I. Executive Summary: Charting GoPro’s Path to Resurgence

GoPro, once the dominant force in the action camera market, currently navigates a challenging landscape. The company has experienced significant financial headwinds, marked by declining revenue and persistent net losses, alongside a notable erosion of its market share.1 This downturn is largely attributed to intensified competition from agile rivals such as DJI and Insta360, delays in product launches, and evolving consumer preferences.3 Despite these considerable challenges, GoPro has strategically shifted its business model towards a subscription-based, recurring revenue stream, a pivot that shows promising growth in subscriber numbers and boasts high gross margins.1

A successful resurgence for GoPro necessitates a multi-faceted strategic approach. This includes aggressive product innovation, particularly focusing on the high-growth 360-degree camera segment, complemented by a robust and intuitive software ecosystem designed to streamline the content creation workflow.7 Achieving financial stability requires rigorous operational efficiency and enhanced supply chain resilience.3 Furthermore, reinvigorating GoPro’s iconic brand identity and fostering deep community engagement will be paramount to regaining market relevance and customer loyalty.11

The forthcoming Max 2, GoPro’s highly anticipated refresh of its 360-degree action camera, is positioned as a pivotal product in this comeback narrative.4 Its successful introduction could enable GoPro to recapture substantial market share within a rapidly expanding segment, attract a broader base of professional content creators, and further strengthen its high-margin subscription service.7 However, the Max 2 enters an increasingly crowded and competitive arena, facing formidable opposition from established players like Insta360 and emerging entrants such as DJI.4 To succeed, the Max 2 must offer truly superior features, seamless software integration, and be strategically priced to differentiate itself effectively.

II. GoPro’s Current Market Position and Financial Health

A. Financial Performance Analysis (2023-2024)

GoPro’s financial performance over the past two years reveals a company under significant pressure. In 2023, total revenue amounted to $1.0 billion, representing an 8.1% year-over-year decrease from $1.093 billion in 2022.1 This downward trajectory continued into 2024, with reported revenue declining to $801 million, a substantial 20% year-over-year reduction.2 The second quarter of 2024 saw revenue drop 23% year-over-year to $186.2 million, and the first quarter of 2025 recorded $134 million, a 14% year-over-year decrease.3

The company has consistently reported net losses. The GAAP net loss for 2023 was $53.183 million, with a non-GAAP net loss of $31 million.1 By Q2 2024, the net loss widened to $47.8 million, a deterioration from $17 million in Q2 2023.3 The full-year 2024 net loss reached an alarming $432 million.2 Adjusted EBITDA also reflected this struggle, being negative $27 million in 2023 and negative $33 million in Q2 2024.1

Gross margins have also contracted, with GAAP gross margin falling from 37.2% in 2022 to 32.2% in 2023.1 Q2 2024 gross margin stood at 30.5%.3 Compounding these issues, the Street Average Selling Price (ASP) decreased by 13% year-over-year to $330 in Q4 2023.1 This trend persisted, with Q1 2025 Street ASP at $349, down from $395 in the prior year.13

While camera units sold initially saw a 6% year-over-year increase to 3 million in 2023 1, this trend reversed in 2024. Q2 2024 experienced a decline to 576,000 units from 704,000 in the same period of the prior year.3 Q1 2025 continued this downturn, with units down 20% year-over-year to approximately 430,000.13 This divergence between unit sales and overall revenue, particularly in 2023, indicates a significant reduction in the average selling price per camera or a strategic shift towards selling a higher proportion of lower-margin products.

For instance, entry-level products accounted for 14% of camera revenue in Q4 2023, while products at or above $400 MSRP represented 74%.1 This suggests that even as more units moved, the revenue generated per unit decreased, placing pressure on overall financial performance without substantial cost reductions or a shift to higher-value offerings.

In contrast to hardware sales, GoPro’s subscription service has demonstrated consistent growth, reaching 2.5 million subscribers by the end of 2023 and further growing to 2.52 million by the end of 2024, generating $107 million in revenue.1 Subscription and service revenue grew 18% year-over-year to $97 million in 2023 1 and 4% year-over-year to $27 million in Q1 2025.13 A notable aspect of this model is that 90% of GoPro.com camera sales are accompanied by a subscription, which significantly increases each customer’s lifetime value by transforming a one-off purchase into a source of yearly, high-margin revenue.6

This recurring revenue stream, while growing, has not yet reached a scale sufficient to fully offset the substantial financial drag from declining hardware sales and associated operational costs. It serves as a vital foundation for future stability but is not an immediate solution to the company’s profitability challenges.

GoPro’s stock performance reflects these financial struggles, having plummeted from over $89 per share to just over $1.34, shedding over 86% in the past three years.3 The 52-week high was $1.76, and the low was $0.40.14 Cash and marketable securities, crucial for future investments and operational stability, were $247 million at the end of Q4 2023 but remained flat at $133 million in Q2 2024.1 This shrinking financial buffer restricts GoPro’s ability to invest aggressively in product development, marketing, or strategic acquisitions, which are essential for innovation and market presence in a highly competitive environment.

Table 1: GoPro Key Financials & Performance Indicators (2023-2025)

| Metric | 2023 (Full Year) | 2024 (Full Year) | Q2 2024 (Quarter) | Q1 2025 (Quarter) |

| Revenue | $1.005 Billion 1 | $801 Million 3 | $186.2 Million 3 | $134 Million 13 |

| GAAP Net Loss | $(53.183) Million 1 | $(432) Million 2 | $(47.8) Million 3 | $(2.418) Million (Q4 2023) 1 |

| Non-GAAP Net Loss | $(31.135) Million 1 | N/A | N/A | $(31.135) Million (2023) 1 |

| GAAP Gross Margin | 32.2% 1 | 34.1% 9 | 30.5% 3 | 34.2% (Q4 2023) 1 |

| Non-GAAP Gross Margin | 32.4% 1 | 34.4% 1 | 30.7% 3 | 34.4% (Q4 2023) 1 |

| Adjusted EBITDA | $(27) Million 1 | N/A | $(33) Million 3 | $3 Million (Q4 2023) 1 |

| Camera Units Sold | 3 Million 1 | 2.5 Million 9 | 576,000 3 | 430,000 13 |

| Subscription Revenue | $97 Million 1 | $107 Million 2 | N/A | $27 Million 13 |

| Number of Subscribers | 2.5 Million 1 | 2.52 Million 2 | N/A | 2.47 Million (Q2 2025) 8 |

| Q4 Street ASP | $330 1 | $346 9 | N/A | $349 (Q1 2025) 13 |

| Stock Price (as of Q2 2024) | N/A | $1.34 3 | N/A | N/A |

| 52-Week High Stock Price | N/A | $1.76 14 | N/A | N/A |

| 52-Week Low Stock Price | N/A | $0.40 14 | N/A | N/A |

| Cash & Marketable Securities | $247 Million 1 | $133 Million (Q2 2024) 3 | $133 Million 3 | N/A |

B. Market Share Erosion and Competitive Landscape

GoPro’s once-dominant position in the action camera market has significantly eroded. Between 2015 and 2023, the company’s market share experienced a steady decline, notably being surpassed by DJI in key territories such as Japan.2 While some reports still refer to GoPro as “a leader in the global action camera market” due to its brand recognition and innovative history 15, other data indicates that a collective of dominant players, including Garmin, GoPro, Nikon, Olympus, Panasonic, and SJCAM, held only 25% of the market share in 2024.15 This suggests a highly fragmented market or a significant shift in competitive leadership.

The rise of DJI and Insta360’s market share directly corresponds with GoPro’s decline. DJI’s video camera market share has seen a meteoric rise, exploding from 7.3% in September 2021 to 37.7% by September 2024.16 In Japan, the DJI Osmo Pocket 3 alone captured a shocking 24.3% of the video camera market, significantly outpacing the GoPro Hero 12 Black by a ratio of nearly 2.7:1.17 DJI’s Osmo Action series, including the Osmo Action 5 Pro and Osmo Action 4, is lauded for its larger image sensors (1/1.3-inch), which contribute to stunning low-light imaging.15 Their cameras also feature superior stabilization technologies like RockSteady and HorizonSteady, dual OLED touchscreens, and a free, user-friendly app.18

Insta360 has emerged as a formidable competitor, becoming the world’s top seller of both consumer-grade action cameras and panoramic cameras.24 In 2023, Insta360 captured 67.2% of global sales in consumer-grade panoramic cameras and 61.4% in the professional segment.24 The company has even surpassed GoPro in overall market share in recent months.17 Their flagship X5 camera offers impressive 8K 360-degree video at 30 frames per second and 5.7K at 60 frames per second, leveraging larger 1/1.28-inch sensors for superior image quality.26

Key strengths of Insta360 include its modularity (e.g., Insta360 ONE R), excellent AI-powered apps with features like Shot Lab, AI Warp, and auto-reframing, rapid product development cycles, replaceable lenses, and the innovative invisible selfie stick effect.18 The long delay in GoPro releasing a successor to its original Max camera allowed Insta360 to dominate the 360-degree segment for nearly five years, establishing a strong competitive advantage that GoPro now faces a steep challenge in overcoming.4

Beyond these two primary rivals, other notable competitors contribute to the fragmented market. Sony offers high-quality video capture, advanced stabilization features, and robust designs.28 Garmin focuses on GPS integration and tracking performance data, appealing to adventure and sports enthusiasts.28 Akaso provides affordable alternatives with 4K video and 6-axis stabilization.18 SJCAM is known for competitive prices and 4K capabilities.28 Other players like Nikon, Olympus, and Panasonic also maintain a presence, further intensifying the competitive pressure on GoPro.15

The competitive landscape also highlights the ongoing threat posed by technologically advanced smartphones. While smartphones offer convenience and increasingly sophisticated camera features like 4K video recording and stabilization, action cameras differentiate themselves by excelling in specific areas where smartphones fall short.32 These core differentiators include extreme durability, inherent waterproofing without external cases, advanced stabilization for high-motion activities, and unique point-of-view (POV) capture capabilities.32 Competitors like DJI emphasize larger sensors for superior low-light performance, while Insta360 focuses on unique 360-degree capture and AI-driven post-production tools.18 This market dynamic means GoPro’s comeback strategy must not only address its internal issues but also hyper-focus on pushing the boundaries of these specialized features, delivering distinct value that smartphones cannot replicate, thereby solidifying its unique niche.

Table 2: Leading Action Camera Competitors and Their Differentiating Features

| Competitor | Key Product Lines | Core Strengths / Differentiators |

| DJI | Osmo Action series (e.g., Osmo Action 5 Pro, Osmo Action 4, Osmo Pocket 3) 15 | Meteoric market share growth; larger image sensors (1/1.3-inch) for stunning low-light; superior stabilization (RockSteady, HorizonSteady); dual OLED touchscreens; free, user-friendly app (DJI Mimo); rugged and waterproof designs 15 |

| Insta360 | X-series (e.g., X5, X3), Ace Pro, ONE R, GO series 18 | World’s top seller of consumer-grade action and panoramic cameras; 8K 360-degree video; larger 1/1.28-inch sensors; modularity; excellent AI-powered apps (Shot Lab, AI Warp, auto-reframing); rapid product cycles; replaceable lenses; invisible selfie stick effect 18 |

| Sony | FDR-X3000, RX0 series 28 | High-quality video capture; advanced stabilization; robust design; compact form 28 |

| Garmin | Virb Ultra 30 series 28 | GPS integration; built-in sensors for tracking performance data (speed, altitude); strong focus on adventure and sports integration 28 |

| Akaso | Brave 7 LE, EK7000 Pro, V50 series 18 | Affordable price point; 4K video; 6-axis stabilization; front-facing screen (Brave 7 LE) 18 |

| SJCAM | SJ8 Pro, SJ9 Strike, SJ20 (dual-lens) 15 | Competitive prices; 4K video quality; stabilization features; waterproof designs; innovative dual-lens design for low-light 15 |

| Nikon | KeyMission series 15 | Imaging technology expertise; cameras for tough conditions 15 |

| Olympus | Tough TG series 15 | Durable designs; underwater capabilities; fast image processing; reliable performance in extreme conditions 15 |

C. Operational Challenges and Strategic Shifts

GoPro’s current struggles stem from a complex interplay of operational and market challenges. Intensifying global competition, a significant decrease in market share, declining camera sales, and an overall worsening financial health have collectively impacted the company.3 A critical factor has been postponed product launches, which have directly contributed to financial setbacks, including an estimated $100 million drop in sales and a $20-$25 million negative impact on Q4 2024 revenue.3 This delay allowed competitors, particularly Insta360 in the 360-degree camera segment, to gain substantial ground and establish market leadership.4 Diminished consumer spending, a decline in direct-to-consumer camera sales on GoPro.com, and adverse foreign exchange rate fluctuations, especially in China and Japan, have further hindered performance.3 Additionally, customer dissatisfaction arising from overheating issues with some camera models has impacted brand loyalty.6

In response to these pressures, GoPro has implemented aggressive cost-cutting measures. These include plans to reduce non-recurring technology development expenses, marketing, and salary costs.3 A significant workforce reduction, impacting approximately 15% of jobs, was announced by the end of 2024.3 These austerity measures have already begun to show results, with non-GAAP operating expenses falling 26% year-over-year in Q1 2025 to $62 million.8 While necessary for financial stabilization, the effectiveness of these cuts in the long term will depend on their balance with continued investment in innovation to avoid further erosion of competitive advantage.

A crucial strategic move to mitigate tariff challenges and geopolitical risks has been GoPro’s diversification of its supply chain. The company has proactively relocated U.S.-bound camera production outside of China, moving manufacturing to countries like Vietnam and Mexico.8 This strategy provides operational flexibility, reduces reliance on a single manufacturing region, and helps protect pricing power, thereby building resilience against potential supply chain disruptions and geopolitical uncertainties.8 This foundational de-risking of the business model is essential for supporting consistent product launches and maintaining competitive market positions in the long term.

Concurrently, GoPro is actively pivoting towards a recurring revenue model through its subscription service.2 The company aims to reach 3.2 million paid subscribers by year-end 2025, projecting $180 million in annual revenue from this segment.7 This shift is designed to provide a more stable and high-margin revenue stream, significantly increasing each customer’s lifetime value.6 The subscription model, with its offerings of cloud storage, camera replacement, editing tools, and discounts, is becoming increasingly synonymous with GoPro camera ownership, particularly for sales made through GoPro.com, where 90% of customers attach a subscription.6 This focus on a robust software ecosystem and recurring revenue is a strategic imperative to build a more resilient and profitable business model.

III. The Evolving Action Camera Market: Trends and Opportunities

A. Market Size, Growth, and Key Segments

The global action camera market is currently experiencing robust growth, presenting a significant opportunity despite GoPro’s recent challenges. The market was valued at USD 6.5 billion in 2024 and is projected to grow to USD 7.2 billion in 2025, with forecasts indicating it could reach USD 16.9 billion by 2034, demonstrating a Compound Annual Growth Rate (CAGR) of 10%.15 Other market analyses corroborate this positive outlook, with CAGRs ranging from 6.1% to 14.2% over various forecast periods, confirming a strong growth trajectory for the industry as a whole.31 This sustained market expansion indicates that GoPro’s decline is company-specific, rather than a reflection of a shrinking industry, underscoring a substantial opportunity for a comeback if the company can effectively address its internal and competitive issues.

The U.S. market is a significant contributor to this global growth, generating an estimated USD 1.5 billion in revenue in 2024 and projected to reach USD 4.1 billion by 2034.15 North America, driven by its strong vlogging culture, outdoor activities, and rapid adoption of new technology, led the global market with a 34.4% revenue share in 2024.15

Within the market, distinct segments are showing varied growth dynamics. “Standard action cameras,” often characterized by their box-style design, continue to be the dominant force, generating USD 2.9 billion in 2024 and projected to reach USD 7.5 billion by 2034.15 These cameras, including GoPro’s HERO series, accounted for 44.2% of the market in 2024 due to their functionality, versatility, durability, and adaptability for various mounting solutions.43 The “sports and adventure” application segment also remains dominant, holding approximately 35% of the market share in 2024, fueled by increasing participation in extreme sports and adventure tourism, as well as the growing trend of sharing content on social media platforms.15

Crucially, the “360-degree camera” segment is anticipated to witness the fastest growth during the forecast period.43 This accelerated growth is driven by the increasing integration of innovative technologies that enhance user experience and convenience, coupled with the rising popularity of virtual reality (VR) content creation.43 This dual market dynamic—a mature, dominant standard camera segment and a rapidly expanding, high-potential 360-degree segment—presents a bifurcated opportunity. For GoPro, this means a need to excel in both areas, particularly leveraging its history and upcoming Max 2 to recapture leadership in the 360-degree space while simultaneously innovating and defending its position in the larger standard action camera market.

Table 3: Global Action Camera Market Size & Growth Forecast (2024-2034)

| Metric | 2024 (Market Size) | 2025 (Projected Market Size) | 2030 (Projected Market Size) | 2032 (Projected Market Size) | 2033 (Projected Market Size) | 2034 (Projected Market Size) | CAGR (2025-2034) |

| Global Market Value | USD 6.5 Billion 15 | USD 7.2 Billion 15 / USD 2.78 Billion 32 / USD 2.625 Billion 40 | USD 12.49 Billion 43 | USD 13.1 Billion 31 | USD 5.49 Billion 32 / USD 5.312 Billion 40 | USD 16.9 Billion 15 | 10% 15 / 9.21% 40 / 8.9% 32 |

| U.S. Market Value | USD 1.5 Billion 15 / USD 562.5 Million 44 | USD 594.8 Million 44 | N/A | N/A | N/A | USD 4.1 Billion 15 / USD 907.97 Million 44 | 4.80% (2025-2034, U.S.) 44 |

| Standard Action Camera Segment | USD 2.9 Billion 15 | N/A | N/A | N/A | USD 7.5 Billion 15 | N/A | N/A |

| Sports & Adventure Application Share | 35% 15 | N/A | N/A | N/A | N/A | N/A | N/A |

| 360-Degree Camera Segment Growth | Fastest Growth 43 | N/A | N/A | N/A | N/A | N/A | N/A |

Note: Market size and CAGR figures vary slightly across different research sources, but all indicate significant growth.

B. Technological Advancements and Consumer Demands

The action camera market is rapidly evolving, driven by continuous technological advancements and shifting consumer demands. Several key trends are shaping product development and user expectations:

A significant trend is the increasing integration of Artificial Intelligence (AI) into action cameras. AI features are being leveraged for enhanced image stabilization, automatic scene detection, voice commands, and simplified video editing.15 GoPro’s “Quik” app, for example, utilizes AI to automatically generate highlight videos by selecting the best parts of footage and adding transitions, streamlining the content creation process for users.7 Competitors like Insta360 also heavily incorporate AI into their editing tools, offering features such as Shot Lab, AI Warp, and intelligent auto-reframing, which democratize immersive content creation by simplifying complex post-production tasks.27

There is a strong and persistent demand for higher video quality, with 4K and 8K recording capabilities becoming standard features.15 Consumers increasingly desire ultra-clear videos with smooth motion, even when capturing fast-paced activities. This pushes manufacturers to continuously improve sensor quality and processing power to deliver superior image fidelity.

Durability and ruggedness remain paramount for action cameras. As more users engage in extreme sports and outdoor activities, there is a critical need for cameras that can withstand harsh conditions. Manufacturers are focusing on making devices inherently waterproof, shockproof, and dustproof, often without the need for external casings.15 This emphasis on robust design ensures reliability in challenging environments.

Advanced stabilization technology is considered a game-changer. Electronic Image Stabilization (EIS) systems now provide gimbal-like footage directly from the camera, eliminating the need for additional bulky gear. This feature is crucial for maintaining smooth, professional-looking video during high-motion activities like mountain biking, skiing, or parkour.15

Improvements in battery life and audio quality are also critical for enhancing the user experience. Newer models are offering extended recording times, with some providing over two hours of 4K footage, along with fast charging capabilities and swappable batteries.20 Enhanced audio features, including directional microphones, advanced wind reduction, and external microphone support, are becoming standard, significantly benefiting vloggers and content creators who require clear sound.27

Consumer preferences are increasingly leaning towards a seamless user experience and a comprehensive ecosystem that extends beyond just the camera hardware. This includes intuitive controls, easy navigation of settings, and a range of accessories for versatile mounting.35 Connectivity options like Wi-Fi and Bluetooth for easy footage transfer to smartphones or tablets for quick editing and sharing are highly valued.45 The integration of sophisticated mobile and desktop applications for editing, cloud storage, and content management is crucial for a complete user experience.7 Features like auto-upload to the cloud, unlimited cloud storage for GoPro footage, and automatic highlight video creation are key components of this ecosystem, reducing the burden of post-production for users.7

The market is also witnessing a demand for both premium, feature-rich cameras and more budget-friendly options.40 While advanced models offer superior features like 4K video, stabilization, and AI editing at higher price points ($300-$500), there’s a growing opportunity for affordable action cameras (under $150) with essential features, particularly in emerging markets.40 The rise of e-commerce platforms facilitates the distribution of these budget models, which gained 20% market share in 2023-2024.40

The continuous improvement of smartphone cameras, offering features like 4K video recording, stabilization, and wide-angle lenses, poses a significant threat to the action camera market.32 Consumers often prefer the convenience of a single multifunctional device, reducing demand for standalone cameras. However, action cameras maintain a distinct advantage in extreme conditions, offering superior durability, waterproofing, and specialized mounting options that smartphones cannot match.33 The market’s growth is therefore driven by companies that can clearly differentiate their products by pushing the boundaries of these specialized features and offering unique capture capabilities.

IV. GoPro’s Comeback Strategy: Core Pillars

A. Product Innovation and Diversification

GoPro’s comeback strategy hinges significantly on robust product innovation and diversification, particularly in the 360-degree camera segment. The company has recently introduced new cameras, including the HERO13 Black with HB-Series Lenses and a more straightforward, compact HERO 4K camera.15 The HERO13 Black features advanced capabilities like GPS, magnetic latch mounting, and four interchangeable HB-Series lenses that auto-detect for optimal settings, including an ultra-wide POV and macro option.15 The compact HERO, weighing under 100 grams, prioritizes simplicity and 4K resolution.15

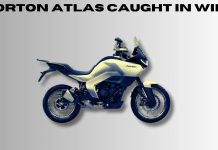

However, the most critical element of GoPro’s product roadmap for 2025 and 2026 is the Max 2, its highly anticipated next-generation 360-degree action camera.4 The original GoPro Max, released in 2019, was praised for its 5.6K 360-degree video, in-camera stitching, and stabilization.12 However, it has been significantly outpaced by competitors like Insta360, whose X5 offers 8K 360-degree video at 30fps and 5.7K at 60fps, along with larger 1/1.28-inch sensors.4 The long delay in releasing the Max 2 has allowed Insta360 to dominate the 360-degree market for years.4

GoPro has teased the Max 2, indicating a similar form factor with potentially centralized lens locations and improved cooling vents.4 Speculation suggests the Max 2 will feature significant upgrades to match or surpass Insta360’s flagship offerings, including higher resolution video capture, improved low-light performance, enhanced stabilization, and potentially new shooting modes for professional content creators.4 The company has also hinted at features like interchangeable lenses and improved software integration for the Max 2.5 GoPro’s management has expressed excitement about the Max 2’s “innovative capabilities that will redefine the 360-camera market and position MAX2 as the world’s most impressive 360-camera”.9

Beyond action cameras, GoPro is exploring new adjacent markets to expand its Total Addressable Market (TAM) and drive growth.13 A notable initiative is the development of a “tech-enabled motorcycle helmet”.9 This move signifies a broader diversification strategy, leveraging GoPro’s core competencies in rugged, high-quality video capture and integrating them into new product categories. This expansion beyond traditional action cameras is crucial for long-term growth and reducing reliance on a single product line in a highly competitive market.

B. Software Ecosystem Enhancement and Subscription Growth

A cornerstone of GoPro’s comeback strategy is the enhancement of its software ecosystem and the continued growth of its subscription service. The company has actively pivoted from a hardware-centric model to a content creation platform, with its Premium and Premium+ subscriptions at the core.7 By the end of 2023, GoPro had 2.5 million subscribers, growing to 2.52 million by the end of 2024, generating $107 million in revenue.1 The goal is to reach 3.2 million subscribers by year-end 2025, aiming for $180 million in annual recurring revenue.7

The GoPro Quik app is central to this ecosystem, simplifying editing with AI-driven tools.7 Features like MotionFrame allow users to manually pan through 360 clips for polished linear videos, and POV maps edits to the camera’s GPS-tracked motion.7 The app also offers automatic highlight videos, where footage is auto-uploaded to the cloud while the camera charges, and an SD card clears, with the video sent to the phone, ready to share.39 For professional creators, the ReFrame plugin for Adobe Premiere Pro provides precise control over angles, lens curvature, and motion blur.7 This synergy between hardware and software creates a closed-loop ecosystem, aiming to reduce switching costs for users reliant on GoPro’s tools for both capture and editing.7

GoPro’s AI innovations are designed to dismantle the complexity of 360 video production. Features like Single Clip Edits allow real-time adjustments to filters and color grading, while the Frame Grab Tool converts video into static photos.7 These features are estimated to reduce editing time by 75% and boost engagement by 85%, enabling users to produce professional-quality content quickly.7 This lowers the barrier to entry for casual creators and accelerates workflows for professionals, reinforcing the ecosystem’s stickiness.7

The subscription service offers significant value: unlimited cloud storage for GoPro footage, 25GB (or 500GB with Premium+) for non-GoPro footage, automatic highlight videos, guaranteed camera replacement (up to two per year for a fee), up to 50% off accessories, and $100 off the next GoPro upon renewal.39 Live streaming capabilities are also included.39 The company reports that 90% of GoPro.com sales attach a subscription, indicating strong customer adoption of this model.6 This focus on recurring revenue at high margins (70-80% gross margins) is a strategic move to improve financial stability and increase customer lifetime value.6 GoPro expects subscriber and revenue growth to resume in tandem with a return to camera unit growth in 2026, as new editing and content management features are added to help subscribers maximize their content.13

C. Operational Efficiency and Supply Chain Resilience

GoPro’s strategic turnaround also emphasizes rigorous operational efficiency and enhanced supply chain resilience. The company has demonstrated a commitment to cost-cutting, with non-GAAP operating expenses falling 26% year-over-year to $62 million in Q1 2025.8 These savings are attributed to systemic changes, including workforce optimization and restructuring costs.8 The company aims to end 2025 with $75 million in cash and no debt, striving for financial resilience to invest in its future without compromising liquidity.8

A critical component of this operational strategy is the diversification of its camera supply chain. By relocating U.S.-bound camera production outside of China to countries like Vietnam and Mexico, GoPro has proactively minimized the impact of tariffs and reduced its exposure to geopolitical risks.8 This strategic move provides operational flexibility, protects pricing power, and offers a competitive edge by reducing reliance on a single manufacturing region.10 This diversification is not merely a reactive measure but a foundational de-risking strategy that underpins the company’s long-term success and ability to navigate an evolving global landscape.10

The company’s focus on cost-cutting and supply chain resilience is intertwined with its product roadmap. By operating as a leaner, more efficient organization, GoPro aims to deliver its 2025 and 2026 products effectively.9 This includes a broader portfolio that is expected to yield profitable returns over time.9 GoPro’s management has stated that the reduced operating expense level for 2025 enables continued innovation and will lead to an exciting year of new releases in 2026 and beyond.9 The company’s commitment to continuous evaluation and optimization of its supply chain is instrumental in ensuring long-term success and resilience, solidifying its position as a market leader.10

D. Brand Reinvigoration and Community Engagement

For GoPro to truly make a comeback, reinvigorating its brand identity and fostering strong community engagement are essential. GoPro’s original success was built on inspiring customers to “Be a HERO” in their own adventures, a slogan derived from its first product, the HERO Camera.11 This brand ethos encouraged users to capture photos and videos that made them look heroic, resonating with values of living life to the fullest and attacking passions head-on.11

A key aspect of GoPro’s historical marketing success was its reliance on user-generated content (UGC). The company constantly featured interesting and exciting UGC from novel perspectives, which kept its millions of YouTube subscribers engaged and returning for more.11 This strategy allowed GoPro to double its profits with minimal marketing spend in its early years, demonstrating the power of authentic content shared by its community.11 People tend to trust UGC more than traditional marketing, and it serves as an effective way to engage customers and excite them to share their experiences.11

To reignite this brand connection, GoPro needs to re-emphasize its core identity as the enabler of epic adventures. This involves showcasing not just professional extreme sports footage, but also the everyday “heroic” moments that resonate with a broader audience, as suggested by CEO Nicholas Woodman’s personal example of being a “hero as a dad”.11 The company’s continued focus on professional content creators and shows like “Beast Games” and MrBeast’s YouTube channel, which reach over 350 million subscribers, helps to put GoPro products and brand in front of a broader and younger audience.9

Furthermore, nurturing a community of trained creators through initiatives like the Content Academy, as outlined in their ecosystem strategy, can build a flywheel of user-generated content that fuels brand equity.7 Empowering users to monetize their work through platforms like the Sponsored Content Platform can deepen ecosystem engagement and foster a loyal community.7 By focusing on these aspects, GoPro can rebuild the emotional connection with its user base, transforming customers into brand advocates and leveraging authentic content to drive renewed interest and sales.

V. The Max 2: Ticket Back to the Top?

The GoPro Max 2 is positioned as a pivotal product in the company’s comeback strategy, particularly as a ticket back to the top of the action camera scene. Its significance stems from its potential to re-establish GoPro’s presence and leadership in the rapidly growing 360-degree camera market.4

The current GoPro Max, released in 2019, has been significantly outmatched by competitors like Insta360, whose X5 offers superior 8K 360-degree video, larger sensors, and advanced features.4 The long delay in releasing a successor allowed Insta360 to dominate this segment for nearly five years, establishing a strong competitive moat.4 The Max 2, therefore, represents GoPro’s crucial opportunity to directly challenge this dominance.

For the Max 2 to be GoPro’s ticket back to the top, it must deliver substantial improvements over its predecessor and truly differentiate itself from the competition. Key areas of focus must include:

- Superior Image Quality: The Max 2 needs to offer competitive or superior resolution (e.g., 8K 360-degree video at high frame rates), larger image sensors for exceptional low-light performance, and improved dynamic range to capture stunning footage in diverse conditions.4 The current Max’s 5.3K stitched video from 1/2.3-inch cameras is outdated compared to Insta360’s 8K from 1/1.28-inch sensors.4

- Advanced Stabilization and User Experience: While GoPro’s HyperSmooth stabilization is industry-leading, the Max 2 must integrate this seamlessly with 360-degree capture, offering features like 360° Horizon Lock and improved in-camera stitching.47 User-friendly controls, intuitive interfaces, and robust waterproofing are also essential.34

- Robust Software Ecosystem: The success of the Max 2 is inextricably linked to GoPro’s software ecosystem. The Quik app must provide seamless, AI-powered editing for 360-degree footage, including easy reframing, object tracking, and cinematic effects.7 Features like cloud editing and auto-highlight videos are crucial for simplifying the post-production workflow, a key differentiator against competitors and smartphones.7 The ability to easily export content for various social media platforms (e.g., vertical video for TikTok) is also vital.29

- Hardware Innovations: The Max 2 could benefit from features like interchangeable lenses, which Insta360 offers, providing greater versatility for different shooting scenarios.5 Improved battery life and efficient heat management are also critical, addressing past user complaints and ensuring extended recording times.6

- Strategic Pricing: While the Max 2 is expected to have a higher price point than the aging original Max, it must be strategically priced to offer compelling value against its rivals.4 Given the intense competition and the availability of budget alternatives, GoPro must justify its premium positioning through superior performance and ecosystem integration.

The 360-degree camera market is projected for the fastest growth within the action camera industry, driven by immersive content and virtual reality applications.43 GoPro pioneered this market, and the Max 2 represents an opportunity to reclaim its position as a market-leading innovator.9 If the Max 2 can deliver on its promise of “innovative capabilities that will redefine the 360-camera market” 9, coupled with a strong software ecosystem and a focus on professional content creators, it could indeed be GoPro’s ticket back to the top. However, the battle will be fierce, with DJI also reportedly preparing to enter the 360-degree market with a strong offering.4 GoPro’s long-term success will depend not just on the Max 2’s initial launch, but on sustained innovation, aggressive marketing, and continuous enhancement of its entire product and software ecosystem.

VI. Conclusions and Recommendations

GoPro is at a critical juncture, facing significant financial challenges and market share erosion due to intense competition and past product delays. Despite these headwinds, the action camera market itself is robust and growing, indicating that GoPro’s struggles are company-specific rather than a reflection of a shrinking industry. The company has made commendable strides in pivoting to a subscription-based recurring revenue model, which offers high margins and a stable financial foundation. However, this alone is not sufficient to offset the decline in hardware sales and return to overall profitability.

The upcoming Max 2 is a crucial product for GoPro’s resurgence, particularly in the high-growth 360-degree camera segment. Its success is paramount for recapturing market share and leveraging the company’s subscription service. However, the Max 2 enters a highly competitive landscape dominated by Insta360 and with DJI poised to enter.

Recommendations for GoPro’s Comeback:

- Maximize the Max 2 Launch and Subsequent Innovation:

- Deliver Unparalleled Performance: The Max 2 must not just match but surpass competitors like Insta360 X5 in key specifications such as 8K 360-degree video resolution, sensor size for low-light performance, and advanced stabilization.4

- Prioritize User-Centric Hardware Design: Focus on features that directly address user pain points, such as improved battery life, efficient heat dissipation, and potentially modular or interchangeable lenses for versatility.5

- Accelerate Product Cycles: To avoid falling behind again, GoPro must adopt a faster product development cycle, similar to Insta360, which launches multiple models annually.24 This ensures continuous innovation and responsiveness to market demands.

- Deepen and Differentiate the Software Ecosystem:

- Enhance AI-Powered Editing: Continue to invest heavily in AI features within the Quik app, making 360-degree video editing effortless and intuitive for both casual and professional users.7 This includes advanced auto-reframing, object tracking, and cinematic effects that are difficult to replicate on smartphones or competitors’ platforms.

- Expand Cloud Capabilities: Leverage unlimited cloud storage and seamless auto-upload features to establish a robust, user-friendly content management system that reduces the burden on users’ local storage and simplifies sharing.7

- Foster Creator Tools and Community: Build on initiatives like the Content Academy and Sponsored Content Platform to empower content creators, generating a self-sustaining flywheel of user-generated content that reinforces brand equity and attracts new users.7

- Maintain Operational Discipline and Strategic Diversification:

- Sustained Cost Efficiency: Continue to manage operating expenses rigorously without compromising essential R&D and marketing investments that fuel innovation and market presence.3

- Leverage Supply Chain Resilience: Maximize the benefits of diversified manufacturing locations (e.g., Vietnam, Mexico) to mitigate geopolitical risks, ensure consistent product availability, and protect pricing power.8

- Explore Adjacent Markets Strategically: While the core action camera business is critical, cautious expansion into new, high-potential adjacent markets, such as the tech-enabled motorcycle helmet, can broaden the revenue base and reduce reliance on a single product category.8

- Reignite Brand Identity and Marketing:

- Re-emphasize the “Be a HERO” Ethos: Reconnect with the core brand message that inspires users to capture and share their adventures, whether extreme sports or everyday moments.11

- Amplify User-Generated Content: Continue to prominently feature compelling UGC across all marketing channels, leveraging its authenticity and broad appeal to drive engagement and trust.11

- Target New Demographics: While maintaining its core adventure sports base, actively engage newer demographics like vloggers and social media content creators, who are significant drivers of action camera market growth.15

The Max 2 is undeniably a critical component of GoPro’s potential resurgence. Its success, however, will not be a standalone event but rather the result of a concerted effort across product innovation, software ecosystem development, operational efficiency, and brand reinvigoration. If GoPro can execute these strategies effectively, leveraging its strong brand recognition and addressing its past missteps, the Max 2 could indeed be its ticket not just back to relevance, but potentially back to a leading position in the dynamic action camera scene.

Sources

- GoPro Announces Fourth Quarter and 2023 Results, accessed on July 15, 2025, https://investor.gopro.com/press-releases/press-release-details/2024/GoPro-Announces-Fourth-Quarter-and-2023-Results/default.aspx

- From the world’s best action camera to the worst drone: The ups and downs of GoPro, accessed on July 15, 2025, https://www.tatlerasia.com/power-purpose/innovation/go-pro-up-and-downs

- GoPro Grapples With Ongoing Competition as Stock Suffers – Nasdaq, accessed on July 15, 2025, https://www.nasdaq.com/articles/gopro-grapples-ongoing-competition-stock-suffers

- GoPro teases Max 2, its new 360 action camera – DroneDJ, accessed on July 15, 2025, https://dronedj.com/2025/07/07/gopro-teases-max-2-its-new-360-action-camera/

- It’s finally happening – GoPro Max 2 teaser shows the DJI and Insta360 rival is almost here after years in development hell | TechRadar, accessed on July 15, 2025, https://www.techradar.com/cameras/action-cameras/its-finally-happening-gopro-max-2-teaser-shows-the-dji-and-insta360-rival-is-preparing-for-lift-off-after-years-in-development

- The Fall of GoPro: What Went Wrong? – YouTube, accessed on July 15, 2025, https://www.youtube.com/watch?v=bqczLH9GG3E

- GoPro’s 360 Video Ecosystem: Pioneering the Future of Immersive Media – AInvest, accessed on July 15, 2025, https://www.ainvest.com/news/gopro-360-video-ecosystem-pioneering-future-immersive-media-2506/

- GoPro’s Strategic Turnaround: A High-Reward Investment in Motion – AInvest, accessed on July 15, 2025, https://www.ainvest.com/news/gopro-strategic-turnaround-high-reward-investment-motion-2505/

- February 6th, 2025 GoPro, Inc. (NASDAQ: GPRO) Management Commentary Q4 & Full Year 2024 Earnings Call, accessed on July 15, 2025, https://s21.q4cdn.com/291350743/files/doc_financials/2024/q4/Q4-2024-Management-Commentary.pdf

- GoPro’s Diversified Camera Supply Chain: A Strategic Move Against Tariff Challenges, accessed on July 15, 2025, https://www.ainvest.com/news/gopro-diversified-camera-supply-chain-strategic-move-tariff-challenges-2502/

- 3 Ways GoPro Became Synonymous with Action Cameras – ReferralCandy, accessed on July 15, 2025, https://www.referralcandy.com/blog/gopro-marketing-strategy

- GoPro to release TWO new Max 360 cameras in 2025, accessed on July 15, 2025, https://www.threesixtycameras.com/360-camera-news/gopro-to-release-two-new-max-360-cameras-in-2025/

- GoPro, Inc. (NASDAQ: GPRO) Management Commentary Q1 2025 Earnings Call, accessed on July 15, 2025, https://s21.q4cdn.com/291350743/files/doc_financials/2025/q1/Q1-2025-Management-Commentary.pdf

- GoPro – 11 Year Stock Price History | GPRO – Macrotrends, accessed on July 15, 2025, https://www.macrotrends.net/stocks/charts/GPRO/gopro/stock-price-history

- Action Camera Market Size & Share, Forecasts Report 2034, accessed on July 15, 2025, https://www.gminsights.com/industry-analysis/action-camera-market

- petapixel.com, accessed on July 15, 2025, https://petapixel.com/2024/10/21/dji-is-pulling-away-from-rivals-in-the-video-camera-market/#:~:text=In%20the%20three%20years%20from,market%20share%20for%20everyone%20else.

- DJI Is Pulling Away from Rivals in the Video Camera Market | PetaPixel, accessed on July 15, 2025, https://petapixel.com/2024/10/21/dji-is-pulling-away-from-rivals-in-the-video-camera-market/

- The best GoPro alternatives in 2025: action cameras that might be cheaper or better!, accessed on July 15, 2025, https://www.digitalcameraworld.com/buying-guides/best-gopro-alternatives

- DJI Osmo Action 4 – Set the Tone, accessed on July 15, 2025, https://www.dji.com/osmo-action-4

- User Manual – DJI, accessed on July 15, 2025, https://dl.djicdn.com/downloads/DJI_Osmo_Action_4/UM/20230802/DJI_Osmo_Action_4_User_Manual_v1.0_en.pdf

- DJI Osmo Action 3 – Specs, accessed on July 15, 2025, https://www.dji.com/osmo-action-3/specs

- Support for Osmo Action 3 – DJI, accessed on July 15, 2025, https://www.dji.com/global/support/product/osmo-action-3

- Osmo Action 5 Pro – Be All In – DJI, accessed on July 15, 2025, https://www.dji.com/osmo-action-5-pro

- Insta360’s IPO pop signals confidence, but the real challenge lies ahead – Kr Asia, accessed on July 15, 2025, https://kr-asia.com/insta360s-ipo-pop-signals-confidence-but-the-real-challenge-lies-ahead

- Insta360 Goes Public in China, 33-Year-Old Founder Now a Billionaire | PetaPixel, accessed on July 15, 2025, https://petapixel.com/2025/06/11/insta360-goes-public-in-china-33-year-old-founder-now-a-billionaire/

- Insta360 Unveils X5: The Smartest, Toughest 360° Camera Ever Made, accessed on July 15, 2025, https://www.insta360.com/blog/news/insta360-launches-X5-360-action-cam.html

- Flagship 8K 360º Action Camera – All Day, All Angles – Insta360 X5, accessed on July 15, 2025, https://www.insta360.com/product/insta360-x5

- Top 30 GoPro Competitors & Alternatives in 2025 – Marketing91, accessed on July 15, 2025, https://www.marketing91.com/gopro-competitors/

- How to Edit and Reframe 360 Videos: The Ultimate Guide – Insta360, accessed on July 15, 2025, https://www.insta360.com/blog/tips/how-to-edit-and-reframe-360.html

- Shot Lab: The AI Tool That Edits Epic Clips For You in Minutes – Insta360, accessed on July 15, 2025, https://www.insta360.com/blog/tips/insta360-shot-lab-ai-editing-tool.html

- Action Camera Market Share Report, Size, Trends and Growth 2032, accessed on July 15, 2025, https://www.marketresearchfuture.com/reports/action-camera-market-4582

- Action Camera Market Size, Share & Growth Report by 2033 – Straits Research, accessed on July 15, 2025, https://straitsresearch.com/report/action-camera-market

- Action Camera vs. Smartphone: A Comprehensive Guide for Business Video Production, accessed on July 15, 2025, https://www.media65.lu/blog/action-camera-vs-smartphone-a-comprehensive-guide-for-business-video-production

- What Is the Difference Between Smartphone Cameras and Action Cameras? – SJCAM, accessed on July 15, 2025, https://www.sjcam.com/blogs/the-difference-between-smartphone-cameras-and-action-cameras/

- What Makes the Action Camera in 2025? Features You Shouldn’t Miss? – DJI, accessed on July 15, 2025, https://www.dji.com/media-center/announcements/buying-guide-choosing-action-cams-in-2025-and-key-features

- DJI OSMO 360 And DJI MIC 3 Leaked. Full Specification And New Release Date – DroneXL, accessed on July 15, 2025, https://dronexl.co/2025/07/05/dji-osmo-360-and-dji-mic-3-full-specs-pics/

- DJI Mimo on the App Store, accessed on July 15, 2025, https://apps.apple.com/us/app/dji-mimo/id1431720653

- Mimo app terms : r/dji – Reddit, accessed on July 15, 2025, https://www.reddit.com/r/dji/comments/1kmb1ry/mimo_app_terms/

- GoPro Subscription – Cloud Storage, Replacement & Discounts, accessed on July 15, 2025, https://gopro.com/en/us/shop/subscriptions

- Action Cameras Market Size, Growth & Analysis 2025-2033, accessed on July 15, 2025, https://www.globalgrowthinsights.com/market-reports/action-cameras-market-105736

- Action Cameras Market Market Size | Forecast 2025 To 2033 – Business Research Insights, accessed on July 15, 2025, https://www.businessresearchinsights.com/market-reports/action-cameras-market-112822

- Action Camera Market: Global Market Industry Analysis and Forecast (2024-2030), accessed on July 15, 2025, https://www.maximizemarketresearch.com/market-report/global-action-camera-market/100070/

- Action Camera Market Size, Share & Growth Report, 2030 – Grand View Research, accessed on July 15, 2025, https://www.grandviewresearch.com/industry-analysis/action-camera-market

- U.S. Action Camera Market Size to Surge USD 907.97 Million by 2034, accessed on July 15, 2025, https://www.precedenceresearch.com/us-action-camera-market

- Pro Capture Action Cam Customer Reviews (Proven Success, Real Reviews) Side Effects, Ingredients – AWS, accessed on July 15, 2025, https://pollo-tropical-public-assets.s3.amazonaws.com/video/procaptureactioncam/procaptureactioncamconsumerreviews-0ycn5.html?pil=t1bK3xQ7

- Action Cameras – Explore Scientific, accessed on July 15, 2025, https://explorescientific.com/collections/action-cameras-1

- GoPro: Action Cameras for Sports, Adventure & Everyday Life, accessed on July 15, 2025, https://gopro.com/en/us/shop/cameras

- GoPro MAX (2025) 360 Action Camera – Sweetwater, accessed on July 15, 2025, https://www.sweetwater.com/store/detail/GPMax–gopro-max-360-action-camera

- The GoPro Story: The Rise, Fall, and Reinvention of an Action Icon | by Shah Mohammed, accessed on July 15, 2025, https://shahmm.medium.com/the-gopro-story-the-rise-fall-and-reinvention-of-an-action-icon-f93c8f7409f2

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter