articleshow/123535263.cms

- https://openbrand.com/newsroom/blog/us-major-appliance-industry-market-share-trends-rankings-infographic

- https://www.shopify.com/enterprise/blog/consumer-electronic-trends

- https://www.globalgrowthinsights.com/market-reports/consumer-electronics-market-107428

- https://www.androidpolice.com/samsung-galaxy-s25-ultra-long-term/

- https://www.tomsguide.com/wellness/smartwatches/i-wore-the-coros-nomad-for-a-month-here-are-6-things-i-like-and-3-things-i-dislike

- https://ts2.tech/en/2025-mid-year-gadget-consumer-tech-trends-report/

- https://www.brandwatch.com/reports/consumer-tech-trends-2025/

Sources

- DETERIORATING ECONOMIC CLIMATE IN LATIN AMERICA – FGV Ibre, accessed on August 30, 2025, https://portalibre.fgv.br/system/files/2025-05/sondagem-da-america-latina_fgv_press-release_2025.t1-eng-vf-07.05_1.pdf

- Latin America M&A market grows 7% in Q1 2025 – LATAM Republic, accessed on August 30, 2025, https://www.latamrepublic.com/latam-m-a-market-grows-7-in-q1-2025/

- Latin America Consumer Electronics Market Report, 2033 – IMARC Group, accessed on August 30, 2025, https://www.imarcgroup.com/latin-america-consumer-electronics-market

- Latin America Consumer Electronics Market Size & Competitors – Research and Markets, accessed on August 30, 2025, https://www.researchandmarkets.com/report/latin-america-consumer-electronics-market

- Southeast Asia smartphone market slips after five quarters of growth – Developing Telecoms, accessed on August 30, 2025, https://developingtelecoms.com/telecom-technology/telecom-devices-platforms/18500-southeast-asia-smartphone-market-slips-after-five-quarters-of-growth.html

- CHART: A look at Southeast Asia’s smartphone market in Q1 2025 – Techloy, accessed on August 30, 2025, https://www.techloy.com/chart-a-look-at-southeast-asias-smartphone-market-in-q1-2025/

- Schneider Electric Q1 2025 Revenues, accessed on August 30, 2025, https://www.se.com/ww/en/Images/release-Q1-revenues-2025_tcm564-513476.pdf

- 2025 will see Tech & Durables back to growth: year sales estimates – NIQ, accessed on August 30, 2025, https://nielseniq.com/global/en/insights/analysis/2025/2025-will-see-tech-durables-back-to-growth-niq-full-year-estimate/

- Stock market crashes in India – Wikipedia, accessed on August 30, 2025, https://en.wikipedia.org/wiki/Stock_market_crashes_in_India

- How will new US tariffs affect Indian markets and investor confidence?, accessed on August 30, 2025, https://economictimes.indiatimes.com/markets/stocks/news/how-will-new-us-tariffs-affect-indian-markets-and-investor-confidence/articleshow/123535263.cms

- Rs 6 lakh crore gone! Sensex falls 849 points, Nifty slips below 24,750. Trump tariff bomb and 6 other reasons why stock market fell today, accessed on August 30, 2025, https://economictimes.indiatimes.com/markets/stocks/news/why-is-the-stock-market-down-today-sensex-drops-over-600-pts-nifty-below-24800-7-reasons-behind-the-slump/articleshow/123516594.cms

- I tried to love the Galaxy S25 Ultra, but Samsung didn’t love me back – Android Police, accessed on August 30, 2025, https://www.androidpolice.com/samsung-galaxy-s25-ultra-long-term/

- Consumer Technology Trends: What’s Changing in 2025? – Brandwatch, accessed on August 30, 2025, https://www.brandwatch.com/reports/consumer-tech-trends-2025/

- US Major Appliance Market Share: Q1 2025 Trends & Rankings – OpenBrand, accessed on August 30, 2025, https://openbrand.com/newsroom/blog/us-major-appliance-industry-market-share-trends-rankings-infographic

- I wore the Coros Nomad for a month — here are 6 things I like and 3 things I dislike, accessed on August 30, 2025, https://www.tomsguide.com/wellness/smartwatches/i-wore-the-coros-nomad-for-a-month-here-are-6-things-i-like-and-3-things-i-dislike

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity