The Japanese motorcycles market experienced a significant decline in April, resulting in a negative year-to-date (YTD) data of -2.1%. Kawasaki, one of the top manufacturers, faced a substantial drop in sales, losing one-third of its market share. On the other hand, Honda, Suzuki, and Yamaha managed to maintain stable sales figures.

Motorcycle market trend

Regarding the motorcycle market trend in 2022, the industry is expected to see a slight increase compared to the previous year. The growth is primarily attributed to the rising demand for electric scooters. However, the weak economic environment suggests that there won’t be a substantial increase in consumer demand.

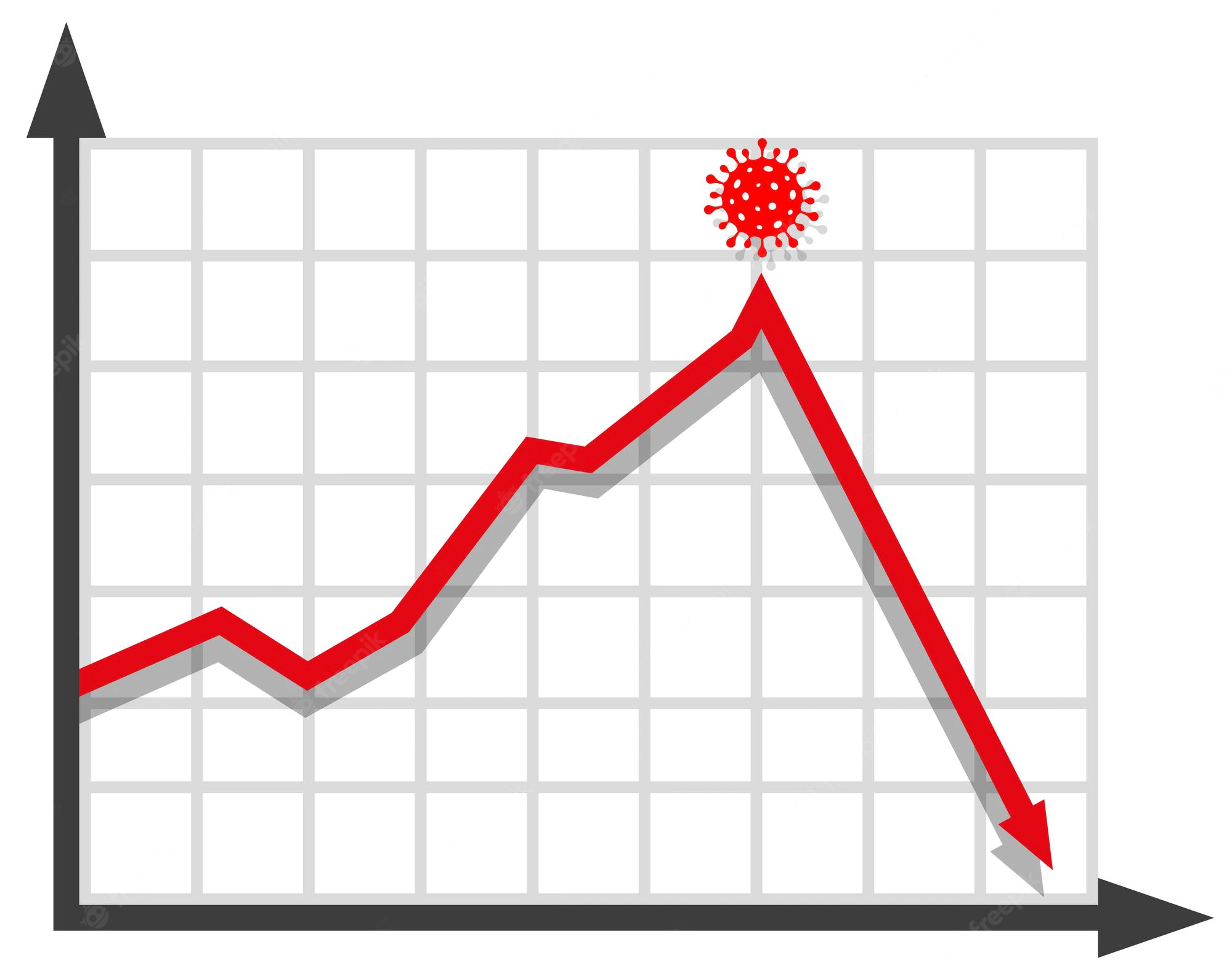

During the past thirty years, the 2-wheeler market in Japan experienced a long decline, going from millions of annual sales to below half a million. However, the arrival of the COVID-19 pandemic led to an increased demand for individual mobility and social distancing, resulting in a boost to the domestic motorcycle industry in 2020 and 2021.

Strict emission limits

Additionally, stricter emissions limits prompted local manufacturers to introduce electric vehicle (EV) versions of several scooter models. Although the price gap between internal combustion engine (ICE) and equivalent EV models is still a deterrent, the demand for electric vehicles is growing. Manufacturers will likely need to change their pricing strategies in the near future, and the EV segment is expected to fuel market expansion in the next decade.

Looking at recent years, the Japanese domestic 2-wheeler market experienced fluctuations. The market peaked in 2013 with 453,036 sales and then declined to a minimum of 357,432 in 2019. The COVID-19 pandemic resulted in a rebound, surpassing 0.4 million sales in 2021. However, the trend turned negative again in 2022, albeit moderately, with the market settling at 397,618 sales.

Segments

In terms of electric vehicles, the development has been positive, with the L1 segment experiencing a significant 425% growth and the L3 segment growing by a more modest 21.8%. However, Japan’s electric segment is still relatively small compared to Europe and other leading countries.

In terms of market competition, Honda maintained its position as the market leader with 191,891 sales (-3.3%), followed by Suzuki with 89,848 sales (-2.2%) and Yamaha with 57,458 sales (-18.5%). Kawasaki emerged as the top performer, with a sales increase of 27.1%. Harley-Davidson also achieved an impressive recovery, with sales up 56.2%, marking its best global performance of the year.

There are a few reasons why the Japanese motorcycle market is not doing well in 2023.

- The global chip shortage: The global chip shortage has been a major problem for the automotive industry, and the motorcycle industry is no exception. The shortage has made it difficult for manufacturers to get the parts they need to build motorcycles, which has led to decreased production and sales.

- The rising cost of living: The rising cost of living in Japan has made it more difficult for people to afford motorcycles. The average price of a new motorcycle in Japan is now over ¥1 million, which is a significant amount of money for many people.

- The ageing population: The population of Japan is ageing, and this is hurting the motorcycle market. Older people are less likely to ride motorcycles than younger people, so the decline in the birth rate is leading to a decline in the number of potential motorcycle riders.

Despite these challenges, there are some reasons to be optimistic about the future of the Japanese motorcycle market.

- The growth of the electric motorcycle market: The electric motorcycle market is growing rapidly, and this is a significant opportunity for Japanese manufacturers. Japanese companies are leaders in developing electric motorcycles, and they are well-positioned to capitalize on this growing market.

- Motorcycle tourism’s popularity is becoming increasingly popular, and this is another opportunity for Japanese manufacturers. Japan is a beautiful country with a lot to offer motorcycle riders, and Japanese companies can make motorcycles that are perfect for touring.

Conclusion

Overall, the Japanese motorcycle market is facing some challenges, but there are also reasons to be optimistic about the future. Japanese manufacturers are well-positioned to take advantage of the growth of the electric motorcycle market and the popularity of motorcycle tourism.

Source: Motorcycledata