I. Executive Summary

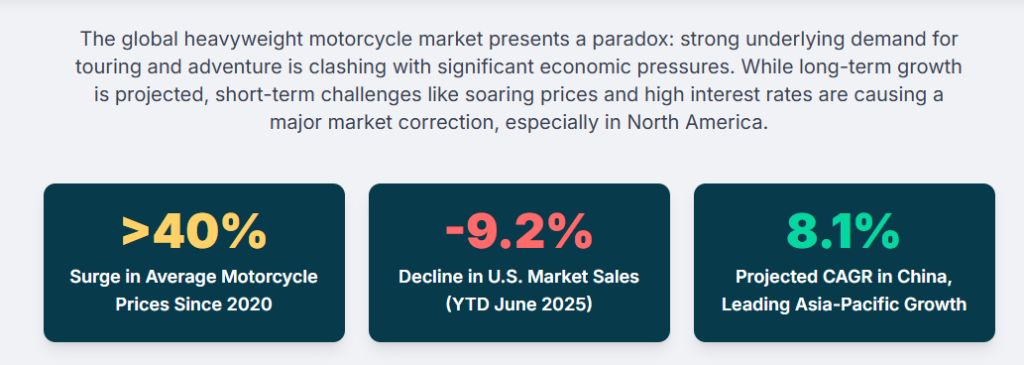

The global heavyweight motorcycle market is navigating a complex landscape characterized by both robust long-term growth prospects and significant short-term pressures. Underlying demand for touring and long-distance models continues to be a fundamental market driver, yet recent sales performance in established regions, particularly the United States, reveals a disconnect between consumer interest and current purchasing capabilities. This is largely due to elevated costs and high financing rates.

The 900-1200cc engine displacement range stands out as a particularly popular segment globally, demonstrating dominance in high-growth areas like Asia-Pacific, valued for its optimal balance of power, control, and versatility. Key factors propelling market expansion include increasing affluence, evolving lifestyle preferences, and the continuous integration of advanced rider-assistance and connectivity features. However, the market faces notable challenges, including persistent economic headwinds, an aging rider demographic in traditional markets, and the intricate interplay of environmental regulations with the nascent, yet still challenged, electrification of heavyweight models. The competitive environment is dynamic, with traditional market leaders experiencing declines in some regions while agile brands capitalize on niche segments and opportunities in emerging markets.

II. Global Heavyweight Motorcycle Market Overview

Current Market Size and Future Growth Projections

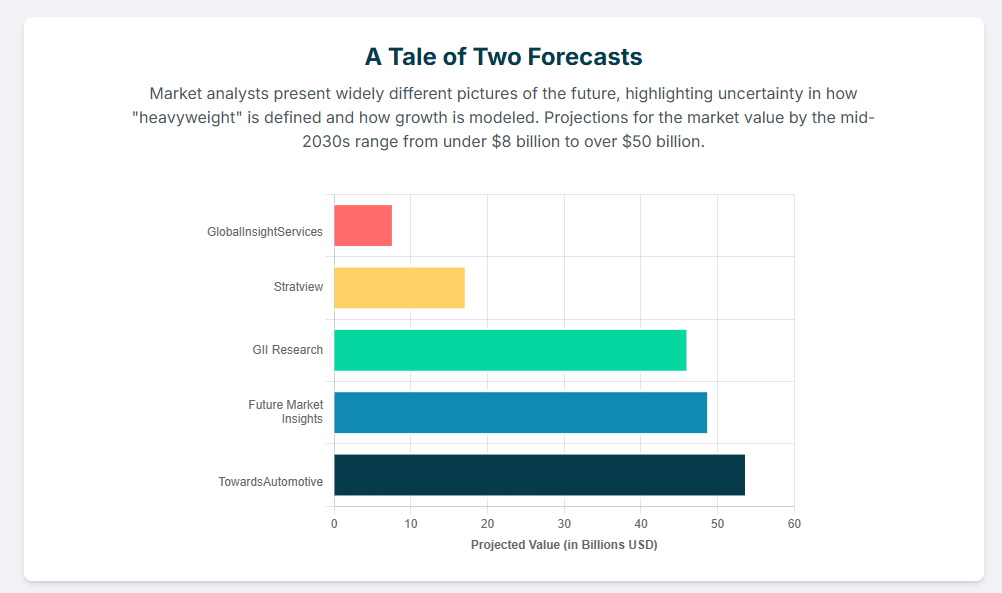

The global heavyweight motorcycle market, defined generally as motorcycles with engine displacements above 600cc or 700cc, presents a varied picture across different market analyses. This variability stems from diverse methodologies, specific definitions of “heavyweight,” and differing forecast periods employed by various research firms.

For instance, Stratview Research projects the market to reach USD 17.3 billion by 2027, anticipating a Compound Annual Growth Rate (CAGR) of 3.3% from 2022 to 2027.1 In contrast, Future Market Insights and GII Research offer a more optimistic long-term outlook. Future Market Insights estimates the market at USD 26.3 billion in 2025 and forecasts growth to USD 48.9 billion by 2035, with a CAGR of 6.4%.3 GII Research provides a similar projection, valuing the market at USD 24.7 billion in 2024 and expecting it to reach USD 46.2 billion by 2034, also at a 6.4% CAGR.4 TowardsAutomotive presents an even higher growth forecast, valuing the market at $26.43 billion in 2024 and projecting it to reach $53.83 billion by 2034, driven by a CAGR of 7.37% from 2025 to 2034.6

It is important to note a significant outlier: GlobalInsightServices estimates the market at a comparatively lower $4.5 billion in 2024, with an expansion to $7.8 billion by 2034 at a CAGR of approximately 5.7%.7 This substantial discrepancy in market size and growth rate projections highlights a lack of universal consensus on precise market definition and future trajectory. For industry stakeholders, this variability underscores the necessity of considering a range of potential scenarios and critically evaluating the underlying assumptions and scope of each market forecast to inform strategic planning effectively. The differences often arise from how “heavyweight” is categorized (e.g., some include bikes over 600cc, others over 700cc, or even broader ranges of “large displacement” motorcycles), as well as the specific geographic regions and market segments included in the analysis.

Segmentation Analysis by Motorcycle Type

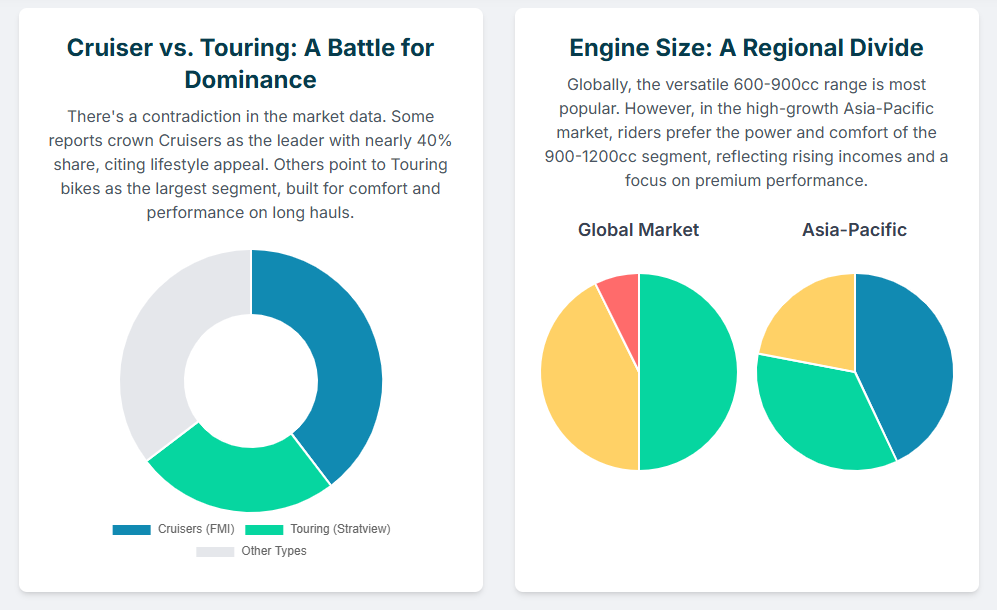

The heavyweight motorcycle market is broadly categorized into several types, including touring, cruiser, bagger, and Sportster/street models.1 However, there are differing views on which of these segments holds the largest market share.

Stratview Research suggests that touring motorcycles are expected to remain the largest segment throughout their forecast period.1 This assessment is based on the design philosophy of touring models, which prioritize both comfort and performance for extended rides, featuring amenities such as plush seating and larger fuel tanks.

Conversely, multiple other analyses indicate the dominance of the cruiser segment. Future Market Insights projects cruisers to maintain leadership with a 39.6% share in 2025, attributing this to effective lifestyle marketing and experiential ownership programs.3 GMInsights and GlobalInsightServices further corroborate this, reporting that cruisers held over 65% and 45% of the market share, respectively, in 2024.5 The popularity of cruisers is often linked to their comfortable riding position, relaxed ergonomics, suitability for long-distance cruising, classic styling, and strong brand appeal, particularly from iconic manufacturers like Harley-Davidson.5

This contradiction regarding the leading motorcycle type suggests that the definitions or categorizations of “touring” and “cruiser” segments might significantly overlap, or different research firms may be emphasizing specific regional strengths or consumer use cases. For instance, “bagger” motorcycles, which are essentially cruisers equipped for touring with features like large windshields and storage, often blur the lines between these categories. This implies that while both touring and cruiser types are crucial for long-distance riding and represent core components of the heavyweight market, their market leadership may depend on the specific market context or the precise criteria used for classification.

Segmentation Analysis by Engine Displacement

The heavyweight motorcycle market is typically segmented by engine displacement into categories such as 600-900cc, 900-1200cc, and above 1200cc.3

Globally, the 600-900cc segment is reported to hold a dominant share, accounting for over 50% of the market in 2024 and projected to exceed USD 22 billion by 2034.4 This range is favored for its balanced performance, fuel efficiency, and versatility, making it suitable for both urban commuting and longer road trips. These mid-range bikes appeal to a wide demographic, including both beginner and experienced riders, and their relative affordability compared to larger models contributes to their broader appeal.

However, the 900-1200cc segment is also recognized as particularly popular, especially in specific high-growth regions. In the Asia-Pacific market, this segment dominated in 2024 with a 43% share.8 Globally, it accounts for 42.7% of the heavyweight motorcycles market, preferred for its optimal balance of power, maneuverability, and ride comfort.3 These motorcycles offer sufficient torque for quick rides and lengthy journeys while maintaining a manageable size compared to larger models above 1200cc.9 The popularity of this range is further bolstered by manufacturers like Yamaha, which increased engine displacement in models like the MT-09 to meet stricter emission standards while boosting performance.10

The differing dominance of the 600-900cc segment globally versus the 900-1200cc segment in high-growth regions like Asia-Pacific suggests distinct regional variations in consumer preferences and market maturity. While the 600-900cc range offers a more accessible entry point for “heavyweight” riding due to its affordability and ease of handling, the 900-1200cc range increasingly caters to a growing desire for enhanced performance, control, and prestige. This is particularly evident in emerging markets where improved road infrastructure and rising disposable incomes support the adoption of higher displacement capabilities.9

III. Deep Dive: Touring and Long-Distance Segment

Drivers of Increasing Demand for Touring and Long-Distance Models

The underlying demand for touring and long-distance motorcycles is fundamentally driven by a consumer prioritization of comfort, robust engine output, and brand prestige for extended journeys.3 Several interconnected factors contribute to this sustained interest.

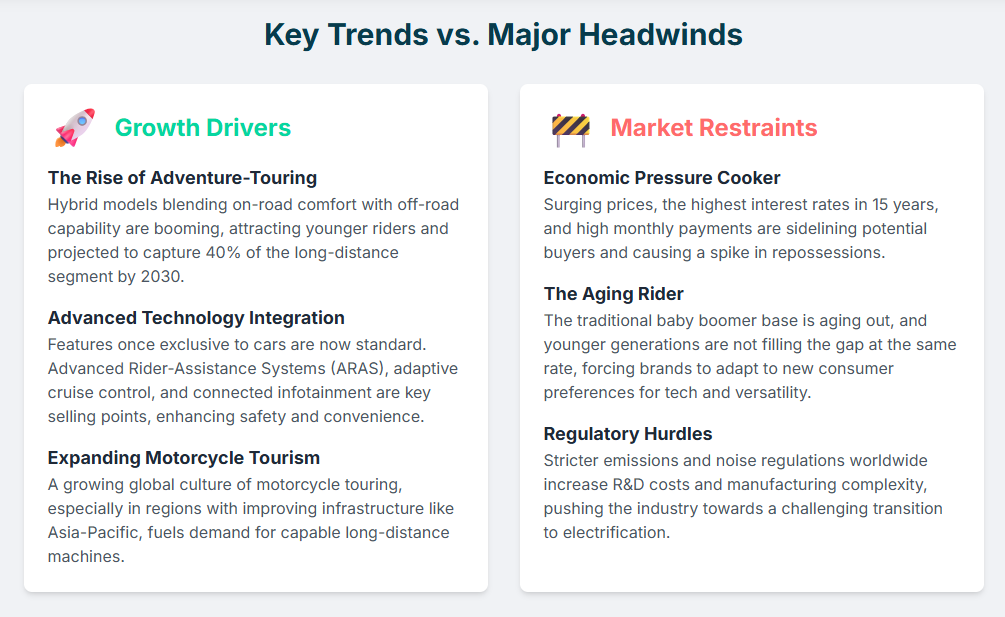

The growing global motorcycle touring culture and the expansion of motorcycle tourism are significant accelerators. Riders are increasingly seeking cross-country and off-road journeys, which naturally necessitates bikes designed for endurance and comfort.4 This trend is particularly pronounced in mature markets like North America and Europe, where extensive scenic highways and well-developed road infrastructure provide ideal conditions for long rides.11

Furthermore, rising disposable incomes in emerging economies, coupled with increased urban affluence and evolving lifestyle shifts, are expanding the addressable market for premium motorcycles suitable for long-distance travel.9 As consumers gain more discretionary income, they increasingly seek leisure-oriented purchases and products that confer social status, with heavyweight motorcycles often serving as a symbol of personal identity and adventure.11

The rapid expansion of motorcycle clubs and enthusiast communities also plays a vital role. These communities accelerate demand for models that facilitate group rides and long-haul events, fostering a strong sense of belonging and shared experience among riders.11

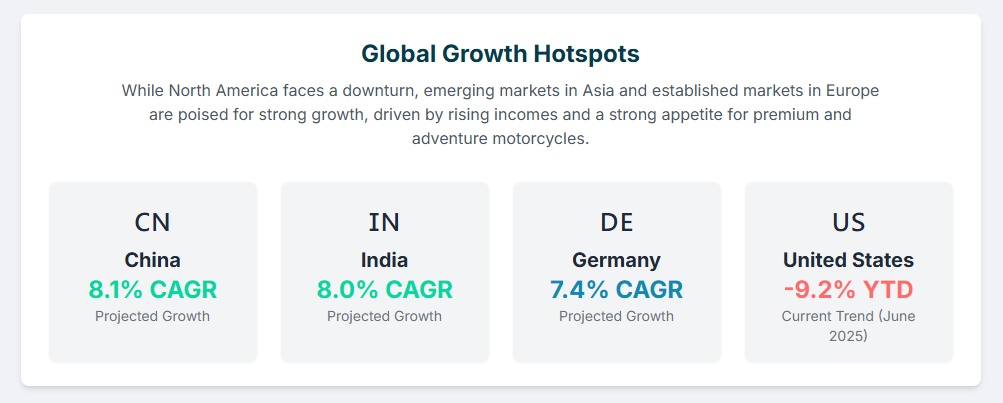

Despite these strong underlying drivers, the market faces critical short-term challenges. The touring motorcycle segment experienced a significant year-over-year decline in sales of -28.90% 12, and the broader overall U.S. motorcycle market has seen a substantial downturn, with sales down 9.2% year-to-date June 2025.13 This contradiction between the positive demand outlook and actual sales performance suggests that current economic headwinds are temporarily overriding the fundamental drivers of demand. Factors such as high interest rates, inflation reducing discretionary spending, and the surging average price of motorcycles (up over 40% since 2020, with touring bikes easily exceeding $30,000) are creating significant barriers to purchase.14 This situation leads to postponed purchasing decisions or a shift towards the more affordable used market, as consumers wait for prices to potentially fall further.14

Key Features and Innovations Appealing to Long-Distance Riders

Manufacturers are increasingly integrating advanced features and design philosophies to enhance the long-distance riding experience, focusing on comfort, safety, and connectivity. This strategic evolution aims to meet the demands of discerning riders and broaden market appeal.

Modern touring and long-distance motorcycles now incorporate sophisticated electronics and advanced rider-assistance features (ARAS). These include advanced traction control, cornering ABS, and electronic suspension systems that adapt to varying road conditions, all designed to improve safety and ride stability.3 Beyond safety, convenience is significantly enhanced through advanced infotainment systems, Bluetooth-enabled dashboards, GPS navigation, and smartphone integration, providing a connected riding experience.11 Cruise control, a staple for long journeys, is also a standard feature.9

Specific models exemplify these advancements. The Honda NT1100, for instance, features a powerful 1084cc engine, integrated navigation, and superior ride comfort, appealing directly to adventure enthusiasts and those prioritizing touring needs.18 Similarly, Yamaha’s Tracer 9 GT+ boasts innovative rider-assistance features, including adaptive cruise control and connected technology, offering a balance of performance and convenience for long-haul travel.18

The growing appeal of “bagger” motorcycles, particularly among maturing Asian motorcycle buyers, highlights a specific sub-segment catering to comfort-focused long-distance travel.9 These models come equipped with luxury comfort features such as large windshields, plush seating, infotainment systems, and advanced suspension, emphasizing a premium, comfortable journey.9 The pervasive integration of automotive-grade technology, such as adaptive cruise control and advanced infotainment, into heavyweight motorcycles signifies a strategic shift by Original Equipment Manufacturers (OEMs). This approach aims to appeal to a more tech-savvy and comfort-oriented demographic, potentially attracting consumers who prioritize convenience and safety for long-distance travel, even if they are not traditional motorcycle enthusiasts. This also serves a strategic purpose for manufacturers, allowing them to differentiate their products and justify the higher price points of premium touring models in a competitive market.

Emergence of Adventure-Touring Models

A significant and expanding trend within the long-distance segment is the rise of adventure-touring models. These motorcycles successfully blend the comfort and amenities of traditional touring bikes with the ruggedness and capabilities required for off-road exploration, thereby appealing to a broader and often younger rider base.

Models such as the BMW R 1250 GS Adventure and KTM 890 Adventure R are specifically cited for their appeal to younger demographics, offering versatility for both urban commutes and challenging off-road touring.12 This blend of capabilities allows riders to transition seamlessly between paved roads and unpaved trails, catering to a desire for diverse riding experiences.

The long-term outlook for the segment, specifically from 2027 to 2030, suggests that hybrid adventure-touring models will dominate a substantial portion, potentially 40%, of the segment.16 This projection underscores a market shift towards machines that offer both high performance and versatility, meeting the evolving demands of riders who seek more dynamic and multi-purpose motorcycles. The growth of 650cc+ adventure and cruiser motorcycles, including popular models like the Interceptor 650, Tiger 900, and Ninja 1000SX, for weekend travel and interstate driving needs further supports this trend, indicating a preference for machines capable of handling various riding scenarios.9

The strong growth of adventure-touring models represents a strategic adaptation by manufacturers to evolving consumer preferences, particularly among younger riders who seek versatility and multi-terrain capability beyond traditional road touring. This segment effectively addresses the broader challenge of an “aging demographic” in traditional motorcycle markets by attracting new individuals into the heavyweight market with a more dynamic and flexible riding experience. By offering bikes that can handle long-distance touring on highways while also being capable of venturing onto less-traveled paths, manufacturers are tapping into a growing desire for exploration and adventure, thereby expanding the overall appeal and sustainability of the heavyweight motorcycle market.

IV. Market Challenges and Restraints

Economic Headwinds and Consumer Behavior Shifts

The heavyweight motorcycle market is currently experiencing significant economic headwinds, leading to a notable shift in consumer behavior and a challenging sales environment. The average motorcycle price has surged by over 40% since 2020, with touring bikes now easily exceeding $30,000.14 This escalating cost, combined with rising interest rates—the highest in over 15 years—has made financing purchases increasingly expensive, with monthly payments for many riders surpassing $700 when insurance and maintenance are included.14

This financial pressure has led to a substantial decline in consumer demand. The U.S. market, for example, saw a 9.2% decrease in sales year-to-date June 2025.13 Major brands like Harley-Davidson have reported significant sales drops, with global retail sales down 15% year-over-year in Q2 2025 and North America down 17%.15 Harley-Davidson’s shipments decreased by 28% due to planned dealer inventory reduction and soft demand.15 This has resulted in a “mountain of unsold inventory” at dealerships, with many new motorcycles sitting untouched for close to a year despite aggressive discounts and promotions.14 The decline in foot traffic at dealerships (down nearly 40% year-over-year) and online inquiries (halved) further underscore the severity of the demand slump.14

The economic strain is also evident in rising default rates and a spike in repossessions, the highest since the 2008 financial crisis.14 These repossessed bikes flood auctions, further depressing used motorcycle prices, which have plummeted significantly, making it difficult for private sellers to get reasonable offers.14 This creates a waiting game for potential buyers, who anticipate deeper discounts as 2025 progresses.14 Manufacturers are responding by scaling back production, with Harley-Davidson halting production lines and Indian Motorcycle suspending some dealer allocations.14 This period represents a significant market correction, forcing the industry to rethink pricing, production, and sales strategies.14

Aging Demographics and Attracting New Riders

A persistent challenge for the heavyweight motorcycle market is the aging demographic of traditional riders. The baby boomer generation, which has historically formed the backbone of motorcycle culture, is gradually aging out of riding.7 This demographic shift creates a void that younger generations are not filling at a sufficient pace.

Younger consumers exhibit different preferences, often prioritizing customization and advanced technology integration over traditional brand heritage.16 For many in these younger cohorts, motorcycles have become an optional luxury rather than a lifestyle staple, influenced by factors such as high insurance premiums, licensing challenges, and evolving urban living preferences.14 This makes it more difficult for the industry to attract new riders and sustain growth from within its traditional customer base.

To counter this, manufacturers are adapting their product offerings and marketing strategies. The rising popularity of adventure and dual-sport bikes, which blend touring comfort with off-road capabilities, is one such strategic response, appealing to a younger, more versatile demographic.9 Additionally, the increasing participation of women in motorcycling is broadening the customer base, prompting manufacturers to design models with better ergonomics and maneuverability to cater to this growing segment.11 The expansion of motorcycle financing and leasing services also aims to make heavyweight motorcycles more accessible to a larger audience, including young professionals and adventure enthusiasts, thereby mitigating the financial barriers to entry.11

Regulatory Landscape and Environmental Concerns

The heavyweight motorcycle market operates within an increasingly stringent regulatory landscape, particularly concerning environmental emissions. Governments worldwide are imposing tighter emission standards and noise regulations, which pose significant design and innovation challenges for manufacturers.3

A notable example is the U.S. Environmental Protection Agency (EPA) settlement with Harley-Davidson, which required the company to cease selling and buy back illegal “tuning devices” that increased air pollution by allowing motorcycles to exceed certified emission limits.19 These devices led to higher emissions of hydrocarbons and nitrogen oxides (NOx), contributing to harmful ground-level ozone and particulate matter pollution.19 This case underscores the regulatory pressure on manufacturers to ensure their products meet clean air standards, even aftermarket modifications.

Beyond tailpipe emissions, regulations designed to address climate change, particularly greenhouse gas (GHG) emissions like CO2, are expected to have a significant impact in the next five to ten years.20 Proposed legislation, such as cap-and-trade systems for GHG emissions and stricter CO2 reporting thresholds, could necessitate changes to manufacturing facilities and product planning.20 While motorcycles may not always be subject to direct CO2 emission limits, regulatory bodies like the California Air Resources Board are investigating evaporative emissions regulations, potentially leading to expanded testing and compliance requirements.20

The challenge for manufacturers lies in simultaneously reducing traditional pollutants (hydrocarbons, NOx) and CO2 emissions. Ironically, improving engine combustion efficiency and exhaust gas after-treatments, such as catalyst technologies, can sometimes lead to an increase in CO2 output.20 This necessitates substantial research and development to find innovative solutions that achieve both goals. The push for electrification in two-wheelers is a direct response to these environmental pressures, with manufacturers investing in electric platforms exceeding 600cc capacity to meet anticipated customer needs.9 However, the adoption of electric heavyweight motorcycles still faces hurdles such as high battery costs, limited range, and insufficient charging infrastructure.18

These environmental regulations and noise emission norms add to manufacturing costs and influence product design, requiring significant investment in research and development and potentially affecting pricing power and global competitiveness.9

Supply Chain Dynamics and Production Adjustments

The global heavyweight motorcycle market is also contending with complex supply chain dynamics and the need for significant production adjustments, particularly in response to fluctuating demand and geopolitical factors. The overall motorcycle industry experienced a weak performance in the U.S. in 2024, with a fast decline in consumer demand leading to a -9.2% year-to-date June figure.13 This sharp drop in sales has resulted in a substantial accumulation of unsold inventory at dealerships, prompting manufacturers to implement production cuts.14

For example, Harley-Davidson reported a 28% decrease in global motorcycle shipments in Q2 2025, primarily due to a planned reduction in dealer inventory and soft demand.15 The company also withdrew its full-year 2025 financial outlook due to the uncertain global tariff situation and overall macroeconomic conditions.15 Other manufacturers, such as Indian Motorcycle and Zero Motorcycles (an electric motorcycle company), have also trimmed their workforces or suspended dealer allocations in response to the market downturn.14

Beyond demand-side issues, unstable trade conditions, including tariffs and retaliatory tariffs, are compelling heavyweight motorcycle brands to relocate production facilities and assembly operations to key markets.9 These measures aim to mitigate the impact of import taxes and exchange rate effects, ensuring profitable operations and maintaining premium market standards.9 Such strategic adjustments in manufacturing and supply chain management are crucial for maintaining global competitiveness and pricing power in a volatile economic and trade environment.9 The cost of new or increased tariffs, for instance, amounted to $13 million for Harley-Davidson in Q2 2025 alone.15 These pressures necessitate flexible production systems and increased research and development investments to sustain market presence.

V. Competitive Landscape and Key Players

Market Dominance and Shifting Positions

The global heavyweight motorcycle market is led by a mix of long-established brands and emerging players. Traditional industry giants such as Harley-Davidson, Honda, Yamaha, BMW, and Ducati continue to be prominent, especially in the premium and touring segments.2 These companies are known for introducing models that blend raw power with sophisticated electronics and rider-assistance features.11

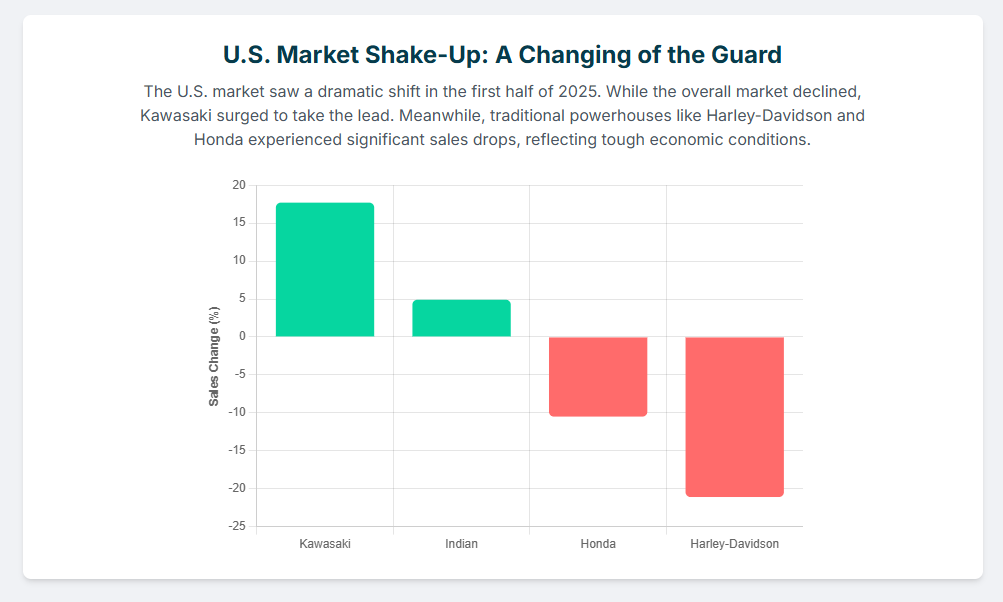

However, the competitive arena has seen notable shifts. In the U.S. market, Kawasaki has recently overtaken Honda to achieve leadership, with sales improving a significant 17.7% year-on-year, while Honda’s sales declined by 10.5%.13 Harley-Davidson, an American icon, has also experienced a deep decline, losing 21.1% in sales and falling to third place in the U.S. market.13 Other brands like KTM, Suzuki, and BMW also reported sales declines in the U.S., while Indian Motorcycle saw a modest increase of 4.9%.13

Globally, Honda remains the dominant player across the entire motorcycle industry (including all displacements), holding a 32% global market share in 2024 with 19.4 million units sold.25 Yamaha is a strong second globally, with 4.6 million units sold, while Indian manufacturers like Hero MotoCorp and TVS Motor are also significant players, particularly in the broader motorcycle market.25 For the heavyweight segment specifically, detailed market share percentages for individual brands are often proprietary and require purchasing full reports.11 However, the general consensus is that brands like Harley-Davidson, BMW, Ducati, and Indian Motorcycle continue to dominate the premium and heavyweight segments.11

Strategic Responses by Manufacturers

In response to market dynamics, economic pressures, and evolving consumer preferences, manufacturers in the heavyweight motorcycle sector are implementing various strategic initiatives.

One key strategy is the continuous innovation and integration of advanced technologies. OEMs are introducing refined engines, sustainable material integrations, and hybrid capabilities to align with evolving regulatory frameworks and environmental standards.3 This includes incorporating cutting-edge technologies such as advanced infotainment systems, smarter safety features, and more efficient engines to enhance the overall rider experience and appeal to high-income consumers.4 For example, Yamaha increased the engine displacement of its MT-09 model to deliver more torque while meeting stricter emission standards.10

Manufacturers are also focusing on lifestyle marketing and experiential ownership programs to sustain consumer engagement, particularly within the cruiser segment.3 This involves expanding premium motorcycle rental services to generate exposure and trial for high-end models, and leveraging digital marketing and social media engagement to drive brand loyalty and community building.11

To address the challenge of an aging rider demographic and attract younger consumers, brands are investing in models that offer versatility and tech integration. The rise of adventure-touring models, which blend touring comfort with off-road capabilities, is a direct response to this, appealing to younger demographics seeking diverse riding experiences.9 Brands are also exploring electric and hybrid models, though range limitations and charging infrastructure remain hurdles for touring applications.16

In response to economic pressures and high inventory levels, some manufacturers are adjusting production. Harley-Davidson, for instance, has reduced global shipments and dealer inventories as part of a planned strategy to align with soft demand.15 Other companies are exploring new retail strategies, such as digital-first approaches and financing options like EMIs and leasing platforms, to simplify access to personalization and ownership.3 Some manufacturers are also strategically relocating production facilities and assembly operations to key markets to navigate unstable trade conditions and maintain competitiveness.9 This allows them to manage price fluctuations and exchange rate effects while sustaining profitable operations.

VI. Regional Market Dynamics

The global heavyweight motorcycle market exhibits distinct dynamics and consumer behaviors across different geographical regions, influenced by economic conditions, cultural preferences, and infrastructure development.

North America

North America, particularly the United States, is a significant market for heavyweight motorcycles, characterized by a strong cultural appreciation for motorcycles as lifestyle symbols.7 The region benefits from extensive road networks and a robust dealer network that supports market growth.7 Demand for heavyweight bikes, especially those designed for cross-country and off-road journeys, is high due to a strong biking culture and the rise of motorcycle tourism.11 The U.S. market was estimated at $6.5 billion in 2024.11

However, the U.S. market has faced significant challenges in 2025. Sales have declined sharply, with year-to-date June figures down 9.2%.13 Major players like Harley-Davidson have seen a deep 21.1% loss in sales, while Honda lost leadership and 10.5% of sales, overtaken by Kawasaki, which saw a 17.7% improvement.13 This downturn is attributed to soft demand, unfavorable consumer confidence due to high interest rates, and an uncertain economic outlook, leading to lower customer traffic at dealerships.15 Despite these short-term struggles, the long-term outlook remains positive as consumers prioritize comfort, engine output, and brand prestige.3

Europe

Europe is projected to remain the largest market for heavyweight motorcycles during the forecast period.1 This region is highly lucrative due to the adoption of advanced technologies, the presence of highly advanced production centers, and a rich motorcycling heritage.2 Countries like Germany and the U.K. show strong demand for premium, touring, and adventure motorcycles.22 Germany, in particular, is expected to grow at a 7.4% CAGR, fueled by strong consumer preference for adventure-touring and electric heavyweight models.3 The United Kingdom is projected to grow at 6.1%, driven by mid-displacement sales and advanced safety features.3 Europe’s well-developed road infrastructure also supports the demand for long-distance touring.11

Asia-Pacific

The Asia-Pacific region is demonstrating promising growth in the heavyweight motorcycle market, driven by increasing urbanization, rising disposable incomes, and an emerging culture of premium motorcycle ownership.7 China is a leading force, projected to grow at an impressive 8.1% CAGR to reach $6.4 billion by 2030.11 China’s market dominance is further highlighted by its 60% share of global revenue in 2024, attributed to its massive production capacity and cost-effective manufacturing processes.5 Demand for heavyweight cruisers, sport-tourers, and premium adventure bikes is increasing as rising disposable income supports lifestyle-oriented purchases.3 Domestic manufacturers are upgrading portfolios with advanced electronics and connected features to compete with global brands, while global brands like Triumph and Honda are scaling domestic assembly to make 650cc+ bikes more accessible.3

India follows closely with an 8.0% CAGR, supported by improving road networks and the aspirational rise of cruiser and touring bike demand.3 The upper-middle-class demographic is rapidly increasing in countries like India, China, and Indonesia, leading to rising demand for premium motorcycle products as individuals seek social status and enhanced performance.9 Heavyweight motorcycle electrification is also gaining popularity in Asian urban markets due to tighter emission standards, with electric models from local brands catering to commuters seeking premium performance.9

Other Key Regions (Latin America, Middle East & Africa)

Latin America is also experiencing increased adoption of heavyweight motorcycles, driven by rising disposable incomes.11 Brazil, for example, is projected to grow at a 4.8% CAGR.3 The Middle East and Africa region shows a nascent yet promising market, with the UAE and South Africa spearheading growth due to a penchant for luxury and adventure.7 However, market expansion in these regions is constrained by economic instability and limited infrastructure.7 Despite these challenges, the overall global market is benefiting from the expansion of motorcycle clubs and enthusiast communities, favorable finance and leasing options, and the appeal of brand heritage and iconic design across various geographies.11

VII. Conclusions and Outlook

The global heavyweight motorcycle market is in a state of dynamic evolution, characterized by a fundamental long-term growth trajectory driven by rising affluence, an expanding motorcycle touring culture, and continuous technological advancements. The demand for touring and long-distance models remains robust, fueled by consumers’ desire for comfort, performance, and prestige on extended journeys. The 900-1200cc engine displacement range is particularly prominent, especially in high-growth Asian markets, due to its optimal balance of power and versatility. The increasing integration of advanced rider-assistance systems, infotainment, and connectivity features is broadening the market’s appeal, attracting a more tech-savvy and comfort-oriented demographic. Furthermore, the strong emergence of adventure-touring models represents a strategic adaptation, successfully engaging younger riders by offering multi-terrain capabilities and versatility.

However, the market is simultaneously undergoing a significant short-term correction, particularly evident in established markets like North America. Economic headwinds, including surging motorcycle prices, high interest rates, and reduced discretionary spending, have created a substantial disconnect between underlying consumer interest and actual purchasing power. This has led to declining sales, high dealer inventories, and production adjustments by major manufacturers. The challenge of an aging rider demographic persists, necessitating continued innovation in product design and marketing to attract new, younger riders. Additionally, stricter environmental regulations, including emission standards and the complex path towards electrification, pose ongoing design and cost challenges for the industry.

Looking ahead, the market’s recovery and sustained growth will depend on several critical factors. Manufacturers must continue to innovate, focusing on models that offer a compelling blend of performance, comfort, and advanced technology while also addressing affordability. Strategic efforts to make heavyweight motorcycles more accessible through flexible financing options and diversified product portfolios will be crucial. Adapting to regional nuances in consumer preferences and investing in emerging markets, particularly in Asia-Pacific, will be vital for capitalizing on growth opportunities. Finally, navigating the evolving regulatory landscape and investing in sustainable, yet high-performance, electric and hybrid solutions will be paramount for long-term viability and competitiveness in this evolving market. The industry’s ability to overcome current economic pressures and strategically adapt to changing demographics and environmental mandates will determine its trajectory in the coming decade.

Sources

- Heavyweight Motorcycle Market is Forecasted to Reach USD 17.3 – openPR.com, accessed August 6, 2025, https://www.openpr.com/news/3972957/heavyweight-motorcycle-market-is-forecasted-to-reach-usd-17-3

- Heavyweight Motorcycles Market | Forecast & Strategic Assessment till 2027, accessed August 6, 2025, https://www.stratviewresearch.com/2302/heavyweight-motorcycle-market.html

- Heavyweight Motorcycles Market | Global Market Analysis Report – 2035, accessed August 6, 2025, https://www.futuremarketinsights.com/reports/heavyweight-motorcycles-market

- Heavyweight Motorcycles Market Opportunity, Growth Drivers …, accessed August 6, 2025, https://www.giiresearch.com/report/gmi1685161-heavyweight-motorcycles-market-opportunity-growth.html

- Heavyweight Motorcycles Market Size, Statistics Report 2034, accessed August 6, 2025, https://www.gminsights.com/industry-analysis/heavyweight-motorcycles-market

- Heavyweight Motorcycles Market Size Expand $53.83 Bn by 2034 – Towards Automotive, accessed August 6, 2025, https://www.towardsautomotive.com/insights/heavyweight-motorcycles-market-sizing

- Heavyweight Motorcycles Market Size, Growth, Trends and Forecast, accessed August 6, 2025, https://www.globalinsightservices.com/reports/heavyweight-motorcycles-market/

- Asia-Pacific Heavyweight Motorcycle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034, accessed August 6, 2025, https://www.researchandmarkets.com/reports/6091262/asia-pacific-heavyweight-motorcycle-market

- Asia Pacific Heavyweight Motorcycle Market Size, Forecasts 2034, accessed August 6, 2025, https://www.gminsights.com/industry-analysis/asia-pacific-heavyweight-motorcycle-market

- The MT Series Pedigree – Motorcycle | Yamaha Motor Co., Ltd., accessed August 6, 2025, https://global.yamaha-motor.com/business/mc/lineup/mt/

- Heavyweight Motorcycles – Global Strategic Business Report, accessed August 6, 2025, https://www.researchandmarkets.com/reports/6069109/heavyweight-motorcycles-global-strategic

- Best Selling Touring Motorcycles 2025: Top Models & Market Trends – Accio, accessed August 6, 2025, https://www.accio.com/business/best_selling_touring_motorcycle

- United States Motorcycles Market – Data & Insight 2025 | MotorcyclesData, accessed August 6, 2025, https://www.motorcyclesdata.com/2025/07/24/united-states-motorcycles-market/

- The Motorcycle Market Crisis of 2025: An Industry in Free Fall – KiWAV motors, accessed August 6, 2025, https://kiwavmotors.com/en/blog/the-motorcycle-market-crisis-of-2025-an-industry-in-free-fall

- Harley-Davidson Delivers Second Quarter Financial Results and Announces HDFS Transaction with KKR and PIMCO, accessed August 6, 2025, https://investor.harley-davidson.com/news/news-details/2025/Harley-Davidson-Delivers-Second-Quarter-Financial-Results-and-Announces-HDFS-Transaction-with-KKR-and-PIMCO/default.aspx

- 2025 Touring Motorcycle Trends: Seasonality & Innovation Insights – Accio, accessed August 6, 2025, https://www.accio.com/business/trend-in-new-touring-motorcycles

- IT’S STARTED! The 2025 Motorcycle Market Crash Is WAY WORSE Than You Think, accessed August 6, 2025, https://www.youtube.com/watch?v=zmlQwl5nwZw

- Medium and Large Displacement Motorcycles Market Size, Growth | CAGR of 4.5 %, accessed August 6, 2025, https://www.globalgrowthinsights.com/market-reports/medium-and-large-displacement-motorcycles-market-103050

- Harley-Davidson Clean Air Act Settlement | US EPA, accessed August 6, 2025, https://www.epa.gov/enforcement/harley-davidson-clean-air-act-settlement

- HARLEY-DAVIDSON MOTOR COMPANY – Responsibility Reports, accessed August 6, 2025, https://www.responsibilityreports.com/HostedData/ResponsibilityReportArchive/h/NYSE_HOG_2009.pdf

- The real global EV buzz comes on two wheels – McKinsey, accessed August 6, 2025, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-real-global-ev-buzz-comes-on-two-wheels

- Global Motorcycles Market Size, Share, and Analysis Report 2032, accessed August 6, 2025, https://www.databridgemarketresearch.com/reports/global-motorcycles-market

- The Best American Motorcycle Brands: Explore America’s Biker Heritage – AmeriFreight, accessed August 6, 2025, https://www.amerifreight.net/information/the-best-american-motorcycle-brands

- Motorcycles Market Size, Share And Growth Report, 2028 – Grand View Research, accessed August 6, 2025, https://www.grandviewresearch.com/industry-analysis/motercycles-market-report

- Global Market Share Analysis of Motorcycle Industry | deallab, accessed August 6, 2025, https://dev.en.deallab.info/global-market-share-analysis-of-motorcycle-industry/

- Ranking of the world’s best-selling motorcycle brands in 2024, accessed August 6, 2025, https://www.kamaxgroup.com/news/ranking-of-the-worlds-best-selling-motorcycle-brands-in-2024

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter