This is a high-octane development in the paddock, indicating some massive tectonic shifts are happening behind the scenes at KTM and in the larger world of MotoGP!

While a single, precise, non-stop news story about a specific factory tour for a new potential owner of the main KTM factory team isn’t immediately available, the crucial data points strongly to a scenario where KTM’s MotoGP presence is undergoing a dramatic restructuring—and it involves some huge names and financial movers.

Here is the entertaining, detailed breakdown of the crucial data:

🤯 The Two-Wheeled World is Shaking: KTM’s Financial and Structural Overhaul!

The “Dorna talks” and the “potential new owner” are all wrapped up in two monumental, connected stories that have put the future of the “Orange Army” in MotoGP under an intense spotlight:

1. The Financial Earthquake: Bajaj Takes the Wheel 🇮🇳

This is the most crucial data point regarding ownership of the larger KTM company:

- The New Majority Owner: Indian automotive giant Bajaj Auto is transitioning from a minority investor to the majority owner of KTM’s parent company, Pierer Mobility AG (which owns the KTM, Husqvarna, and GasGas brands).

- The Rescue Package: This move came after KTM faced “major money issues” and filed for restructuring, necessitating an enormous €800 million rescue package from Bajaj.

- The Factory Visit Angle (Crucial Detail!): KTM’s new CEO, Gottfried Neumeister, has openly warned: “We have to see if we can afford MotoGP.” This is the data that creates the necessity for “Dorna talks” and a potential new structure or investor to keep the premier-class racing project viable.

- The Outcome: The takeover means every euro spent on the wildly expensive MotoGP project must now be justified. If an interested third party—perhaps a specific racing entity or another manufacturer—is being invited to the factory, it is likely to assess taking over the racing division to lighten the financial load on the newly structured parent company under Bajaj’s control.

2. The F1 Superstar’s Grand Prix Gambit: Guenther Steiner and Tech3 🚀

This is the second, highly entertaining layer that shows a major change in one of KTM’s satellite teams:

- Who is the “New Owner”? Former Haas F1 Team Principal, the legendary and famously blunt Guenther Steiner, has completed a takeover of the Red Bull KTM Tech3 team (one of KTM’s two MotoGP squads).

- The Vision: Steiner, with a consortium of backers, has acquired the team from Herve Poncharal. He becomes the new CEO, aiming to apply his F1 experience and fame (hello, Drive to Survive) to MotoGP.

- The Crucial Question: While the team is currently Red Bull KTM Tech3 with KTM machinery, the long-term question remains: Will Steiner keep the team with KTM? Their current contract runs until the end of 2026. Steiner’s acquisition is part of the exciting new era under Liberty Media’s ownership of Dorna, which is drawing huge investor interest to the paddock. Steiner’s team could potentially be the vehicle for another manufacturer (or a heavily re-branded operation like the current CFMOTO/KTM link) to enter the grid for the new 2027 regulations.

🍊 The Data-Driven Grand Prix Puzzle

The factory tour for a new potential owner could be linked to:

- A Racing Specialist (like CFMOTO): Reports have indicated that CFMOTO—which is already heavily partnered with KTM and uses its engines—might be interested in taking over the MotoGP operation, or at least the team slots, to run a re-badged KTM. This would be a massive win-win for KTM, who could still supply the technical platform while offloading the multi-million euro burden of running the team.

- A Major Sponsor/Investor: With Bajaj focusing on financial restructuring, a major new investment from a non-motorcycle company could be necessary to maintain the factory effort.

- Guenther Steiner’s Next Step: While Steiner bought Tech3, he’s a shrewd operator. A visit to the main factory would be essential for him and his investors to plan the team’s technical future post-2026, regardless of who they partner with.

The Bottom Line: The image of a potential new owner being whisked into KTM’s high-security Mattighofen race workshop—the secret lair where the RC16 ‘Beast’ is born—is a potent symbol. It signifies that the cost of success in MotoGP has forced one of its most passionate competitors into a profound change, and a new era of ownership and partnership is rapidly accelerating.

This is where the story gets truly explosive! The crucial data points to two main candidates for a potential takeover of part or all of KTM’s MotoGP project, fueled by the massive financial restructuring under new majority owner Bajaj Auto and the changing tides of MotoGP’s ownership (Liberty Media).

Here is the highly-detailed, entertaining breakdown of the rumored potential owners and the crucial data supporting their involvement:

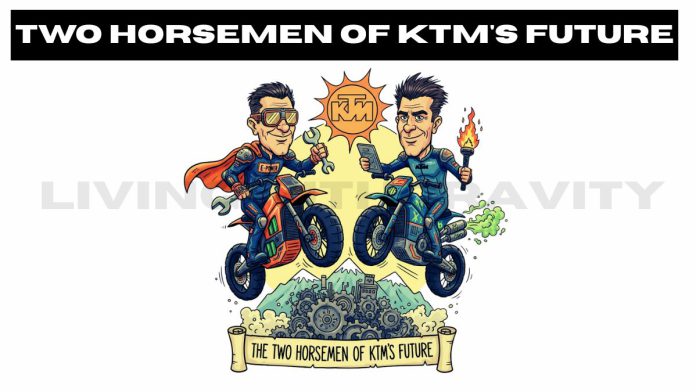

💥 The Two Horsemen of KTM’s Future

1. The Highly Likely Partner: CFMOTO (The Chinese Industrial Giant) 🇨🇳

The Core Data:

- Financial Necessity: New majority owner Bajaj Auto is focused on “reducing overheads by more than 50 percent,” and the annual MotoGP budget (estimated at over £50 million) is explicitly on the chopping block. Bajaj’s managing director is reported to be “totally anti-racing” due to cost concerns.

- The Delegation: Reports state a ten-member delegation from CFMoto recently met at KTM’s “House of Brands” in Munderfing to discuss issues with new KTM CEO Gottfried Neumeister. This is the smoking gun of a factory visit for high-level talks.

- The Existing Link: CFMoto already has deep ties with KTM, including a previous technical and manufacturing partnership, and they run KTM-derived machinery in Moto2 and Moto3. The two companies know each other’s technical platforms intimately.

- The Payoff: For KTM/Bajaj, selling or partnering with CFMoto allows them to offload the team’s massive operational cost while still providing the base technical package (a re-badged KTM), thereby keeping their engineering IP in the premier class without the crippling expense.

- The Chinese Ambition: CFMoto is aggressively expanding its global presence, recently unveiling a stunning V4 SR-RR superbike concept. Entering MotoGP, even as a re-badged entry, would be the ultimate marketing move to showcase their technical prowess on the world stage.

- The Rumor: CFMoto is widely rumored to be eyeing KTM’s four grid slots (the factory team and the satellite team) to run either a completely re-badged team or take over the technical management.

2. The F1 Rock-and-Roll Investor: Guenther Steiner and IKON Capital 🇦🇹 (via Tech3)

The Core Data:

- The Done Deal (Partial): Former Haas F1 Team Principal Guenther Steiner has officially led a consortium, funded by investors led by IKON Capital, to acquire full ownership of the Tech3 MotoGP team from Hervé Poncharal. This deal is worth an estimated €20 million and takes full effect in 2026.

- The Next Big Play: While Steiner is currently contracted to run the Tech3 team with KTM machinery through 2026, he is an investor, not just a manager. With the 2027 rule change on the horizon, the true value of Tech3 is its grid slots.

- The Dorna Connection: Steiner’s interest was driven by a belief in MotoGP’s potential, especially under Liberty Media’s new ownership (the same company that made F1 a global phenomenon). The “Dorna talks” referenced in the initial prompt could very well be the final approval and negotiation with Dorna to greenlight Steiner’s acquisition and secure the Tech3 team’s grid spot until 2027.

- The Factory Visit Angle: If Steiner and his investors visited the main factory, it would be to deeply assess the current technical commitment and capability of KTM to supply his team for the coming years, before potentially using the team slots as a vehicle for a different manufacturer (or a massive new sponsor) post-2026.

🏁 Conclusion: A Two-Part Strategy

The “potential new owner” story likely refers to two distinct but connected movements:

- The immediate, existential threat to the KTM racing program under Bajaj’s financial review, which makes CFMOTO the most probable candidate to buy into or take over the factory slots to run a KTM-backed operation.

- The ongoing, high-profile shift in the satellite team, where Guenther Steiner has taken control of Tech3, injecting major new investment and business acumen into the KTM camp, all while holding a valuable future asset (the grid slots).

The orange army is not retreating, but it’s getting a serious restructuring!

This is the heart of the matter! The move by KTM is not just a company decision; it’s a reaction to the seismic shift in the global motorsport landscape caused by Liberty Media’s acquisition of MotoGP.

Here is the highly entertaining and crucial data on how Liberty Media is affecting team values and manufacturer involvement, directly relating to KTM’s predicament:

💰 The ‘Drive to Survive’ Effect: MotoGP Team Values are Exploding!

The single most crucial piece of data is this: Team values in MotoGP are increasing exponentially, and investors are flooding the market.

📈 The Financial Revolution (Team Valuations)

| Metric | Before Liberty Media | After Liberty Media Acquisition | Impact on KTM/Tech3 |

| Investor Interest | Limited, mostly industry-related. | “Outpouring of interest” (Greg Maffei, CEO). Over 20 investor groups inquired immediately. | This is why the Guenther Steiner/IKON Capital purchase of Tech3 (an estimated €20M deal) happened. Steiner got in before the market fully booms. |

| Grid Slot Value | High Seven-Figures (e.g., Trackhouse slot in 2023). | Increased Multiple-Fold. Teams like Trackhouse are now considering selling stakes to partners. | KTM’s four grid slots (two factory, two satellite) are now seen as a massively valuable financial asset. This pressure is why Bajaj/KTM may sell or partner to realize the value. |

| Financial Model | Heavy reliance on manufacturers (like KTM) subsidizing satellite teams. | Liberty Media plans to equally support all teams financially from 2027 (like F1’s model), treating them as independent franchises. | This shifts the financial burden away from the manufacturer and onto the new team owners, making a Tech3 (Steiner) or a factory slot takeover much more attractive to investors like CFMOTO. |

| The F1 Parallel | When Liberty Media bought F1 in 2016, the enterprise value was $8 Billion. Now, it’s estimated at over $49 Billion. | MotoGP’s enterprise value is currently €4.2 Billion—meaning investors see massive, untapped potential for growth and multi-billion-dollar returns. | Everyone is trying to be an “early-bird investor.” KTM’s crisis under Bajaj gives investors a rare chance to buy in early. |

🏭 The Technical Revolution: Attracting New Manufacturers

The 2027 technical regulations, combined with Liberty’s new commercial approach, are a direct incentive for new manufacturers to enter—and a financial lifeline for existing ones like KTM.

⚙️ The Crucial 2027 Rule Changes (The Invitation)

The new rules for 2027 are being designed to reduce costs and level the playing field, making it a more enticing prospect for new and old OEMs:

- Engine Size Reduction: From $1000 \text{cc}$ to $850 \text{cc}$. This cuts top speeds (safer) and reduces development costs.

- Aerodynamics Reduction: Tighter control and smaller fairings will minimize the ‘dirty air’ effect, making races closer and more spectacular (the “show” is key to Liberty).

- Banning Devices: The removal of ride-height and holeshot devices reduces complexity and development expenditure.

- Concession Reset: All manufacturers will start in Rank B in 2027, giving everyone a fresh start, even newcomers, and ensuring fair competition from Day One.

The Manufacturer Impact

This combination of rising team values and cost-controlled rules has led to:

- Massive New Interest: Liberty Media has confirmed an “outpouring of interest” from prospective manufacturers, with BMW already openly expressing their interest in joining the grid.

- KTM’s Pivot: KTM’s willingness to sell or partner parts of its racing effort (as seen with the CFMOTO and Steiner talks) means they are monetizing the value of their grid slots and engineering platform. They can offload the massive race team running costs, but keep their technical expertise, and even supply their new partner/team (like CFMOTO) with a heavily branded KTM machine.

The grand narrative is this: KTM’s financial stress coincided perfectly with Liberty Media making MotoGP a blue-chip investment. This convergence forces KTM to choose between the passion of ownership and the financial wisdom of securing a profitable technical partnership.

Source

. KTM Financial Restructuring & Bajaj Majority Ownership

- Bajaj Takes Control of KTM’s Parent Company (Bajaj Mobility AG / Pierer Mobility AG):

- Bajaj MD on Cost Cuts & MotoGP Program:

2. Guenther Steiner / IKON Capital Tech3 Acquisition

- Steiner Completes Tech3 Takeover (€20M Deal):

3. CFMOTO Interest in KTM’s MotoGP Slots

- CFMOTO Delegation Visits KTM HQ & Rumored Takeover of MotoGP Slots:

4. Liberty Media Acquisition & Growth Strategy

- Liberty Media Completes MotoGP Acquisition (€4.2 Billion):

- Liberty’s Plan to Grow MotoGP in US & Globally:

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity