Strategic Report

Executive Summary: The Strategic Contradiction of Small Displacement

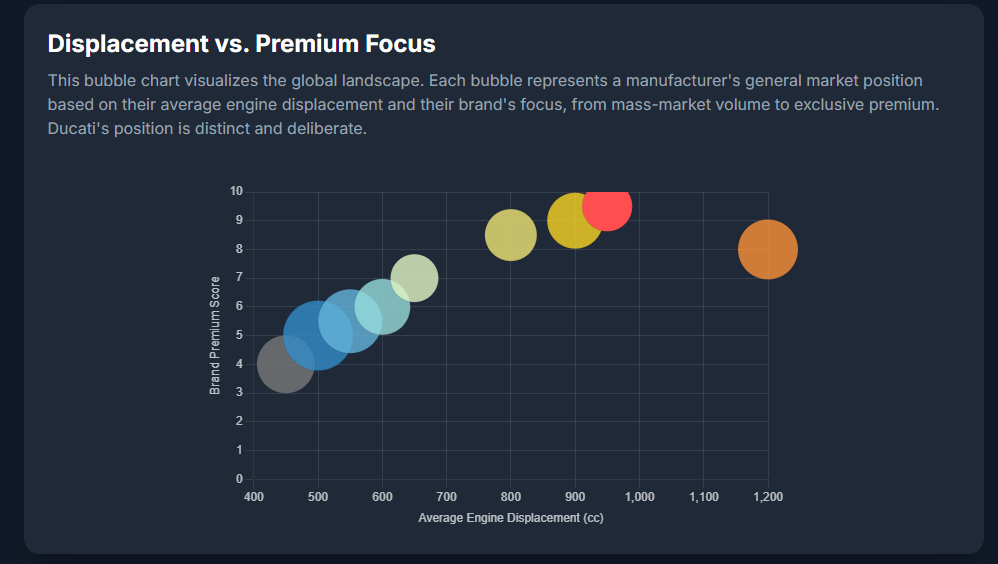

The claim that Ducati will not manufacture 400cc motorcycles is definitively validated by explicit corporate mandate and a robust analysis of historical product failures, unachievable cost structures, and current competitive dynamics. Ducati’s core business model is strategically locked into high-cost, high-value production, aiming for benchmark profitability and exclusivity. The development of small-displacement models (sub-600cc) presents an insurmountable strategic contradiction, leading to an unacceptable dilution of the brand prestige and a severe erosion of operational profitability.

This strategic refusal is affirmed by the Borgo Panigale leadership. CEO Claudio Domenicali has explicitly stated the company’s position, confirming that Ducati will not pursue the development and production of small motorcycles, viewing the brand as a status symbol to be aspired to.1 This stance is not merely a preference but a necessity driven by four strategic imperatives: the protection of brand equity, the demonstrated inability to scale down production costs without compromising premium quality (as evidenced by the failed Scrambler Sixty2 experiment), the necessity of maintaining a benchmark profitability (9.1% EBIT) 2, and the incompatibility with the aggressively priced, outsourced competitive models dominating the 400cc segment today.3 Consequently, Ducati’s strategic focus remains centered on maximizing value and technological superiority in its core premium displacement classes.

I. The Official Position: Upholding Ducati’s Aspirational Mandate

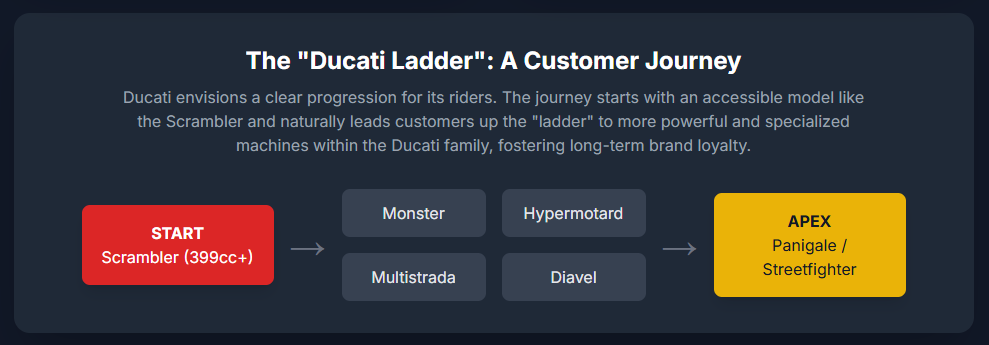

The strategic direction of Ducati is firmly committed to high-performance, high-displacement motorcycles, thereby excluding the sub-600cc category from future development plans. This commitment is articulated through official corporate statements that define the brand’s mission in terms of exclusivity, emotional engagement, and superior performance.

1.1. The Strategic Pillar of Exclusivity and Aspiration

The foundation of Ducati’s market positioning rests upon maintaining an image of aspiration and prestige. CEO Claudio Domenicali has been emphatic regarding this mandate, declaring unequivocally that “Ducati will not make a small motorcycle,” and reinforcing this by stating, “Ducati is a brand to be aspired to, there is a certain prestige that is attached to the brand”.1 The company views itself as a global brand possessing a potent Italian soul, defined by a sporty spirit, excellent design, and an ability to arouse strong emotions.5

This philosophy demands that any product bearing the Ducati logo must deliver upon the market’s high expectations of Italian performance. The company’s strategic goal is to preserve the “exclusivity and value of its products for its passionate clients”.2 This rigorous adherence to performance standards is so critical that even in the nascent electric mobility sector, Ducati has expressed caution, noting that the company is not yet confident that an electric motorcycle platform—which often necessitates smaller displacements—can currently meet the high-performance expectations required to wear the Ducati logo.6 By extension, a current internal combustion 400cc product, constrained by displacement and price, inherently fails this stringent “Ducati expectation” test.

The explicit rejection of small displacement is intrinsically linked to the brand’s integrity. Ducati’s core value proposition is built upon a history of racing success (MotoGP, Superbike) and superior technology, including innovative systems like ARAS (Advanced Rider Assistance Systems) and high-performance engines.7 A low-displacement motorcycle, typically generating around 40 horsepower (hp) in the 400cc class 10, carries the inherent risk of diluting this established high-performance image. The company views such a compromise on power and technology as potentially damaging to its aspirational value, which justifies the premium pricing required to sustain benchmark profitability. Maintaining high Average Selling Prices (ASP) through high-value, high-performance bikes is critical to sustaining the operating result (9.1% EBIT in 2024) 2, positioning the strategic refusal of the 400cc segment as a financial defense mechanism.

1.2. Current Entry Point and Performance Floor

Ducati has effectively defined a minimum performance floor for its contemporary product line, solidifying the abandonment of the sub-600cc space. The smallest production engine currently employed in Ducati’s mainline portfolio is the Superquadro Mono, a high-performance single-cylinder engine with a displacement of 659cc, delivering 77.5 hp.11

This engine is deployed in the Hypermotard 698 Mono, establishing the company’s new strategic entry point. The selection of a 659cc high-performance single-cylinder engine aligns perfectly with Ducati’s aggressive, performance-oriented heritage. This sharply differentiates the brand’s minimum offering from the utilitarian or A2 license-compliant focus of the typical 400cc entry-level segment, reinforcing the message that all Ducati products, regardless of whether they are powered by an L-twin, V4, or high-output single-cylinder engine, must adhere to a strict standard of exhilarating performance.

II. Historical Deep Dive: The Ducati Scrambler Sixty2 Case Study (399cc)

The history of the 399cc Ducati Scrambler Sixty2 offers empirical proof of why the 400cc segment is fundamentally incompatible with the Borgo Panigale operational model and cost structure. The discontinuation of this model serves as a stark warning against re-entering the low-displacement market.

2.1. Inception and Limited Market Success

The Scrambler range, launched with the 803cc Icon, was an instant global hit for Ducati, propelling the company to record sales in 2015, with 16,000 Scrambler units sold globally and an overall 22 percent hike in sales volume compared to the prior year.12 This success naturally spurred range expansion, leading to the introduction of the 399cc Scrambler Sixty2 in late 2015 as a 2016 model.10

The Sixty2 was conceived with clear strategic goals: to attract younger riders, comply with European A2 licensing requirements, and specifically target markets such as Japan, where vehicles larger than 400cc incur significantly higher licensing and insurance costs.10 Ducati sought to utilize the massive popularity of the Scrambler sub-brand to lower the average age of its customer base, which at the time was 37 for the Scrambler line.14

2.2. The Price-to-Value Disparity that Caused Failure

Despite its promising initial strategy, the Sixty2 was retired within a few years because its value proposition was fundamentally flawed, with analysts noting that its “price point was its biggest downfall”.15 This failure stemmed from a disastrously narrow price gap between the entry-level 400cc bike and its much more powerful 800cc sibling.

In the crucial US market, the 399cc Scrambler Sixty2 carried an MSRP of $7,995. In comparison, the base 803cc Scrambler Icon retailed for only $8,495.10 A marginal price difference of just $500 failed to justify the loss of half the engine capacity and approximately 34 horsepower (41 hp for the Sixty2 versus 75 hp for the Icon).10 While some regional markets, such as the Philippines, saw a more substantial price differentiation (₱599,000 for the Icon versus ₱499,000 for the Sixty2) 16, the minimal price distinction in major Western markets proved insufficient to drive necessary volume.

The high cost of the small bike resulted in a severe value mismatch. A detailed analysis of the pricing revealed a catastrophic failure of the product’s value proposition relative to its sibling.

Scrambler Price-to-Performance Ratio Analysis

| Model (Discontinued) | Engine Displacement | Rated Horsepower (HP) | MSRP (Original US) | Cost Per Horsepower ($/HP) |

| Scrambler Sixty2 | 399cc (L-Twin) | 41 hp | $7,995 | $195.00 |

| Scrambler Icon | 803cc (L-Twin) | 75 hp | $8,495 | $113.27 |

The data confirms that the Sixty2 was quantitatively 72% more expensive per unit of horsepower than the 803cc Icon. This demonstrated that the high fixed manufacturing costs required to produce an Italian-engineered motorcycle prevented Ducati from offering a competitive price that matched the power output of the smaller engine. This critical finding indicates that entry-level buyers, even those drawn to the Ducati brand, are rational consumers in the sub-$10,000 category. When presented with two Ducatis, paying a marginal premium for significantly better performance is the logical choice, exposing the Sixty2’s poor market positioning.

2.3. Production Cost Parity and Component Sharing

The root cause of the Sixty2’s uncompetitive pricing was the inability to achieve manufacturing efficiency when scaling down engine size. Analysts observed that the Sixty2 “appears to use all the same parts” as its larger-engined siblings and therefore “can’t be much less expensive to produce”.10

The 399cc engine was a modified L-Twin, a smaller-bored, shorter-stroked version of the 803cc motor.10 Critically, the bike retained shared platform costs, including high-specification chassis components, suspension, and proprietary electronics. Ducati’s vertically integrated, high-quality production system, centered in Bologna 17, entails high fixed manufacturing costs related to R&D, tooling, and sourcing of premium hardware. Scaling down the engine displacement did not proportionally scale down the cost of the shared premium components. This established a high cost floor that fundamentally cannot accommodate the price sensitivity inherent to the 400cc segment, confirming the failure of the model’s financial scalability within Ducati’s current premium manufacturing architecture.

III. Financial and Operational Constraints: The Total Cost of Ownership Barrier

The decision to exclude the 400cc segment is fundamentally supported by Ducati’s high-margin financial model and the unsuitability of its total cost of ownership (TCO) profile for entry-level customers. A 400cc bike is designed for new riders and commuters—demographics highly sensitive to maintenance expenses and reliability, factors that conflict with Ducati’s traditional operating environment.

3.1. Ducati’s High-Margin Financial Model

Ducati’s financial strategy is centered on maximizing profit per unit, a key lesson learned from surviving a near-bankruptcy period in the 1990s.18 The company has achieved remarkable financial stability, reporting an operating result (EBIT) of 91 million euros in 2024, corresponding to a strong profitability of 9.1%.2 This is considered a “benchmark profitability” in the two-wheeler industry.2

These high margins are sustained overwhelmingly by high-ASP products such as the Multistrada V4, Panigale, and high-specification variants, which continue to drive revenues exceeding one billion euros annually.20 Introducing a low-ASP, high-volume model in the 400cc segment would necessitate drastically lower margins. Unless extreme scale efficiency could be instantly achieved—which would demand massive, risky capital investment outside the existing Borgo Panigale infrastructure—the new model would inevitably drag down the overall company profit margin, undermining the financial mandate set by the parent group (Audi/VW).

3.2. Total Cost of Ownership (TCO) and Service Costs

For entry-level or commuter motorcycles, a low TCO is a crucial purchasing criterion. Ducati’s brand image, however, is associated with high upkeep expenses and complexity.10 Maintenance costs are recognized to be higher than those of competing brands.21

A significant deterrent for TCO competitiveness is Ducati’s signature Desmodromic valve actuation system, which requires expensive and complex Desmo services (often due around 15,000 miles).22 While the 400cc Sixty2 used an air-cooled L-Twin, it retained high mandatory service costs inherent to the platform, making its TCO uncompetitive against rivals using simpler, conventional engine architectures. Furthermore, dealership labor rates are high (e.g., $132 per hour cited for service in the Atlanta area).24

This issue is compounded by structural problems within the authorized dealer service network. While customers are covered by warranty, dealerships often express a reluctance toward performing warranty jobs. This is because Ducati headquarters determines the time required for repairs and pays the dealers an hourly rate that is often considered too low, leading to dealerships feeling “shorted” on hours.24 This complexity and lower profitability for repair work on entry-level models create systemic resistance within the dealer ecosystem, which is fundamentally optimized for servicing and selling high-value, high-margin motorcycles (e.g., Panigale and Multistrada). The existing operational structure is therefore inherently resistant to supporting a high volume of low-profit 400cc models.

3.3. Barrier to Entry: Platform Investment and Risk

To be competitive in the contemporary 400cc market, Ducati would be required to develop an entirely new, cost-efficient engine platform, likely a modern single-cylinder or parallel-twin, rather than a scaled-down L-Twin. Developing any new engine platform—as demonstrated by the Superquadro Mono—involves significant R&D, rigorous reliability testing (including simulation of endurance races and high-speed runs like Nardò), and industrial scaling through the Avanserie phase.17

Executing this massive R&D undertaking for a product that must sell at a low ASP introduces unacceptable financial risk. The investment required to develop a world-class, cost-competitive 400cc engine and then manufacture it efficiently (likely requiring production in a low-cost Asian region) is massive and deviates fundamentally from Ducati’s core competency. The negative financial memory of the Sixty2 failure confirms that channeling resources into high-value product development (e.g., the Hypermotard 698 Mono, high-end V4 platforms) is the more prudent and profitable path.18 Furthermore, the technical complexity, particularly the Desmo system, is central to Ducati’s brand definition of “premium”.8 Developing a simplified, conventional, low-cost 400cc engine to meet TCO demands would dilute the technical definition of a “true” Ducati, potentially alienating core, affluent clientele.

IV. Competitive Landscape and The Triumph Imperative

The contemporary 400cc motorcycle market has fundamentally shifted since the failure of the Scrambler Sixty2, becoming dominated by aggressively priced models that leverage strategic outsourcing. This renders the segment commercially inaccessible to Ducati’s European operational model.

4.1. Global Market Momentum in Sub-500cc Displacement

The global motorcycle industry confirms the strategic importance of small displacement, primarily for volume growth. The 200cc to 400cc segment is identified as the fastest-growing sector globally, driven by versatility, capability, and accessibility for first-time buyers in emerging markets.25 While the over 800cc segment continues to cater to enthusiasts seeking premium performance (Ducati’s core demographic), the substantial volume and unit sales growth are concentrated in the smaller, more affordable classes.25

4.2. Competitor Strategy: The Triumph-Bajaj Model

The dominant competitive paradigm in the premium 400cc segment is defined by strategic partnerships with high-volume, low-cost manufacturers, exemplified by the Triumph-Bajaj alliance. Triumph motorcycles, seeking to significantly expand its global reach and enter high-volume market segments, established a partnership with India’s Bajaj Auto.4

This outsourcing arrangement enables Triumph to manufacture small-displacement motorcycles, like the highly successful Triumph Speed 400, at production costs that Ducati’s Borgo Panigale factory cannot match. The Speed 400 is compliant with A2 licensing regulations and is aggressively priced, placing it far below the price point of the retired Sixty2.3 This business model—similar to the partnerships between BMW and TVS, or Bajaj and KTM (which produces the competitive KTM 390 series) 4—allows European brands to achieve volume sales and low manufacturing costs while attaching a premium badge.

4.3. Price Point Incompatibility Analysis

The competitive price point established by rivals creates an insurmountable financial barrier for Ducati. The discontinued Ducati Sixty2 was launched at an MSRP of $7,995.10 Today, the market benchmark for a premium, single-cylinder 400cc model, the Triumph Speed 400, lands at an approximate MSRP equivalent of $5,000.27

Competitive Benchmarking of the Global 400cc Segment (2025)

| Manufacturer | Model | Engine Displacement | Approx. Power (HP) | Approx. MSRP (US/EU Equivalent) | Manufacturing Strategy |

| Ducati (Historical) | Scrambler Sixty2 (Retired) | 399cc (V-Twin) | 41 hp | ~$8,000 | In-House (High Cost) |

| Triumph | Speed 400 | 398cc (Single) | 40 hp | ~$5,000 | Outsourced (Bajaj, India) 4 |

| KTM | 390 Duke/Adventure | 398cc (Single) | 45 hp | ~$5,500 | Outsourced (Bajaj, India) 4 |

To successfully re-enter the 400cc segment, Ducati would need to launch a product priced approximately $3,000 cheaper than its last attempt, demanding a price point similar to or below that of the Triumph Speed 400. Achieving this low price is impossible given Ducati’s financial structure and its insistence on maintaining Italian manufacturing excellence and engineering.5

Competitive success in the 400cc category requires the adoption of the outsourcing model. For Ducati, whose identity is intrinsically linked to the “Made in Bologna” ethos and Italian engineering 5, adopting an Asian manufacturing strategy poses an existential threat to its premium positioning. Such a move risks transforming Ducati into a brand perceived as badge-engineered, severely compromising the “Italian soul” that defines its desirability. The CEO’s rejection of small displacement is, therefore, an explicit rejection of the outsourcing requirement necessary to achieve competitive pricing. Ducati has chosen to maintain its brand integrity by focusing on displacement classes where its high production costs and superior engineering are warranted and accepted by affluent clientele.

By focusing above the 600cc threshold, Ducati establishes a competitive moat based on displacement exclusivity. This maneuver avoids a direct, fatal price war with superior, cost-optimized products from Triumph and KTM, ensuring Ducati maintains its perception as the top-tier, performance-focused premium brand, using displacement as a key metric to justify its premium pricing.

V. Strategic Future and Outlook: Focusing on High-Value Innovation

Ducati’s forward strategy decisively rejects volume growth in the low-displacement segment in favor of maximizing value and technological superiority within its profitable core segments. This approach guarantees the maintenance of financial stability and brand equity.

5.1. Alternative Growth Vectors in Existing Segments

Instead of pursuing the high-volume 400cc segment, Ducati is directing its significant capital investments toward high-end technological differentiation. The company has a defined safety roadmap until 2025, which includes the implementation of Advanced Rider Assistance Systems (ARAS), leveraging radar technology for features like blind spot warning and collision prevention.9 This substantial investment in sophisticated technology reinforces Ducati’s image as a high-tech leader in the premium space. Such high-cost technological advancements are only financially viable when integrated into high-ASP models, further justifying the focus on the premium end of the market.

This strategy is validated by the commercial success of high-displacement models. Despite carrying a high price tag, the Multistrada V4 range has emerged as Ducati’s best-selling model family in recent years, demonstrating that the market rewards the delivery of high-value, high-specification machines (like the Multistrada V4 S Grand Tour and Multistrada V4 RS).20

Furthermore, while Ducati acknowledges the long-term necessity of exploring electric mobility, the company maintains a cautious approach. Leadership insists that any future electric product must deliver on performance expectations before it can carry the Ducati logo.6 This vigilance regarding performance, even across different propulsion technologies, underscores the unwavering commitment to the high-end market, regardless of whether the required minimum performance threshold is achieved by a 400cc internal combustion engine or a nascent electric platform.

5.2. Maintaining Exclusivity and Controlling Volume

A fundamental component of Ducati’s current strategy is the management of volume to protect exclusivity. In 2024, the company delivered 54,495 motorcycles globally, a controlled decline from the previous year, which aligns with the company’s stated philosophy of preserving the exclusivity and value of its products.2

Entering the 400cc mass-market segment would inherently necessitate a radical shift toward volume sales, potentially requiring output figures triple or quadruple the current annual delivery total. Such a pursuit would directly conflict with the core strategic objective of maintaining controlled exclusivity and high resale value. By adhering to a strategy of disciplined volume, Ducati mitigates the risk of market saturation and ensures the continued desirability of its brand.

5.3. Strategic Focus on High-Profitability Niche Segments

Ducati’s resource allocation is focused on dominating niche segments where premium pricing is accepted and expected, guaranteeing the continuity of its financial solidity. This focused approach on the sport bike, high-end adventure, and high-performance naked bike markets ensures that capital resources are channeled toward core competencies.

By strategically positioning its new entry point at 659cc (Hypermotard Mono) 11, Ducati maintains a clear separation in the new bike market from the crowded and aggressively priced 400cc segment. This separation also serves a crucial function in the secondary market: the absence of a hyper-competitive, cheap new 400cc Ducati helps stabilize the residual value of existing, slightly larger used models, such as the 803cc Scrambler Icon.21 If Ducati were to introduce a $5,000 new 400cc model, it would drastically cannibalize the demand for used 803cc Scramblers, upsetting the existing customer base and fleet values. The current strategy maintains a healthy value proposition across its entire product lifecycle.

VI. Conclusions: Defense of Brand Equity and Financial Performance

The decision by Ducati to officially abandon and actively refuse the 400cc motorcycle segment is a calculated, financially necessary defense of its premium brand equity. It represents a clear commitment to high-margin, high-value operations over low-margin, high-volume market share.

The evidence conclusively demonstrates that Ducati cannot manufacture a 400cc motorcycle at a price point competitive with benchmark rivals (like the Triumph Speed 400, which leverages outsourced manufacturing) while simultaneously adhering to its established cost structure, quality standards, and mandatory high TCO (driven by Desmo service complexity and dealer rates).3 The historic failure of the 399cc Scrambler Sixty2 provides definitive empirical proof that the attempt to integrate a low-displacement, high-cost platform into the Ducati portfolio results in catastrophic price-to-value disparity and consumer rejection.10

Ducati is therefore strategically constrained, electing to protect its core identity as an aspirational, Italian-engineered brand synonymous with performance and advanced technology (ARAS).5 The strategic refusal of the 400cc market is a cornerstone of the company’s ability to sustain benchmark profitability and ensure long-term value creation. The brand’s future success lies in continuing to dominate the high-displacement, high-technology segments, using the new 659cc Superquadro Mono platform as the definitive, performance-validated gateway to premium ownership.

Sources

- Ducati Won’t Make a Small Displacement Motorcycle, That’s Stupid, accessed on October 15, 2025, https://www.rideapart.com/news/730042/ducati-small-displacement-motorcycle/

- Ducati ends 2024 with a revenue of over one billion euros combined with a benchmark profitability, accessed on October 15, 2025, https://www.ducati.com/gb/en/news/ducati-ends-2024-with-a-revenue-of-over-one-billion-euros-combined-with-a-benchmark-profitability

- Ducati Scrambler Full Throttle [2018] vs Triumph Speed 400 – Know Which Is Better!, accessed on October 15, 2025, https://www.bikewale.com/compare-bikes/ducati-scrambler-full-throttle-2018-vs-triumph-speed-400/

- Triumph also partners up with India’s Bajaj – RevZilla, accessed on October 15, 2025, https://www.revzilla.com/common-tread/triumph-also-partners-up-with-indias-bajaj

- Employer Branding – Ducati, accessed on October 15, 2025, https://www.ducati.com/us/en/company/employer-branding

- Ducati CEO: ‘We’re not necessarily a luxury brand’, accessed on October 15, 2025, https://www.ducati.com/us/en/news/ducati-ceo-we-re-not-necessarily-a-luxury-brand

- 2025 Multistrada V4 Pikes Peak | A Symphony of Emotions with Ducati Motorcycles, accessed on October 15, 2025, https://www.ducati.com/us/en/bikes/multistrada/multistrada-v4-pikes-peak

- Ducati Brand Analysis | PDF | Motor Vehicle – Scribd, accessed on October 15, 2025, https://www.scribd.com/document/559020133/Ducati-Brand-Analysis

- Ducati “2025 Safety Road Map”, accessed on October 15, 2025, https://www.ducati.com/ww/en/editorial/ducati-2025-safety-road-map

- What’s up With the Ducati Sixty2? | Motorcycle.com, accessed on October 15, 2025, https://www.motorcycle.com/features/whats-up-with-the-ducati-sixty2.html

- Ducati Motorcycles Superquadro Mono | Single-Cylinder, Maximum Thrill, accessed on October 15, 2025, https://www.ducati.com/us/en/company/product-innovation/engines/superquadro-mono

- Launch: Ducati Scrambler Sixty2 – bikesales.com.au, accessed on October 15, 2025, https://www.bikesales.com.au/editorial/details/launch-ducati-scrambler-sixty2-56353/

- Scrambler Ducati: the history and success – Bennetts Insurance, accessed on October 15, 2025, https://www.bennetts.co.uk/bikesocial/news-and-views/features/bikes/scrambler-ducati-the-history-and-success

- Ducati Scrambler Sixty2 review – Visordown, accessed on October 15, 2025, https://www.visordown.com/reviews/motorbike/ducati-scrambler-sixty2-review

- Ducati Scrambler Sixty2 is no longer available. Do you have any idea if Ducati will release a new model for it??? Thanks – Reddit, accessed on October 15, 2025, https://www.reddit.com/r/Ducati/comments/11tbc5v/ducati_scrambler_sixty2_is_no_longer_available_do/

- Ducati Scrambler Icon vs Ducati Scrambler Sixty2 Comparison | Zigwheels Philippines, accessed on October 15, 2025, https://www.zigwheels.ph/compare-motorcycles/ducati-scrambler-icon-vs-ducati-scrambler-sixty2

- Ducati Motorcycles Engine Development | How a Ducati Engine Is Born, accessed on October 15, 2025, https://www.ducati.com/us/en/company/product-innovation/engines/how-is-a-ducati-engine-born

- Ducati Solution | PDF | Market Segmentation | Strategic Management – Scribd, accessed on October 15, 2025, https://www.scribd.com/doc/25594107/Ducati-Solution

- Ducati ends 2024 with a revenue of over one billion euros combined with a benchmark profitability, accessed on October 15, 2025, https://www.ducati.com/se/sv/news/ducati-ends-2024-with-a-revenue-of-over-one-billion-euros-combined-with-a-benchmark-profitability

- Ducati closes 2023 confirming its solidity with increasing profitability and revenue above one billion euros, accessed on October 15, 2025, https://www.ducati.com/ww/en/news/ducati-closes-2023-confirming-its-solidity-with-increasing-profitability-and-revenue-above-one-billion-euros

- Hey, looking for a first bike. I really like the look of the Ducati Scrambler, but I heard that it’s not a very good bike. Any suggestions? : r/SuggestAMotorcycle – Reddit, accessed on October 15, 2025, https://www.reddit.com/r/SuggestAMotorcycle/comments/1kh22fl/hey_looking_for_a_first_bike_i_really_like_the/

- The Hidden Cost of Owning a Ducati Scrambler – YouTube, accessed on October 15, 2025, https://www.youtube.com/watch?v=IgrOmJRUzC4

- Detailed bill for the $2,422 Ducati “Desmo” major servicing : r/motorcycles – Reddit, accessed on October 15, 2025, https://www.reddit.com/r/motorcycles/comments/18q0ole/detailed_bill_for_the_2422_ducati_desmo_major/

- 2018 scrambler Sixty2 Issue : r/Ducati – Reddit, accessed on October 15, 2025, https://www.reddit.com/r/Ducati/comments/9dq7j2/2018_scrambler_sixty2_issue/

- Motorcycle Market Size, Share, Value | Growth Report [2032] – Fortune Business Insights, accessed on October 15, 2025, https://www.fortunebusinessinsights.com/motorcycle-market-105164

- World Motorcycles Market – Data & Fact 2025 | MotorCyclesData, accessed on October 15, 2025, https://www.motorcyclesdata.com/2025/06/05/world-motorcycles-market/

- Hot Selling 400cc Bikes: Top Models & Market Trends in 2025, accessed on October 15, 2025, https://www.accio.com/business/hot-selling-400cc-bike

- Reviewed: Triumph Speed 400 – Carole Nash, accessed on October 15, 2025, https://www.carolenash.com/news/bike-news/detail/reviewed–triumph-speed-400

- 2025’s new motorcycles: Ducati – Carole Nash, accessed on October 15, 2025, https://www.carolenash.com/news/bike-news/detail/2025s-new-motorcycles-ducati

Our Social Media Handles

- Instagram : LivingWithGravity

- Medium : Akash Dolas

- YouTube Channel : Gear and Shutter

- Facebook : LivingWithGravity