Executive Summary

The automotive industry is undergoing a profound transformation driven by the dual imperatives of enhanced safety and rapid technological advancement. The period of 2024-2025 is characterized by the accelerated integration of advanced software, sophisticated connectivity features, and increasingly stringent global safety regulations. This dynamic environment is compelling manufacturers to innovate at an unprecedented pace, reshaping vehicle design, functionality, and the overall mobility experience.

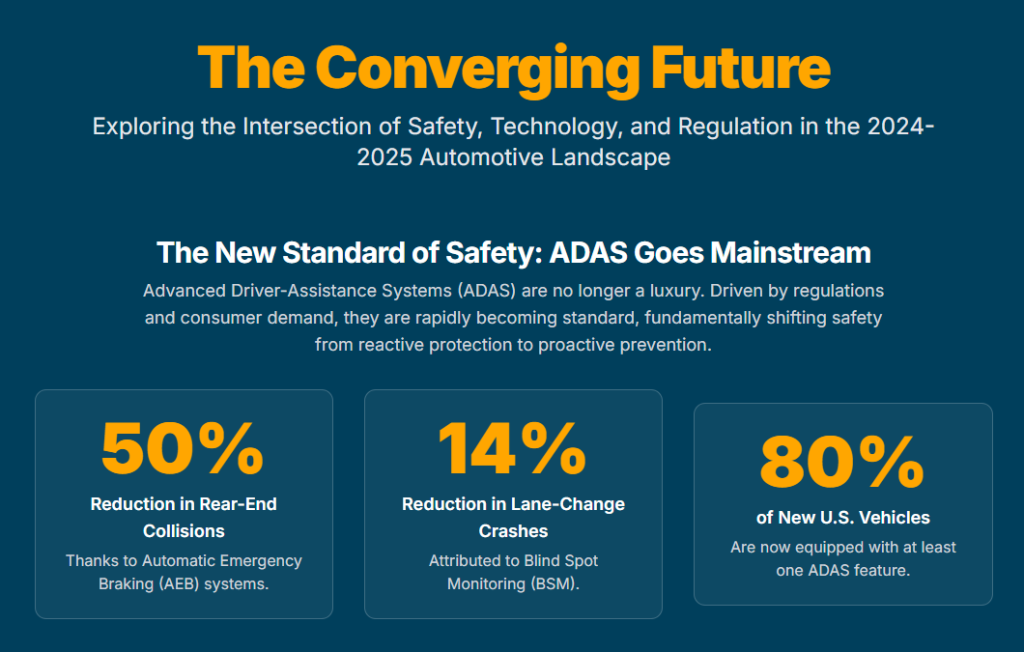

Advanced Driver-Assistance Systems (ADAS) are rapidly transitioning from luxury features to standard equipment across various vehicle segments, significantly contributing to the reduction of accident rates and improvement of road safety.1 This widespread adoption is heavily influenced by both evolving regulatory mandates and growing consumer demand for safer vehicles.

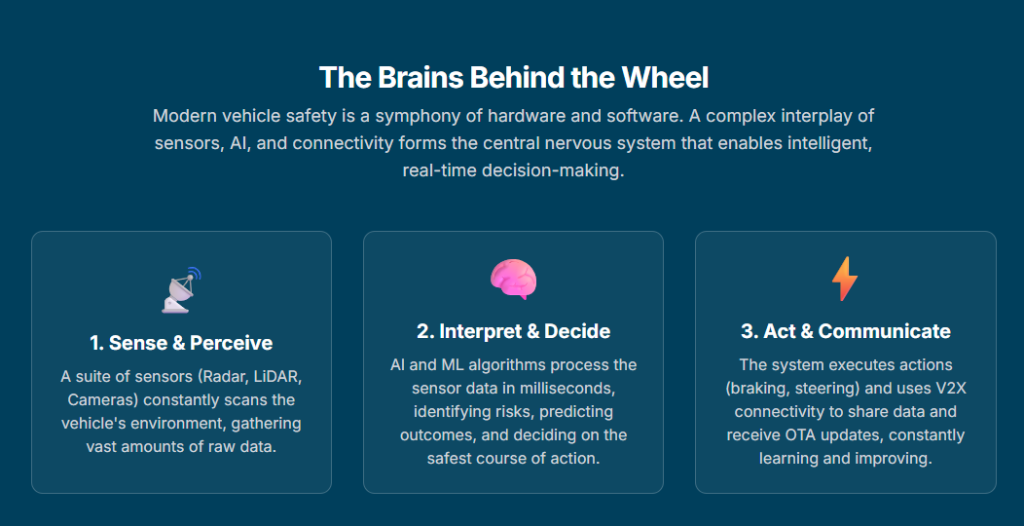

Software-Defined Vehicles (SDVs) and the pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML) are becoming the central nervous system of modern automobiles. These technologies enable real-time decision-making, predictive capabilities, and highly personalized user experiences. Furthermore, they facilitate Over-the-Air (OTA) updates, ensuring continuous improvement and adaptability of vehicle systems throughout their lifespan.6

Global regulatory bodies, including the National Highway Traffic Safety Administration (NHTSA), Euro NCAP, and the United Nations Economic Commission for Europe (UNECE), are enacting stricter rules. These mandates particularly focus on pedestrian protection, Automatic Emergency Braking (AEB), and cybersecurity, compelling manufacturers to innovate and standardize safety features across all vehicle segments.12 These regulatory frameworks are not merely compliance hurdles; they serve as powerful catalysts for innovation and significant market shifts.

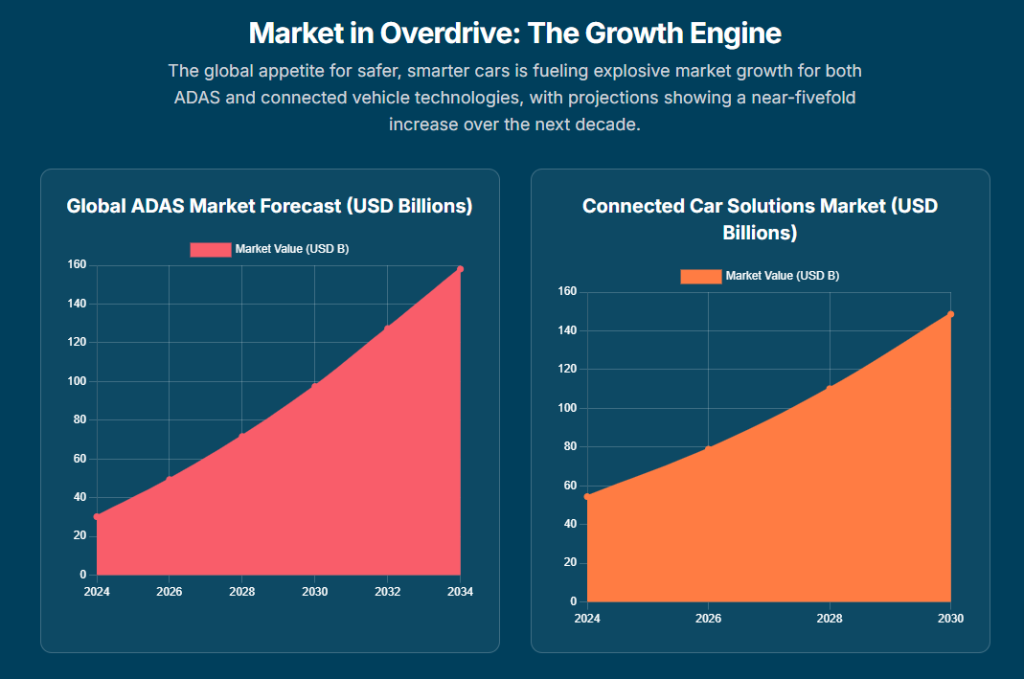

The market for ADAS and connected car solutions is experiencing robust growth. The global passenger vehicle ADAS market, valued at USD 30.20 billion in 2024, is projected to reach USD 158.06 billion by 2034, representing a Compound Annual Growth Rate (CAGR) of 18%.4 Similarly, the global market for Connected Car Solutions, valued at US

54.4billionin2024,isprojectedtoreachUS148.6 billion by 2030, growing at a CAGR of 18.2%.19 North America currently leads this market, while the Asia-Pacific region is demonstrating the fastest growth, underscoring strong consumer demand and attractive investment opportunities.4

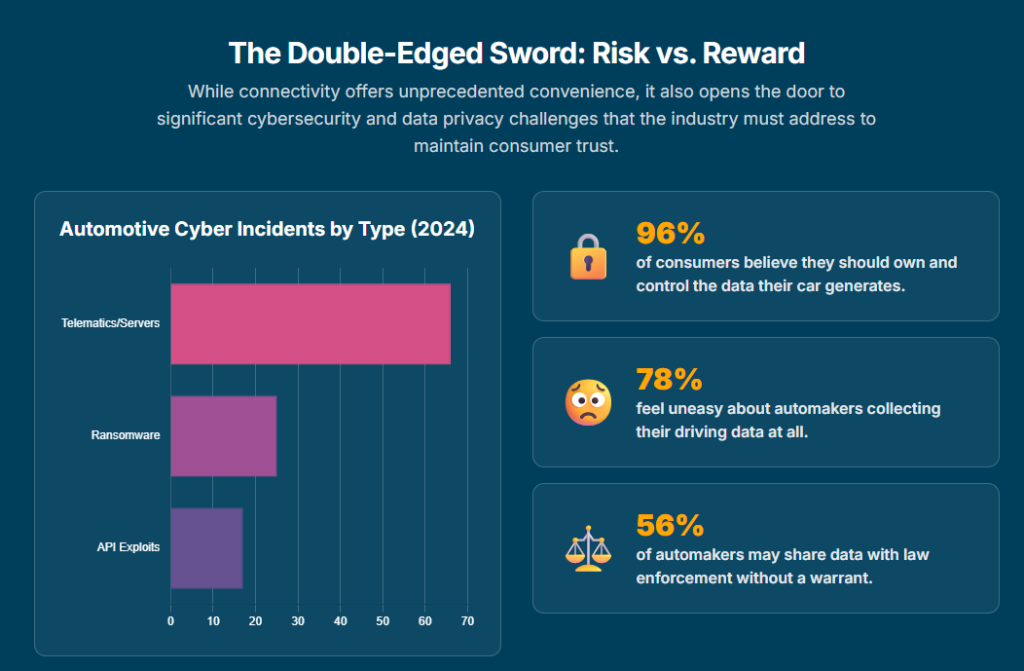

However, this technological evolution introduces significant challenges. Escalating cybersecurity threats, including sophisticated ransomware attacks and API vulnerabilities, alongside complex data privacy concerns, necessitate proactive, AI-driven security measures and robust compliance frameworks.20 Addressing these issues is paramount for maintaining consumer trust and brand loyalty.

Leading automakers such as Tesla, Mercedes-Benz, Toyota, and BMW, along with pivotal technology providers like Aptiv, Mobileye, NVIDIA, Bosch, and Qualcomm, are at the forefront of this innovation. Their strategic investments and collaborations are driving the development and deployment of safer, smarter, and more integrated mobility solutions.11

One critical observation from the current landscape is how regulatory compliance has emerged as a significant market differentiator and a powerful driver for innovation. The consistent mention of regulations mandating ADAS features indicates that these are not merely about meeting minimum requirements but about pushing the entire industry forward.5 If compliance becomes a baseline expectation, then exceeding it transforms into a competitive advantage. The Global NCAP’s “Safer Choice Award,” for instance, explicitly links regulatory recognition to influencing consumer demand.12 This implies that manufacturers who proactively integrate advanced safety features beyond current mandates, anticipating future regulatory shifts, can cultivate a strong “safety image” and command a premium, thereby capturing greater market share by appealing to safety-conscious consumers.12 This strategic approach also stimulates internal research and development and fosters deeper collaboration across the supply chain.

Another crucial observation centers on the profound interdependence of hardware, software, and connectivity in achieving enhanced safety. ADAS relies heavily on a diverse array of sensors, including LiDAR, radar, and cameras.3 However, these sensors are ineffective without sophisticated software and artificial intelligence to interpret the vast amounts of data they collect and translate it into actionable decisions.6 Furthermore, robust connectivity, facilitated by Over-the-Air (OTA) updates and Vehicle-to-Everything (V2X) communication, further augments these systems by enabling real-time data exchange and continuous improvements.6

The industry’s pivot towards Software-Defined Vehicles (SDVs) is a direct consequence of this fundamental need for software-driven flexibility and ongoing enhancement.9 This necessitates that automotive companies abandon siloed operations for hardware, software, or connectivity. Instead, success will hinge on a holistic, integrated approach to vehicle architecture, prioritizing software-first design and robust data pipelines. This shift, in turn, demands the cultivation of new skill sets, such as automotive software developers and cybersecurity specialists 35, and fosters deeper, more integrated collaboration across the entire supply chain.12

Finally, the industry is grappling with a significant paradox: the convenience offered by connected cars is intrinsically linked to escalating risks. Connected features provide immense benefits, including remote access, personalized profiles, advanced voice assistants, and even in-car commerce.6 However, this very connectivity simultaneously expands the attack surface for cyber threats and raises substantial data privacy concerns.9

The recent lawsuit against General Motors regarding data sharing serves as a stark illustration of this inherent tension.23 While consumer demand for connected features remains high, manufacturers face a critical balancing act. Building and maintaining consumer trust requires not only delivering innovative features but also demonstrating an unwavering commitment to robust cybersecurity and transparent data handling practices. A failure to prioritize these aspects can lead to significant financial losses, severe reputational damage, and a profound erosion of customer loyalty.23 This also underscores the growing necessity for “embedded compliance” within vehicle design, where security and privacy are considered from the earliest stages of development.34

Introduction: The Dual Imperative of Safety and Technology

The automotive industry is currently at an inflection point, driven by a profound and accelerating focus on both active and passive safety, inextricably linked with rapid technological advancements. This period, particularly 2024-2025, witnesses vehicles evolving from mere modes of transport into sophisticated, intelligent platforms. This transformation is fueled by several critical factors: increasing consumer expectations for safer and smarter vehicles, the maturation of foundational technologies like Artificial Intelligence (AI) and advanced sensors, and a global push for stricter regulatory frameworks aimed at significantly reducing road fatalities and injuries.1

At the core of this evolution lies the growing adoption of advanced software, which enables increasingly sophisticated functionalities, and pervasive connectivity features that are redefining the in-car experience and vehicle-to-environment interactions.6 Manufacturers are compelled to innovate at an unprecedented pace, not just to meet compliance requirements but to gain a competitive edge in a market where safety and technological sophistication are rapidly becoming primary purchasing criteria for consumers.6

A significant development in this era is the fundamental shift from reactive to proactive safety measures. Historically, automotive safety primarily focused on protecting occupants during a crash through passive features such as airbags and crumple zones.36 However, contemporary advancements, particularly in Advanced Driver-Assistance Systems (ADAS), emphasize features like Automatic Emergency Braking (AEB), Lane-Keeping Assist (LKA), Blind Spot Monitoring (BSM), and predictive navigation.1 These systems are explicitly designed to prevent accidents or mitigate their impact

before they occur. Toyota’s “Proactive Driving Assist,” for example, aims to provide a sense of security even under normal driving conditions, not solely during emergencies.28 This represents a fundamental paradigm shift in automotive safety philosophy. The industry is moving beyond merely protecting occupants during a collision to actively preventing crashes and minimizing risks in real-time driving scenarios. This has profound implications for vehicle design, software development, and the evolving role of the driver, holding the potential to significantly reduce human error as a leading cause of accidents.11

Furthermore, technology is increasingly serving as the primary enabler of regulatory compliance. Regulations such as NHTSA’s mandate for pedestrian-avoidance braking (PAB) by 2029 12 and the European Union’s General Safety Regulation II (GSR II) requiring intelligent-speed assistance and AEB 12 are directly driving specific technological adoptions. These are not abstract rules; they necessitate the development and widespread deployment of advanced sensors, sophisticated AI algorithms, and robust software solutions. This indicates that regulatory bodies are, in effect, dictating the technological roadmap for the automotive industry. This creates a clear and urgent demand signal for technology providers and strongly incentivizes automakers to invest in and standardize these solutions across their product lines. It also suggests that future regulations will likely continue to target specific, measurable safety outcomes, further embedding technology into the core of vehicle safety and accelerating the pace of innovation.

Advanced Safety Features: Redefining Vehicle Protection

Advanced Driver-Assistance Systems (ADAS) are rapidly transitioning from being premium options to becoming standard equipment across various vehicle segments, significantly enhancing overall road safety.1 This widespread integration marks a pivotal shift in automotive safety.

Evolution and Standardization of Advanced Driver-Assistance Systems (ADAS)

Several key ADAS features are at the forefront of this evolution:

- Automatic Emergency Braking (AEB): This vital system utilizes radar sensors mounted on the front of a vehicle to detect potential collisions. It alerts the driver to avoid the impact and, if no response is detected, automatically applies the brakes. Research indicates that AEB alone can reduce rear-end collisions by 50%, and when combined with pedestrian detection, it can reduce pedestrian crashes by 27%.3 Many manufacturers, including Honda and Toyota, already incorporate AEB into most of their new models, and it is widely expected to become a universal feature.3 Further solidifying its importance, NHTSA finalized a rule mandating pedestrian-avoidance braking (PAB) by 2029 for all passenger cars and light trucks, a measure projected to save 360 lives annually.12

- Lane-Keeping Assist (LKA) & Lane-Centering Assist: These systems employ cameras to monitor road markings and subtly adjust the vehicle’s steering to maintain its position within the lane. This functionality significantly reduces the chances of sideswipe collisions and head-on crashes, proving particularly beneficial in preventing accidents caused by drowsy or distracted driving.1

- Blind Spot Monitoring (BSM) & Rear Cross-Traffic Alert (RCTA): These features detect vehicles in adjacent lanes that may be outside the driver’s view or crossing traffic when reversing. They warn the driver through visual cues (e.g., flashing lights on mirrors), auditory alerts, or even haptic feedback (e.g., steering wheel vibrations), reducing lane-change crashes by 14%.3 RCTA was specifically highlighted by NHTSA in 2016 for its importance in providing an extended field of vision and reducing backover crashes.36

- Adaptive Cruise Control (ACC): This system maintains a pre-set driving speed and automatically adjusts it to maintain a safe following distance from the vehicle ahead, even in stop-and-go traffic.3 ACC reduces driver fatigue during long journeys and contributes to smoother traffic flow, potentially improving fuel consumption.

- Traffic Sign Recognition (TSR): Utilizing forward-facing cameras, TSR detects traffic signs such as speed limits and stop signs and displays them on the dashboard or head-up display.3 This feature helps drivers stay informed and compliant with road rules, especially on unfamiliar routes.

- Intersection Assist & Cross Traffic Alert: These systems actively monitor other vehicles approaching cross streets or while the vehicle is reversing, providing crucial warnings to prevent collisions in complex scenarios.6

The market adoption of ADAS features is substantial. Over 98 million vehicles on U.S. roads now feature advanced driver assistance systems, accounting for approximately 80% of the current automotive market.5 The global passenger vehicle ADAS market size was estimated at USD 30.20 billion in 2024 and is projected to reach USD 158.06 billion by 2034, expanding at a CAGR of 18%.4 North America held the largest market share at 36% in 2024, while the Asia-Pacific market is anticipated to experience the fastest growth between 2025 and 2034.4 Leading innovators in this space include automakers such as Tesla, whose Autopilot technology demonstrates significantly fewer crashes per mile than the national average 25, Mercedes-Benz 26, and Toyota 28, all continuously enhancing their ADAS suites.

Innovations in Passive Safety and Crashworthiness

Beyond active prevention systems, traditional passive safety features and vehicle crashworthiness remain critical components of overall vehicle protection. Federal government mandates continue to ensure advanced crash protection, encompassing robust structural features, sophisticated restraint systems, and comprehensive airbag deployments.36 While front airbags became mandatory for all passenger cars, light trucks, and vans in 1999, most new vehicles now incorporate at least six airbags, with some models offering as many as ten. Research by the Insurance Institute for Highway Safety (IIHS) demonstrates significant reductions in fatality risk with the inclusion of torso-only side airbags (26% for cars, 52% for SUVs) and head-protecting airbags (37% for cars, 30% for SUVs).36

Vehicle structures are continually being engineered to absorb crash energy more effectively, a design imperative that now also includes accommodating the numerous sensors and complex electronic architectures required to support advanced ADAS functionalities.12 A notable development in this area is NHTSA’s proposed new Federal Motor Vehicle Safety Standard (FMVSS) No. 228 on Pedestrian Head Protection. This proposed standard would require vehicles to mitigate the risk of serious to fatal head injuries for both child and adult pedestrians in impacts at speeds up to 40 km/h (25 mph) by mandating specific protective countermeasures within vehicle hoods.16 This measure is expected to mitigate approximately 67.4 fatalities annually.16

Emergence of Driver Monitoring and In-Cabin Health Systems

The definition of vehicle safety is expanding beyond collision avoidance to encompass the driver’s state and the overall cabin environment.

- Driver Monitoring Systems (DMS): These systems are increasingly prevalent, utilizing cameras and sensors to track driver behavior, including eye movements and head position. Their purpose is to detect signs of fatigue, distraction, or impaired behavior and issue timely alerts to enhance driver attentiveness.1 Continental, for example, previewed an “Invisible Biometrics Sensing Display” that can monitor a driver’s heart rate and other vital signs.7 Similarly, LG’s Affectionate Intelligence technology employs heart rate monitoring and facial expression recognition to assess a user’s physical health and emotional state, notifying the driver if they become distracted or drowsy.7

- In-Cabin Health Sensors: To further enhance occupant well-being, features such as air quality monitors that filter pollutants and allergens, CO2 detection systems to prevent drowsiness from stale air, and intelligent climate zones that automatically adjust temperatures for different passengers are emerging.6

- AI-Enhanced Safety Cameras: The evolution of camera systems extends far beyond standard backup cameras. The trend is towards 360-degree AI-enhanced full-surround vision, which offers significant improvements in object detection (including small pets, curbs, and potholes), real-time stitching of multiple camera views, and smart alerts whether the vehicle is parked or in motion.6

Key ADAS Features and Their Impact (2024-2025 Adoption & Benefits)

| Feature Name | Description | Primary Safety Benefit | Adoption (2024-2025) | Supporting Information |

| Automatic Emergency Braking (AEB) | Detects potential collisions and automatically applies brakes if the driver doesn’t react. | Reduces rear-end collisions by 50%; pedestrian crashes by 27%. | Near-universal, mandated by NHTSA for PAB by 2029. | 3 |

| Lane-Keeping Assist (LKA) | Monitors lane markings and subtly adjusts steering to keep the vehicle centered. | Reduces sideswipe and head-on crashes, prevents drowsy/distracted driving incidents. | Increasingly prevalent. | 1 |

| Blind Spot Monitoring (BSM) | Detects vehicles in adjacent lanes outside the driver’s view and provides warnings. | Reduces lane-change crashes by 14%. | High adoption. | 3 |

| Driver Monitoring Systems (DMS) | Uses cameras/sensors to track driver behavior (e.g., eye movements) to detect fatigue or distraction. | Improves driver attentiveness, prevents accidents due to impaired driving. | Emerging, becoming standard in some regions (e.g., China). | 1 |

| Adaptive Cruise Control (ACC) | Maintains a set driving speed and adjusts to keep a safe distance from the vehicle ahead. | Reduces driver fatigue, promotes smoother traffic flow, improves fuel efficiency. | Widely available, increasingly standard. | 3 |

| Rear Cross-Traffic Alert (RCTA) | Detects approaching vehicles or pedestrians when reversing out of a parking spot or driveway. | Prevents backover collisions. | High adoption, mandated by NHTSA for extended field of vision. | 3 |

| Traffic Sign Recognition (TSR) | Utilizes cameras to detect and display traffic signs (e.g., speed limits) on the dashboard or HUD. | Keeps drivers informed and compliant with road rules, reduces distraction. | Growing adoption. | 3 |

The “democratization of safety” is a notable trend. Several sources indicate that ADAS features are becoming “increasingly standard even in non-luxury vehicles” 6 and are expected to be “standard features in most new vehicles”.2 Aptiv explicitly highlights “Democratized Safety” through modular solutions designed to scale across diverse vehicle models.33 This broad adoption is not solely a result of competitive pressure—where manufacturers must keep pace if rivals offer ADAS as standard 3—but is significantly driven by regulatory mandates.5 This implies that the market is moving towards a baseline where advanced safety is an expected feature, rather than a premium add-on. Consequently, manufacturers can no longer differentiate solely on the mere presence of ADAS but must instead focus on the superior performance, reliability, and seamless integration of these systems. This shift also creates a substantial aftermarket for calibration and repair services 5, and reorients the competitive landscape towards a brand’s overall safety reputation rather than just its luxury offerings.

Furthermore, ADAS features are clearly serving as a foundational layer for the progression towards higher levels of autonomy. The description of Adaptive Cruise Control (ACC) paired with Lane-Keeping Assist (LKA) contributing to a “semiautonomous driving experience on highways” 3, and the consistent mention of ADAS as a stepping stone towards “Autonomous Vehicles (AVs)” 24 and “full self-driving” 11, indicates a clear developmental trajectory. The sensor fusion and AI algorithms initially developed and refined for ADAS are directly applicable and essential for achieving higher levels of vehicle autonomy.8 This suggests that current investments in ADAS are not merely for immediate safety improvements but are strategic, foundational steps for future autonomous driving capabilities. Companies that excel in ADAS development are inherently positioning themselves advantageously for the next phase of mobility, implying a continuous research and development pipeline where ADAS innovations directly contribute to AV development, thereby blurring the lines between assisted and fully autonomous driving.

The definition of “safety” is also expanding to encompass driver well-being and environmental factors within the cabin. Beyond traditional crash prevention, there is a growing emphasis on Driver Monitoring Systems (DMS) that detect fatigue and distraction 1, the integration of in-cabin health sensors for monitoring air quality and CO2 levels 6, and even advanced biometric monitoring of heart rate and vital signs.7 This signifies that automotive safety is no longer confined to preventing collisions or protecting occupants during impact. It now extends to actively monitoring and potentially managing the driver’s cognitive state, physical well-being, and the quality of the interior environment. This holistic view of safety opens new avenues for innovation, potentially leading to vehicles that actively manage driver health and alertness, and offer a healthier interior environment, which could become a significant new differentiator for automotive brands.

Technological Advancements Driving Automotive Innovation

The automotive industry is experiencing a profound technological transformation, with advanced software and connectivity at its core. These advancements are not merely incremental improvements but are fundamentally reshaping how vehicles are designed, operate, and interact with their users and the surrounding environment.

The Transformative Impact of Software-Defined Vehicles (SDVs) and Over-the-Air (OTA) Updates

Software-Defined Vehicles (SDVs) represent a paradigm shift in vehicle architecture, fundamentally decoupling hardware and software functionalities. This “software-first design” approach makes vehicles inherently future-proof and easily upgradable.9 By allowing for flexible and adaptable systems, SDVs enable manufacturers to introduce new features and improvements throughout the vehicle’s lifespan, extending its relevance and value.

A cornerstone of the SDV concept is the widespread adoption of Over-the-Air (OTA) updates. These updates allow vehicle software to be upgraded wirelessly while the car is parked, much like a smartphone, enhancing features, performance, and safety long after the initial purchase.6 This capability creates continuous opportunities for software innovation, enabling automakers to respond rapidly to emerging needs, deploy new functionalities, and address potential issues without requiring a dealership visit.35 Leading automakers such as Volvo and Mercedes-Benz are actively showcasing their latest SDVs, featuring customizable user interfaces and AI-driven performance tuning.11 Continental is also heavily invested in SDV innovations.30 The regulatory landscape is also adapting, with UNECE R156 specifically enforcing secure software update operations, underscoring the critical importance of robust OTA capabilities.34

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Vehicle Control and Decision-Making

Artificial Intelligence (AI) and Machine Learning (ML) are the foundational drivers of autonomous capabilities and are increasingly integrated into various aspects of vehicle control and decision-making. These technologies empower vehicles to perceive, interpret, and react to complex real-world scenarios with unprecedented accuracy and efficiency.8 AI specifically improves real-time decision-making, leading to safer and more efficient driving experiences.10

Key AI-driven capabilities emerging in 2024-2025 include:

- Predictive Navigation: Systems that learn driver habits and recommend optimized routes based on real-time conditions.6

- Driver Monitoring Systems: As previously discussed, these systems detect fatigue, distraction, or impaired behavior and issue alerts to the driver.6

- Smart Voice Assistants: Advanced voice assistants that understand complex natural language commands, allowing seamless adjustment of climate, navigation, or media without manual input.6 Mercedes-Benz has notably integrated ChatGPT as a free update for its MBUX infotainment system, enabling more natural and conversational interactions.7 Sony Honda Mobility’s Afeela 1 vehicle range will also include an interactive AI-powered voice agent.7

- AI-Driven Data Analysis: Sophisticated systems analyze real-time data from sensors and user behavior to optimize vehicle performance and safety.6 AI is also enhancing sensor capabilities, such as Aptiv’s AI/ML-enhanced radars, which provide improved object classification and detection in diverse road scenarios.33 Toyota is actively exploring how automotive neural networks can become more effective, with the long-term vision of matching or even exceeding the competencies of vigilant human drivers.28

Next-Generation Connectivity: Seamless Integration, 5G, and Vehicle-to-Everything (V2X) Communication

Consistent and stable connectivity is foundational for virtually every new advance in Software-Defined Vehicles (SDVs) and modern automotive functionalities.7

- Seamless Smartphone & Cloud Integration: The modern vehicle is more connected to a driver’s digital life than ever before. Cloud-based applications and remote access features are transforming how drivers interact with their vehicles. This includes capabilities like Over-the-Air (OTA) updates, remote vehicle access (e.g., starting, locking/unlocking, and monitoring the car via a mobile app from anywhere), and personalized profiles that sync driving preferences across different vehicles via the cloud.6 Wireless Apple CarPlay® and Android Auto™ are rapidly becoming standard features, offering seamless integration of smartphone functionalities.6

- 5G Connectivity: The deployment of 5G networks is crucial for enabling lightning-fast updates and ultra-responsive infotainment systems.27 This high-speed connectivity makes advanced telematics features, such as real-time diagnostics and the complex data exchange required for autonomous driving, far more feasible and reliable.24

- Vehicle-to-Everything (V2X) Communication: V2X technology enables vehicles to communicate not only with other cars (Vehicle-to-Vehicle or V2V) but also with road infrastructure (Vehicle-to-Infrastructure or V2I) and other network entities. This communication facilitates greater situational awareness, allowing for features like live hazard alerts that notify drivers about road conditions, hazards, or accidents nearby.19 V2X is a key technology powering connected car solutions, integrating internet-connected devices and sensors into vehicles to collect, analyze, and communicate critical data.19

The global market for Connected Car Solutions was valued at US54.4billionin2024andisprojectedtoreachUS148.6 billion by 2030, demonstrating a robust CAGR of 18.2%.19 Globally, over 470 million connected cars are estimated to be on the roads, with demand continuing to climb rapidly.34

Cutting-Edge User Interfaces and Experiences

Modern vehicles are increasingly offering sophisticated user interfaces and immersive experiences that enhance both safety and convenience.

- Augmented Reality (AR) Head-Up Displays (HUDs): These advanced displays project critical information, such as turn-by-turn navigation directions, real-time hazard warnings, and traffic sign recognition, directly onto the road ahead in the driver’s line of sight.6 This technology significantly reduces driver distraction and improves reaction time, especially useful for long-distance driving. BMW has debuted a Panoramic iDrive with a digital display spanning the entire dashboard, while Hyundai showcased a Holographic Windshield Display that projects high-definition information onto the lower portion of the windshield.7

- Biometric Vehicle Access: The traditional car key is being replaced by biometric systems that utilize face ID, fingerprint, or even heartbeat as personal vehicle logins.6 These systems securely unlock doors, start the engine, and activate personalized driver profiles, enhancing both security and convenience. Continental’s technology can even recognize the vehicle owner from a distance, allowing for automated actions like opening the boot when approaching a supermarket.7

- Smart Voice Assistants: Building on AI advancements, smart voice assistants are becoming more sophisticated, understanding complex commands and adjusting climate, navigation, or media settings seamlessly and naturally.6 Generative AI is further enhancing these assistants, making them more conversational and intuitive.7

- Autonomous Parking Systems: These systems are bringing the industry closer to hands-free parking in more vehicle segments. They offer fully automatic parallel and perpendicular parking, memory parking (where the car remembers preferred spots), and remote smart summon capabilities via a mobile app, minimizing the need for human intervention and making parking easier and more convenient.6

A significant observation across these technological advancements is that software is rapidly becoming the primary value driver and differentiator in the automotive industry. The concept of Software-Defined Vehicles (SDVs) explicitly highlights the decoupling of hardware and software 9, allowing for continuous improvement through Over-the-Air (OTA) updates.6 Artificial Intelligence and Machine Learning are recognized as the “engine of autonomy” 8 and are enhancing core vehicle functions.10 The automotive industry is witnessing a clear transition where hardware is no longer the sole “star of the show,” with software increasingly “stealing the spotlight”.11 This indicates that the automotive industry is fundamentally transforming into a software-driven sector. Competitive advantage will increasingly stem from the sophistication, adaptability, and user-centric design of a vehicle’s software ecosystem. This shift necessitates significant investment in software development capabilities, a focus on agile development methodologies, and the ability to deliver continuous value to consumers through software updates, effectively transforming the vehicle into an evolving digital platform rather than a static product.

The Influence of Stricter Global Safety Regulations

Global regulatory bodies are playing an increasingly critical role in shaping the automotive industry’s focus on safety and technology. Their mandates and assessment programs are compelling manufacturers to accelerate innovation and standardize advanced safety features across their fleets.

Analysis of Key Regulatory Bodies and Their Mandates

- National Highway Traffic Safety Administration (NHTSA) – United States:

- In 2024, NHTSA finalized a rule mandating that, starting in 2029, all passenger cars and light trucks must be equipped with pedestrian-avoidance braking (PAB).12 This measure is expected to save 360 lives per year and significantly reduce rear-end and pedestrian crashes.12

- The New Car Assessment Program (NCAP) scoring method is being overhauled to include blind-spot warning, lane-keeping support, and pedestrian AEB, with phased targets for the next decade.12

- NHTSA is also revising reporting rules for driver-assistance crashes and expanding its exemption program for autonomous models.12

- A proposed new Federal Motor Vehicle Safety Standard (FMVSS) No. 228, Pedestrian Head Protection, would apply to passenger cars, light trucks, and vans, requiring vehicles to mitigate the risk of serious to fatal head injury in child and adult pedestrian crashes at speeds up to 40 km/h (25 mph).16 This standard would define specific test areas on the hood for child and adult headform impacts, requiring protective countermeasures or sufficient clearance to prevent bottoming out.16

- NHTSA also finalized revised fuel economy standards (CAFE) for model years (MYs) 2024-2025, increasing at a rate of 8% per year, and 10% for MY 2026 vehicles, projected to require roughly 49 mpg in MY 2026.39 This includes accounting for electric vehicles in meeting CAFE standards.39

- A rule published on December 20, 2024, adopting FMVSS No. 305a (Electric-Powered Vehicles: Electric Powertrain Integrity) to replace FMVSS No. 305, was temporarily delayed until March 20, 2025, for further review.13 This rule requires manufacturers to compile risk mitigation documentation and submit standardized emergency response information for electric vehicles.13

- Euro NCAP – Europe:

- Euro NCAP continues to play a crucial role in improving new car safety through independent crash tests and ratings.14

- The organization’s roadmap for 2024-2025 includes ongoing drives to improve vehicle safety for all road users, with a focus on assisted driving systems and the safety implications of car size.14

- In 2024, Euro NCAP released its “Year in Numbers” review and “Best in Class” cars, highlighting top safety performers.14 New test centers were approved to boost capacity.14

- New protocols from February 2025 include updates for Adult Occupant Protection, Child Occupant Protection, Vulnerable Road User (VRU) Protection, and Safety Assist.15

- Euro NCAP also released Assisted Highway Driving Gradings for several car models in late 2024.14

- United Nations Economic Commission for Europe (UNECE):

- The UNECE develops harmonized technical requirements to remove trade barriers and ensure high levels of safety and environmental protection.17

- The General Safety Regulation II (GSR II), effective July 2024 in the EU, mandates several ADAS features in new vehicles, including intelligent-speed assistance (using sign recognition and map data to warn of speeding) and AEB for vehicles and pedestrians.12 Studies show AEB can cut rear-end collisions by about 50% and pedestrian hits by 30%.12

- UNECE R155 requires automakers to have a cybersecurity management system in place from July 2024, and UNECE R156 enforces secure software update operations.34

- Proposed amendments for 2025 include updates to heavy vehicle braking, speedometer/odometer equipment (including anti-tampering provisions), road illumination devices, and a new UN regulation on the determination of system power for hybrid and pure electric vehicles with multiple electric machines.17

- UN Regulation No. 131 (Advanced Emergency Braking System for M2, M3, N2, N3 vehicles) was published on July 11, 2025.18 UN Regulation No. 125 (forward field of vision of the driver) was published on May 21, 2025.18

- Regional NCAPs (China, India, ASEAN, Brazil):

- China: The 2024 C-NCAP revision introduced driver-monitoring into the score and gave greater weight to pedestrian and cyclist protection.12 Regulators have also published new guidelines on ADAS marketing and liability, banning the overuse of “autonomous driving” and scrutinizing OTA updates, especially after incidents like the 2025 Xiaomi SU7 crash.12 Major domestic makers are now installing driver-monitoring systems as standard.12

- India: Launched its Bharat New Car Assessment Program (Bharat NCAP) in 2023, with safety rules advancing rapidly. From April 2026, all vehicles carrying more than eight people must have AEB, drowsiness alerts, and lane-departure warnings.12

- ASEAN: A 2024 test of a new electric SUV showed six airbags, ESC, city/highway AEB, blind-spot, and pedestrian detection, indicating the spread of active safety.12

- Brazil: Mandated ESC and AEB on all new cars from 2024.12

Regulatory Frameworks as Catalysts for Innovation and Market Shifts

Policymakers are adopting a blended approach, combining mandatory requirements with incentives. Global NCAP’s Safer Choice Award, which demands dual five-star ratings and a suite of advanced features, not only recognizes compliance but also actively steers consumer demand.12 This creates a powerful incentive for manufacturers to exceed minimum standards.

Stricter rules are fundamentally reshaping vehicle engineering. This requires vehicle structures to absorb crashes more effectively while simultaneously accommodating the increasing number of sensors and complex electronic architectures that support powerful processors and fast networks for ADAS and connectivity.12 This necessitates increased investment across the supply chain for components like radar, cameras, LiDAR, and high-performance chips. While these investments raise costs, brands often benefit from an enhanced safety image and can command a premium for their vehicles.12 Original Equipment Manufacturers (OEMs) are increasingly collaborating with Tier-1 suppliers, such as Bosch, ZF, and Huayu, to co-develop ADAS solutions.12 Furthermore, OEMs are establishing local test grounds and R&D labs to meet diverse regional standards.12

Global policy is shifting towards an integrated safety philosophy, where pedestrian protection and other vulnerable road user considerations are central. Experts advise that regulation should align with technological progress and public acceptance, advocating for phased rules and harmonized international standards to facilitate global innovation and deployment.12

Market Dynamics and Consumer Adoption

The automotive industry is witnessing significant market growth driven by the increasing adoption of advanced safety features and connected car solutions. This growth is a direct reflection of evolving consumer expectations and the impact of regulatory mandates.

Growth Trajectory and Regional Variations in ADAS and Connected Car Market Adoption

The market for Advanced Driver-Assistance Systems (ADAS) is experiencing substantial expansion. The global passenger vehicle ADAS market size was calculated at USD 30.20 billion in 2024 and is projected to increase to approximately USD 158.06 billion by 2034, representing a robust Compound Annual Growth Rate (CAGR) of 18% from 2025 to 2034.4

Regionally, North America led the global market with the highest share, accounting for 36% in 2024. The U.S. passenger vehicle ADAS market alone was valued at USD 8.15 billion in 2024 and is projected to reach around USD 43.56 billion by 2034, growing at a CAGR of 18.24%.4 This increase in adoption in the U.S. in 2024 was partly due to rising demand for SUVs, which often feature such systems, and a meaningful increase in consumer adoption across mainstream models like the Ford Mustang Mach-E.4

The Asia-Pacific market is estimated to expand at the fastest CAGR between 2025 and 2034, largely driven by technological advancements and strong government support for integrating advanced safety features like lane-keeping assistance and automated emergency braking.4 Europe is also expanding at a significant pace, propelled by stricter safety rules and strong consumer demand.4

The connected car market is similarly booming. The global market for Connected Car Solutions was valued at US54.4billionin2024andisprojectedtoreachUS148.6 billion by 2030, growing at a CAGR of 18.2%.19 Currently, over 470 million connected cars are estimated to be on roads globally, each capable of streaming up to 25 GB of data every hour, and this demand is climbing rapidly.34

Consumer Demand and Expectations for Advanced Safety and Connectivity Features

Consumer demand is a significant driver for the adoption of these advanced technologies. Drivers in 2025 increasingly expect intelligent, responsive systems that enhance safety by preventing injuries, collisions, and reducing fatigue.6 Features like adaptive cruise control, lane-keeping assist, and 360-degree cameras are making every drive safer and more convenient, becoming standard expectations rather than optional luxuries.6

For connected car features, digital-first mobility solutions are now an expectation. One in four drivers are already paying for connected vehicle services, and 47% of owners in premium segments indicate they would pay after purchase to unlock additional features.34 Connected cars enhance the driving experience by integrating in-built Wi-Fi, advanced navigation systems, and remote diagnostics, making driving safer, more efficient, and more convenient.19 Consumer expectations for seamless digital integration are driving demand for smartphone integration, real-time traffic updates, on-demand entertainment, and digital assistants.19

Opportunities for Market Expansion and Competitive Differentiation

The widespread adoption of forward-facing ADAS systems across all vehicle segments, from small cars to heavy-duty pickups, presents significant market opportunities.5 With 168 different vehicle models now equipped with these systems, representing approximately 80% of the current U.S. automobile market, there is a growing need for specialized calibration and repair services. Each of these systems requires calibration to ensure correct functioning, opening a host of opportunities for service centers prepared to meet this demand.5 Regulatory changes worldwide related to ADAS features provide a valuable blueprint for predicting future safety system requirements and adoption patterns, guiding investment decisions and future service offerings for the aftermarket.5

The increasing popularity of vehicle automation and autonomy further amplifies the need for integrated connectivity solutions to support safe and efficient functioning.19 Collaborations between automakers and tech companies, supported by government initiatives for smart cities and mobility projects, are fostering innovations that leverage AI and ML for personalized driving experiences.19 The growth of Electric Vehicles (EVs) also expands the addressable market for connected solutions, as EVs inherently require sophisticated software and connectivity for battery management, charging optimization, and smart grid integration.8

Critical Challenges and Strategic Considerations

While the automotive industry embraces advanced safety and technology, it simultaneously faces significant challenges that demand strategic attention. These include escalating cybersecurity threats, complex data privacy concerns, and the increasing complexity of integrated vehicle systems.

Addressing the Escalating Threat of Automotive Cybersecurity

The rapid evolution of connected and software-defined vehicles has dramatically expanded the attack surface, leading to an unprecedented level of cyber risk in 2024.20 Upstream’s 2025 Automotive & Smart Mobility Cybersecurity Report highlights over 400 new publicly reported incidents in 2024, with a dramatic increase in the number and sophistication of threat actors operating in the deep and dark web.20

The shift towards large-scale attacks impacting thousands or even millions of vehicles or endpoints at once is particularly alarming.20 Nearly 25% of all recorded incidents in 2024 involved ransomware, marking a significant rise in both frequency and severity. A prime example was a ransomware attack on a major dealership management software provider in 2024, leading to a three-week service outage, over $1 billion in economic damage, and a $25 million ransom demand.20

The primary targets of these cyber threats are shifting towards software-defined components, telematics systems, and cloud-based infrastructure. Telematics accounted for 66% of total incidents, and API-related attacks increased by nearly 30% to 17% of total incidents in 2024.20 Exploiting weak authentication protocols, threat actors have manipulated vehicle companion apps to unlock doors, start engines, and even alter vehicle ownership records.20

This situation reveals a growing “automotive cyber gap”—a widening disconnect between regulatory compliance efforts and actual cybersecurity resilience.20 While regulations like UNECE WP.29 (R155 and R156) mandate cybersecurity management systems and secure software update operations 20, the rapid expansion of software-defined vehicles and third-party integrations (cloud infrastructures, dealership management systems) introduces additional vulnerabilities.20 Without comprehensive, real-time threat monitoring and proactive security measures, organizations risk falling behind.20 The US Department of Commerce’s ban on Chinese vehicles in 2024, citing cybersecurity and national security risks, further underscores the geopolitical dimension of this challenge.20

Navigating Complex Data Privacy Concerns and Consumer Trust Issues

The vast amount of data collected from connected cars — including biometric information, precise location data, telematics, video, and other personal information — poses significant privacy concerns.22 This data collection, use, and disclosure can threaten consumers’ privacy and financial welfare. News reports have suggested that car data could be used to stalk individuals or influence insurance premiums.22

Consumer sentiment clearly indicates discomfort: a survey found that 96% of consumers believe they should own and control any data their cars generate, and 78% feel uneasy about automakers collecting driver data at all.23 Specific concerns include:

- 82% are uncomfortable with data being sold to insurers.23

- 79% do not trust data brokers with their vehicle data.23

- 81% would be uncomfortable if automakers or data brokers shared data with law enforcement without their knowledge.23

A notable example is the lawsuit filed against General Motors in March 2024, which led GM to announce it would stop collecting customers’ driving data. The lawsuit accused GM, OnStar, and LexisNexis of violating privacy and consumer protection laws by disclosing data to insurance companies without consent, resulting in unexpected spikes in premiums.23 The Mozilla Foundation’s research labeled all 25 automakers studied as privacy risks, identifying cars as the worst product category for privacy, with over half (56%) of automakers capable of sharing customer car data with government or law enforcement without a warrant.23

The Federal Trade Commission (FTC) has taken action to protect consumers against the illegal collection, use, and disclosure of personal data. The FTC considers geolocation data sensitive and subject to enhanced protections, taking action against companies that have used or disclosed such data unfairly.22 Furthermore, surreptitious disclosure of sensitive information and the use of sensitive data for harmful automated decisions (e.g., facial recognition programs leading to false alerts) have also led to FTC enforcement actions.22 These cases underscore the significant potential liability associated with handling sensitive data, emphasizing that firms do not have a free license to monetize personal information beyond the purposes needed to provide requested products or services.22

The tension between convenience and risk in connected cars is becoming increasingly apparent. While connected features offer immense convenience, they simultaneously expand the attack surface for cyber threats and raise significant data privacy concerns.9 The General Motors lawsuit serves as a stark illustration of this inherent tension.23 This means that while consumer demand for connected features is high, manufacturers face a critical balancing act. Building and maintaining consumer trust requires not only delivering innovative features but also demonstrating an unwavering commitment to robust cybersecurity and transparent data handling practices. A failure to prioritize these aspects can lead to significant financial losses, severe reputational damage, and a profound erosion of customer loyalty.23 This situation also underscores the growing necessity for “embedded compliance” within vehicle design, where security and privacy are considered from the earliest stages of development, rather than as an afterthought.34

Managing the Increasing Complexity of Integrated Systems and Calibration Requirements

The proliferation of ADAS features and the trend towards system integration have led to significantly increased complexity in modern vehicles. Newer vehicles are increasingly combining multiple ADAS features into sophisticated safety networks, with Active Driving Assistance (ADA) — which combines multiple ADAS functions — increasing from 0% adoption in 2015-2016 to 33.8% in 2023 models.5

This interconnectedness means that individual safety systems, such as Lane Centering Assistance and Adaptive Cruise Control, while powerful on their own, create more advanced capabilities when integrated. This requires calibration professionals to understand not just individual components but how they interact within the larger system.5 For example, a single windshield replacement might now necessitate the calibration of multiple systems.5

This increasing complexity creates new demands for service centers. Shops and calibration specialists require specialized equipment for different calibration procedures, and technicians need ongoing training to stay current with new systems.5 Proper documentation and verification processes become essential to ensure these complex systems function correctly and safely.5 This transformation in vehicle architecture and maintenance presents both challenges and expanded revenue opportunities for service providers ready to invest in the necessary equipment and training.5

Key Industry Players and the Innovation Ecosystem

The rapid advancements in automotive safety and technology are driven by a diverse ecosystem of leading automakers, technology providers, and strategic collaborations.

Leading Automakers’ Strategic Investments and Innovations in Safety and Technology

- Tesla: Tesla vehicles, utilizing Autopilot and Full Self-Driving (Supervised) technologies, demonstrate significantly fewer crashes per mile driven compared to the national average.25 Their active safety features include Automatic Emergency Braking, Forward Collision Warning, Side Collision Warning, Obstacle Aware Acceleration, Blind Spot Monitoring, Lane Departure Avoidance, and Emergency Lane Departure Avoidance.25 Tesla’s Autopilot maintains set speeds and distances, intelligently keeping the vehicle in its lane, and the Full Self-Driving (Supervised) system is designed to drive itself almost anywhere under active supervision, continuously improving with software updates.25

- Mercedes-Benz: The 2025 Mercedes-Benz lineup emphasizes next-level connectivity and safety. Standard safety features include Blind Spot Assist, Active Brake Assist, Adaptive braking technology, Attention Assist (for drowsy drivers), and Crosswind Assist.26 Their available Driver Assistance Package adds advanced systems like Active Lane Keeping Assist and Active Emergency Stop Assist.26 The Mercedes-Benz User Experience (MBUX) system, a market leader, introduces AI-enhanced voice assistants, a zero-layer interface for predictive suggestions, and Augmented Reality Navigation.27 Their Mercedes Me App offers remote vehicle control, digital key access, 5G connectivity, and personalized settings.27 The company is also integrating ChatGPT as a free update for MBUX, enhancing natural language interaction.7

- Toyota: Toyota’s safety evolution focuses on continuous improvement of its Toyota Safety Sense (TSS) suite, with recent efforts on pedestrian, bicyclist, and nighttime driving conditions.28 Their Proactive Driving Assist (PDA) aims to enhance driver security even under normal conditions by subtly decelerating or adjusting the driving path when obstacles like pedestrians or parked vehicles are detected.28 Toyota is also investing in “Look Out” (peripheral monitoring) and “Look In” (in-cabin monitoring) technologies, utilizing data communication modules to collect real-world driving data for future safety advancements.28

- BMW: The 2025 BMW M5 features enhanced USB and Bluetooth wireless technology, Apple CarPlay® and Android Auto™, and a Connected Package Professional with Real-Time Traffic Information and cloud-based navigation.29 Their Intelligent Personal Assistant voice control offers natural speech input, and the BMW Curved Display integrates a 12.3-inch instrument cluster and 14.9-inch central information display.29 BMW also debuted a Panoramic iDrive digital interface at CES, spanning the entire dashboard.7

The Pivotal Role of Technology Providers, Sensor Suppliers, and Software Developers

The automotive industry’s technological leap is heavily reliant on specialized technology providers and component suppliers:

- Technology Providers:

- Aptiv: Demonstrates ADAS technologies that optimize performance and deliver a safer, more human-like driving experience through modular solutions scalable across vehicle models and levels of autonomy.33 They are showcasing urban hands-off driving and automated parking powered by their Gen 6 ADAS platform.33

- Mobileye: A key player in ADAS and autonomous driving, Mobileye’s EyeQ chips and software power ADAS and Level 4 autonomy solutions.31 They showcased systems capable of handling complex urban environments at CES 2025, thanks to improved sensor fusion and AI algorithms.11

- NVIDIA: Their DRIVE platform, powered by Orin and Thor AI chips, supports autonomous driving, infotainment, and SDVs. NVIDIA’s simulation tools are crucial for training AI models for Level 3+ autonomy, partnering with automakers like Toyota and Tesla.24

- Bosch: A leading supplier showcasing next-gen platforms that seamlessly integrate with smart home devices and AI-powered in-car connectivity solutions.11 Bosch also presented a cloud-based wrong-way driver warning system.30

- Qualcomm: Developing in-cabin solutions and ADAS features using their Snapdragon Digital Chassis, partnering with companies like Desay and Panasonic Automotive.30

- Continental AG: Previewed an Invisible Biometrics Sensing Display for monitoring driver vital signs and a car that recognizes its owner from a distance.7 They are focused on SDV innovations, including cabin sensing, holistic motion control, and smart device-based vehicle access.30

- LG: With its Affectionate Intelligence technology, LG uses heart rate monitoring and facial expression recognition to detect user health and emotional state, notifying drivers of distraction or drowsiness.7

- HERE Technologies: Introduced HERE AI Assistant, using maps as a starting point for driver assistance.7

- Other Key Software and Embedded System Providers: Renesas (microcontrollers, SDKs for ADAS), Infineon Technologies (semiconductor-based software for safety, cybersecurity), Vector Informatik (development tools, testing platforms), Wind River (real-time operating systems for SDVs), Arm (Automotive Enhanced processors), Huawei (ADAS components, software), XPeng (XNGP platform for ADAS), IBM (AI platforms for ADAS, cybersecurity), Deloitte, KPMG, Montavista Software.31

- Sensor Suppliers: The global market for Automotive Sensors is estimated at US33.2billionin2024andisanticipatedtoreachUS66.8 billion by 2030, growing at a CAGR of 12.4%.32 Key sensor types include pressure, gas, image, position, safety, speed, and LiDAR sensors.32 Major players include Allegro MicroSystems, Analog Devices, Aptiv PLC, Bosch Sensortec, Continental AG, Denso Corp., Infineon Technologies AG, Innoviz Technologies Ltd., Mobileye, NXP Semiconductors, OmniVision Technologies, Robert Bosch GmbH, Sensata Technologies, STMicroelectronics NV, Texas Instruments, Valeo SA, and Velodyne Lidar, Inc..32

Emerging Collaborations and Partnerships Shaping the Future of Mobility

The complexity and capital intensity of developing advanced automotive technologies are fostering a strong trend towards collaborations and partnerships. Automakers are increasingly working with Tier-1 suppliers to co-develop ADAS.12 At CES 2025, multiple collaborations were announced, signifying a convergence between carmakers and technology companies in the SDV space.30

- Blackberry, Amazon Web Services (AWS), Snapdragon, and Qualcomm are all increasing their automotive presence through partnerships.30

- LG is collaborating with Ambarella on AI-driven technology for vehicle safety and with Qualcomm on cross-domain controller platforms.30

- Sony Honda Mobility is integrating an interactive AI-powered voice agent into its Afeela 1 vehicle range.7

- Toyota is collaborating with Pony.ai for large-scale deployment of Level 4 robotaxis.31

- Continental and QNX are collaborating on virtualizing digital cockpit development in the cloud, speeding up development workflows.30

These collaborations are crucial for accelerating innovation, sharing development costs, and integrating diverse expertise across the automotive and tech sectors to deliver the next generation of safer, smarter, and more connected vehicles.

Strategic Outlook and Recommendations

The automotive industry’s trajectory towards enhanced safety and technological sophistication is undeniable, driven by a confluence of regulatory mandates, consumer demand, and rapid advancements in software and AI. To thrive in this evolving landscape, automotive stakeholders must adopt a multi-faceted strategic approach.

- Prioritize Software-First Architecture and Continuous Development: Given that software is increasingly the primary value driver and differentiator, manufacturers must fully embrace the Software-Defined Vehicle (SDV) paradigm. This involves investing heavily in in-house software development capabilities, adopting agile methodologies, and designing vehicles with upgradability in mind from the outset. Leveraging Over-the-Air (OTA) updates for continuous feature enhancements, performance optimization, and security patches will be critical for maintaining vehicle relevance and customer satisfaction throughout the product lifecycle. This also necessitates a shift in organizational culture to one that prioritizes software expertise and rapid iteration.

- Proactive Regulatory Engagement and Compliance Beyond Baseline: Regulatory bodies are dictating the technological roadmap for safety. Companies should engage proactively with regulators globally, anticipating future mandates rather than merely reacting to current ones. By investing in and implementing advanced safety features that exceed current minimum requirements, manufacturers can gain a significant competitive advantage, build a strong “safety image,” and potentially influence future standards. This includes a deep understanding of evolving NCAP scoring methods and regional specificities to ensure global designs can be adapted locally while maintaining a high safety standard.

- Holistic Approach to Safety Integrating Active, Passive, and In-Cabin Systems: Safety is no longer solely about crash protection. A comprehensive safety strategy must integrate advanced active safety features (ADAS) for accident prevention, robust passive safety structures for impact mitigation, and emerging in-cabin systems that monitor driver well-being (fatigue, distraction) and cabin health (air quality). This holistic view will lead to vehicles that not only prevent collisions but also actively manage driver alertness and provide a healthier, more secure environment for occupants.

- Strengthen Cybersecurity and Data Privacy as Core Competencies: The expansion of connected features and SDVs inherently broadens the attack surface for cyber threats and intensifies data privacy concerns. Cybersecurity must be embedded into every stage of vehicle design, development, and operation, moving beyond mere compliance to proactive, AI-driven threat intelligence and real-time monitoring. Transparent data collection, usage, and sharing policies are paramount to building and maintaining consumer trust. Manufacturers must invest in robust API security, secure communication protocols, and continuous vulnerability management to protect critical vehicle data and ensure operational integrity. Failure to do so risks significant financial penalties, reputational damage, and erosion of customer loyalty.

- Foster Strategic Partnerships and Ecosystem Collaboration: The complexity and cost of developing cutting-edge automotive technology necessitate collaboration. Automakers should continue to forge strategic partnerships with technology providers (e.g., AI specialists, software developers, sensor manufacturers) and even competitors where it benefits standardization and accelerates innovation. This collaborative ecosystem approach can facilitate shared R&D, leverage specialized expertise, and accelerate time-to-market for advanced features, distributing the financial and technical burden while maximizing collective progress.

- Invest in Workforce Development and Specialized Skills: The shift towards software-defined, connected, and increasingly autonomous vehicles demands new skill sets across the entire value chain. Significant investment in training programs for automotive software developers, cybersecurity specialists, AI/ML engineers, and highly skilled diagnostic and calibration technicians is crucial. Attracting and retaining talent with expertise in these areas will be a key determinant of success.

Conclusion

The automotive industry is navigating a transformative period where safety and technology are inextricably linked, driven by a powerful combination of innovation and stringent global regulations. The widespread adoption and continuous evolution of Advanced Driver-Assistance Systems (ADAS) are fundamentally redefining vehicle protection, shifting the paradigm from reactive crash mitigation to proactive accident prevention. This evolution is underpinned by the rise of Software-Defined Vehicles (SDVs) and the pervasive integration of Artificial Intelligence and Machine Learning, which serve as the intelligent backbone for advanced functionalities, seamless connectivity, and personalized user experiences.

While these technological advancements promise safer and more efficient mobility, they also introduce significant challenges, particularly in the realms of cybersecurity and data privacy. The escalating sophistication of cyber threats and growing consumer concerns about data handling necessitate a robust, embedded security posture and transparent privacy practices. Success in this new era will hinge on the industry’s ability to balance innovation with unwavering commitment to security and trust.

Leading automakers and a vibrant ecosystem of technology providers are actively shaping this future through strategic investments and collaborative partnerships. The path forward demands a holistic approach to vehicle design, a proactive stance on regulatory engagement, and a continuous investment in the specialized skills required to manage increasingly complex, software-driven systems. By embracing these strategic imperatives, the automotive industry can continue its trajectory towards a future where vehicles are not only smarter and more connected but fundamentally safer for all road users.

Sources

- Driving Safety in 2024: Key Trends and What to Expect in 2025 | SafetyConnect, accessed August 3, 2025, https://www.safetyconnect.io/post/driving-safety-in-2024-key-trends-and-what-to-expect-in-2025

- 2025 Auto Trends: What to Know Before Buying Your Next Car – Public Service Credit Union, accessed August 3, 2025, https://www.pscu-wausau.com/blog/2025-auto-trends

- ADAS Features That Will Soon Come Standard on New Vehicles, accessed August 3, 2025, https://fusionwindshield.com/2025/07/23/adas-features-that-will-soon-come-standard-on-new-vehicles/

- Passenger Vehicle ADAS Market Size to Hit USD 158.06 Bn by 2034, accessed August 3, 2025, https://www.precedenceresearch.com/passenger-vehicle-adas-market

- ADAS Adoption in 2025 – Revv, accessed August 3, 2025, https://www.revvhq.com/blog/adas-adoption-in-2025

- Top Car Technologies to Look for in 2025 – Daytona Auto Mall, accessed August 3, 2025, https://www.daytonaautomall.com/blogs/6031/what-new-car-technology-should-you-look-for-in-2025

- Automotive at CES 2025. All the innovations shaping the new in-car experience – Thales, accessed August 3, 2025, https://www.thalesgroup.com/en/worldwide-digital-identity-and-security/mobile/magazine/automotive-ces-2025-all-innovations-shaping

- Top 10 Trends in Automotive Software Development (2025), accessed August 3, 2025, https://vlinkinfo.com/blog/trends-in-automotive-software-development

- Explore the Top 10 Automotive Electronics Trends in 2025 – StartUs Insights, accessed August 3, 2025, https://www.startus-insights.com/innovators-guide/automotive-electronics-trends/

- What New Car Technology Should You Look for in 2025? – Gary Yeomans Ford Palm Bay, accessed August 3, 2025, https://www.palmbayford.com/blogs-what-new-car-technology-should-you-look-for-in-2025/

- The Best Automotive Tech at CES 2025, accessed August 3, 2025, https://pdmautomotive.com/the-best-automotive-tech-at-ces-2025/

- Global Automotive-Safety Policy in 2025 and Its Industrial Consequences – Solution 1, accessed August 3, 2025, https://solution1.com.tw/global-automotive-safety-policy-in-2025-and-its-industrial-consequences/

- Federal Motor Vehicle Safety Standards; FMVSS No. 305a Electric-Powered Vehicles: Electric Powertrain Integrity Global Technical Regulation No. 20; Incorporation by Reference – Federal Register, accessed August 3, 2025, https://www.federalregister.gov/documents/2025/02/14/2025-02582/federal-motor-vehicle-safety-standards-fmvss-no-305a-electric-powered-vehicles-electric-powertrain

- Press Releases – Euro NCAP, accessed August 3, 2025, https://www.euroncap.com/en/press-media/press-releases/?loadAll=true&a=press-54288

- What’s New? – Euro NCAP, accessed August 3, 2025, https://www.euroncap.com/en/for-engineers/

- Federal Motor Vehicle Safety Standards: Pedestrian Head Protection, Global Technical Regulation No. 9; Incorporation by Reference, accessed August 3, 2025, https://www.regulations.gov/document/NHTSA-2024-0057-0001

- COM(2025) 31 final – EUR-Lex – European Union, accessed August 3, 2025, https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52025PC0031

- UNECE regulations – Internal Market, Industry, Entrepreneurship and SMEs, accessed August 3, 2025, https://single-market-economy.ec.europa.eu/sectors/automotive-industry/legislation/unece-regulations_en

- Connected Car Solutions Strategic Business Report 2025: Global Market to Reach $148.6 Billion by 2030 – Evolution of V2X Expands Opportunities, Growth of MaaS Accelerates Demand – ResearchAndMarkets.com – Business Wire, accessed August 3, 2025, https://www.businesswire.com/news/home/20250514524630/en/Connected-Car-Solutions-Strategic-Business-Report-2025-Global-Market-to-Reach-%24148.6-Billion-by-2030—Evolution-of-V2X-Expands-Opportunities-Growth-of-MaaS-Accelerates-Demand—ResearchAndMarkets.com

- Mind the Cyber Gap: Key Insights from Upstream’s 2025 Automotive Cybersecurity Report, accessed August 3, 2025, https://upstream.auto/blog/insights-from-upstreams-2025-automotive-cybersecurity-report/

- Upstream’s 2025 Global Automotive Cybersecurity Report, accessed August 3, 2025, https://upstream.auto/reports/global-automotive-cybersecurity-report/

- Cars & Consumer Data: On Unlawful Collection & Use – Federal Trade Commission, accessed August 3, 2025, https://www.ftc.gov/policy/advocacy-research/tech-at-ftc/2024/05/cars-consumer-data-unlawful-collection-use

- Consumer data privacy concerns mount for connected cars – Car Dealership Guy News, accessed August 3, 2025, https://news.dealershipguy.com/p/consumer-data-privacy-concerns-mount-for-connected-cars

- Top 10 Automotive Industry Trends in 2025 – StartUs Insights, accessed August 3, 2025, https://www.startus-insights.com/innovators-guide/automotive-industry-trends/

- Autopilot | Tesla Support, accessed August 3, 2025, https://www.tesla.com/support/autopilot

- 2025 Mercedes-Benz CLE Keeps You Safe With Advanced Features, accessed August 3, 2025, https://www.mbfortwayne.com/blog/2025/march/5/2025-mercedes-benz-cle-keeps-you-safe-with-advanced-features.htm

- Experience Next-Level Connectivity in the 2025 Mercedes-Benz Lineup, accessed August 3, 2025, https://www.mercedesbenzofathens.com/blog-experience-next-level-connectivity-in-the-2025-mercedes-benz-lineup/

- The Evolution of Safety at Toyota – Part 3: The Future of Safety – Toyota USA Newsroom, accessed August 3, 2025, https://pressroom.toyota.com/the-evolution-of-safety-at-toyota-part-3-the-future-of-safety/

- 2025 BMW M5 Technology Overview, accessed August 3, 2025, https://www.unitedbmw.com/manufacturer-information/2025-bmw-m5-infotainment-and-safety/

- CES 2025: Automotive suppliers focus on software and safety – Autovista24, accessed August 3, 2025, https://autovista24.autovistagroup.com/news/ces-2025-automotive-suppliers-focus-on-software-and-safety/

- Top 50 Automotive Software Development Companies in 2025 – Stanga1, accessed August 3, 2025, https://www.stanga.net/trends/top-50-automotive-software-development-companies-in-2025/

- Automotive Sensors Market Sensor Types and Applications Report 2025 – GlobeNewswire, accessed August 3, 2025, https://www.globenewswire.com/news-release/2025/05/02/3073281/28124/en/Automotive-Sensors-Market-Sensor-Types-and-Applications-Report-2025-Pressure-Sensors-Lead-but-Gas-Sensors-Boom-in-Global-Automotive-Market.html

- CES 2025 Advanced Safety – Aptiv, accessed August 3, 2025, https://www.aptiv.com/en/ces-2025/ces-2025-advanced-safety

- How to power seamless driver experiences with your connected car, accessed August 3, 2025, https://www.cubic3.com/blog/how-to-power-seamless-driver-experiences-with-your-connected-car/

- Top Automotive Careers in 2025 – JTech – J-Tech Institute, accessed August 3, 2025, https://www.jtech.org/top-automotive-careers-in-2025/

- Vehicle Safety Features to Seek in 2025 | RBFCU – Credit Union, accessed August 3, 2025, https://www.rbfcu.org/learn/article/vehicle-safety-features

- Toyota Safety Sense 3.0: Smarter Driving Features in 2025 Toyota, accessed August 3, 2025, https://www.keithpiersontoyota.com/blogs/1539/technology/toyota-safety-sense-3-0-whats-new-in-2025/

- Tech Innovation of the 2024 BMW i7, accessed August 3, 2025, https://www.bmwautohaus.com/blog/2024/february/16/tech-innovation-of-the-2024-bmw-i7.htm

- Final-Rule-Preamble_CAFE-MY-2024-2026.pdf – NHTSA, accessed August 3, 2025, https://www.nhtsa.gov/sites/nhtsa.gov/files/2022-04/Final-Rule-Preamble_CAFE-MY-2024-2026.pdf

- Active Safety Features – Tesla, accessed August 3, 2025, https://www.tesla.com/ownersmanual/model3/en_us/GUID-0D9B548B-D1A4-494B-8C5F-C4360304D99F.html

- Electric Vehicle Sensor Market Report 2025-34 – For Insights Consultancy, accessed August 3, 2025, https://www.forinsightsconsultancy.com/reports/electric-vehicle-sensor-market

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter