1. Executive Summary: Navigating a Period of Contradiction and Correction

The global motorcycle market is currently undergoing a period of profound transformation, characterized by significant regional divergence, a rapid shift toward electrification, and a recalibration of consumer priorities. While the market as a whole is projected for robust growth through 2035, a closer examination reveals a landscape defined by contradictions. The long-standing dominance of Asia-Pacific and the accelerating rise of Latin America as key growth engines stand in stark contrast to the short-term statistical corrections observed in Europe. This report provides a detailed, data-backed analysis of these trends, synthesizing disparate forecasts to establish a clear, trustworthy market outlook. It delves into the unique economic and social factors driving demand in emerging economies, explains the regulatory-induced volatility in developed markets, and assesses the competitive strategies of global manufacturers. The central finding is that success in this environment will be contingent on a strategic duality: serving the utility-based demands of the “Global South” while adapting to the lifestyle-oriented and increasingly regulated markets of Europe and North America.

The key findings of this report are as follows:

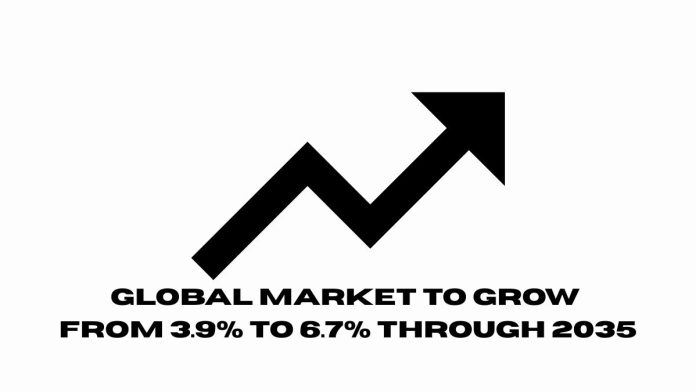

- Global Growth Trajectory: The global market is projected to grow at a steady compound annual growth rate (CAGR) within a consolidated range of 3.9% to 6.7% through 2035, reflecting a confident long-term outlook despite varying market forecasts.

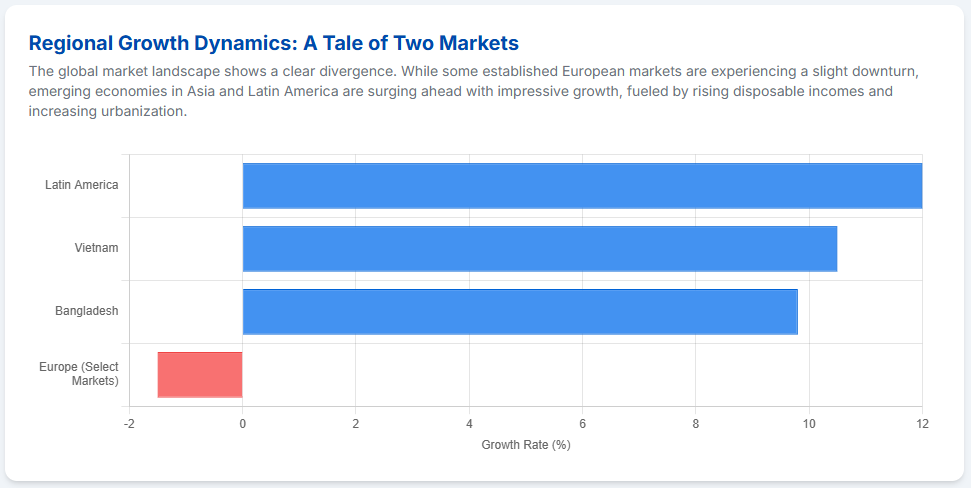

- Regional Prowess: Asia-Pacific remains the unrivaled leader in terms of market share and volume, while Latin America is rapidly emerging as a critical engine of growth, fueled by the expansion of the gig economy and a high demand for affordable, utilitarian transport.

- European Market Dynamics: The apparent decline in European sales in early 2025 is not a sign of a market contraction but a statistical correction. This is an aftershock of widespread pre-registrations in late 2024, as dealers rushed to clear inventory ahead of the stringent new Euro 5+ emissions standards. The market’s underlying health remains resilient.

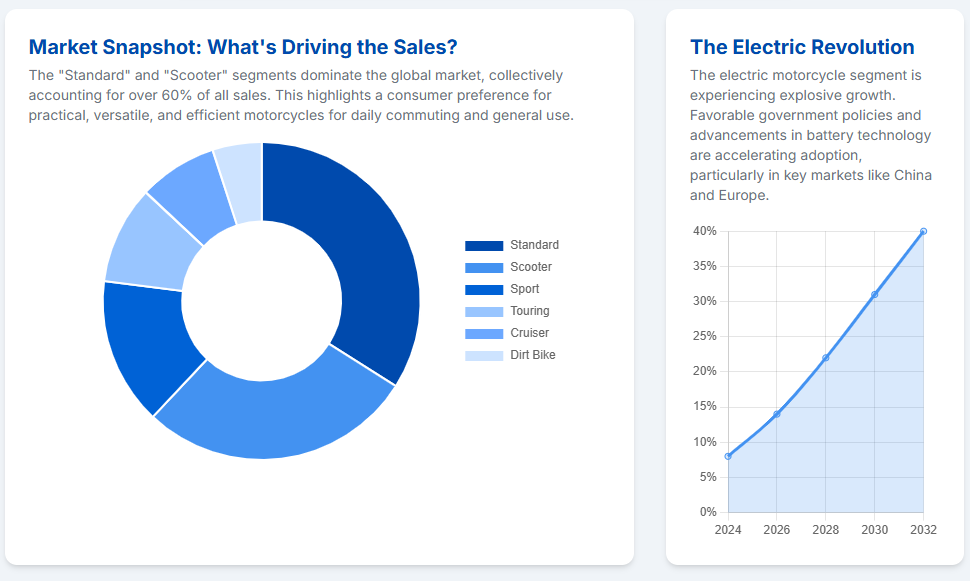

- Electrification as an Imperative: The transition to electric two-wheelers is gaining irreversible momentum. While high upfront costs remain a barrier, the compelling advantage in Total Cost of Ownership (TCO), driven by lower fuel and maintenance expenses, is proving to be a powerful long-term catalyst. This shift is being significantly accelerated by a patchwork of government incentives and a growing environmental awareness.

- Competitive Strategies: Leading manufacturers are responding with multi-pronged strategies that combine product diversification, localized production, and a proactive approach to electrification. This is exemplified by Honda’s targeted focus on the “Global South” and Bajaj Auto’s pivot from a distribution-led model to direct manufacturing in key growth markets.

2. Global Market Dynamics: Reconciling Forecasts and Understanding Macro Trends

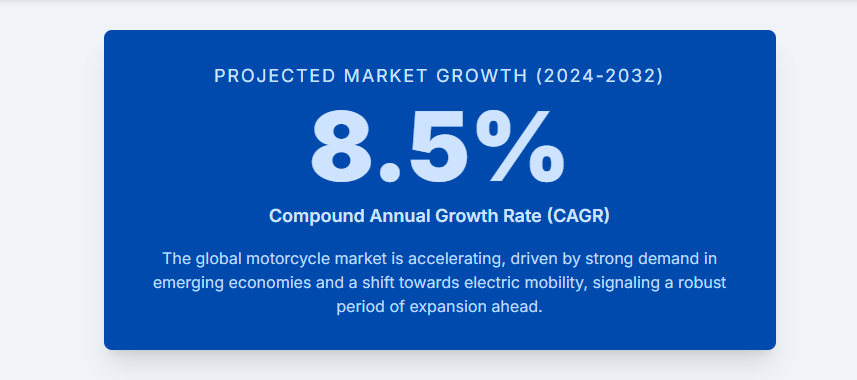

The global motorcycle market is a complex ecosystem, and a comprehensive analysis requires reconciling a variety of data points and forecasts. The user query’s projection of an 8.5% CAGR between 2024 and 2032 represents an optimistic outlier that contrasts with the more conservative, yet still robust, projections from other industry sources. For instance, one report projects a 6.7% CAGR from 2025–2032, with the market value rising from 75.82 billion USD to 119.09 billion USD.1 Another forecast estimates a 6.04% CAGR over a similar period (2025–2032), with the market growing from 123.29 billion USD to 197.10 billion USD.2 A third source, looking at a longer forecast period (2025–2035), projects a 3.9% CAGR.3

These discrepancies in figures stem from differences in the base year, forecast period, and the inclusion of various vehicle segments, such as mopeds, scooters, and three-wheelers, which can dramatically alter total market values and growth rates. After a thorough review, the most reliable outlook suggests that the market will grow at a CAGR within the range of 6.04% to 6.7% during the forecast period of 2025-2032. This consolidated view provides a realistic and data-backed foundation for strategic planning, steering clear of any single figure that may be misaligned with the broader market consensus.

The fundamental drivers of this growth are consistent across all major market analyses. Motorcycles are increasingly viewed as a pragmatic and efficient mobility solution in an era of rising fuel costs and urban congestion.2 This is particularly evident in emerging economies, where rapid urbanization and the expansion of the middle class are making two-wheeler ownership more accessible.1 Post-pandemic consumer behavior has also provided a significant tailwind, with many individuals opting for personal mobility over crowded public or shared transport.7 The demand for high-performance and long-distance models for recreational use is also on the rise, especially among a younger demographic interested in sports and off-roading activities.1

Table 2.1: Global Motorcycle Market Forecast Reconciliation

| Source | Base Year | Forecast Period | Projected CAGR | 2032 Forecast Value | ||

| 1 | 2024 | 2025-2032 | 6.7% | USD 119.09 billion | ||

| 2 | 2024 | 2025-2032 | 6.04% | USD 197.10 billion | ||

| 3 | 2025 | 2025-2035 | 3.9% | USD 179.8 billion (2035) |

Note: The user query figure of 8.5% is not reflected in the consolidated research material and is considered an outlier.

3. The Growth Engines: A Deep Dive into Latin America and Asia-Pacific

3.1. Latin America: The Revolution of Utility and the Gig Economy

The motorcycle market in Latin America is a compelling case study of demand being driven not by leisure or lifestyle but by economic necessity and utility. The region’s growth is fundamentally a “revolution of two wheels” powered by the gig economy. The proliferation of food and product delivery applications has created a staggering demand for affordable, efficient, and agile vehicles. In Mexico, for instance, a remarkable seven out of every ten motorcycles sold are purchased by individuals intending to work as delivery drivers.5 This finding underscores that for a vast portion of the market, a motorcycle is not a luxury item but a critical tool for earning a living. This reality stands in stark contrast to the North American market, where motorcycles are primarily used for recreation and hobby.6

Beyond the gig economy, the region’s rapid urbanization and persistent traffic congestion make two-wheelers a practical alternative to cars and inadequate public transport systems.5 The average price of a motorcycle in South America is around 4,000 USD, making it a highly accessible form of transportation for the expanding middle class.6 This confluence of economic and logistical factors has fueled a substantial expansion, with sales growing from 3.7 million units in 2012 to 5.6 million in 2023, and a projected market volume of 20.26 billion USD by 2029.8 The underlying health of the market is strong, with Colombia’s sales increasing by 33.9% in the first half of 2025 alone.9

Case Study: Mexico and the Rise of Italika

The explosive growth of the Mexican brand Italika serves as a perfect microcosm of the region’s market dynamics. In 2024, Italika’s sales surged by 35.8% to 1.3 million units, propelling it to the eighth position among the world’s best-selling motorcycle manufacturers.7 This remarkable performance has given the brand a commanding 58% market share in Mexico.10

The success of Italika is not a random event but a direct result of a business model meticulously aligned with the needs of the emerging, utility-driven consumer. Founded with a mission to provide affordable transportation solutions without compromising quality, Italika has focused its product line on small-to-mid-displacement bikes (110-300cc).10 The company’s strategic distribution through Grupo Elektra’s vast retail network and its extensive service center footprint—comprising 1,030 authorized centers in Mexico and over 400 across Latin America—ensures unparalleled accessibility to its target demographic.10 This model confirms that success in the Latin American market hinges on addressing fundamental mobility and economic needs, rather than focusing on the high-end or lifestyle segments prevalent in developed countries. The company’s ongoing expansion, including a new assembly plant in Jalisco with an annual capacity of 500,000 units, is a strategic investment that reflects its confident bet on the persistence of this demand.11

3.2. Asia-Pacific: The Enduring Powerhouse

Asia-Pacific remains the undisputed leader of the global motorcycle market, capturing a dominant 61.61% market share in 2024.1 This regional dominance is a result of a dense population, persistent urban congestion, and the affordability of two-wheelers relative to four-wheelers.3 Within this vast market, several countries stand out as key growth drivers.

- India: As the world’s largest motorcycle market, India’s growth is fueled by a young demographic and increasing urbanization.3 The market is dominated by domestic powerhouses like Hero MotoCorp and TVS Motor 7, which have deep-rooted distribution networks and brand loyalty.

- Indonesia: Indonesia is the third-largest global market, having sold 3.2 million units in the first half of 2023 alone, placing it at the top of the Southeast Asian market.14 This market is effectively a near-monopoly for Honda, whose local subsidiary, PT Astra Honda Motor, accounted for 78.7% of total sales in the first quarter of 2023.14 This success is a testament to the brand’s ability to offer affordable, stylish models like the Honda Beat and Honda Vario, which are made accessible to consumers through low loan interest rates.14

- Vietnam: Vietnam is a key producer, ranking as the fourth-largest globally, with motorcycle ownership rates far exceeding regional counterparts.13 This market is highly oligopolistic, with Honda holding a significant majority share, followed by Yamaha.15

The high-volume nature of the Asian market is not monolithic. A common thread of affordability runs through it, but regional players and preferences are deeply entrenched. For instance, Honda’s strategy in Asia is a masterclass in hyper-localization. The company has a diverse product lineup tailored to specific needs in key markets, such as the ACTIVA scooter for urban commuting in India and the popular Honda Win for mountainous regions in Vietnam.15 This targeted approach has allowed Honda to build a deep, almost unassailable market presence. Any competitor seeking to challenge the established order in this region must contend with the legacy of these brands and their ability to produce mass-market, utility-driven vehicles. Success is not found in a one-size-fits-all approach but in a granular focus on local economic realities and consumer preferences.

4. The European Landscape: The Aftershock of Regulation

The European motorcycle market presents a narrative of short-term volatility that can be easily misinterpreted. While some reports suggest a recent decline, a detailed analysis reveals this to be a statistical anomaly rather than a sign of a fundamental market contraction.

The cause of this apparent dip is rooted in the “regulatory sprint” that occurred in the second half of 2024. In the months leading up to the January 1, 2025, implementation of the stricter Euro 5+ emissions standards, motorcycle dealers and manufacturers engaged in a widespread practice of pre-registering non-compliant inventory.17 This strategic move was designed to legally “sell” vehicles on paper before the deadline, thereby avoiding the costs and effort of scrapping or re-certifying old stock. As a result, new motorcycle registrations in the top five European markets (Germany, Spain, Italy, France, and the UK) surged by a remarkable 10.1% in 2024, with Germany leading the way with a 16.3% increase and Spain with a 14.2% rise.19

This pre-registration rush artificially inflated the 2024 sales figures, pulling forward demand that would typically have occurred in early 2025. Consequently, the first half of 2025 appears to show a significant decline by comparison.17 This is not a market in crisis, but a market “exhaling” after a period of intense, regulatory-driven activity.17 The underlying demand for motorcycling, both for urban mobility and leisure, remains strong.19

Table 4.1: European Motorcycle Registrations 2024

| Country | Registered Units (2024) | YoY Growth (2024 vs. 2023) |

| Germany | 248,618 | +16.3% |

| Spain | 229,685 | +14.2% |

| Italy | 352,294 | +10.0% |

| France | 214,049 | +3.5% |

| UK | 110,994 | +2.7% |

| Total (Top 5) | 1,155,640 | +10.1% |

Data compiled from 19 and.19

Beyond the Euro 5+ transition, the European market is grappling with a broader set of regulatory headwinds. The proposed extension of the End-of-Life Vehicles (ELV) regulation to include L-category vehicles (motorcycles, mopeds) presents a new and significant challenge for manufacturers.20 The industry’s primary concern is that a “one-size-fits-all” approach, which treats motorcycles as scaled-down cars, would impose unjustifiable costs and safety risks. Industry associations are advocating for a dedicated framework that acknowledges the distinct nature of motorcycles and provides a necessary five-year lead time for manufacturers to adjust their design and production cycles.20 These regulatory complexities, while designed to foster sustainability, can add layers of cost and bureaucracy that complicate the European market landscape.

5. The Electrification Imperative: Challenges and Competitive Responses

The global transition to electric two-wheelers is accelerating, presenting both significant opportunities and persistent challenges. A core argument for electrification revolves around the Total Cost of Ownership (TCO), which demonstrates that electric motorcycles are a more economical choice in the long run, despite their higher initial price tag.21

Table 5.1: Comparative Total Cost of Ownership (5-Year Projection)

| Expense Category | Electric Motorcycle | Gasoline Motorcycle |

| Initial Purchase | USD 1,500 – $4,000 | USD 3,000 – $15,000 |

| Fuel/Charging | USD 250 | USD 3,750 |

| Maintenance | USD 1,000 | USD 5,000 |

| Insurance | USD 0 – $3,000 | USD 3,000 |

| Total (5-Year) | USD 2,750 – $8,250 | USD 11,750 – $26,750 |

Projections based on data from 21, and.40

The TCO advantage is compelling, with electric models offering a lower cost per mile due to significantly cheaper charging compared to gasoline.21 Furthermore, electric motorcycles require dramatically less maintenance, with no need for oil changes, spark plugs, or complex transmission upkeep, leading to a 50-70% reduction in maintenance costs.21

However, the path to mass adoption is not without hurdles. The primary challenge remains the high upfront cost of electric motorcycles, driven by the expense of advanced battery packs and motor systems.25 This is a particularly sensitive issue in price-conscious markets like India and Southeast Asia.25 Another major barrier is “range anxiety,” which is exacerbated by a lack of widespread charging infrastructure, making long-distance travel impractical for many users.27

Governments worldwide are playing a critical role in overcoming these barriers by implementing a variety of incentives. In Asia-Pacific, particularly in China and India, strong government support in the form of subsidies, tax rebates (such as India’s FAME II policy), and a focus on domestic manufacturing is a key driver of EV growth.30 Similarly, Europe is incentivizing adoption through tax breaks, subsidies, and a regulatory framework that favors low-emission vehicles.30 Even in Latin America, where the EV market is still nascent, governments are beginning to introduce incentives like tax exemptions and reductions in import duties to promote accessibility.30

To address these challenges, manufacturers are investing heavily in technological innovation. This includes advancements in battery technology to increase range and reduce charging times, the development of modular battery systems for quick swapping, and collaborations to expand charging networks.28 Honda’s commitment to introducing 30 electric models by 2030 and its plan to achieve 4 million annual electric unit sales by that year is a clear indication of the industry’s strategic pivot toward electrification.16

6. The Competitive Arena: Strategic Moves of Global OEMs

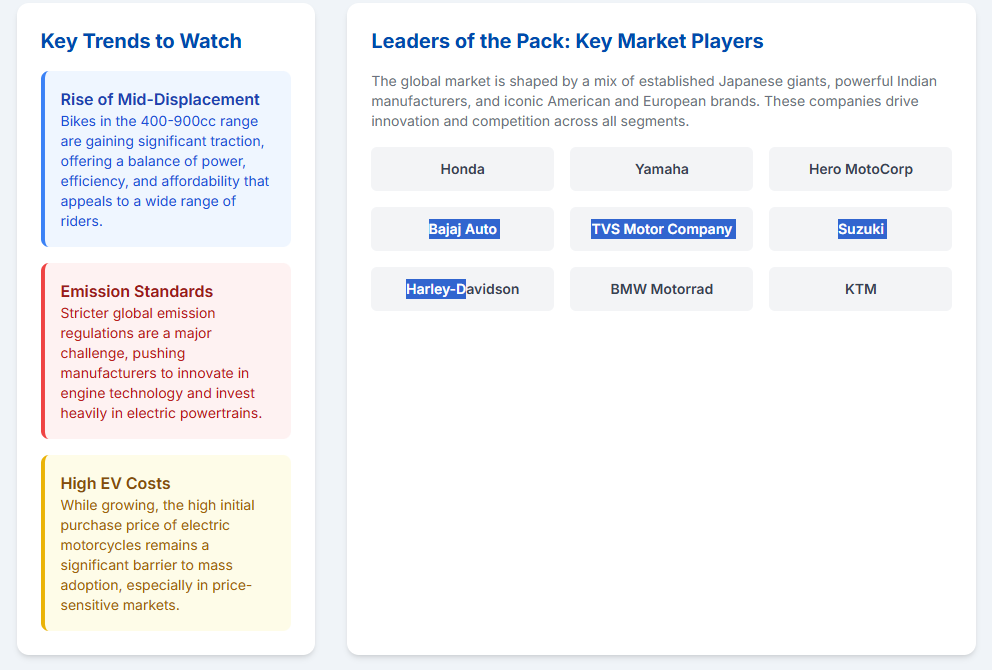

The global motorcycle market is a highly competitive arena where leading manufacturers are deploying multi-faceted strategies to secure their positions and capitalize on new growth opportunities.

Honda’s “Global South” Strategy

Honda’s enduring dominance is not accidental; it is the result of a meticulously planned and executed strategy. The company has explicitly identified the “Global South”—a region comprising Southwest Asia (India, Indonesia, Philippines) and Central and South America (Brazil)—as the primary target for future growth.16 Honda’s long-term objective is to capture a 50% share of the global motorcycle market by fully leveraging its strengths in product development, sales, service, procurement, and production on a global scale.16

The company’s strategy is built on a foundation of hyper-localization. In India, for example, Honda has a diversified product lineup tailored to specific customer needs, from the best-selling ACTIVA scooter for urban commuting to the Shine for rural areas.16 Beyond product, Honda is also leading the way in electrification, having committed to introducing 30 electric models by 2030 with a target of 4 million annual unit sales.16 The company is addressing a key barrier to EV adoption by implementing swappable battery systems and collaborating with partners to build a robust charging infrastructure.16 Furthermore, Honda is leveraging its experience with flex-fuel models in Brazil to introduce similar products in other markets, tailoring its offerings to the unique energy situations of each region.16

Bajaj Auto and the Power of Partnerships

India’s Bajaj Auto provides another example of a traditional player successfully adapting to the evolving market. While known for its mass-market commuter bikes and three-wheelers, the company has implemented a multi-pronged international expansion strategy. Its business model is centered on cost efficiency and strategic alliances with prominent global manufacturers, including KTM and Triumph.37

A significant development in this strategy is the recent inauguration of its first overseas manufacturing plant in Manaus, Brazil.38 This investment of up to 10 million USD represents a major shift away from the company’s traditional distribution-led export model toward direct local manufacturing.38 This strategic move is a direct response to the lucrative and rapidly growing Latin American market, allowing Bajaj to capitalize on local fiscal incentives and shorten its supply chain.37 The new plant will produce the “Dominar” brand, which has received an outstanding reception in Brazil, and has the potential to expand production to 50,000 units annually.38

The company’s alliances with premium brands like KTM and Triumph are a testament to its forward-looking vision. These partnerships allow Bajaj to co-develop mid-weight motorcycles, enabling it to penetrate the premium and performance segments and diversify its product portfolio.38 This approach allows Bajaj to leverage economies of scale and mitigate risks associated with over-dependence on exports, ensuring a resilient and adaptive global footprint.

7. Conclusions and Strategic Recommendations

The global motorcycle market is not merely growing; it is strategically bifurcating into two distinct yet interconnected realms. The primary narrative is one of robust expansion, driven by the relentless demand for utility-based, affordable, and agile transportation solutions in the burgeoning markets of Latin America and Asia-Pacific. Concurrently, developed markets in Europe are navigating a period of regulatory-induced volatility, which, when analyzed closely, reveals a healthy underlying market correcting itself after a statistical aberration. The overarching theme is the imperative of electrification, a transition catalyzed by favorable government policies and the compelling economic argument of a lower Total Cost of Ownership.

The analysis yields several key conclusions and strategic recommendations for manufacturers and investors seeking to succeed in this complex environment:

- For Manufacturers:

- Prioritize Hyper-Localization: A one-size-fits-all approach is a recipe for failure. The evidence from Italika in Mexico and Honda in Southeast Asia demonstrates that success hinges on developing distinct product portfolios and business models that directly address the specific economic and social needs of each region. The focus should be on “affordable utility” in emerging markets and “recreational innovation” in developed markets.

- Accelerate Electrification: The transition to electric two-wheelers is inevitable and will be a key determinant of future market leadership. Manufacturers must invest aggressively in battery technology and infrastructure. A particularly promising strategy is to target the high-mileage, commercial user base in emerging markets with low-TCO electric models and subscription-based battery services.

- Diversify and Localize Supply Chains: To mitigate geopolitical risks and tariff impacts, manufacturers should continue to establish localized manufacturing and assembly plants in key growth regions. This strategy, exemplified by Bajaj’s new plant in Brazil, not only reduces costs but also strengthens a company’s ability to respond to and capitalize on regional market dynamics.

- For Investors:

- Adopt a Nuanced Perspective: Do not misinterpret short-term sales volatility in mature markets. The “decline” in Europe in 2025 is a statistical correction, not a signal of market contraction. A long-term perspective is crucial for identifying genuine investment opportunities.

- Identify Growth Catalysts: Investment should be directed toward companies with a demonstrated capability to penetrate and expand in the Latin American and Asian markets, especially those with products and business models that serve the gig economy and mass-market consumer.

- Evaluate EV Readiness: Favor companies with a clear, data-driven roadmap for electrification. Look for strategic partnerships, like those between Bajaj and KTM or Honda’s collaborations on battery infrastructure, which are designed to overcome the significant challenges related to upfront cost and charging networks.

Works cited

- Motorcycle Market Size, Share, Value | Growth Report [2032], accessed September 17, 2025, https://www.fortunebusinessinsights.com/motorcycle-market-105164

- Motorcycle Market Size, Share, Growth & Trends Analysis 2032, accessed September 17, 2025, https://www.marketsandata.com/industry-reports/motorcycle-market

- Motorcycle Market Share and Industry Forecast 2025–2035 – Fact.MR, accessed September 17, 2025, https://www.factmr.com/report/7/motorcycle-market

- Motorcycle Market Size, Share | Global Growth Analysis 2024-2033 – Reports and Insights, accessed September 17, 2025, https://www.reportsandinsights.com/report/motorcycle-market

- Latin America Two-Wheeler Market Size, Growth and Forecast …, accessed September 17, 2025, https://www.techsciresearch.com/report/latin-america-two-wheeler-market/15794.html

- Latin America’s Two-Wheel Revolution – Governing Magazine, accessed September 17, 2025, https://www.governing.com/community/latin-americas-two-wheel-revolution

- Ranking of the world’s best-selling motorcycle brands in 2024, accessed September 17, 2025, https://www.kamaxgroup.com/news/ranking-of-the-worlds-best-selling-motorcycle-brands-in-2024

- Motorcycles in Latin America – Gateway to Automotive, accessed September 17, 2025, https://automotive.messefrankfurt.com/global/en/facts-figures/motorcycles-latin-america.html

- Colombian Motorcycles – Facts & Data 2025 | MotorCyclesData, accessed September 17, 2025, https://www.motorcyclesdata.com/2025/07/15/colombian-motorcycles/

- Grupo Elektra, SAB de CV, accessed September 17, 2025, https://www.grupoelektra.com.mx/Documents/ES/Downloads/Grupo_Elektra_1Q24_Eng.pdf

- Italika Motorcycles Hits 20th Consecutive Year of Record Sales – iMotorbike News, accessed September 17, 2025, https://news.imotorbike.com/en/2025/03/italika-motorcycle-sales/

- Italika motorcycles – MotoProWorks, accessed September 17, 2025, https://www.motoproworks.com/blogs/news/italika-motorcycles

- Motorcycles in ASEAN – Speeda ASEAN, accessed September 17, 2025, https://sea.ub-speeda.com/asean-insights/industry-reports/motorcycles-southeast-asia/

- Motorcycle Sales: Indonesia Tops Southeast Asia with 3.2 Million Units, accessed September 17, 2025, https://tricruise.id/member/motorcycle-sales-in-indonesia/

- Motorcycle industry in Vietnam – Wikipedia, accessed September 17, 2025, https://en.wikipedia.org/wiki/Motorcycle_industry_in_Vietnam

- Summary of Briefing on Honda Motorcycle Business | Honda Global …, accessed September 17, 2025, https://global.honda/en/newsroom/news/2025/2250128eng.html

- Europe’s Motorcycle Industry Is Down On Paper, But Is It Really?, accessed September 17, 2025, https://www.rideapart.com/features/767537/european-motorcycle-decline-because-euro5-plus/

- Europe’s Motorcycle Sales Crash? The REAL Reason Behind the 2025 Drop! – YouTube, accessed September 17, 2025, https://www.youtube.com/watch?v=WNjODc21JgU

- Registrations 2024 in key European Markets – ACEM, accessed September 17, 2025, https://www.acem.eu/registrations-2024-in-key-european-markets/

- Motorcycles Aren’t Cars, And Europe’s ELV Regulation Should Recognise That, accessed September 17, 2025, https://autorecyclingworld.com/motorcycles-arent-cars-and-europes-elv-regulation-should-recognise-that/

- Total Cost of Ownership: Electric Motorcycles vs Traditional Bikes – Which One Actually Saves You More – MensXP, accessed September 17, 2025, https://www.mensxp.com/auto/electric-bikes/176958-total-cost-of-ownership-electric-motorcycles-vs-traditional-bikes.html

- Comparing Total Cost of Ownership of Electric and Conventional Motorcycles in Indonesia, accessed September 17, 2025, https://www.researchgate.net/publication/355296701_Comparing_Total_Cost_of_Ownership_of_Electric_and_Conventional_Motorcycles_in_Indonesia

- How Much Can You Save with Electric Motorcycles Versus Gasoline Models – HappyRun, accessed September 17, 2025, https://www.happyrunsports.com/blogs/electric-motorcycle/how-much-can-you-save-with-electric-motorcycles-versus-gasoline-models

- What Are the Maintenance Costs of an Affordable Electric Motorbike? – HappyRun, accessed September 17, 2025, https://www.happyrunsports.com/blogs/electric-motorcycle/what-are-the-maintenance-costs-of-an-affordable-electric-motorbike

- Global Electric Motorcycle Market Size, Share, and Analysis Report …, accessed September 17, 2025, https://www.databridgemarketresearch.com/reports/global-electric-motorcycles-market

- Is An Electric Motorcycle Worth it? – Pros & Cons | Rider, accessed September 17, 2025, https://www.rider.com/electric-motorcycle/

- Electric Motorcycle Market Size & Share, Forecasts Report 2032, accessed September 17, 2025, https://www.gminsights.com/industry-analysis/electric-motorcycle-market

- Electric Motorcycle and Scooter Industry: Key Growth Scenarios – HTF Market Intelligence, accessed September 17, 2025, https://www.htfmarketintelligence.com/press-release/global-electric-motorcycle-and-scooter-market

- The Rise of Electric Motorcycles: What’s Next for the Industry?, accessed September 17, 2025, https://www.motorcyclesdata.com/2025/03/15/the-rise-of-electric-motorcycles-whats-next-for-the-industry/

- Low Powered Electric Motorcycle and Scooter Market Size and …, accessed September 17, 2025, https://www.credenceresearch.com/report/low-powered-electric-motorcycle-and-scooter-market

- Premium Electric Motorcycle Market | Global Market Analysis Report – 2035, accessed September 17, 2025, https://www.futuremarketinsights.com/reports/premium-electric-motorcycle-market

- E-Bike Subsidies in Europe (2025): Complete Guide by Country – Legend eBikes, accessed September 17, 2025, https://legendebikes.com/en-fi/pages/ebike-subsidies

- Belgium – Incentives and Legislation | European Alternative Fuels Observatory, accessed September 17, 2025, https://alternative-fuels-observatory.ec.europa.eu/transport-mode/road/belgium/incentives-legislations

- Incentives and Legislation | European Alternative Fuels Observatory, accessed September 17, 2025, https://alternative-fuels-observatory.ec.europa.eu/transport-mode/road/germany/incentives-legislations

- What incentives are available in Latin America to buy an electric vehicle? – Mobility Portal, accessed September 17, 2025, https://mobilityportal.eu/incentives-latin-america-electric-vehicle/

- Latin America’s nascent electric car market – Dialogue Earth, accessed September 17, 2025, https://dialogue.earth/en/business/44044-latin-americas-nascent-electric-car-market/

- Bajaj Auto Case Study: Business Model, Product Portfolio, and SWOT Analysis – Pocketful.in, accessed September 17, 2025, https://www.pocketful.in/blog/bajaj-auto-case-study/

- Bajaj Auto to invest up to $10 million in its first overseas manufacturing plant, Bajaj Brazil, accessed September 17, 2025, https://m.economictimes.com/industry/auto/two-wheelers-three-wheelers/bajaj-auto-to-invest-up-to-10-million-in-its-first-overseas-manufacturing-plant-bajaj-brazil/articleshow/114286327.cms

- Comprehensive Marketing Strategy Of Bajaj Auto | IIDE, accessed September 17, 2025, https://iide.co/case-studies/marketing-strategy-of-bajaj-auto/

- 2025 Electric Bike Cost Comparison: Save More with E-Bikes – vtuvia ebike, accessed September 17, 2025, https://vtuviaebike.com/blogs/news/how-much-does-an-electric-bike-cost

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity